Since the peak of Axie Infinity (AXS) at the end of 2021, the entire GameFi industry has been in a prolonged downtrend. In the first half of 2024, along with the Tap-to-earn wave, many investors predict that GameFi will become attractive again. However, the market has not been as vibrant as expected so far.

What are the signs that give hope to GameFi investors in 2025? Here are the assessments and observations from BeInCrypto.

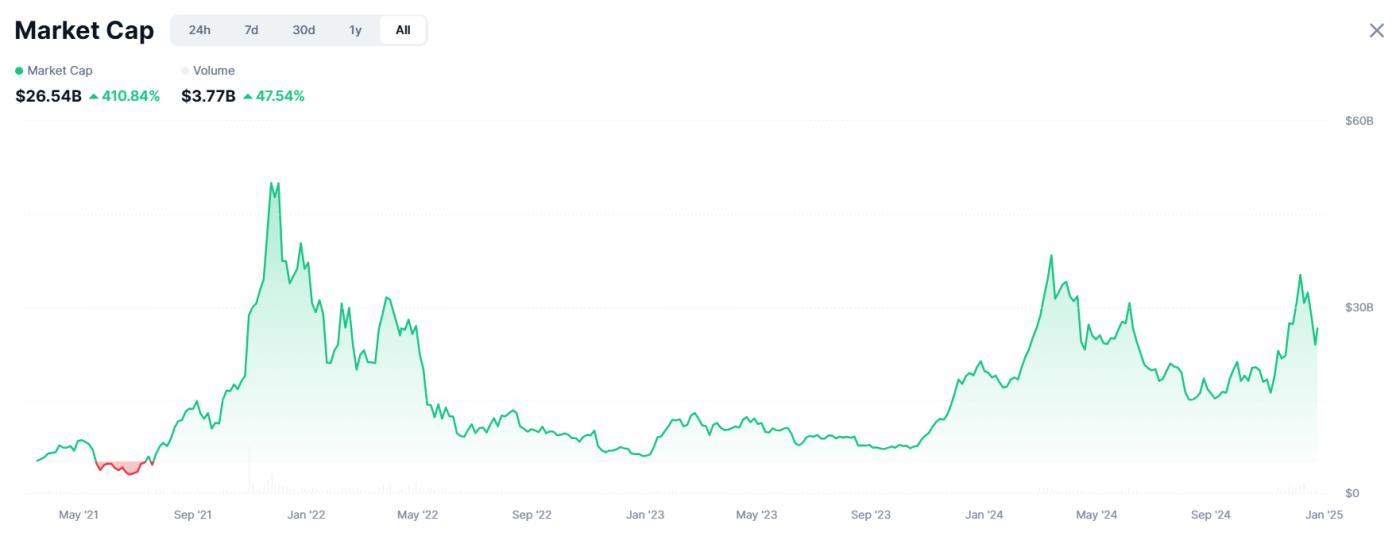

Market capitalization has increased, but trading volume is far behind the 2021 period

CoinMarketCap data shows that the GameFi market capitalization is currently around $26.5 billion, still far from the 2021 high of $50 billion. Notably, the trading volume in the GameFi segment reached over $10 billion at its peak in 2024, comparable to 2021.

Although the trading volume is similar, the increase in market capitalization is different. This indicates selling pressure from previous investors.

GameFi market capitalization and trading volume. Source: CoinMarketCap.

GameFi market capitalization and trading volume. Source: CoinMarketCap.Additionally, Coingecko data shows that the popularity of the GameFi narrative has declined, with investor interest dropping 6.77 percentage points from 10.49% in 2023 to only 3.72% in 2024. Meme coins, AI, and RWA are the dominant topics in 2024. Meanwhile, the biggest hope for the GameFi ecosystem in 2024 was the Tap-to-earn movement from Telegram Mini Apps, but this trend has shown signs of cooling down.

