Author: Coinbase | Bai Hua Blockchain

In just the past year, the United States has approved Altcoin and Ethereum spot ETFs, made significant progress in the tokenization of financial products, the growth of Stablecoins, and the integration of global payment frameworks. These achievements did not happen overnight, and while they may seem like the fruits of years of effort, there are more signs that this is just the beginning of a larger transformation.

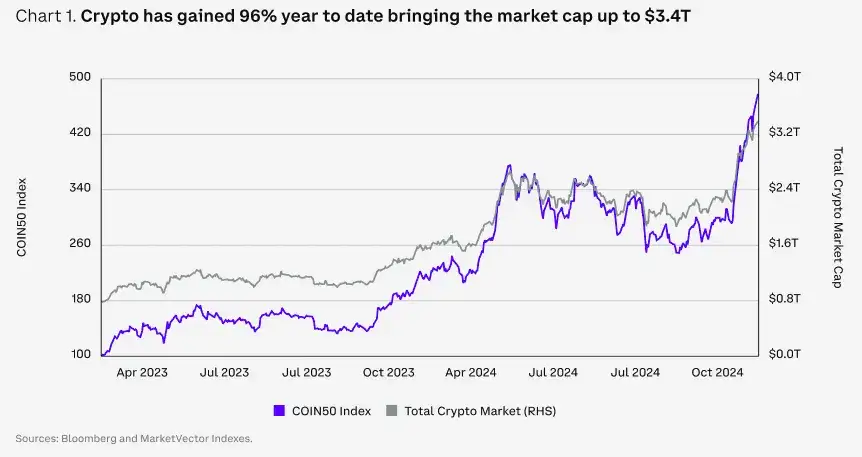

From a market perspective, the upward trend in 2024 is different from previous bull markets. On the surface, "web3" is gradually being replaced by the more appropriate "onchain"; more fundamentally, fundamental demand is gradually replacing narrative-driven investment, which is closely related to the deepening participation of institutional investors.

The market dominance of BTC has significantly increased, Decentralized Finance (DeFi) has broken the boundaries of blockchain technology, and has driven the formation of a new financial ecosystem. Central banks and major financial institutions around the world are also exploring how to use Crypto to improve the efficiency of asset issuance, trading and recording.

Looking ahead to 2025, the Crypto market is poised for transformative growth. Coinbase covers various aspects of the Crypto ecosystem, from Altcoins, ETFs, staking to gaming, providing a comprehensive and in-depth analysis of the outlook for the Crypto market in 2025, with the following key excerpts.

01

Macroeconomic Trends in 2025

1) The Federal Reserve's Demand and Objectives

Donald Trump's victory in the 2024 US presidential election became the biggest catalyst for the Crypto market in the fourth quarter of 2024, driving a significant rise in the price of BTC, which was 4-5 standard deviations higher than the three-month average.

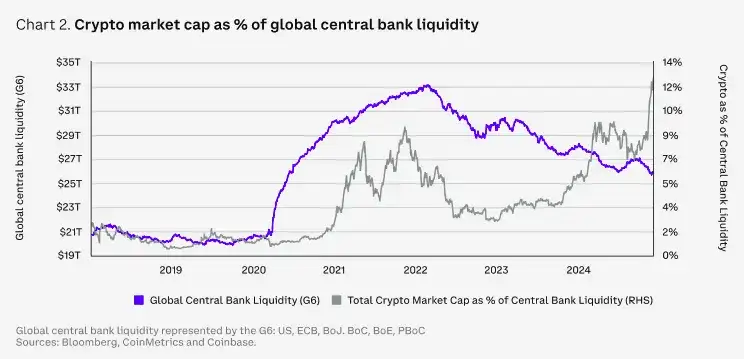

Looking ahead, we believe that the impact of fiscal policy may not be as great in the short term as the long-term trend of monetary policy, especially as the Federal Reserve is about to face a critical decision point. By 2025, the Federal Reserve is likely to continue to ease monetary policy, but the pace of easing may be affected by future fiscal expansion, such as tax cuts and tariffs that could push up inflation. Although the overall CPI (Consumer Price Index) has already fallen to 2.7%, core CPI is still around 3.3%, higher than the Federal Reserve's target.

