2024 was undoubtedly an important year in the history of cryptocurrency.

This year, with Bitcoin as the main leverage, the cryptocurrency industry successfully broke through, with listed companies, traditional financial institutions, and even national governments rushing in, driven by the two core narratives of ETF and the US election. The mainstream adoption and recognition have increased significantly, and the regulatory environment has also moved towards a clearer and more relaxed path with the inauguration of the new government. The collision of the mainstream, the divergence of paths, and the evolution of regulations have become the industry's main themes this year.

01 Review of 2024: Bitcoin Tops, Ethereum Chased, MEME Casino Attracts Attention

Looking at the industry's major developments this year, Bitcoin is undoubtedly the core narrative.

ETF and national reserves have helped Bitcoin successfully reach $100,000, officially announcing that Bitcoin has transcended the connotation of cryptocurrency and has become a globally resilient anti-inflation asset, with its value storage being recognized. BTC is gradually transitioning from digital gold to a supranational currency, marking a stage victory in the grand financial experiment initiated by Satoshi Nakamoto. On the other hand, the Bitcoin ecosystem has been expanded this year. Although Memecoin, Altcoin, and even Layer 2 are in a state of hot and cold, the diverse Bitcoin ecosystem has already taken shape, with applications such as BTCFi, Non-Fungible Token, gaming, and social media continuing to develop. The TVL of Bitcoin DeFi has soared from $30 million at the beginning of the year to $6.755 billion, an increase of more than 20 times. Among them, Babylon has become the largest protocol on the Bitcoin chain, with a TVL of $5.564 billion as of December 20, accounting for 82.37% of the total. The broader BTCFI has also performed brilliantly this year, with the share of Bitcoin spot ETFs soaring and MicroStrategy, which was included in the Nasdaq 100, being widely imitated, reflecting the overwhelming success of Bitcoin in the CeFi field.

Returning to the public chain domain, the leading Ethereum has not had an easy time this year. Compared to other assets, its value capture and user activity have declined, and its narrative is not as strong as before. The "value theory" has made Ethereum suffer greatly. Although the slogan of the revival of the consensus-formed DeFi is loud, apart from the TVL pyramid frenzy triggered by re-pledging, it seems that only Aave has taken on the entire burden, and the actual investment is clearly insufficient. However, the emergence of the year-end derivative dark horse Hyperliquid has not only half-killed the CEX, but also sounded the bugle of a counterattack for DeFi. On the other hand, the acceleration of the Layer 2 internal circulation of Ethereum after the Dencun upgrade has continued to encroach on the share of the mainnet, causing the market to launch a major discussion on the Ethereum mechanism, with doubts emerging one after another, and even the rapid growth of Base has led to market rumors about Ethereum's future being Coinbase's.

The strong rise of Solana forms a sharp contrast. From the perspective of TVL, Ethereum's market share in the public chain has dropped from 58.38% at the beginning of the year to 55.59%, while Solana has soared from being unknown at the beginning of the year to 6.9% at the end of the year, becoming the second largest public chain after Ethereum. SOL has also created a miracle of growth, skyrocketing from $6 two years ago to $200 now, and has even surged more than 100% just this year. In terms of the recovery path, relying on the unique advantages of low cost and high efficiency, Solana has targeted the core of liquidity positioning, and with the support of the Degen culture, it has risen to the undisputed MEME king, becoming the retail concentration camp of the year. This year, Solana's daily on-chain fees have surpassed Ethereum multiple times, and the growth of new developers has also exceeded Ethereum, with a significant catch-up trend.

TRON and Sui also broke through this year. Telegram, with its 900 million users, single-handedly ignited the Web3 gaming sector, opening up a new traffic entrance for Web3, giving a strong stimulus to the market that had been dormant for a long time before September. TRON, which was able to bask in the shade of the big tree, has finally entered the fast lane of growth after lingering at the dawn for a long time. According to Dune data, TRON currently has over 38 million cumulative on-chain users and over $2.1 billion in cumulative transaction volume. Sui, on the other hand, has completely won by rising, with the Move language public chain making rapid progress, opening up hardware, diversifying protocols, and airdropping to attract users, with a seemingly bright future. Compared to the price-driven Sui, the public chain Aptos, although its price performance was relatively weak during the same period, has received more attention from traditional capital, successfully establishing partnerships with BlackRock, Franklin Templeton, and Libre this year, and its compliance-oriented nature may bring it dawn in the new RWA and BTCFI cycle.

