Here is the English translation of the text, with the terms in <> retained as is:

In 2024, the crypto industry experienced a turbulent year. During this year, cryptocurrencies entered the mainstream, with institutionalization, compliance, and politicization becoming core narratives. The headline-grabbing $100,000 Bitcoin price marked the end of the crypto market's stigmatization, as digital gold shone brightly, and a new cycle slowly unfolded.

However, crypto is far more than just Bitcoin, and the market is not solely about institutions. The shifting spotlight recorded the changes of the year, with Bitcoin gracefully taking center stage, but it was not the eternal protagonist. Every month, the crypto market welcomed new topics and headlines, with technologies, projects, communities, and personalities taking the stage, traversing the ups and downs of 2024 and leaving indelible footnotes for the arrival of 2025.

Looking back on the old year and welcoming the new, the crypto market remains a dormant dragon, with limitless potential for the future.

January

Bitcoin Spot ETF Approved

In January, spot ETFs officially brought institutions onto the crypto ark. On January 10th, Eastern Time, the US SEC announced the official listing of 11 Bitcoin spot ETFs, with issuers including Grayscale, Bitwise, Hashdex, iShares, Valkyrie, Ark 21Shares, Invesco Galaxy, VanEck, WisdomTree, Fidelity, and Franklin.

For the crypto market, the Bitcoin ETF was undoubtedly a historic milestone. After a decade-long and protracted battle with the SEC, the crypto world finally gained regulatory recognition, and the digital asset market entered a new chapter. Thereafter, Bitcoin was officially recognized as a legitimate and compliant investment product, with a flood of traditional institutional capital entering the market and further driving the compliant development of the crypto market.

As of December 31st, according to Coinglass and SOSOvalue data, the cumulative total inflow of Bitcoin ETFs reached $35.27 billion, with a total net asset value exceeding $109.532 billion. However, with the continuous growth of Bitcoin ETFs, institutions have replaced miners as the dominant force controlling Bitcoin prices, a testament to the changing times.

March

Ethereum Cancun Upgrade

After a relatively calm new year in February, March saw Bitcoin and Ethereum return to the spotlight. With the influx of ETFs, Bitcoin's price continued to rise, successfully breaking through $70,000 on March 8th, setting a new high in 3 years. At the time, the market had already considered $70,000 as Bitcoin's peak, unaware that this was just a quiet milestone in the price journey.

However, Ethereum, despite the focused narrative, still performed averagely in terms of price. As the industry's leader, construction was Ethereum's primary focus. On March 13th, Ethereum successfully completed the Cancun upgrade, introducing the Blob data unit of the Ethereum Scaling Solution (protodanksharding), ushering in an era of reduced fees for Layer 2s.

As of now, all mainstream Layer 2s, including Optimism, Starknet, Base, zkSync, Zora, and Mode, have adopted blobs. Blobscan data shows that since the Cancun upgrade, as of December 30th, Ethereum has exceeded 1.2 million total blocks, with 2.4 million total transactions, using 4.9 million Blobs, saving 3,008 ETH in gas fees. However, it is worth noting that the liquidity of L2 networks is fragmented across multiple sub-networks, and L2 fee reduction has occupied a portion of the mainnet's value, making the competition between Ethereum and L2s increasingly apparent.

April

Bitcoin Halving, Hong Kong Virtual Asset Spot ETF Approved

The most important event in April was the Bitcoin halving. On April 20th at 8:09, Bitcoin successfully completed its fourth halving at block height 840,000, with the mining reward reduced from 6.25 BTC to 3.125 BTC, the previous halving having occurred on May 11, 2020. The halving undoubtedly has long-term effects on the price, and in terms of the affected groups, the mining companies, as the main mining force, have been the most widely impacted. The mining companies have sparked a wave of consolidation, with the head-of-the-pack effect further intensifying. Leading miners like Marathon, CleanSpark, and Riot have been racing to increase their computing power, combining high-performance equipment and low-energy costs, with the industry competition reaching a fever pitch, and some miners have even begun to shift towards the hotter AI sector.