The Federal Reserve hopes to achieve a slowdown in price growth through "disinflation" while maximizing employment, i.e. controlling the pace of price increases. However, US households would prefer to see prices fall, but deflation could lead to a recession, posing greater risks.

The most likely scenario currently is a soft landing, thanks to the long-term decline in interest rates and the unique advantages of the US. Fed rate cuts are almost a foregone conclusion, and easing credit conditions will also support the performance of Crypto in the next 1-2 quarters. Furthermore, if the next administration pursues deficit spending, with more US dollars circulating in the economy, risk appetite (including Crypto purchases) may rise further.

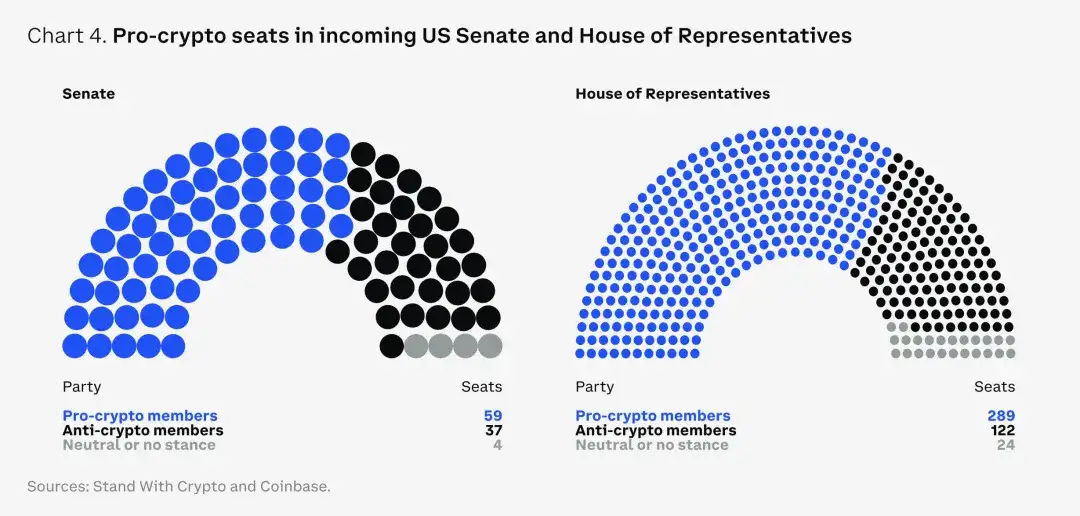

2) The Most Pro-Crypto Congress in History

After years of political ambiguity, we believe the next legislative session could be a critical moment for the US to finally establish regulatory clarity for the Crypto industry. This election sent a strong signal to Washington: the public is dissatisfied with the existing financial system and craves change. From a market perspective, the bipartisan pro-Crypto majority in the House and Senate means that US regulation is likely to shift from being an obstacle to the Crypto market to a driving force, becoming a positive factor for Crypto performance in 2025.

A new focus of discussion is the establishment of a strategic BTC reserve. In July 2024, after the Bitcoin Nashville conference, Wyoming Senator Cynthia Lummis introduced the Bitcoin Bill, and Pennsylvania also introduced a similar bill allowing up to 10% of the state's general fund to be invested in BTC or Crypto assets. Michigan and Wisconsin have already included Crypto in pension fund investments, and Florida is also following suit. However, creating a strategic BTC reserve may face some challenges, such as legal restrictions on the Federal Reserve holding Crypto assets on its balance sheet.

At the same time, the US is not the only region making progress in regulation. The rise in global Crypto demand is also changing the landscape of regulatory competition internationally. Looking abroad, the EU's Crypto Asset Markets (MiCA) regulation is being implemented in stages, providing a clear regulatory framework for the industry. Many G20 countries and major financial centers, such as the UK, UAE, Hong Kong and Singapore, are also actively developing regulatory rules adapted to digital assets, creating a more favorable environment for innovation and growth.

