Bit has reached its 16th anniversary this year, evolving from an obscure experiment to a global financial asset. Since its launch in 2009, Bit has redefined the concepts of money and decentralization, impacting technology, finance, and culture.

From the mystery of its creator Satoshi Nakamoto to its development as a store of value and payment system, the story of Bit is unique. To commemorate this important milestone, we present 16 key facts highlighting the impact and growth of Bit over the past 16 years.

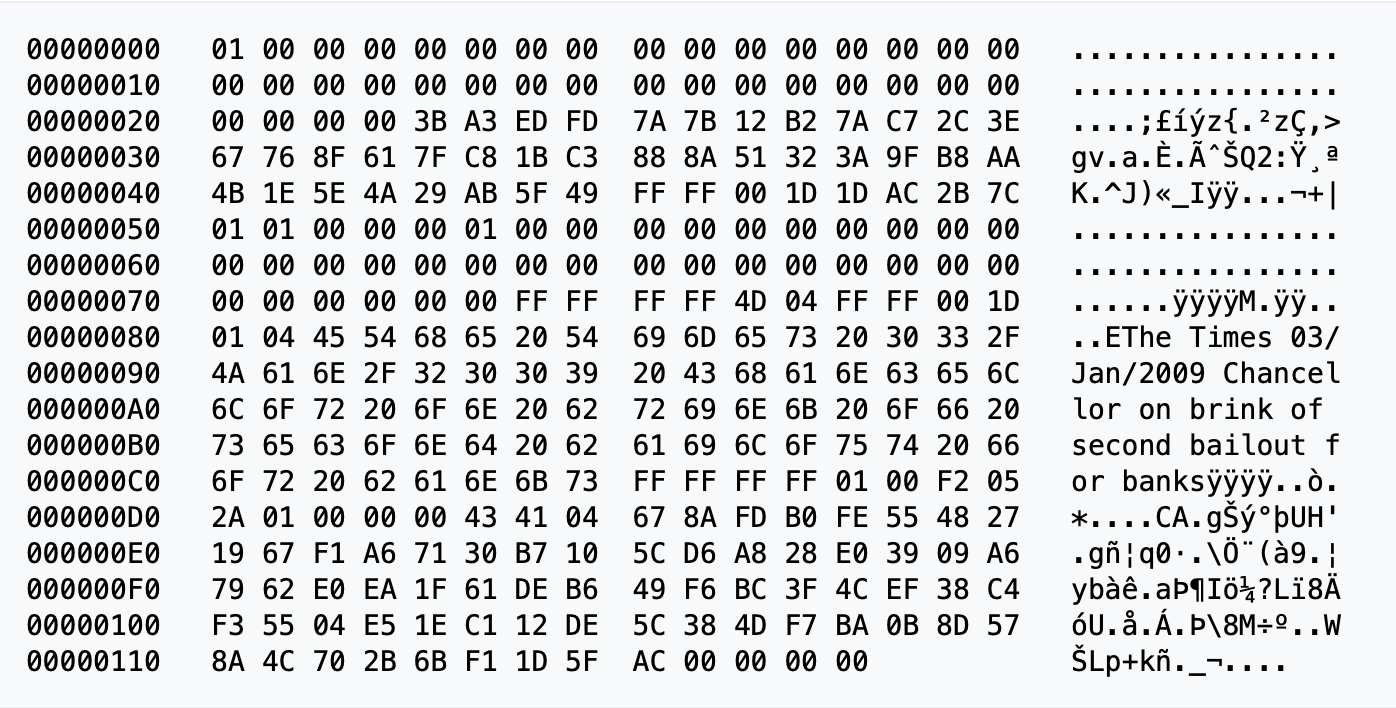

1. Bit Genesis Block Includes Secret Message

On January 3, 2009, Bit officially came into existence with the mining of the Genesis Block or Block 0. Unlike subsequent Blocks, the Genesis Block was hardcoded into Bit's source code and did not reward any spendable BTC. This was an intentional act by the mysterious creator Satoshi Nakamoto.

This Block contained an excerpt from The Times text: "The Times 03/Jan/2009 Chancellor on brink of second bailout for banks." This inclusion served as a timestamp and a critique of the traditional financial system, emphasizing Bit's goal of a decentralized currency.

Today, the Genesis Block remains a symbolic part of Bit's history, often referenced in discussions about its origins and purpose. Its creation laid the foundation for Bit's uninterrupted operation and growth over the past 16 years, which has evolved into a global movement.

