Bitcoin has stabilized and rebounded above $96,000 after falling below $92,000 at the end of the year. In the Altcoin market, AI Agent has become the most eye-catching sector. The two leading platforms, Virtuals Protocol and ai16z, have hit new highs consecutively, and the related ecosystem tokens have also risen sharply.

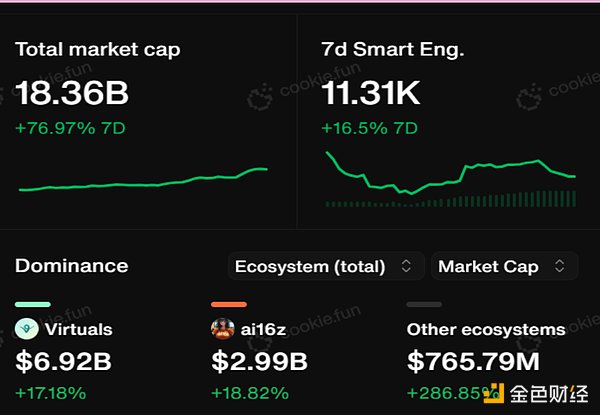

According to the latest data from Cookie.fun, as of January 2, the total market capitalization of the AI Agent sector has reached $18.36 billion, with a staggering 76.97% increase in the past 7 days. This strong performance reflects the market's strong interest in this track.

From AI Meme to AI Agent

The AI hype in the crypto market has gone through multiple stages. Initially, the AI concept was mostly tied to DePIN, focusing on decentralized computing power and distributed data training for AI. Subsequently, decentralized artificial intelligence networks represented by WLD and TAO began to become the market focus. However, the real outbreak of AI was driven by the meme narrative, and the viral spread provided an ideal "soil" for AI, propelling it into the public eye.

In October last year, the AI chatbot "Terminal of Truths" became popular on social media due to its humorous content, even receiving funding from the founder of a16z. Subsequently, the Meme community launched the GOAT token, which saw a price surge, further amplifying the potential of AI Meme. This not only redefined the boundaries of Meme coins, but also allowed the blockchain world to witness the cultural tension of AI technology, gradually forming a unique narrative logic.

Driven by the GOAT wave, many similar projects have emerged in the past few months, which can automatically post and reply on Twitter, gradually segmenting into AI Meme and forming an increasingly clear track ecosystem. The AI Meme field has gradually expanded to more valuable scenarios, including music, image, and even investment analysis and fund management, which are more in line with the needs of the crypto community.

At the same time, Pump.fun has promoted the craze for one-click issuance of meme coins through low technical thresholds and high transparency. After the obvious wealth effect appeared with the flourishing of AI + Meme, a large number of coin issuance platforms began to emerge. From this stage, AI and Meme have gradually separated, and a new AI Agent track has begun to form, developing towards a more independent and mature direction.

As AI Agent technology can perceive the environment and respond accordingly, the market has begun to explore collaboration between different projects, forming an ecosystem. For example, AI Agent may cooperate with DeFi protocols to enhance automated investment strategies. This requires AI Agent to have the ability to actively plan, make autonomous decisions, and coordinate the execution of multiple tasks, rather than just responding to external instructions.

Similar to the various protocol standards and development tools launched by Ethereum, the AI Agent field also needs a similar framework to connect internal and external networks, providing necessary components and tools for developers, reducing the development process, and promoting the formation of the ecosystem. Currently, there are several mainstream frameworks on the market, such as Virtuals, ai16z, and Zerebro, which correspond to different programming languages and tokens.

From AI Meme to AI Agent, it has been less than two months, but the total market capitalization of the track has grown from zero to nearly $20 billion. The speed of the AI Agent outbreak is undoubtedly fast. Currently, the AI Agent that has evolved from meme is no longer pure meme, but has certain practical functions, and is evolving towards the ability to make autonomous decisions and coordinate the execution of multiple tasks, showing the potential to change the operation mode of the blockchain ecosystem.

