Bit has recorded a new all-time high (ATH) this week, briefly exceeding $108,000. However, it has since experienced a correction, falling below $96,000.

This decline reflects short-term profit-taking, but does not negate the long-term potential of Crypto.com. This potential continues to be the focus of attention.

Bit is experiencing active turnover

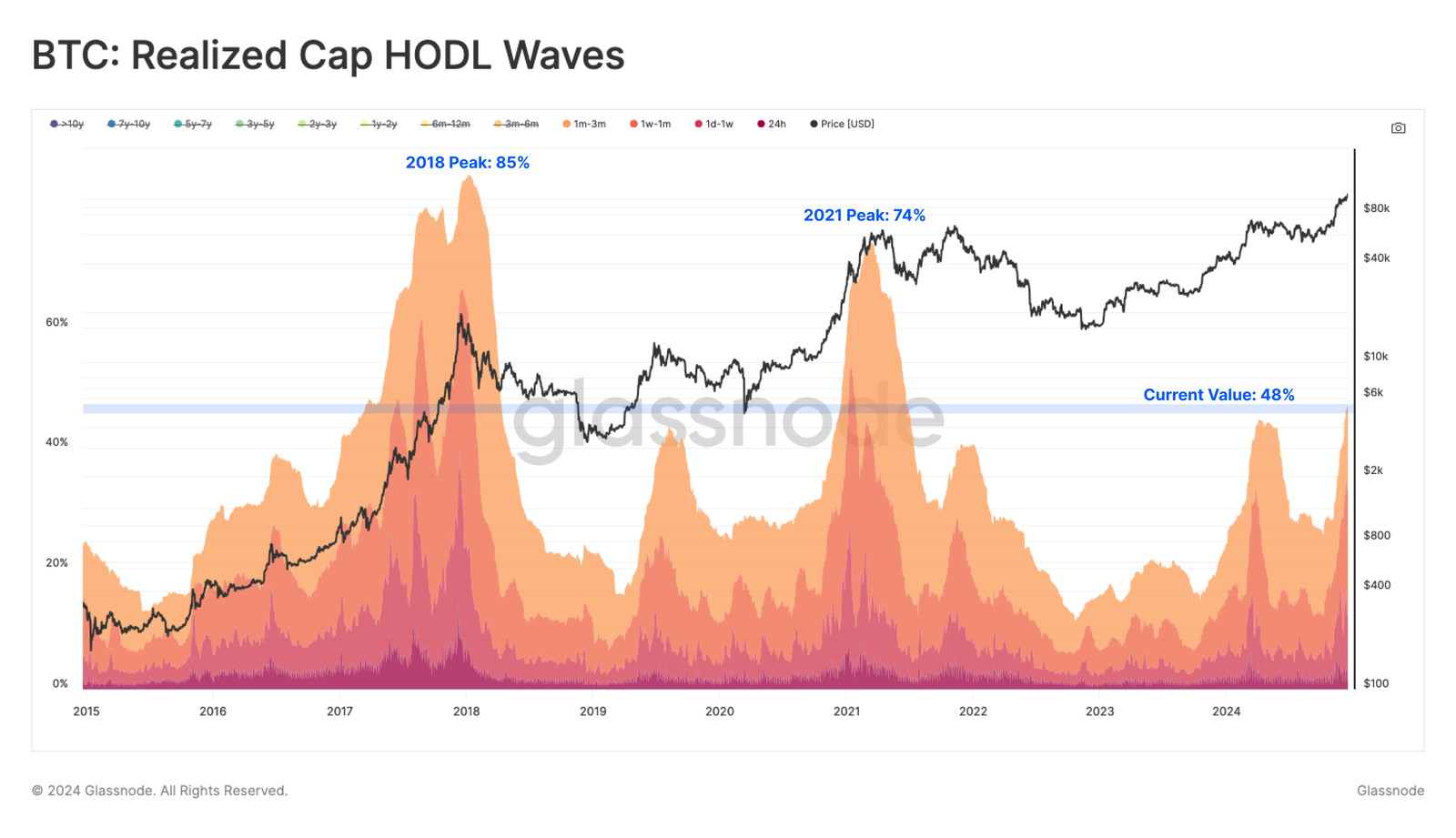

Medium-term Bit holders, particularly those who have held BTC for 6 to 12 months, are currently driving the trend of profit-taking. These investors had accumulated Bit during the previous cycle and are now seizing the opportunity to realize their gains.

This behavior reflects the actions seen during the 2015-2018 bull market. The Spent Output Profit Ratio (SOPR) used at the time remained below 2.5 for an extended period, ultimately leading to a euphoric rise.

As seen in the previous bull market, this large-scale profit-taking by holders has the potential to cause fatigue. For Bit to maintain its upward momentum, an increase in demand and the entry of new buyers is essential. Without these factors, the bull market may struggle to sustain its continuous rise.

The HODL wave shows an increase in the wealth held by recently moved Bit, indicating an increase in demand-side activity. Coins that were held by long-term investors are being distributed to new buyers, demonstrating the influx of fresh capital into the market. This trend emphasizes that interest in Bit is growing, despite the recent price fluctuations.

However, the proportion of wealth held by new investors has not yet reached the levels seen at the peak of the previous ATH cycle. The current indicators provide positive signals, but Bit's macroeconomic momentum depends on whether this demand will continue to increase. The sustained accumulation of new market participants will be the key to driving future price appreciation.

BTC price forecast: Securing $95,600 support is crucial

Bit is expected to find immediate support around $95,000. Currently trading at $95,144, it can recover if market sentiment remains positive.

The next important milestone for Bit is to turn $95,668 into support. Achieving this would increase the likelihood of a move back above $100,000. Crossing this psychological barrier could create renewed confidence and bullish momentum, attracting additional buyers.

If the $95,000 range cannot be maintained or profit-taking increases, Bit may decline. In such a case, the next critical support level is located at $89,800. A drop to this point would invalidate the bullish thesis and suggest a potential bearish phase for the market.