Another major event in April was the approval of Hong Kong's virtual asset spot ETF. On April 15th, the first batch of virtual asset ETFs were publicly announced to have been approved, and on April 30th, 6 Hong Kong virtual asset spot ETFs were listed on the Hong Kong Stock Exchange, with Huaxia Fund (Hong Kong), Bosera International, and Jiashi International as the main issuers. In fact, after the December 2022 declaration, the Hong Kong Web3 market had cooled down, and despite the frequent policy announcements, the market remained skeptical. The virtual asset ETF was a significant milestone for Hong Kong, and although the market had been pessimistic, it still held a relatively bright hope, even believing that this move might be a precursor to the mainland's opening up. However, the reality has poured cold water on this, as not only are the capital channels limited, but due to the impact of compliance costs, the virtual asset spot ETFs in Hong Kong are more expensive than their US counterparts, and the capital raising between the two is vastly different. According to SOSOVALU data, as of December 27th, the total net asset value of Hong Kong's Bitcoin spot ETFs was only $409 million, holding a total of about 4,290 Bitcoins. In June, as the first anniversary of Hong Kong's crypto regulations approached, multiple crypto-native exchanges fled the city, raising more questions in the market. It can be seen that Hong Kong's Web3 journey is still long and arduous, but with the powerful force of traditional finance, Hong Kong still has the hope of overtaking on the bend, with stablecoins and RWAs becoming the focus paths for Hong Kong in 2025.

May

Ethereum Spot ETF Resurrected, CZ Sentencing Hearing

The spotlight returned to Ethereum in May. The seemingly hopeless Ethereum spot ETF made a comeback, becoming this year's dark horse. On May 24th, according to official documents, the US Securities and Exchange Commission (SEC) had approved the plans of the New York Stock Exchange, Chicago Options Exchange, and Nasdaq for Ethereum spot ETFs, i.e., the issuers' Ethereum spot ETF 19b-4 (exchange rule change) applications. Compared to Bitcoin, the key approval process for Ethereum reflects a more positive regulatory attitude, not only shedding the historical baggage of its security attributes, but also symbolizing a turning point in the openness of US regulation, with the prospect of other decentralized projects gaining regulatory relief. This also timely rescued the crypto market, which was under the suction effect of Bitcoin. Across every bull market, the rise of Ethereum has been the key indicator of sector rotation.

On July 23rd, the Ethereum spot ETF was officially approved. According to Coinglass data, as of now, the cumulative total inflow of Ethereum spot ETFs has reached $2.68 billion, with a total net asset value exceeding $12.11 billion. However, it can be seen that Ethereum's appeal to institutions is still far from comparable to Bitcoin.

The headline figure in May was undoubtedly CZ. After last year's record-breaking settlement, CZ faced a sentencing hearing this month. As early as April, the crypto community had launched a massive campaign to support this representative figure, with 161 letters of support led by his wife He Yi sent to the court, witnessing the precious trust and sincerity within the crypto circle, and this ultimately led to victory. Compared to SBF's sentence of over a century, CZ's four-month sentence is not too long. On September 28th, 2024, CZ was released from prison, and BNB rose in celebration, reflecting his strong community influence.

June

LayerZero, ZKsync Airdrops Spark ControversyHere is the English translation:

In June, airdrops became the main theme in the market. The LayerZero witch hunt sparked widespread discussion, bringing the conflict between projects and the "meme army" to the forefront for the first time. Even the increasingly professionalized, institutionalized, and scaled-up "meme army" did not have the upper hand in the back-and-forth between the projects. On the other hand, although ZKsync was controversial due to the rat race, the new standard of capital retention it brought also had a profound impact on subsequent airdrops. In the long run, the reduction of short positions, the increase in complexity, and the increase in investment funds will become the trend of airdrops. It must be admitted that the threshold for individuals to get rich through airdrops will continue to rise. In addition, the weakening of macroeconomic expectations and the surrender of miners directly led to the first major 6.18 earthquake in the crypto market this year, with Bitcoin falling below $65,000 and most Altcoins falling more than 20%.

July

7.5 plunge, VC tokens mired in public opinion, Trump's personal photos released

After 6.18, 7.5 came to take over. Under the influence of the Mango Pay default and the German government's purchase of coins, the crypto market ushered in another wash-up, with Bitcoin falling below $60,000 and returning to the level of late February. Since then, until mid-July, the term "bull market" seemed to have disappeared from the crypto market, with widespread complaints becoming a reality, with VC tokens and exchanges bearing the brunt, and the public opinion vortex continuing to ferment. But on July 16, Trump's personal photos were released, not only illuminating his personal electoral path, but also bringing a glimmer of hope to the crypto market. After that, Trump appeared at the Bitcoin conference, with ten promises such as strategic reserves, a US crypto hub, and the resignation of the SEC chairman, which resonated strongly and successfully won the support of the crypto world.