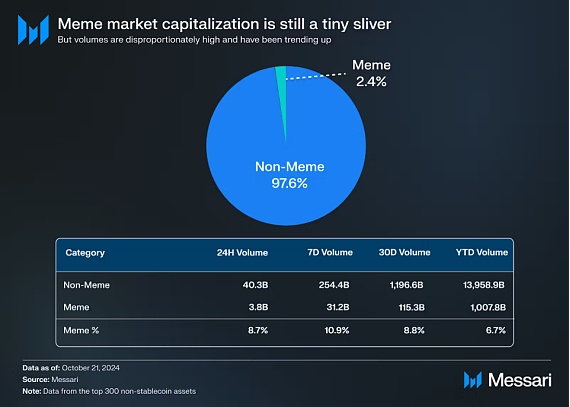

From the application perspective, MEME has been the main driver of the market this year. Essentially, the rise of MEME is a sign of the current market pattern change, with VC tokens not being accepted, and the excess liquidity having no target to flow into, ultimately pouring into the more equitable and profit-seeking sectors. In this process, the connotation of MEME is also constantly expanding, from a single speculative target to gradually developing into a typical representative of cultural finance, and "everything can be MEME" is happening in reality. Although in terms of market capitalization, MEME only accounts for less than 3% of the top 300 cryptocurrencies (excluding stablecoins), its trading volume has continued to account for 6-7% of the share, reaching 11% at one point recently, making it the most liquid major track. According to Coingecko data, MEME accounted for 30.67% of investor attention this year, ranking first among all tracks. Where attention is, money naturally follows, and this is indeed the case. Looking back on this year's MEME, pre-sale fundraising, celebrity tokens, animal farm wars, PolitFi, and AI, each one is a top influencer in the industry.

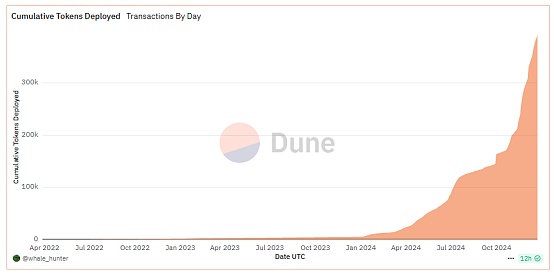

Against this backdrop, the infrastructure around MEME has continued to solidify, with the fair launch platform Pump.fun emerging, which not only reshapes the MEME landscape, but also successfully tops the list of the most profitable and successful applications of the year. In November, Pump.fun became "the first Solana protocol to generate over $100 million in monthly revenue". According to Dune data, as of December 22, Pump.fun's cumulative revenue has exceeded $320 million, with approximately 4.93 million tokens deployed.

Of course, the platform making money does not mean that the retail investors make money. Considering the one-in-ten-thousand probability of a large MC memecoin, and only 3% of users can profit more than $1,000 on Pump.fun, combined with the increasingly prominent trend of MEME institutionalization, from the user's perspective, no matter how fair it may seem, being cut or being cut is inevitable. Perhaps it is for this reason that adding fundamentals to MEME has become a new development model for projects, and most Desci and AIMEME projects with relatively long cycles have adopted this model, but so far, the one-time wonder is still the mainstream, and the value of "running faster to live better" is still rising.

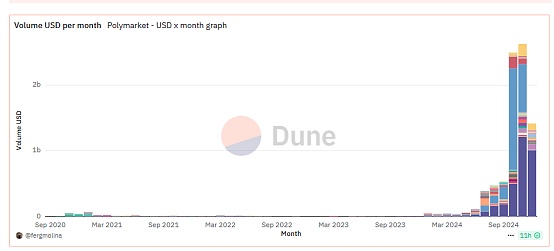

And under the influence of the US election, another godlike application has surfaced. Polymarket has surpassed all the betting platforms on the market, becoming an overnight sensation in the prediction market with its high accuracy. In October alone, Polymarket's website had 35 million visits, twice that of popular betting sites like FanDuel, and its monthly trading volume surged from $40 million in April to $2.5 billion. Broad user base and real demand equals clear value application, which is why Vitalik praised it so highly. The only regret is that it has not achieved large-scale conversion of cryptocurrency users. But the new hybrid of media and betting is undoubtedly coming step by step.

