Two whales continue to increase their holdings of ai16z, with unrealized profits of nearly $8.5 million

The whale starting with E9uD bought 3.09 million ai16z (worth $2.46 million) 2 hours ago. This whale has bought 18.7 million ai16z (worth $15.72 million) at an average price of about $0.45 over the past month, with unrealized profits of $7.36 million.

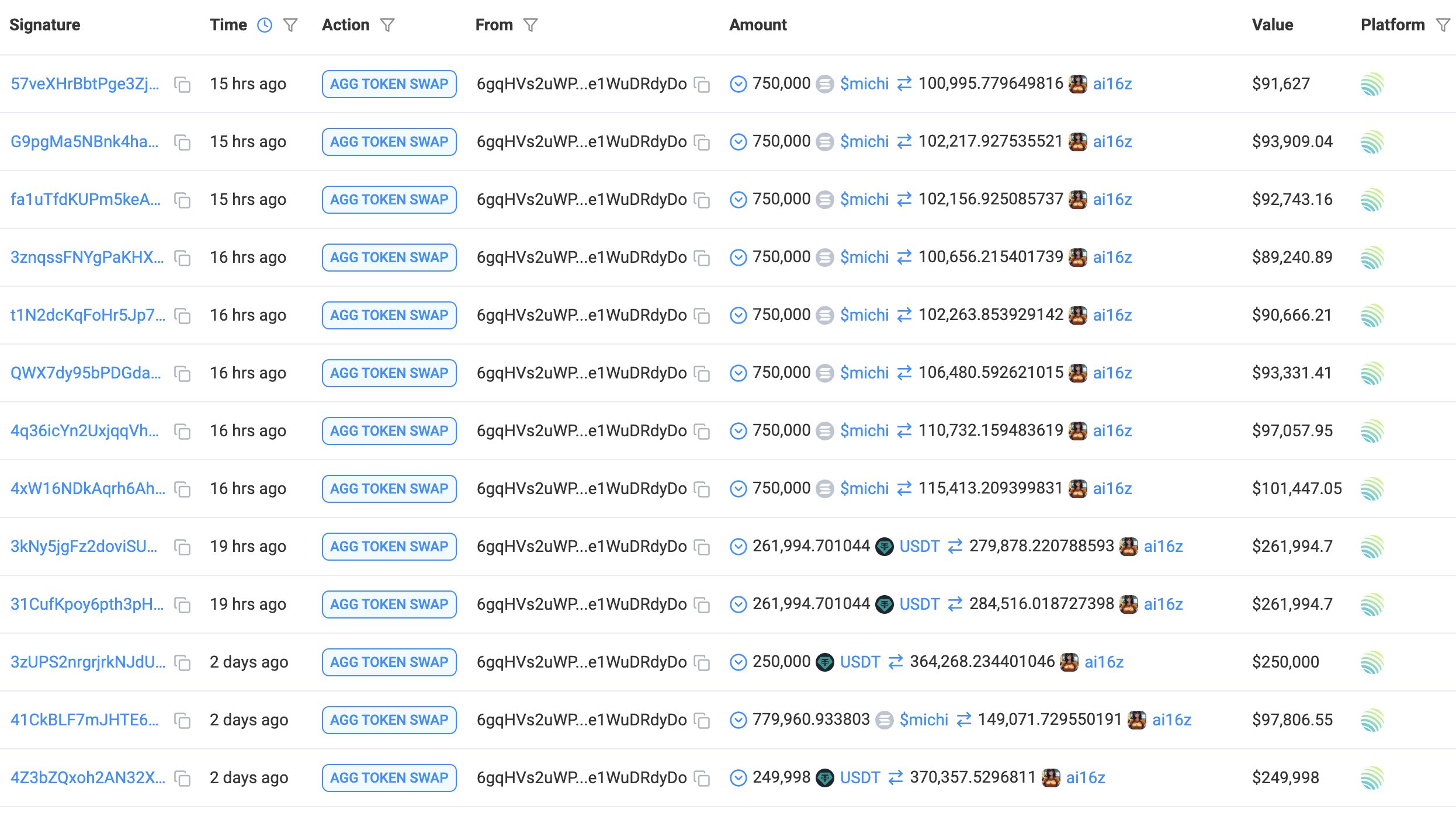

The whale starting with 6gqH bought 1.4 million ai16z (worth $1.27 million) 15 hours ago. This whale has bought 7.2 million ai16z (worth $6.05 million) at an average price of about $0.68 over the past week, with unrealized profits of $1.13 million.