3) Crypto ETF 2.0

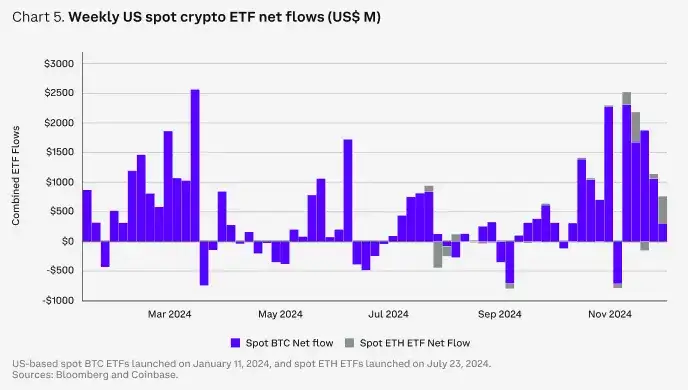

The approval of spot BTC and Ethereum ETFs in the US is an important milestone for the Crypto market. Since their launch, these products have attracted net inflows of $30.7 billion (about 11 months), far exceeding the $4.8 billion performance of the SPDR Gold ETF in its first year in 2004. Bloomberg data shows that this has placed Crypto ETFs in the top 0.1% of the approximately 5,500 ETFs launched in the past 30 years.

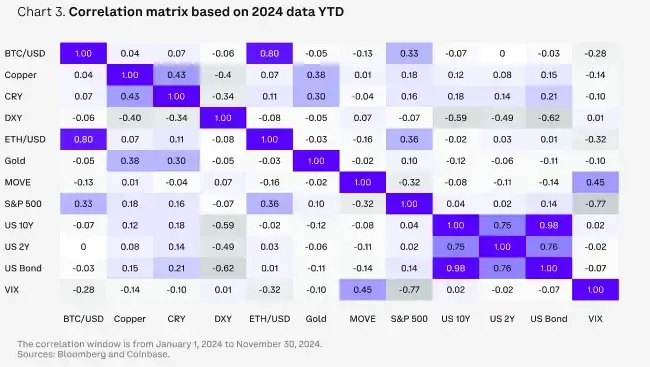

These ETFs have created new demand drivers for BTC and Ethereum, increasing BTC's market share from 52% at the beginning of the year to 62% in November 2024. The latest 13-F reports show that almost all types of institutional investors - such as endowments, pensions, hedge funds and family offices - have participated in these products. At the same time, the US options products launched in 2024 have provided investors with lower-cost risk management tools.

Looking ahead, the industry's focus is on issuers potentially expanding the asset range of ETFs to include more Tokens like XRP, SOL, LTC and HBAR, but we believe potential approvals may only benefit a limited group of assets. More noteworthy is whether, if the SEC allows ETFs to use staking functions, or relaxes restrictions to allow ETF shares to be created and redeemed in kind rather than just in cash, what impact this would have? The current cash model leads to settlement delays, share price deviations from net asset value (NAV), and higher trading costs. The in-kind model, on the other hand, is expected to improve price alignment, narrow bid-ask spreads, reduce trading costs, and mitigate price volatility and tax impacts, thereby improving market efficiency.

4) Stablecoins: The "Killer App" of Crypto

Here is the English translation of the text, with the specified terms translated as instructed:In 2024, the Altcoin market saw significant growth, with its total market capitalization increasing by 48% to reach $193 billion as of December 1st. Some market analysts believe that based on the current trend, the Altcoin market could grow to nearly $3 trillion in the next five years. Although this forecast may seem too aggressive, as it would be almost equivalent to the current size of the entire Crypto market, it only accounts for around 14% of the $210 trillion US money supply and liquidity, which means it is not impossible.