As the year-end approaches, large models have transitioned from technical breakthroughs to applications, and the competitive landscape has become white-hot. After a year of hovering around the Web3 hotspot, AI has finally staged a counterattack and become the dark horse of the year. MEME was the first to ignite the fuse, with Truth Terminal quickly coming with large MC memecoin GOAT, ACT, and Fartcoin, reviving the myth of a hundredfold return and unveiling the craze for AI Agent applications. Currently, almost all mainstream institutions are optimistic about AI Agent, believing it to be the second phenomenon-level track after DeFi. However, as of now, the infrastructure in this field is still not complete, and the applications are mostly concentrated in MEME, Bot, and other superficial areas, with less deep integration of AI and blockchain. But the new also means opportunities, and the cyberpunk-style coin speculation remains to be seen.

Here is the English translation of the text, with the terms in <> retained as is: On the other hand, from the perspective of the core driving forces of the current bull market, the seamless integration of traditional finance and Web3, PayFi, will undoubtedly be at the forefront. Stablecoins and RWA are typical representatives. Stablecoins have truly emerged as the long-awaited large-scale application this year, not only growing rapidly in the crypto field, but also beginning to occupy a share in the global payment and remittance market. Sub-Saharan Africa, Latin America, and Eastern Europe have started to bypass the traditional banking system and directly use stablecoins for transaction settlement, with year-on-year growth exceeding 40%. The value of stablecoins currently in circulation exceeds $210 billion, significantly higher than the billions of dollars in 2020, with an average of more than 20 million addresses conducting stablecoin transactions on public blockchains, and the settlement value of stablecoins is expected to exceed $2.6 trillion in the first half of 2024 alone. In terms of new products, Ethena is the most eye-catching stablecoin project this year, further catalyzing the trend of interest-bearing stablecoins, which is also a major driver of AAVE's revenue this year. As for RWA, it was completely ignited after BlackRock's announcement of its entry, and the market value of RWA, which was less than $2 billion three years ago, has now expanded to $14 billion this year, covering lending, real estate, stablecoins, bonds, and other fields. In fact, the development of PayFi is consistent with the market's performance. It is precisely because the internal market growth has encountered a bottleneck that the mainstream institutionalization market, as an incremental market, is at the beginning of a new cycle. To seek incremental space, PayFi is entering a critical process at this stage. It is worth noting that due to the integration with the traditional financial system, this field is also the most favored Web3 track by government agencies, such as Hong Kong, China, which has already listed stablecoins and RWA as important areas for development next year. Of course, although it seems to be on the upswing, it cannot be denied that under the dual background of nearly 2 years of macroeconomic tightening and the industry's downward cycle, the crypto field has also experienced an exceptionally difficult stress test. Innovative applications are difficult to emerge, internal conflicts have intensified, and restructuring and mergers and acquisitions are ongoing. The weakening of liquidity has led to a path differentiation in the crypto industry, forming a pattern where Bitcoin is the core inflow, continuously siphoning off other cryptocurrencies. The Altcoin market was in the doldrums for most of this year, and Shenyu's "no Altcoins in this bull market" was repeatedly confirmed and refuted until the end of the year, when it rebounded under the attention of Wall Street, marking the start of the Altcoin season. From the current perspective, path differentiation will continue in the short term and will have an increasingly intensified trend. Looking ahead to 2025, with the Trump administration ushering in a new era of crypto, well-capitalized institutions are also eager to try. As of now, more than 15 institutions have released their market forecasts for next year. In terms of price forecasts, all institutions are optimistic about the value of Bitcoin, with 6 institutions believing that the peak price of Bitcoin will be in the range of $150,000 to $200,000. Among them, VanEck and Dragonfly believe the price will reach $150,000 next year, while Presto Research, Bitwise, and Bitcoin Suisse believe it will reach $200,000. If based on strategic reserves, Unstoppable Domains and Bitwise have even proposed forecasts of $500,000 or higher. As for other cryptocurrencies, VanEck, Bitwise, and Presto Research have provided forecasts, believing that ETH will be around $6,000-$7,000, Solana around $500-$750, and SUI may also rise to $10. Presto and Forbes believe the total crypto market cap will reach $7.5-$8 trillion, while Bitcoin Suisse believes the Altcoin market cap will increase 5-fold. The price forecasts are also supported by fundamentals. Almost all institutions believe that the US economy will experience a soft landing next year, with an improved macroeconomic environment, and crypto regulations will also be relaxed accordingly. More than 5 institutions hold a positive view on Bitcoin's strategic reserves, believing that at least one sovereign state and many listed companies will include