August

Telegram CEO Pavel Durov arrested made headlines

In August, Telegram made headlines, dealing a heavy blow to the TON ecosystem. On the evening of August 24, French television revealed that Telegram founder and CEO Pavel Durov was arrested at a French airport. On the day of the incident, Toncoin fell nearly 11% in 24 hours, and the single-day drop in TON TVL reached 57.62%. Given TON's independent ecosystem attributes, the price quickly recovered after the short-term impact. But the Telegram incident also made the market start to rethink decentralized social media, and finding a balance between order and freedom under the banner of defending freedom of speech is the next goal of the crypto market.

September

The Fed's first rate cut in 4 years, kicking off a rate cut cycle

In September, the long-awaited rate cut finally arrived in the crypto market. On September 18, local time, the Federal Reserve announced that it would lower the target range for the federal funds rate by 50 basis points, to a level between 4.75% and 5.00%. This was the first rate cut by the Fed in 4 years. This marks the official transition from the tightening rate hike cycle that has been in place since 2022 to a rate cut cycle. As of now, the Fed has successfully implemented three consecutive rate cuts, with the federal funds rate target range reaching 4.25%-4.50%, and the cumulative rate cut by the Fed in this rate cut cycle reaching 100 basis points. It must be admitted that the macroeconomic easing has provided a solid foundation for the rise of the crypto market.

October, November

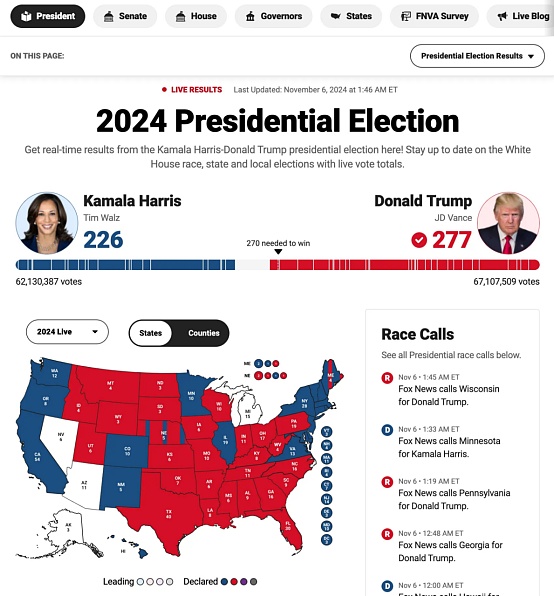

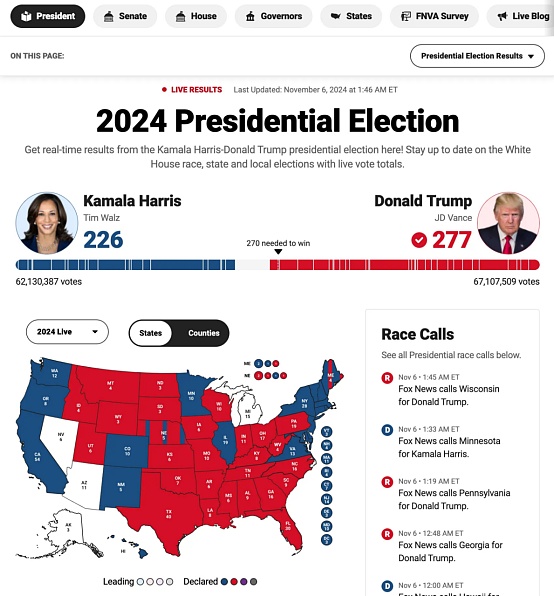

The US election as the main line, "Bitcoin President" Trump takes the White House

In October and November, the political arena was the headline of the crypto field. On November 5, the spotlight of the world was focused on the US election, and Trump successfully won a majority of the electoral votes, securing victory in this US presidential election and officially becoming the 47th President of the United States. The inauguration of the "Bitcoin President" sounded the bugle for the bull market, and with the most crypto-friendly Congress in history, crypto regulation also entered a new era. Subsequently, Bitcoin soared, breaking through $90,000 in November and surpassing silver to become the 8th largest asset in the world by market capitalization for the first time. On the other hand, Dogecoin also seized the opportunity, with Musk's government efficiency department taking shape, fueling the PolitiFi craze. In addition, November was full of hot spots, with the DEXX hack casting a shadow over the Chinese MEME circle, the DeSci track rising under the celebrity effect of CZ and Vitalik, Justin Sun's sky-high banana making headlines in traditional media, and the native token HYPE of the derivative dark horse Hyperliquid launching, all of which brought FOMO to the crypto world.

