All victories come from the persistence of faith. Believe in the power of belief, and it has never let you and me down. Welcome to follow Starry Sky Value Investment, someone has to look up at the stars.

Overnight, Bitcoin rebounded after hitting the bottom, returning above $98K. Before writing the article, I happened to flip through the data in the assistant's daily report in the member group. In the past three days, Bitcoin ETF outflows have reached nearly $1.2 billion, with a net outflow of $338 million in a single day. Surprisingly, Ethereum has become a net inflow, with $53.54 million coming in. It's a bit magical.

Speaking of this, many people are cursing and grumbling at Ethereum, which has been struggling to break through $4K. Even Massari's 2024-2025 industry report has a special chapter to criticize Ethereum, saying that Solana is biting too tightly, too outdated, and lacks new ideas, and there are a lot of negative news. Then I just glanced through it, and I couldn't bear to look at it anymore. I suggest you all don't bother to read it.

What is the real situation? Putting aside the development of the Ethereum ecosystem in recent years, let's just look at the price. Today, I was still talking about this as a joke in the member group:

"At the end of December 2020, which was 4 years ago, the crypto bull market had already started. The price of Bitcoin was $29,000, about 145% of the previous bull market's high. The price of Ethereum was $760, 54% of the previous bull market's high. Now another halving bull market has started, with Bitcoin at $98,000, 142% of the previous bull market's high, and Ethereum at $3,500, 71.8% of the previous cycle's high."

The data is there, Ethereum is not lagging behind, but is even stronger than the previous year. The only difference is that as the market cap has grown larger, the multiple in this round is likely to be smaller than the previous round, that's it. Many people invest based on impulse, relying solely on feelings, being vague about this and that, how can they do well?

Even for Solana, which is highly recognized by everyone, I think most people haven't actually made money. They keep listening to this and that, constantly switching positions, and the coins they hold keep decreasing. In the end, they come back to ask for guidance, wondering if this coin or that coin can still be saved.

Chances are they can't be saved, and I'm not talking about the coins, but the people. Don't put me on too high a pedestal, we're all retail investors, the only difference is that I may have a little more money, but the essence is the same. The influence of retail investors' concepts and resources on the market is almost zero.

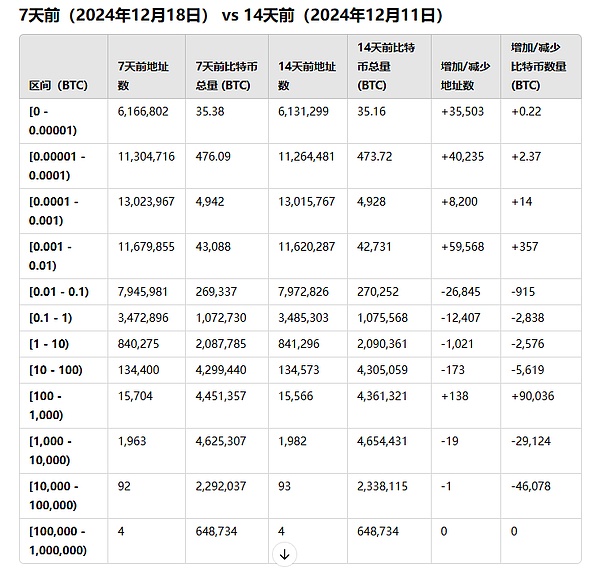

Don't believe it? Let me show you some data. From December 11 to December 18, the number of Bitcoin holding addresses increased by 103,000 cumulatively, and looking at the K-line, this was the worst drop. Why? The addresses with the most growth are those holding 0-0.01 Bitcoin, with a cumulative increase of only 373.59 Bitcoins, currently worth $36 million. At the same time, the top 10 addresses decreased by one, with a decrease of 46,078 Bitcoins; the addresses holding 1,000-10,000 Bitcoins decreased by 19, with a decrease of 29,124 Bitcoins.

The market is determined by the whales, this is the reason for the decline. But the reason it doesn't fall further is that there are also whales buying in, with the number of addresses holding 100-1,000 Bitcoins increasing by 138, with an increase of 90,000 Bitcoins.

Retail investors are really adrift in this market, with not much ammunition to play with and can't withstand the turmoil. In the last bull-bear cycle, a friend took out 6 million yuan to buy the dips, and I told him to buy Bitcoin and Ethereum. Now it's skyrocketing, so I'll congratulate him and show off a bit. But when I asked, he actually lost 820,000 yuan, and I was surprised and asked about it.

The reason is, first, he didn't buy enough Ethereum, only 1.5 million yuan, then he only bought 500,000 ETH after not listening carefully, and then he focused on studying various alpha opportunities, Bitcoin second-layer ecosystems, TON ecosystems, Solana & meme, LSD, and the remaining 500,000 ETH was basically wiped out. Just when he thought he had the 500,000 ETH as a cushion, he heard all kinds of rumors and news, and kept switching positions, operating frantically...

Of course, there are also many people who are willing to follow my advice and guidance. In the bear market, they adjusted their positions significantly according to our strategy, exchanged a lot of Bitcoin, and are now very comfortable, and will be even more comfortable in the future.

Many people like to boast, "I made a lot of money on small coins based on my knowledge," but in reality it's just luck. People with enough knowledge will choose Bitcoin. Not to mention some KOLs and bloggers who don't understand, I've met several top OGs in the past few days, they've made a lot of money running funds, with far more industry resources and inside information than us, but none of them have outperformed Bitcoin.

Earlier, I talked to a top VC in Shanghai, without mentioning the name. Their research reports are very forward-looking, saying that if the ETF is approved this round, it will bring at least $30 billion in incremental funds to Bitcoin, which is a very powerful judgment. However, the problem is that they chose to go all-in on Bitcoin's second layer, not because they are stupid, but because if they only buy Bitcoin, there's no way to explain it to their LPs, after all, they can buy it themselves.

With this, many institutions have unanimously stopped emphasizing returns. On the one hand, they haven't outperformed Bitcoin, so they don't have the face to say it; on the other hand, it may make LPs think "I might as well just buy Bitcoin myself"... So VCs are all talking about "supporting innovation," "witnessing the future of the future," blah blah blah...

Then the projects they invested in, all with locked positions, the first ones to run away are the market makers, project parties, and airdrop parties. They tried to use the Internet playbook, but ended up being harvested extremely miserably, especially the third-tier and fourth-tier VCs, who are being bullied completely. And that's not all, VC firms have no business, so they start trading coins individually, playing MEME, playing this and that, losing money like a farmer...

So, if you want to trade coins and play small coins, these VCs are really hard to deal with. Why should retail investors take big positions? Other than Bitcoin and Ethereum, to make money, you have to be in the crypto industry for dozens of hours a day, and you need your own analysis capabilities. Many people have their own jobs and don't have that much time, the best way is to allocate Bitcoin, and follow the people who can get results with the little money left, without wasting the early industry dividends.