Bitcoin in their reserves. All institutions believe that increased ETF inflows will become an objective fact. In terms of specific tracks, stablecoins, tokenized assets, and AI are the areas of greatest concern for institutions. For stablecoins, VanEck believes the stablecoin settlement volume will reach $300 billion next year, while Bitwise believes the stablecoin market will reach $400 billion with the acceleration of legislation, fintech applications, and global settlement. Blockworks Mippo is even more optimistic, giving an estimate of $450 million. A16z also believes that enterprises will increasingly accept stablecoins as a payment method, and Coinbase has pointed out in its report that the next real adoption (killer app) of cryptocurrencies may come from stablecoins and payments. For tokenized assets, A16z, VanEck, Coinbase, Bitwise, Bitcoin Suisse, and Framework are all optimistic about the track. A16z's forecast mentions that as the cost of blockchain infrastructure decreases, the tokenization of non-traditional assets will become a new source of income, further driving the decentralized economy. VanEck gives a specific figure, believing that the value of tokenized securities will exceed $50 billion, which is consistent with Bitwise's forecast data. Messari, on the other hand, gives a differentiated conclusion based on actual conditions, believing that as interest rates decline, the tokenization of government bonds may face resistance, but idle on-chain funds may receive more attention, and the focus may shift from traditional financial assets to on-chain opportunities. In the AI direction, A16z, which has already placed a heavy bet in the AI field, remains highly optimistic about the integration of AI and crypto, believing that the autonomous agency capabilities of AI will be greatly enhanced, and AI can have its own wallet to achieve autonomous behavior, while decentralized autonomous chatbots will become the first truly autonomous high-value network entities. Coinbase also recognizes this, directly pointing out that AI agents equipped with crypto wallets will be at the forefront of disruption. VanEck also stated that the on-chain activity of AI agents has exceeded 1 million, and Robot Ventures believes that the total market value of AI agent-related tokens will increase at least 5-fold. Although there are some differences in the specific points, it is not difficult to see that all institutions have optimistic and positive expectations for next year, whether it is the rise in prices, the expansion of the ecosystem, or mainstream adoption, they all expect to continue to scale new heights by 2025. It can be foreseen that in terms of prices alone, the rise in the prices of mainstream cryptocurrencies is inevitable, especially in the first quarter of next year, which will be a period of concentrated policy benefits. The Altcoin market will continue to differentiate, and under the influence of ETFs, Altcoins that meet compliance attributes will be more likely to attract capital inflows and narrative continuation, while other cryptocurrencies will slowly contract. If macroeconomic liquidity tightens, the risks of Altcoins will become more prominent. From an industry perspective, while the strong old public chains still occupy a leading position in the ecosystem, the impact from new public chains is also inevitable. The value capture and narrative of Ethereum will continue to ferment, but the optimistic news is that the inflow of external capital may provide some relief, and the expansion of technology and the popularization of account abstraction will also become important breakthroughs for Ethereum in 2025. Solana's growth momentum under capital discourse power still exists, but its high dependence on MEME poses hidden risks, and the competition with Base will become increasingly fierce. In addition, it is expected that a batch of new public chains will also join the market competition, such as Monad and Berachain.The development of applications based on infrastructure is the main direction of future industrial development, and consumer-level applications will be the focus of applications in the next few years. Application chains and chain abstraction may become the main way of DAPP construction. From the track, the revival of DeFi has become a consensus, but at this stage it is still projected on AAVE, and the focus of centralization is on the payment track, with Hyperliquid and Ethena still worth focusing on.

The speculative craze of MEME will most likely continue in the short term, but the rhythm will slow down significantly, especially under the influence of the Altcoin season, however, the focus direction such as Politifi still has a relatively long narrative to go. Nevertheless, the infrastructure around MEME is still expected to be improved, user experience optimized, access threshold reduced, and MEME institutionalized is an inevitable trend. It is worth noting that new token launch methods will always trigger a new round of sensation.

As the incremental market comes from institutions, the tracks that institutions are optimistic about are expected to accelerate their development, with stablecoins, AI, RWA, and DePin still becoming the focus of the next round of narratives. In addition, in the context of tight liquidity, any on-chain liquidity tools and protocols that can increase leverage are likely to be favored.

A new cycle is about to come, and as an investor, except for the old and welcoming the new, discovering the cycle, following the cycle, in-depth research and participation, is the only choice.