The price outlook for Ethereum (ETH) is attracting the interest of investors. In this atmosphere, cryptocurrencies have surpassed $4,000, and at one point fell below $3,200.

However, the price of Ethereum has risen 10% in the last 24 hours. Large transactions have increased to their highest level in nearly a week.

Ethereum, Increased Institutional Interest

The 10% surge in Ethereum has lifted altcoins to $3,422. On-chain data shows that the increase in institutional interest is a key factor influencing the Ethereum price outlook.

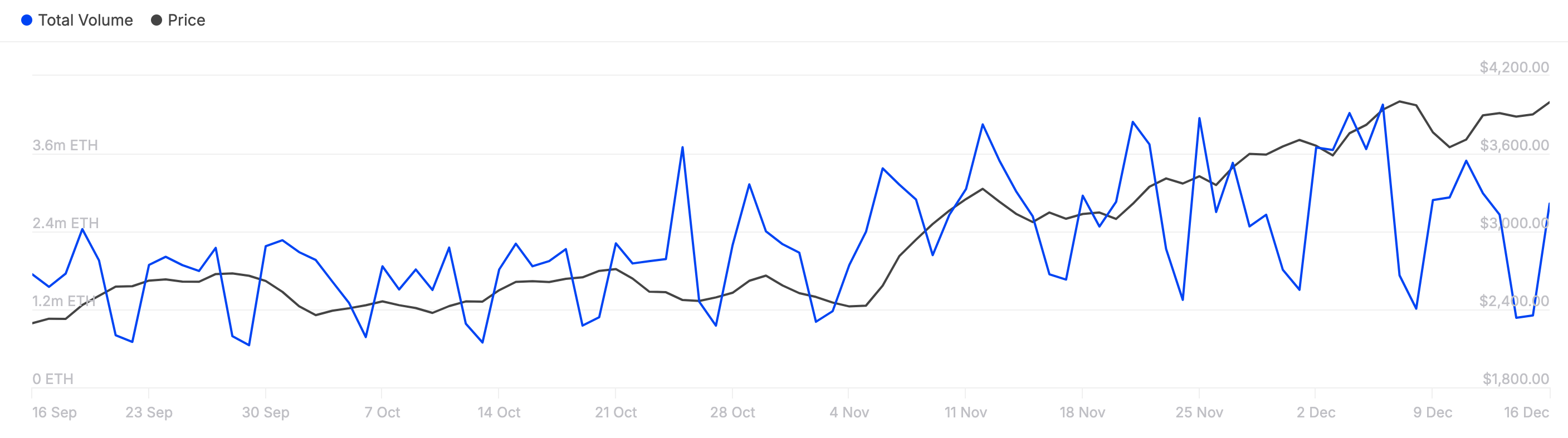

The on-chain data platform IntoTheBlock reports that large Ethereum transactions have increased to 2.83 million ETH. This increase suggests that trading activity between whales and major stakeholders has become more active.

Conversely, a decrease in this indicator suggests that interest is waning. At the time of writing, these transactions amount to about $11 billion. Historically, when this indicator rises along with the price, it is a bullish signal. Therefore, the ETH price could exceed $4,500 in the short term.

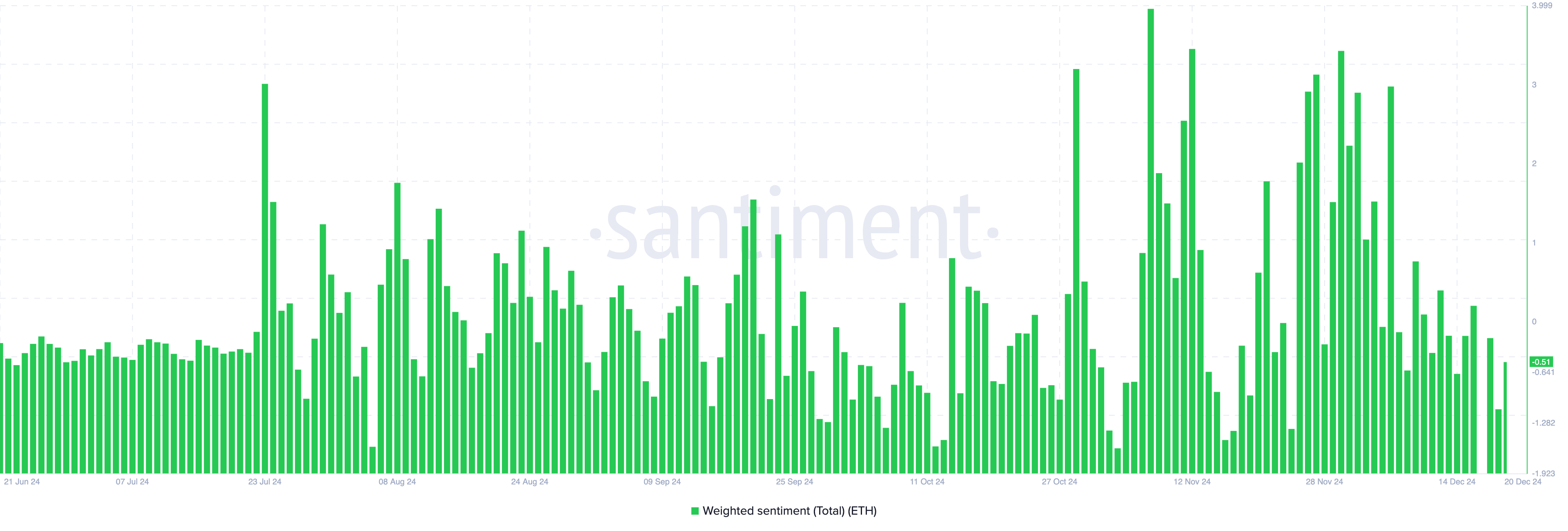

The weighted sentiment indicator suggests that the price of Ethereum can continue to rise. This indicator measures the overall market perception of cryptocurrencies. Positive values reflect bullish sentiment, while negative values indicate bearish sentiment.

According to data from the cryptocurrency online data platform Santiment, the weighted sentiment for Ethereum is approaching the positive territory. Remaining in this area could allow the value of ETH to continue to increase.

ETH Price Prediction: Hope Rekindled... Can It Break Through $4,000?

According to the 3-day ETH/USD chart, the Accumulation/Distribution (A/D) line continues to rise. The rise in the A/D line indicates that investors are buying, which can push the price higher. If the indicator's value declines, it suggests that investors are distributing, which is a bearish signal.

In the case of ETH, the electronic nature of the cryptocurrency suggests that the price can break through the $3,982 resistance. If verified, the value could reach $4,110. However, if the market conditions become strongly bullish, the price of Ethereum could exceed $4,500.

However, if the cryptocurrency fails to break through the resistance, it may not experience such a rally. Instead, the price could drop to $3,178.