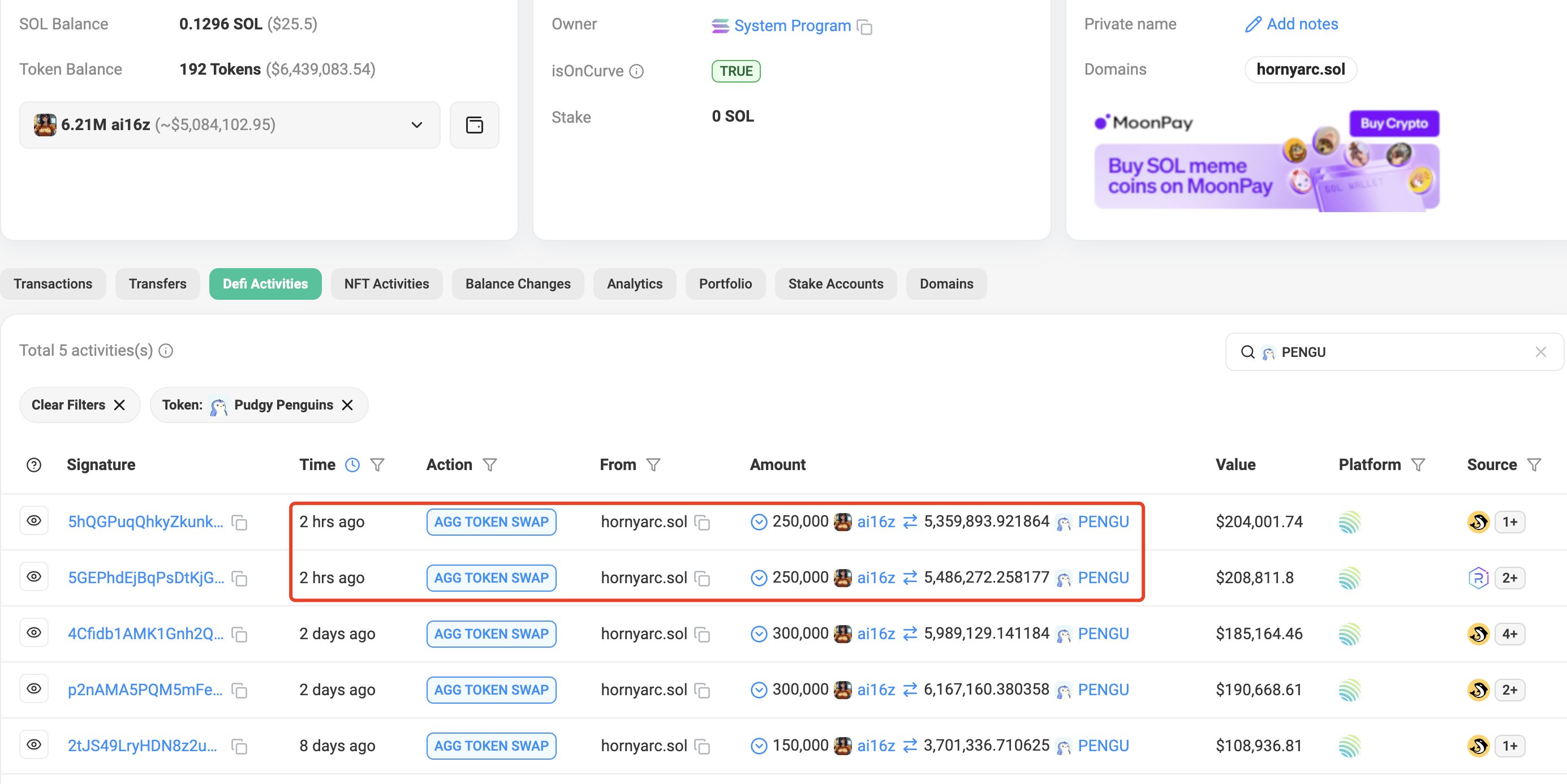

A certain ai16z whale has built a position of 79.9 million PENGU in the past 8 days, with unrealized profits of $835,000

A certain whale, after making a profit of $9.5 million through ai16z, converted another 500,000 ai16z (worth $412,000) into PENGU 2 hours ago.