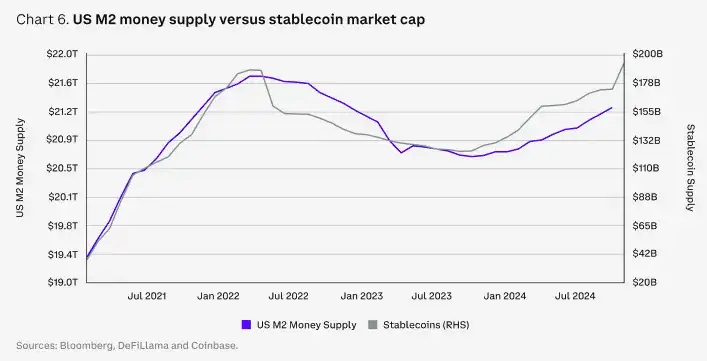

We increasingly believe that the next wave of Crypto adoption may come from the Stablecoin and payment sectors, which also helps explain why Stablecoins have received such intense attention over the past 18 months. Compared to traditional payment methods, Stablecoins can provide faster and lower-cost transactions, making them increasingly widely used in digital payments and remittances, with many payment companies also accelerating the construction of Stablecoin infrastructure. In fact, we may be approaching a point where the primary use of Stablecoins will no longer be limited to trading, but will expand to global capital flows and commercial transactions. Furthermore, the widespread financial applications of Stablecoins have also raised political attention, particularly regarding their potential in helping to address the US debt problem.

As of November 30, 2024, the total trading volume of the Stablecoin market has reached $27.1 trillion, nearly triple the $9.3 trillion in the same period (11 months) of 2023. This includes a large amount of peer-to-peer (P2P) transfers and cross-border business-to-business (B2B) payments. More and more businesses and individuals are starting to use Stablecoins like USDC to meet compliance requirements and deeply integrate with payment platforms like Visa and Stripe. In fact, Stripe acquired the Stablecoin infrastructure company Bridge for $1.1 billion in October 2024, which is the largest transaction in the Crypto industry to date.

5) The Token Revolution

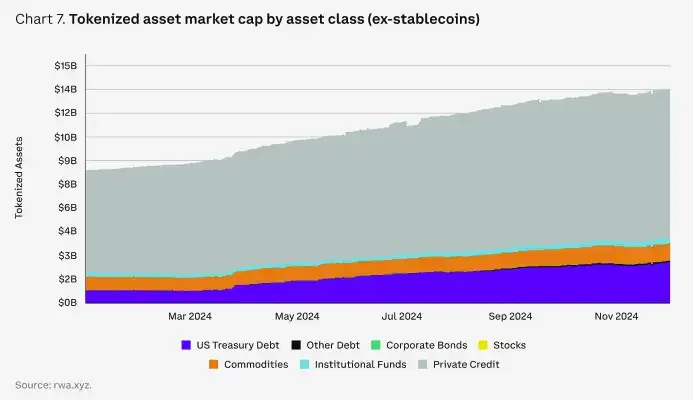

Tokenization made significant progress in 2024. According to data from rwa.xyz, the Real-World Assets (RWA) tokenized grew from $8.4 billion at the end of 2023 to $13.5 billion as of December 1, 2024, an increase of over 60% (excluding Stablecoins). Analysts' forecasts indicate that this market could grow from a minimum of $2 trillion to a maximum of $30 trillion over the next five years, an increase of nearly 50 times. Asset management companies and traditional financial institutions, such as BlackRock and Franklin Templeton, are increasingly adopting the Tokenization of traditional assets like government bonds on public and permissioned blockchains, enabling near-instant cross-border settlement and 24/7 trading.

Some companies are experimenting with using Tokenized assets as collateral for other financial transactions, such as derivatives trading, which can not only simplify operations (e.g., margin calls) but also reduce risk. Furthermore, the trend of RWA Tokenization has expanded from US Treasuries and money market funds to areas such as structured credit, commodities, corporate bonds, real estate, and insurance. Ultimately, Tokenization is expected to shift the investment portfolio construction and investment process to the blockchain, further simplifying the entire investment process, although this goal may still take a few years to achieve.