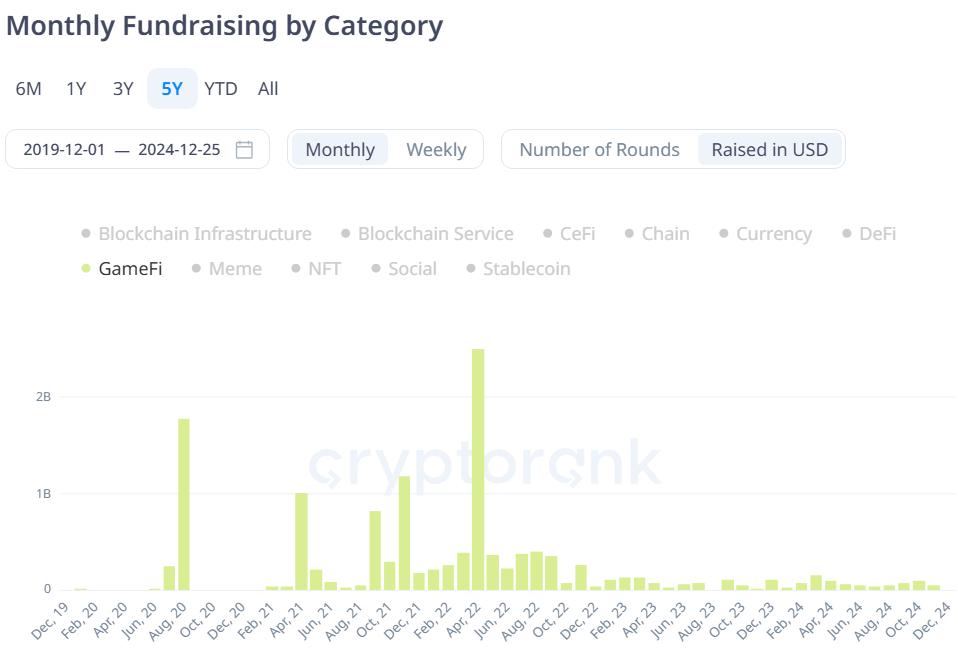

Funds raised by GameFi projects in recent years. Source: CryptoRank.

Funds raised by GameFi projects in recent years. Source: CryptoRank.From the perspective of VCs, the expectations of investment funds for the GameFi segment have not yet improved, as evidenced by the highest monthly fundraising of around $100 million in 2023-2024. This figure was in the hundreds of millions of dollars, and even exceeded $1 billion per month, in 2020-2022.

Positive signs in the GameFi sector that provide a basis for expectations in 2025

Based on the above analysis, it is difficult to expect GameFi to regain its attractiveness in the first quarter of 2025. GameFi needs new projects or ideas to revive investor and VC interest. The bullish market in December has helped GameFi tokens recover, but GameFi itself needs to create its own internal momentum.

A few positive signs that provide a basis for investors to expect the GameFi sector in the coming year:

- Changes in the legal environment under the Trump administration may have a positive impact. The SEC has stated that ERC-20 tokens associated with a blockchain game must be registered as securities - a position that could seriously impact the entire industry. CyberKongz is the latest victim of this stance. When these legal concerns are lifted, GameFi projects may have more room to implement their ideas.

- The second notable sign is that the global gaming market in general is projected by many experts to continue growing over the next 4 years with a compound annual growth rate (CAGR) of 12.2%. The development of the global gaming market will create an environment for blockchain-based ideas to integrate with traditional games and become a catalyst for the emergence of new GameFi projects that can change the game.

Report and forecast of the global gaming market. Source: thebusinessresearchcompany

Report and forecast of the global gaming market. Source: thebusinessresearchcompanyHowever, these expectations do not guarantee the revival of current GameFi projects or the return of token prices to their previous highs.

Also Read: What can GameFi projects learn from the success of "Black Myth: Wukong"?

Join the BeInCrypto community on Telegram to stay updated on the latest analysis and news about the financial market in general and cryptocurrencies in particular.