This whale initially spent $1.15 million to purchase 14.08 million ai16z, and later sold 7.87 million for $5.57 million, leaving 6.21 million ai16z (worth $5.08 million).

Over the past 8 days, this whale has spent $2.47 million to purchase 79.9 million PENGU, with unrealized profits of $835,000.

A certain Ethereum ICO whale transferred 4,160 ETH, worth about $14.5 million, to Kraken

A certain Ethereum ICO whale transferred 4,160 ETH (worth about $14.5 million) to the Kraken exchange 3 hours ago.

This whale obtained 20,000 ETH (worth $62,000 at the time) during the Ethereum Genesis Block in July 2015, and still has about 7,043 ETH (worth $24.6 million) in staking. The whale's historical transactions show a tendency to realize profits at market highs.

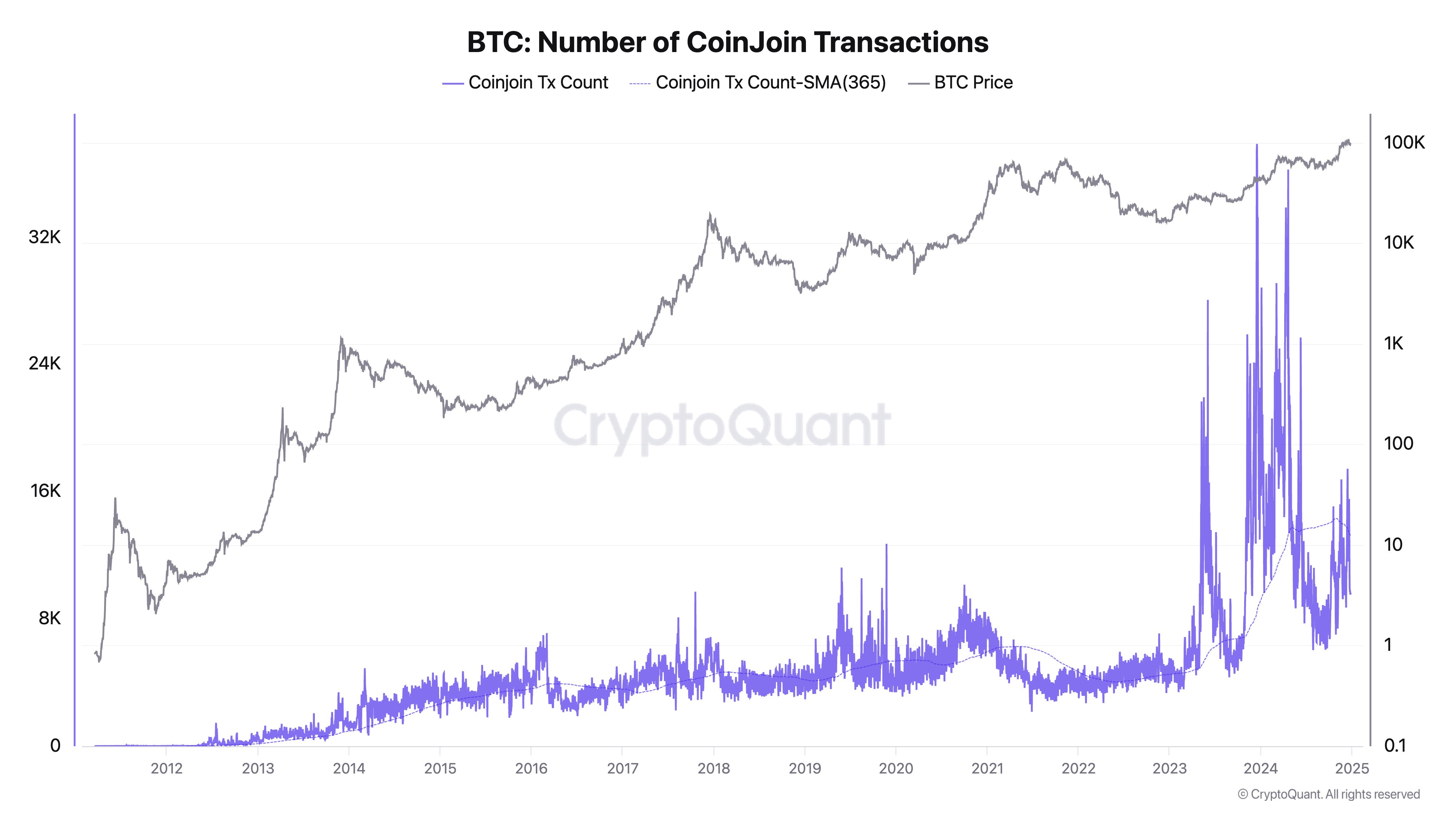

Whales are accumulating BTC through privacy transactions

On December 26, CryptoQuant CEO Ki Young Ju posted on social media that "whales are accumulating BTC through privacy transactions.