2. Satoshi Nakamoto, Bit's First Transaction Was 10 BTC

On January 12, 2009, Satoshi Nakamoto conducted the first recorded Bit transaction by sending 10 BTC to the famous computer scientist and cryptographer Hal Finney.

Finney was an early Bit adopter and contributor, downloading the software on the day of launch and posting the famous tweet "Running bit" on January 11, 2009.

3. Bit's Creator Remains Mysterious

The creator of Bit is known only by the pseudonym, and is one of the biggest mysteries in the crypto world. In October 2008, Satoshi published the Bit white paper titled "Bit: A Peer-to-Peer Electronic Cash System," outlining the framework for a decentralized digital currency. Despite widespread speculation, Satoshi's true identity has not been conclusively confirmed.

Satoshi communicated with early Bit developers and enthusiasts through forums and email, helping to improve the network, before disappearing in April 2011. Some theories suggest Satoshi may have been a single person, while others believe multiple developers worked under the pseudonym.

Satoshi's disappearance left the project in the hands of the community, fostering the decentralized spirit that Bit embodies today. Whoever Satoshi was — or is — their vision created the technology that has reshaped global finance.

4. Bit White Paper Embedded in Blockchain

In 2013, an anonymous individual took a unique step to preserve the origins of Bit by directly embedding the full Bit white paper into the Bit Blockchain. This was achieved through a specific transaction that encoded the text of the white paper as metadata.

The immutable design of the Blockchain ensures that the Bit white paper will always be available to anyone using the network. By adding the white paper to the Blockchain, this individual combined the original idea and technology of Bit, demonstrating the deep connection between the creation of cryptocurrencies and decentralized systems.

5. Coinbase Transaction Is the First Transaction in New BTC Blocks

The first transaction in a new Bit Block is known as a Coinbase transaction. Unlike regular transactions, it has no inputs and generates new Bit as a Block reward for the miner. This transaction includes the Block subsidy — currently 6.25 BTC after the 2024 Halving — and all the transaction fees in the Block.

Interestingly, the popular cryptocurrency exchange Coinbase derived its name from this term, paying homage to Bit's new coin creation mechanism. While the term is specific to Bit's technical design, the exchange's name reflects the connection to the fundamental processes of the Blockchain.

6. Around 4 Million BTC Are Already Lost Forever

As of 2025, approximately 20% of all Bit, or around 4 million BTC, are inaccessible due to forgotten keys, lost hardware wallets, or irretrievable accounts. Most of these losses occurred in the early days of Bit, when the value was low and proper storage practices were not widely understood.

Some users have forgotten their wallet passwords, while others have discarded old devices containing their private keys, unaware of Bit's future potential. The infamous case of James Howells, who accidentally threw away a hard drive containing 8,000 BTC, continues to be a topic of discussion as he has funded large-scale landfill searches to try and recover his lost treasure.

7. First Real-World Purchase: 10,000 Bit for Two Pizzas

On May 22, 2010, Bit was used for the first time to purchase a real-world item. Programmer Laszlo Hanyecz bought two pizzas for 10,000 BTC, worth around $40 at the time. Crypto enthusiasts annually commemorate this day as Bit Pizza Day, highlighting a significant moment in Bit's history.

While Bit had little value at the time, those 10,000 BTC are now worth hundreds of millions of dollars. The transaction was facilitated through a Bit forum, where Laszlo proposed exchanging Bit for the pizzas. Another user accepted the offer and ordered two Papa John's pizzas for him.

8. Satoshi Nakamoto's Assets Remain Intact

As of 2025, the approximately 1.1 million BTC mined by the pseudonymous creator of Bitcoin remain untouched. Held across various wallets, this asset is worth around $100 billion.

The mystery surrounding Nakamoto's identity and the dormant coins continues to fuel speculation about Bitcoin's origins. Some theorists believe these coins demonstrate Bitcoin's decentralization ethos, while others suggest Nakamoto's absence emphasizes the technology's independence from central authority. This untouched wealth symbolizes Bitcoin's unique status as a truly trustless financial system.

9. World's First Satoshi Nakamoto Statue Erected in Budapest

The world's first statue honoring Bitcoin's creator, Satoshi Nakamoto, stands in Graphisoft Park in Budapest, Hungary. Unveiled on September 16, 2021, this bronze sculpture features a hooded figure with a reflective, expressionless face, symbolizing Nakamoto's anonymity and allowing visitors to "see themselves" in the idea of "we are all Satoshi."

In October 2024, a "disappearing" statue of Satoshi Nakamoto was installed in Lugano, Switzerland. Located in front of Villa Ciani, this unique art piece depicts a faceless figure working on a laptop, creating a transparent effect when viewed from the front or back, symbolizing Nakamoto's elusive identity.