December

South Korea declares martial law, Bitcoin breaks $100,000, SEC chairman changes

At the beginning of December, the South Korea martial law incident dominated the headlines, with Bitcoin briefly surging 30% and XRP plunging 60%, once again demonstrating the influence of political situations on the crypto field. But it is worth noting that a large amount of capital flowed into Upbit and successfully picked up the bargains, and blunders can sometimes be the key to small profits.

On December 5, Bitcoin reached a historic milestone, officially breaking through the $10 barrier and embarking on the path to six figures, not only vindicating digital gold, but also being formally recognized by the world for its value storage function, transitioning from an experiment to an asset and then to a good asset, announcing the phased victory of the financial experiment initiated by Satoshi Nakamoto.

The prerequisite for achieving this goal is the favorable policy environment. Approaching his inauguration, President Trump also began to announce his personnel arrangements and policy strategies one after another, and the crypto market speculation centered around Trump throughout December. First, Gary Gansler, the long-suffering SEC chairman, announced that he would resign on the day of the president's inauguration, to be replaced by Paul Atkins, nominated by Trump. After Atkins' formal nomination on December 5, the crypto market priced in this new chairman with significant pro-crypto characteristics and rich experience, which also helped Bitcoin reach $100,000.

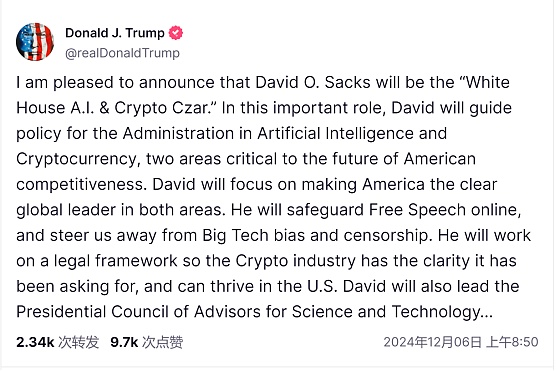

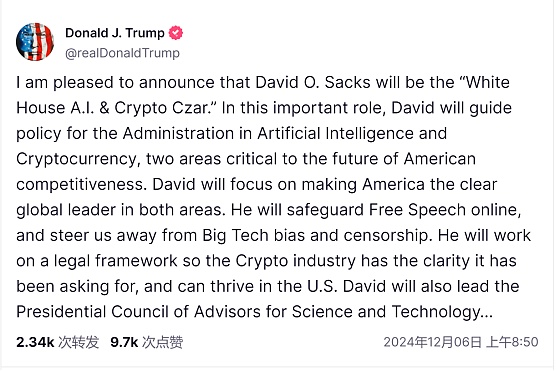

Good news kept coming, on December 6, Trump nominated David O. Sacks as the White House's cryptocurrency and artificial intelligence czar, the first time crypto has entered the White House and been listed alongside the strategic industry of artificial intelligence, fully demonstrating Trump's emphasis on the crypto field. Institutions flocked to the scene, and Altcoin ETFs were put on the agenda, ushering in the Altcoin season. The FOMO sentiment was briefly interrupted on December 11, when Microsoft shareholders voted against the Bitcoin investment proposal, coupled with the emergence of quantum chips that caused industry concerns, leading to a sharp drop in Bitcoin and the market gradually entering a sideways oscillation.

The last good news before Christmas was that Microstrategy was listed on the Nasdaq 100 index, making it the first crypto component stock to be included in the index, reflecting the growing influence of the crypto field. Not only did it expand the investment channels, but it also marked a watershed for crypto companies entering the traditional financial world.

Christmas arrived as scheduled, and the news flow also came to a halt, with capital flowing back conservatively and the market mostly in a downward trend, but it is clear that the crypto bull market has just begun, and Trump has not yet officially taken office, with the macroeconomic environment continuing to improve. The hidden dragon of 2024 is about to pass, and in 2025, the dragon appearing in the field may be the next step for the crypto market.