Over the past two years, the annual average number of CoinJoin transactions has surged. While some attribute this surge to hackers laundering money, a Chainalysis report states that the total hacker losses this year were $2.2 billion - less than 0.5% of the $377 billion in realized market value inflow of BTC. In 2024, 1.55 million BTC flowed into accumulation addresses, mainly related to ETFs, MicroStrategy, and custodial wallets. Whales often use privacy transactions to transfer funds to new institutional investors.

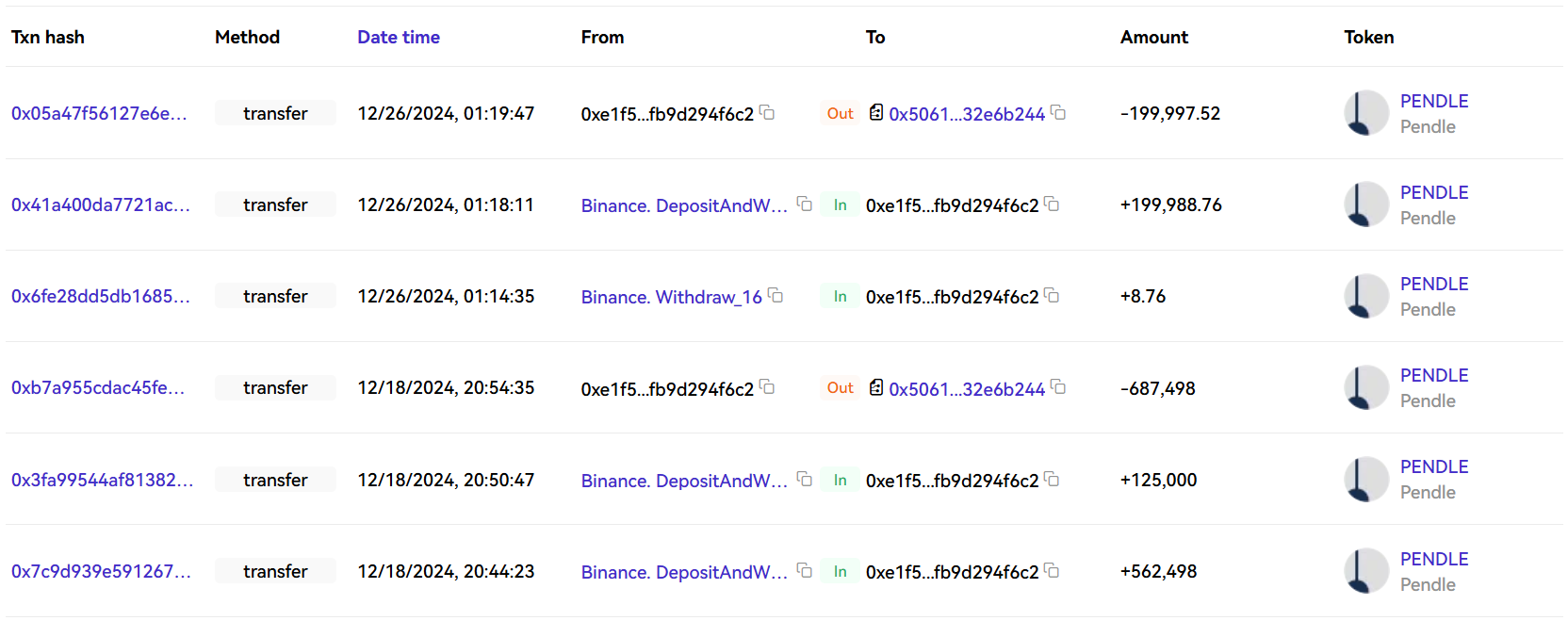

A certain whale has accumulated and staked 887,500 PENDLE over the past week

16 hours ago, a certain whale withdrew 200,000 PENDLE (about $1.04 million) from Binance. Last week, it withdrew 687,500 PENDLE (about $4.26 million) from Binance.

It has accumulated a total of 887,500 PENDLE at an average price of $5.97, and has staked all of it on Pendle.

