Bitcoin opened a rapid upward trend last night, breaking through multiple previous resistances, and reached a high of around $99,480 at around 2 am today, and the bulls seem to have regained their upward momentum.

VX: TTZS6308

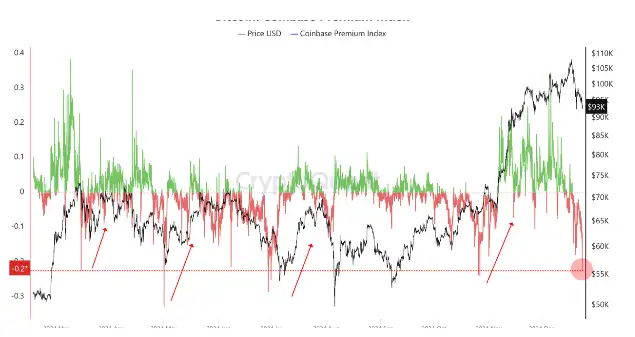

Does the negative premium on Coinbase Bitcoin suggest a rebound?

Today, Western countries will welcome the most important holiday of the year, Christmas. Therefore, some investors were originally concerned that Bitcoin might continue to decline due to a lack of upward momentum.

Last night, on the US-listed cryptocurrency exchange Coinbase, Bitcoin had a negative premium of -0.221%, suggesting that the current buying demand from US investors has eased slightly.

Looking at historical data, this phenomenon is usually short-lived during a bull market and is often a buying opportunity:

The negative premium on Coinbase Bitcoin reached -0.221%, which is the fifth time it has reached this level since May last year. The decline of this indicator suggests that the buying pressure from US investors has eased compared to investors on Binance.

Although it is not yet certain whether the current correction has bottomed out, if the bull market is still ongoing, the bottom will likely form soon and a rebound will occur.

From the chart below, although the price has fallen again twice since May last year when the negative premium exceeded 0.2%, overall it has rebounded shortly afterwards, which may be an indicator worth long-term attention for spot traders.

Altcoins may see a catch-up rally

On Friday, Bitcoin and Ethereum options worth about $20 billion will expire, and the market may see a new round of volatility.

If Bitcoin rebounds and rises above $100,000 at that time, the volatility may remain stable; but if Bitcoin continues to struggle below $100,000, it may trigger a catch-up rally in Altcoins:

A similar situation occurred a month ago, when the Ethereum/Bitcoin exchange rate was rebounding from the 0.032 support level, driving changes in Altcoins. We are closely monitoring whether Bitcoin will continue to explore lower levels from the current level to confirm the direction of market capital rotation and the trends of other cryptocurrencies.

The core factor of this round of correction is still the profit-taking of short-term investors

In this cycle, whenever the profit rate of short-term investors reaches above 30%, the probability of a correction increases rapidly, until their profit rate is reduced or the cost of continuous buying becomes too high, and the market will then enter the next stage of development.

At the same time, external changes also support the adjustment, the main forces supporting the next level of BTC adoption in this cycle: the Fed's interest rate cuts, the Trump effect, and MicroStrategy's BTC purchases have passed their initial strong period and entered a period of rest between cycles. In addition, factors such as the Christmas holiday that have a significant impact on the BTC ETF, the BTC adjustment is also reasonable.

All of the above factors are not short-term forces, and in the long run they will all help the long-term development of BTC. Take MicroStrategy as an example, on December 23, it will officially enter the Nasdaq 100 index, which will open the door for mainstream US funds to passively allocate BTC.

The inflow of funds has shown a more obvious slowdown in the past week, and this may continue for 1-2 months. Correspondingly, the scale of selling by both long-term and short-term investors has also started to slow down significantly, returning to the level before this round of rise. With the balance of the two, the probability of a volatile market increases.

During this period, if the capital side maintains a relatively net inflow state, and the cost of short-term investors further rises to above $90,000, then the space for the next major upward wave will be further opened up.

The relative support level of this round of adjustment may be around $85,000 - the cost line of short-term investors, which is currently in a gradual upward trend.

Ethereum and Bitcoin are similar, often losing momentum when prices rise sharply, especially when prices have risen more than 60% within 30 days. Historical data shows that this is usually a good opportunity to take profits.

The price has now retreated to the same level as a month ago, which may mean that an opportunity to re-enter the market is brewing, especially if the cryptocurrency bull market is expected to continue until 2025.

Ethereum has not shown a higher cost performance ratio in this round of rebound compared to the previous bull market. However, it is still a favored asset for investors. The continuous inflow of ETF funds is the best proof. This strong demand not only highlights the important position of Ethereum, but also shows that it is still highly regarded even if its performance in this cycle is slightly lower than expected.