Of course, these efforts also face some unique challenges, including liquidity fragmentation across multiple blockchains and a constantly evolving regulatory environment, but there has been significant progress in both areas.

Overall, we expect Tokenization to be a gradual and ongoing process, but the benefits it brings are widely recognized. The current time is the best for companies to experiment, ensuring they can stay ahead of the technological development wave.

6) The Revival of DeFi

"DeFi is dead, long live DeFi." Decentralized Finance (DeFi) suffered a major setback in the previous market cycle, as some applications relied on Token incentives to attract liquidity, offering high but unsustainable yields. However, over time, a more sustainable financial system has emerged, one that not only includes real-world use cases but also has a transparent governance structure.

In our view, changes in the US regulatory environment may be key to reigniting the prospects of DeFi. Specifically, this may include establishing a regulatory framework for Stablecoins and providing avenues for traditional institutional investors to enter the DeFi market, especially as the synergies between off-chain and on-chain capital markets deepen. In fact, DEXes currently account for about 14% of CEX trading volume, up from 8% in January 2023. The possibility of decentralized applications (dApps) sharing protocol revenue with Token holders is also becoming more of a reality in a more favorable regulatory environment.

Furthermore, Crypto's disruptive role in financial services is gaining recognition from key figures. In October 2024, Federal Reserve Governor Christopher Waller gave a speech on how to make DeFi complement Centralized Finance (CeFi), stating that Distributed Ledger Technology (DLT) can make CeFi's record-keeping more efficient and faster, while smart contracts can enhance CeFi's capabilities. He also mentioned that Stablecoins may bring benefits in payments and as a "safe asset" on trading platforms, although they need to address risks such as runs and illicit finance.

All of this suggests that DeFi is likely to extend beyond the Crypto user base and into the traditional finance (TradFi) domain.

02

Disruptive Paradigms

1) Telegram Trading Bots: The Hidden Profit Center of the Crypto Realm

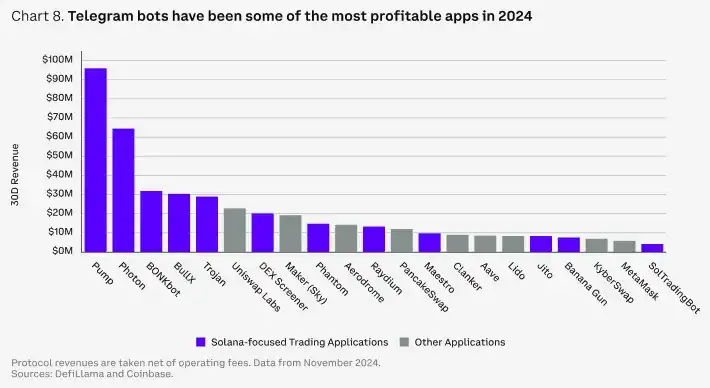

After Stablecoins and native L1 transaction fees, Telegram trading bots have become the most lucrative part of the 2024 Crypto realm, even surpassing the net protocol revenues of major DeFi protocols like Aave and MakerDAO (now Sky). This trend is primarily driven by the increase in trading and Memecoin activity. In fact, Memecoins have become the strongest performing Crypto sector in 2024 (measured by market capitalization growth), and Memecoin trading activity (on Solana DEX platforms) has also seen a sharp rise in the fourth quarter of 2024.

Telegram trading bots are chat-based trading tools. Users can create custodial wallets directly within the chat window and deposit and manage funds through buttons and text commands. As of December 1, 2024, Telegram trading bot users are primarily concentrated on Solana (87%), followed by Ethereum (8%), and then Base (4%). (Note: Most Telegram trading bots are not associated with the native wallet of The Open Network (TON), which is integrated with Telegram.) In other words, the users of these bots tend to use the Solana blockchain for their trading or other operations.

Like most trading platforms, Telegram trading bots typically charge around a 1% fee per transaction. However, due to the high volatility of the traded assets, users do not mind these relatively high fees. As of December 1, 2024, the highest-earning Photon bot has accumulated $210 million in fees, close to the $227 million collected by Pump, the largest Memecoin launchpad on Solana. Additionally, other major bots like Trojan and BONKbot have generated $105 million and $99 million in revenue, respectively. In comparison, Aave's protocol revenue for the full year 2024 was $74 million (net of fees).