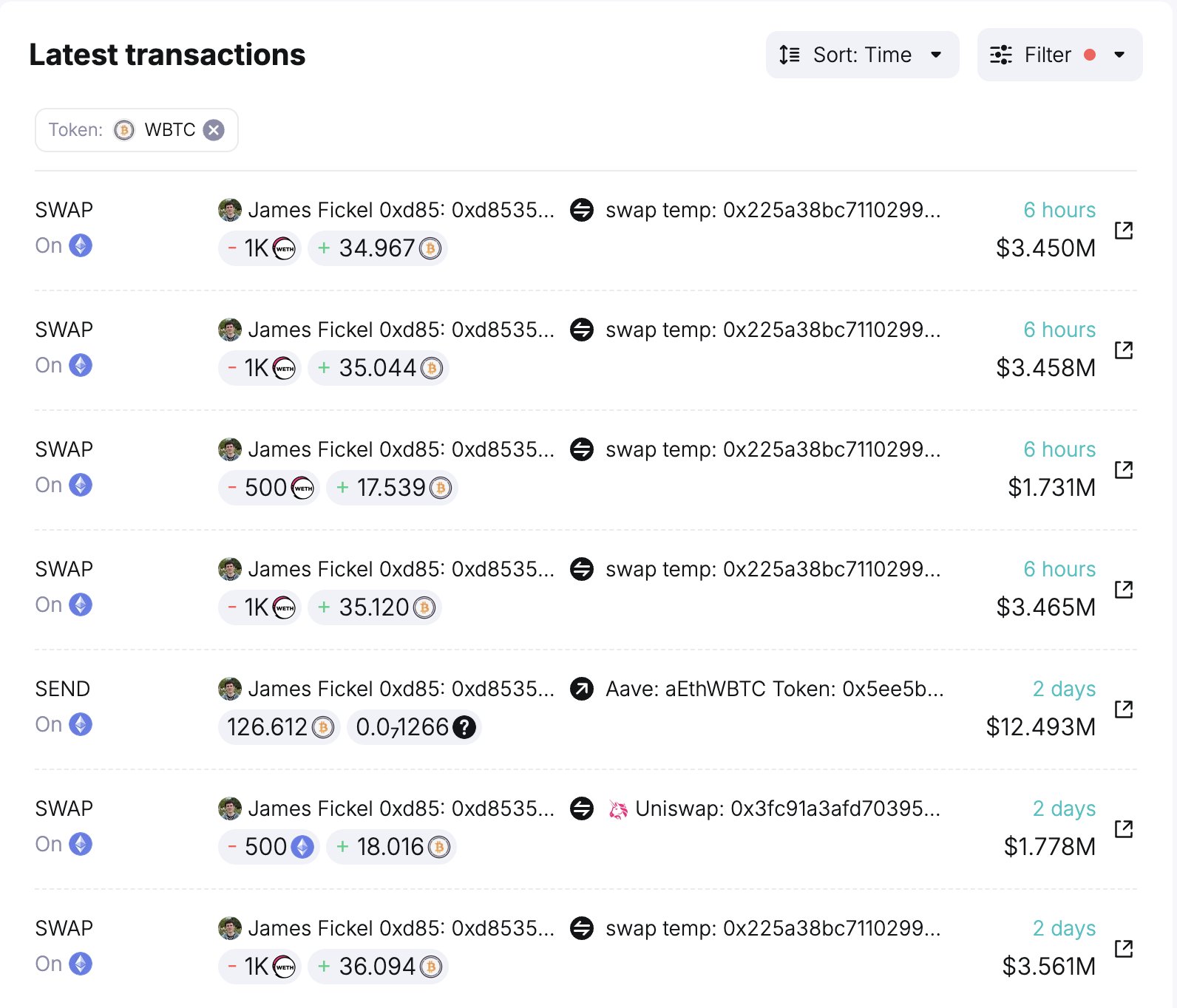

An ETH/BTC bull whale converted 3,500 ETH to 122.67 WBTC in the early morning

About 16 hours ago, the ETH/BTC bull whale James Fickel again converted 3,500 ETH ($12.1 million) to 122.67 WBTC.

Overall, over the past 2 days, he has converted 10,000 ETH ($34.6 million) to 358.3 WBTC at an ETH/BTC rate of 0.0358, possibly to reduce his debt on Aave to 452.6 WBTC ($45 million).