2024 was a momentous year for the cryptocurrency industry. The launch of the Bitcoin spot ETF, accelerating institutional adoption, the industry boom brought by Trump's crypto-friendly stance, and BTC's first breakthrough of the $100,000 mark - all these signs indicate that cryptocurrencies have become an unstoppable force, with profound changes shaping the industry's future and providing endless possibilities for 2025.

Review of the Cryptocurrency Industry in 2024

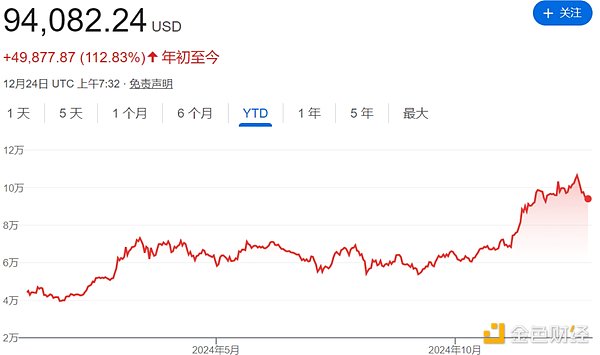

In 2024, the cryptocurrency market saw many events, with shifts in industry dynamics and market sentiment shaping the unique character of the year. Looking back, Bitcoin's performance was particularly eye-catching, with its price cumulatively soaring over 110%, showcasing the unique charm and potential of cryptocurrencies as an emerging investment field.

1. The ETF Era Begins

At the beginning of the year, the U.S. Securities and Exchange Commission (SEC) approved the first Bitcoin spot ETF, a milestone decision that marked the formal entry of crypto assets into the mainstream financial market. Funds poured in like a tide, driving Bitcoin's price to a new all-time high in March, with the enthusiasm of institutional investors and the market's high recognition laying a solid foundation for the prosperity of the cryptocurrency market throughout the year.

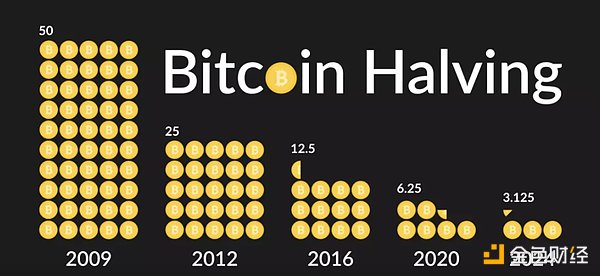

2. Bitcoin's Fourth Halving

At the end of April, Bitcoin experienced its fourth halving event in history, further highlighting Bitcoin's unique position as a scarce asset. Although the market did not continue to strengthen after the halving, but instead entered a correction period after May, historical data shows that the supply reduction effect brought by the halving cannot be ignored in its long-term price-driving role, becoming an important catalyst for the market's optimistic sentiment in 2024.

3. Market Adjustment and the Rise of MEME

Around the middle of the year, the cryptocurrency market began a painful adjustment period, affected by factors such as global macroeconomic uncertainty, geopolitical conflicts, and the German government's sell-off, leading to increased market volatility, with major market indicators falling sharply from their highs in the first half of the year, and Altcoins even dropping to the lows of the bear market. During this period, the listing of the Ethereum spot ETF brought a glimmer of hope to the market, but failed to replicate the bullish performance of the Bitcoin ETF, with Ethereum and its ecosystem leading the decline, and market sentiment becoming depressed. In the midst of this, MEME coins, with their unique value capture model and community consensus, emerged as a new frontier, becoming a market cap of over $100 billion, triggering deep industry discussions on their core value.

4. The Fed Initiates a Rate Cut Cycle

In September, the global financial market saw a major turning point, with the Federal Reserve cutting interest rates for the first time in four years, forcing central banks around the world to follow suit with easing policies, ushering in a relatively loose global monetary policy environment. Interest rate cut cycles are often closely related to the rise in prices of risky assets, and the cryptocurrency market's confidence, after a period of depression, began to rebound, with trading volume and stablecoin total supply showing signs of recovery, and market liquidity and activity gradually restoring.

5. The "Trump Trade" Drives Bitcoin to Break $100,000

In the fourth quarter, the cryptocurrency market witnessed a historic moment. During the U.S. election period, cryptocurrency became a core topic on the American political stage for the first time. The Trump team's clear commitment to promoting a more crypto-friendly regulatory framework greatly boosted market sentiment, with the "Trump trade" continuously heating up and continuing to gain momentum after his victory.

Subsequently, Trump appointed crypto-supportive individuals to key positions in various departments, such as the Treasury Secretary, Commerce Secretary, SEC Chair, Government Efficiency Department leader, and Cryptocurrency Affairs Officer, and also promoted Bitcoin strategic reserve plans across states, stimulating the price of Bitcoin to soar, historically breaking through the $100,000 mark. Bitcoin and other cryptocurrencies not only achieved a leap in economic value, but also gained unprecedented recognition and attention at the political and social levels.