We believe that the main attraction of these bots lies in their convenience in DEX trading, especially for Tokens that have not yet been listed on CEX. Many bots also provide additional features, such as "sniping" functionality during Token launches and integrated price alerts. The Telegram trading experience is very user-friendly, with nearly 50% of Trojan bot users using the platform for more than four days (while only 29% of users stop using it after one day), resulting in an average income of $188 per user.

Although the increasingly fierce competition among Telegram trading bots may ultimately lead to a reduction in trading fees, we believe that Telegram bots (as well as other core interfaces discussed below) will continue to maintain a leading profit center position by 2025.

2) Prediction Markets: Transparent Bets

Prediction markets may be one of the biggest winners in the 2024 US election cycle, with platforms like Polymarket outperforming traditional polling data in predicting election results. We believe this is a victory for Crypto, as blockchain-based prediction markets have demonstrated significant advantages over traditional polling data, showcasing the unique application potential of blockchain technology. Prediction markets not only demonstrate the transparency, speed, and global access advantages of crypto technology, but their blockchain foundation also enables decentralized dispute resolution and outcome-based automatic settlement, distinguishing them from traditional non-blockchain prediction platforms.

Although many believe these decentralized applications (dApps) may lose momentum after the elections, we have already seen their applications expanding into other areas such as sports and entertainment. In the financial domain, they have been proven to more accurately reflect economic data such as inflation and non-farm employment data, suggesting they may continue to thrive even after the elections.

3) Gaming: Controversy Breeds Attention

Gaming has always been a core theme in the Crypto space, due to the potential transformative impact of on-chain assets and markets. However, attracting a loyal user base, especially the dedicated players that traditional games have, has been a challenge for crypto games. Many crypto game players are more focused on profiting than pure entertainment, making it difficult to attract more non-crypto users. Additionally, many crypto games rely on web browser distribution and require the use of self-hosted wallets, limiting their audience and primarily attracting crypto enthusiasts rather than mainstream gamers.

However, compared to the previous cycle, games integrating crypto technology have seen significant improvements. The key change is a shift from the initial "fully on-chain owned games" idea to selectively placing assets on-chain, unlocking new functionalities without impacting the overall gaming experience. In fact, we find that many renowned game developers now view blockchain technology as an auxiliary tool, rather than a core marketing selling point.

'Off the Grid' is representative of this trend. Although the game's core blockchain component - the Avalanche subnet - was still in the testing phase at the time of release, it still became the top-ranked free game on the Epic Games platform. The game's core appeal lies in its unique gameplay, rather than Crypto Tokens or item trading markets. More importantly, we believe this game has paved the way for crypto-integrated games to enter a broader market, as it is now playable on Xbox, PlayStation, and PC (via the Epic Games store).

Mobile has also become an important distribution channel for crypto-integrated games, including native apps and embedded apps (such as Telegram mini-games). Many mobile games also selectively integrate blockchain functionality, but most of the activities are actually running on centralized servers. Typically, these games can be played without the need for external wallets, reducing the entry barrier and allowing even those unfamiliar with Crypto to participate.

In our view, the line between Crypto games and traditional games may continue to blur. Upcoming "Crypto games" are likely to be games with Crypto integration, rather than those solely focused on Crypto, and we believe they will focus more on the sophistication of gameplay and distribution channels, rather than "play-to-earn" mechanics as the core, which may drive broader adoption of Crypto technology, but we are uncertain how this will directly drive demand for liquid Tokens. In-game Tokens are likely to remain isolated across different games, and we believe non-Crypto enthusiast game players may not want external investors to influence the in-game economy.

4) DePIN

Source link: https://www.hellobtc.com/kp/du/12/5593.html

Source: https://mp.weixin.qq.com/s/hkVVmJVY91D50welhz6Eow