10. Bitcoin Becomes a Popular Subject in Media and Content

Bitcoin has become a popular topic in media, with characters using it for online businesses in films like Dope (2015), and exploring its financial and innovative aspects in TV shows such as Billions and Mr. Robot.

Documentaries like Banking on Bitcoin (2016) and The Rise and Rise of Bitcoin (2014) chronicle its origins and growing impact, while Cryptopia (2020) investigates its place in the blockchain ecosystem.

Bitcoin has also appeared in pop culture, with The Simpsons humorously predicting its future and South Park depicting it as a dominant currency. These portrayals emphasize Bitcoin's journey from technical curiosity to cultural phenomenon.

11. Successful Bitcoin Transaction Sent from the Stratosphere

In August 2016, the cryptocurrency mining company Genesis Mining conducted an experiment to send the first Bitcoin transaction from space. Using a weather balloon equipped with a Bitcoin wallet and a 3D model of Bitcoin, the payload reached an altitude of 34 kilometers (about 21 miles) in the stratosphere.

During the flight, the team successfully transmitted a Bitcoin transaction using the wallet on the balloon. This remarkable achievement demonstrated Bitcoin's resilience and its ability to function without relying on traditional infrastructure. The experiment symbolized the boundless potential of decentralized technology, showing how Bitcoin can transcend geographical boundaries and connect users worldwide.

12. Bitcoin Mining Utilizes Over 60% Renewable Energy

While Bitcoin mining has often been criticized for its environmental impact, a shift towards sustainability occurred in 2024. Industry reports indicate that renewable energy now accounts for approximately 60% of global Bitcoin mining operations.

Mining companies are increasingly locating their facilities near hydroelectric dams, solar farms, and wind farms to reduce their carbon footprint and lower energy costs. Bitcoin miners are also exploring innovative energy solutions, such as utilizing stranded natural gas or excess power that would otherwise be wasted.

13. Over 95% of Bitcoin Supply Mined

Bitcoin's protocol limits the supply to 21 million coins, creating a scarcity similar to precious metals like gold. This fixed cap prevents inflation and makes Bitcoin a deflationary asset.

As of 2025, over 19.9 million BTC have been mined, with less than 110,000 coins remaining. This limited supply has contributed to Bitcoin's establishment as "digital gold," attracting investors seeking a hedge against inflation. Bitcoin's scarcity is further increased by the fact that an estimated 20% of all mined BTC have been lost, either due to forgotten keys or inaccessible accounts.

14. Institutional Bitcoin Holdings Exceed Satoshi Nakamoto's Stash

By the end of 2024, institutional Bitcoin holdings, primarily through physical ETFs, exceeded 1.1 million BTC, surpassing the holdings of Bitcoin's pseudonymous creator. This development underscores the increasing institutional adoption of cryptocurrencies as a legitimate asset class.

Major financial institutions, including BlackRock and Fidelity, have launched Bitcoin ETFs, attracting significant investment and contributing to the mainstream acceptance of Bitcoin in traditional finance.

15. Bitcoin Reserve Proposals Garner Global Attention

By the end of 2024, discussions integrating Bitcoin into national reserves have intensified, with both developed and emerging economies exploring its potential. In the United States, lawmakers and financial experts have proposed allocating a portion of the Federal Reserve's holdings to Bitcoin, citing its limited supply and independence from central control as key advantages. Proponents argue that including Bitcoin could provide a hedge against the decline of the dollar's dominance and diversify reserve assets alongside traditional holdings like gold.

Meanwhile, emerging markets are taking concrete steps to adopt Bitcoin in their reserves. In Switzerland, a political proposal has urged the Swiss National Bank to diversify its reserves to include BTC. Supporters argue that Bitcoin's limited supply and decentralization provide a unique hedge against currency devaluation and global economic instability.

Similarly, in Germany, there was a discussion where the European Central Bank was considering Bit in its digital preparedness strategy. This was triggered by an increase in interest in decentralized alternatives.

16. Bit Network, 16 Years of Uninterrupted Record

In 2025, Bit has achieved an unprecedented milestone of over 16 years of continuous operation without any network downtime. This achievement underscores the unparalleled reliability of Bit's decentralized infrastructure, maintained by thousands of geographically distributed nodes and miners.

Centralized financial systems are vulnerable to power outages and cyber attacks, but the Bit network has demonstrated resilience against threats, including large-scale hacking, regulatory crackdowns, and technical challenges. Even during periods of high transaction volume, such as when BTC exceeded $100,000 at the end of 2024, the network continued to process transactions securely and efficiently.