The AI Agent ecosystem is in the early stage

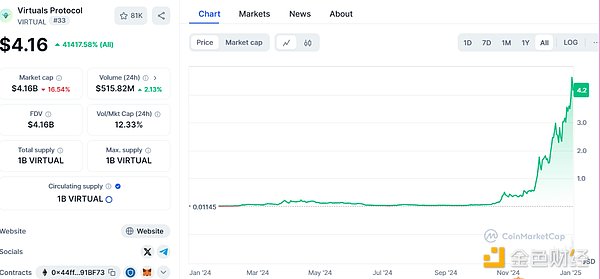

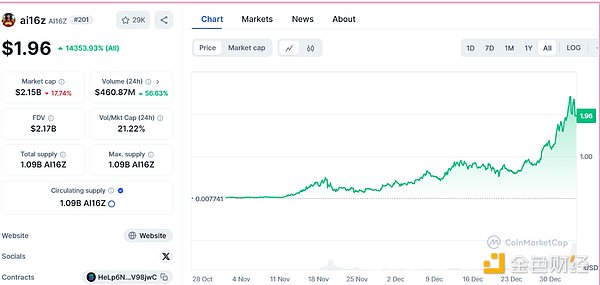

In the AI Agent craze, Virtuals Protocol and ai16z are undoubtedly the most representative projects, forming a relatively obvious competitive landscape.

Virtuals Protocol is an AI Agent issuance platform that helps users easily build and issue AI agents. Currently, there are more than 500 AI agents in the Virtuals ecosystem. All AI agents in the Virtuals ecosystem are developed using the official team's G.A.M.E modular framework. Whether it's creating new AI agents, selling tokens, or obtaining service revenue, they are deeply bound to Virtuals. As the AI agents in the Virtuals ecosystem continue to develop, the value of the entire ecosystem will be fed back to Virtuals.

Ai16z, the runner-up in the AI agent track, started from AI Meme and later built the Token incentive mechanism into the Ai16z architecture system, which was later than the Virtuals ecosystem. Currently, Ai16z's value capture is not only the narrative of the autonomous investment DAO, but also the Eliza framework ecosystem platform developed by the team. All AI agents using the Eliza framework will allocate 5-10% to the Ai16z DAO.

Based on the 858 AI agent projects currently recorded by cookie.fun, the market capitalization of the Virtuals ecosystem has reached $5.9 billion, and ai16z is $2.5 billion, accounting for 91.8% of the AI Agent market share and contributing more than half of the market.

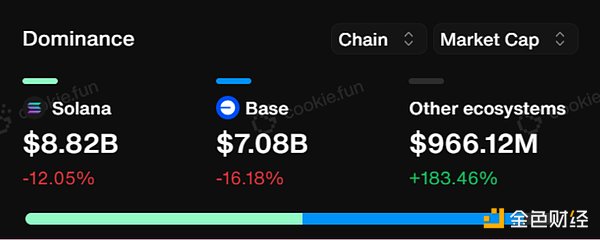

In terms of on-chain distribution, Base and Solana are the two main battlegrounds, with the market capitalization of AI Agents on Solana reaching $8.82 billion and on Base reaching $7.08 billion, accounting for 94.3% of the overall market.

However, overall, the current market structure is still relatively simple, mainly driven by a few leading projects, and the AI Agent ecosystem is still in the early stage.

As we enter the new year, the on-chain AI Agent track and the secondary mainstream market are presenting a "yin and yang" situation. Currently, in the global market, AI has always been the most innovative and persistent core narrative, and many crypto institutions are not stingy in describing the optimistic development of AI Agent in their 2025 outlook. At present, the AI Agent narrative is hot, and new concepts and new projects in the entire track are emerging endlessly. The market pattern is far from being finalized, and the fire of the AI agent track should continue to burn for a long time to come.

4E, as the official partner of the Argentine national team, provides trading services covering more than 600 assets including Cryptocurrencies, commodities, stocks, and indices, and also supports financial products with an annualized yield of up to 5.5%. In addition, the 4E platform has a $100 million risk protection fund to further safeguard the security of user funds. With 4E, investors can closely follow market dynamics, flexibly adjust their strategies, and seize every potential opportunity.