Author: Ezra Reguerra, CoinTelegraph; Compiled by: Tong Deng, Jinse Finance

Although the asset class has faced some major setbacks, Non-Fungible Tokens (NFTs) remain an integral part of the Web3 space in 2024. Industry commentators and professionals insist that the utility of NFTs remains intact, bringing an optimistic sentiment for a recovery.

While the media occasionally declares NFTs dead, holders continue to trade, with data tracker CryptoSlam showing that NFT sales this year were around $8.5 billion.

Sales volume may be lower than previous years, but the number of buyers increased from 4.6 million in 2023 to 7.5 million in 2024, a 62% growth. This is also 37% higher than the 5.4 million unique buyers recorded in 2022, a year widely considered the peak of NFTs. Thus, while transaction volume may decline, demand for the asset class continues to grow.

Although the space has persisted, it is undeniable that NFT holders have taken a beating this year, from a seven-month slide and major projects exiting the space, to the U.S. Securities and Exchange Commission issuing Wells notices to NFT projects.

NFT Projects Face Setbacks in 2024

In January, the social media platform X discontinued support for NFTs, after allowing paid users to link NFTs to their profile pictures the previous year. A community member called it the "bottom" for NFTs, while another said it was another "black eye" for the industry.

Some questioned the decision to remove the feature, arguing it provided real utility for users, and raised issues of bot accounts and scammers. A community member stated that NFT profile pictures allowed users to verify they were interacting with real people.

That same month, video game retailer GameStop announced it would be shutting down its NFT marketplace, citing unclear U.S. regulations.

In July, U.S. gaming company DraftKings also took a similar move, closing its NFT business, including its Reignmakers series and marketplace, citing "legal developments."

Additionally, the layer-2 blockchain Immutable and cryptocurrency exchange Kraken shut down their NFT marketplaces in August and November, respectively.

In December, Nike's NFT project RTFKT announced it will cease operations in January 2025.

SEC Issues Wells Notices to NFT Entities

The SEC increased its focus on NFTs in 2024. On August 28, OpenSea CEO Devin Finzer posted on X that the securities regulator had issued Wells notices to NFT trading platforms.

A Wells notice is a formal notification from the SEC that it is considering enforcement action against an entity. The notice indicates the agency has completed its investigation and found evidence of potential securities law violations.

Finzer stated that the SEC alleges that NFTs on OpenSea may be considered unregistered securities. The executive said the market is prepared to contest any enforcement action by the agency, and added that the SEC's stance on NFTs will "stifle innovation" across a broader range.

On December 16, the NFT platform CyberKongz received a Wells notice from the SEC. The CyberKongz team stated the issue stems from their sale of Genesis Kongz NFTs in 2021.

The project said the SEC has engaged with them in "concerning language," claiming the tokens cannot be used in blockchain games without being registered as securities. CyberKongz said the SEC's stance could have far-reaching implications for blockchain gaming and vowed to contest the allegations.

NFTs Face Seven-Month Slump in 2024

NFT sales reflect the broader challenges of 2024. March saw the highest monthly sales at $1.6 billion, buoyed by NFTs on Ethereum, Bitcoin, and Solana - the three most popular digital collectibles blockchains.

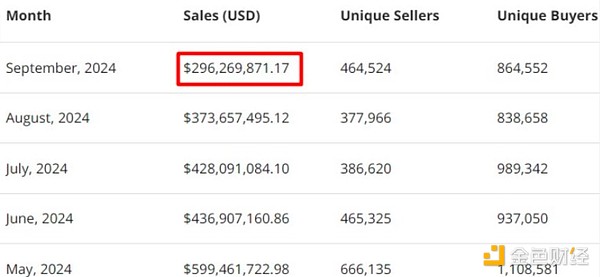

However, the market steadily declined, with NFT sales hitting a historic low in September, falling below $300 million for the first time since 2021. Total NFT trading volume also dropped from 7.3 million in August to 4.9 million in September.

After hitting the lowest point, NFTs reversed the trend in October, growing 18% with sales of around $356 million. In October, Solana-based NFTs also reached a historic $6 billion sales milestone.

November's performance was even stronger, with NFT monthly sales reaching $562 million, the highest level in six months. The recovery of NFT assets was again driven by Ethereum, Bitcoin, and Solana collectibles later in the year.

2025 NFT Predictions

While some may have given up on NFTs, professionals working in the space have various theories on their potential comeback.

RARI Foundation's Head of Strategy Jana Bertram said on the Hashing It Out podcast that NFTs may return in different forms, acknowledging the decline in trading volume, but believing the technology still has value.

Bertram thinks NFTs can expand beyond digital art and collectibles, into use cases like identity verification, ownership records, and healthcare documents.

When asked about the prospects of Bitcoin NFTs in 2025, OKX's Global Chief Commercial Officer Lennix Lai said these assets are entering a new growth phase. He shared that their trading data reflects a recovery, with Ordinals volume growing 55% from October to November.

"We're seeing encouraging signs of adoption - from the first Bitcoin-backed jewelry brand JVRN launching Ordinals series, to other renowned artists choosing to inscribe their works on the world's first blockchain," Lai said.

Lai also shared they are launching an Ordinals launchpad to enable creators to publish, inscribe, and trade collectibles on Bitcoin. "With these foundations and broader market tailwinds, we believe the Bitcoin NFT movement is still in its early stages and has tremendous growth potential ahead," Lai added.

Meanwhile, Animoca Brands Executive Chairman Yat Siu pointed out that the NFT market will be larger than in 2021 and 2022. He believes that as the crypto market grows, every component within the Web3 space will grow accordingly:

"Standard Chartered predicts the crypto market could reach $10 trillion by 2026. If that's true, then everything will be better. That means, looking at the current NFT market trading volume, I think their monthly trading volume will exceed billions of dollars, because the entire market is growing."