Grayscale Research today released a new report forecasting the top cryptocurrency sectors for the first quarter of 2025. The end of 2024 saw great success and injected competition and dynamism into this space.

The company's report concluded that smart contracts have more potential and dynamic energy than anything else. However, some key areas such as tokenization and DeFi also caught Grayscale Research's attention.

Grayscale Report, Fierce Competition in Smart Contract Market

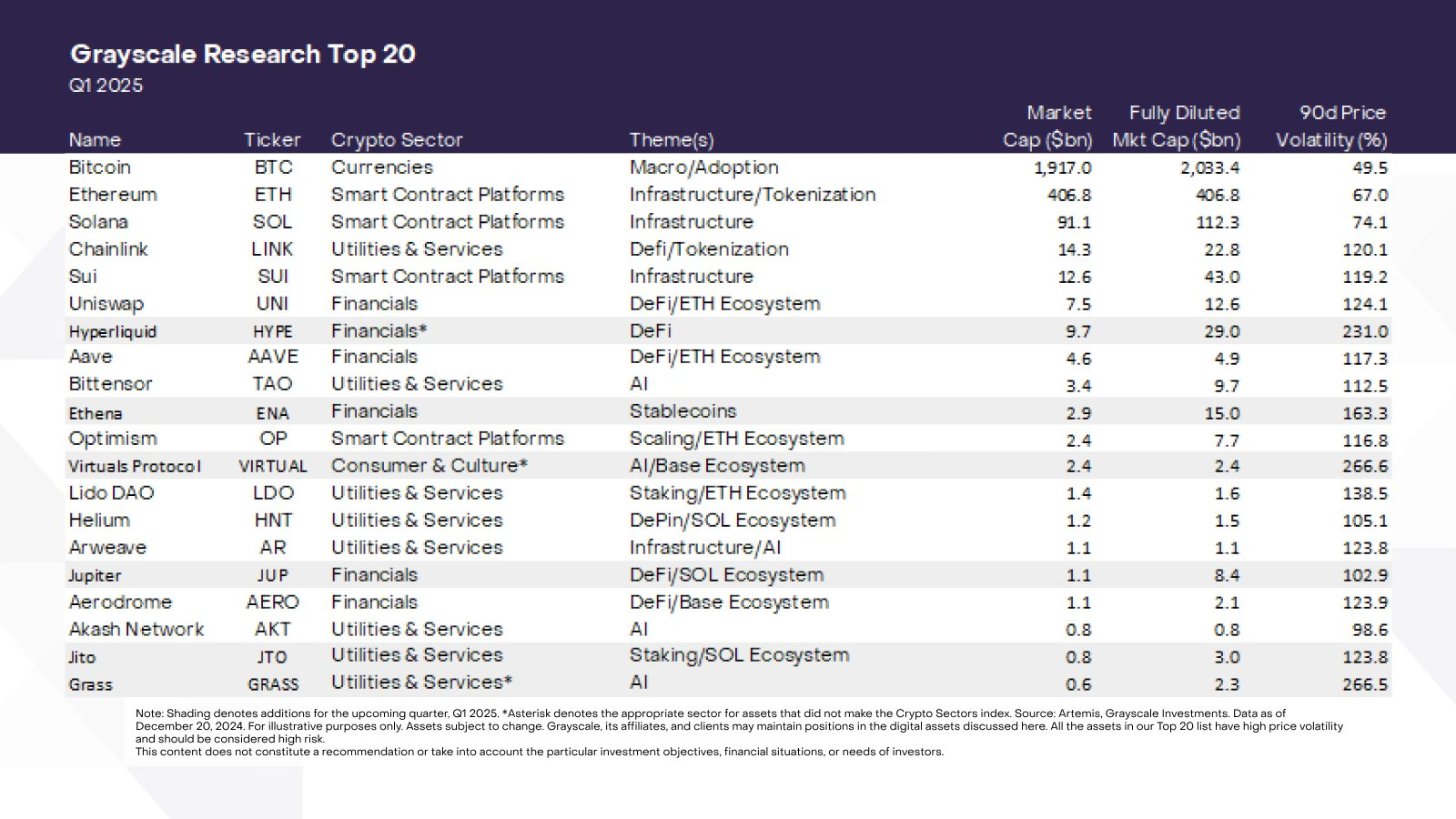

Grayscale, one of the leading Bitcoin ETF issuers, released this report with several opinions on key forecasts. The company concluded that the cryptocurrency market surged in the fourth quarter of 2024, and fierce competition between smart contract platforms was a major growth driver. It also provided a "Top 20" list of the best DeFi/Web3/cryptocurrency investment options.

The company referred to smart contracts as "the most competitive market segment in the digital asset industry," and mentioned that Ethereum underperformed despite landmark victories like ETFs. Instead, competitors like Solana, Sui, and TON captured market share, highlighting the dynamic energy in this sector.

Grayscale has the highest expectations for smart contracts. However, only some of the Top 20 assets belong to this category, and there are no leading assets in this category. Other areas of interest include scaling solutions, tokenization, and DeFi, which received high interest in previous reports.

"Regardless of design choices and the strengths and weaknesses of networks, one way for smart contract platforms to accrue value is their ability to generate network fee revenue. The greater a network's ability to generate fee revenue, the greater its ability to deliver value to its token holders through token burns or staking rewards. This quarter, the Grayscale Research Top 20 includes the following smart contract platforms: ETH, SOL, SUI, OP," the report stated.

The company is a subsidiary of Digital Currency Group (DCG), with a long history in the cryptocurrency field. Grayscale led the legal efforts for a Bitcoin ETF, which succeeded in January 2024. However, the company quickly lost dominance in new markets.

Despite these frustrations, the company has been a pioneer in securing SEC approval for Ethereum ETFs and new ETF options trading. Ultimately, the ability of a company to successfully sell ETFs does not significantly impact its capacity to critically assess market potential.

Frankly, Grayscale Research's Q1 2025 report barely mentions the ETF space, which seems to be considered a given. Nonetheless, Grayscale remains quite optimistic about the future of cryptocurrencies.