Bitcoin reached a high of $108,000

Events to Watch in 2025

On January 20, 2025, the United States will hold the presidential inauguration ceremony, and Trump will officially take office. Compared to the Biden administration, the new government led by Trump is more crypto-friendly, and the increasingly open and transparent regulatory environment will provide ample imagination space for the future of the cryptocurrency market, which the market is highly focused on and looking forward to.

1. Advancement of the Bitcoin Strategic Reserve Plan

Trump's vision of an "American Strategic Bitcoin Reserve" is undoubtedly one of the most noteworthy focuses in 2025. If Bitcoin is granted strategic reserve status, it will undergo a magnificent transformation from a niche market asset to a public treasury asset, significantly enhancing its legitimacy and recognition. As a strategic reserve asset, Bitcoin will stand alongside traditional assets such as gold and foreign exchange reserves, providing a guarantee for national economic stability and financial security.

Trump has repeatedly proposed the idea of establishing a national Bitcoin reserve during his campaign, and recently hinted at it again in an interview at the New York Stock Exchange. Whether this ambitious proposal can be implemented in the short term remains to be seen, but it is expected to be actively promoted in 2025, and any indication from Trump that this plan is progressing will provide a clear bullish signal to the market and convey a crypto-friendly message, expanding Bitcoin's influence in the global financial system.

At the federal level, multiple states have already submitted proposals for Bitcoin strategic reserves, and an increasing number of U.S. listed companies are either already implementing or discussing Bitcoin reserve plans. Globally, these "pioneering occupancy" moves by the U.S. are expected to be quickly emulated, and many countries may soon engage in a round of Bitcoin reserve competition. Forbes has even predicted that the G7 or BRICS countries may establish strategic Bitcoin reserves by 2025.

2. Continued Growth of Bitcoin ETFs and the Birth of New Cryptocurrency ETFs

For Bitcoin, the most important event this year was perhaps the SEC's approval of multiple Bitcoin spot ETF listings in early January, and these ETF products have attracted nearly $120 billion in funds in less than a year.

The success of Bitcoin and Ethereum ETFs is expected to make 2025 a turning point for the launch of other cryptocurrency ETFs, including SOL, XRP, and the staking function of Ethereum spot ETFs. Although the SEC previously rejected some Solana ETF applications, it is still reviewing over 10 related applications, indicating a continued interest in expanding crypto investment options. As the market matures and regulations become clearer, more types of cryptocurrency ETFs are expected to be approved, enhancing market liquidity and investor confidence.

3. The Cryptocurrency Market Reaches a New Bull Market Peak

Historical data shows that the Bitcoin halving effect usually brings about a year-long price appreciation cycle. It is expected to drive the market's optimistic sentiment and push prices higher, continuing until the first half of 2025.

On the other hand, historical experience shows that the peak of the cryptocurrency bull market is usually not during the interest rate cut cycle, but more likely at the end of the interest rate cut cycle or near the beginning of the interest rate hike cycle. For example, the extremely loose monetary policy triggered by the COVID-19 pandemic in 2020 kicked off the cryptocurrency bull market, and as the Federal Reserve gradually released tightening policy signals, the market peaked at the end of 2021, and the interest rate hike officially began in 2022.

From a macro perspective, the first stage of the Federal Reserve's current interest rate cut cycle has ended, and a new stage will begin next year. The latest dot plot shows that there are expected to be 2 more interest rate cuts totaling 50 basis points next year. It is expected that by mid-2025, the benchmark interest rate will drop to a neutral level. Whether there will be further interest rate cuts or tightening signals will depend on the inflation level at that time, as well as whether Trump can successfully exert influence on the Federal Reserve. If the Federal Reserve releases tightening signals to address inflation, the market may enter an adjustment period.

Summary

2024 is undoubtedly the beginning of a milestone year for cryptocurrencies to enter the mainstream financial market, and it has also opened up endless possibilities for 2025. Although the current market is experiencing volatility and adjustment, with the Trump administration further promoting cryptocurrency-friendly policies, the launch of more cryptocurrency ETFs, and the increasing adoption by more institutions and sovereign states, the market is at the forefront of innovation and expansion, full of attractiveness, and the industry is expected to usher in broader development prospects and richer investment opportunities.

4E, as the official partner of the Argentine national team, provides trading services covering more than 600 assets including cryptocurrencies, commodities, stocks, and indices, and also supports financial products with an annualized yield of up to 5.5%. In addition, the 4E platform has a $100 million risk protection fund to further safeguard the security of users' funds. With 4E, investors can closely follow market dynamics, flexibly adjust their strategies, and seize every potential opportunity.