Author: Martin Young, CoinTelegraph; Translator: Wuzhu, Jinse Finance

Bitwise CEO Hunter Horsley said that with the help of artificial intelligence and tokenization, 2025 may see the flourishing of small, niche businesses, more companies adopting Bit, and a potential "resurgence" of mergers and acquisitions that could benefit cryptocurrencies.

In a series of X posts on January 5, Horsley stated that he believes the world in 2025 is "on the cusp of transformation".

Tokenization Empowers Small Businesses

In an X post, Horsley also made some predictions about tokenization, noting that the focus has been mostly on the demand side's interests, such as democratizing access to money market funds, but the real revolutionary potential lies on the supply side.

He stated that the transformative power of tokenization may come from enabling a vast number of untapped small businesses to access capital markets.

Brickken founder and CEO Edwin Mata said that the real-world assets (RWA) tokenization industry may be the next key narrative in the crypto space in 2025. He pointed out: "Real-world asset tokenization is transforming traditional markets by digitizing and trading assets like real estate, debt, and equity on the blockchain."

AI to Drive a Surge in Micro-Enterprises

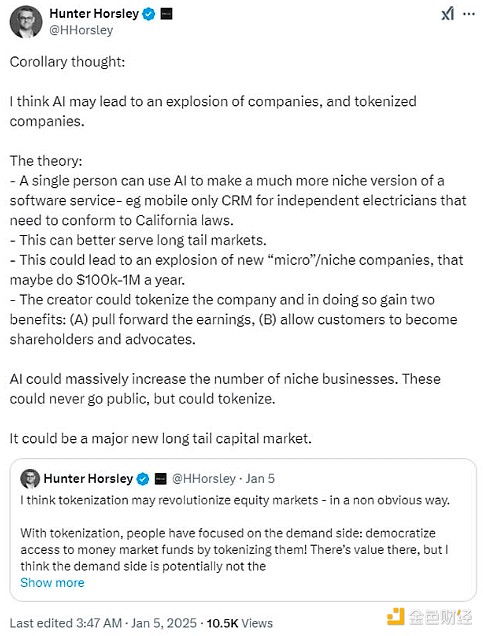

"I think AI could drive a surge in the number of companies and tokenized companies," Horsley shared his views on the future development of AI in another article.

"AI could dramatically increase the number of niche businesses. These will never be able to IPO, but they can be tokenized. It could be an important new long-tail capital market."

An example of how AI can drive tokenization. Source: Hunter Horsley

"Bit Standard" Companies

Horsley also predicted that a major theme in 2025 will be the emergence of "Bit Standard" companies that hold BTC on their balance sheets. "There will be many companies joining the Bit standard by 2025," Horsley said.

MicroStrategy, the largest corporate holder of BTC with 446,400 Bit, worth around $43.7 billion at the current market price, hinted it will buy more on Monday.

By the end of 2024, several smaller companies announced they have started to formulate strategies to invest in and hold Bit as part of their treasury.

Relaxation of Merger Control

Horsley said that the Trump administration may "relax" control over large corporate mergers, which would be beneficial for cryptocurrencies.

In an X post on January 6, Horsley predicted that the "Big Tech Seven" - Alphabet, Amazon, Apple, Meta, Microsoft, Nvidia, and Tesla - "may ultimately be able to flex their market cap".

"Big companies may get bigger, and mid-sized companies may shrink," he said, adding that "if this happens, I think it will accelerate the development of cryptocurrencies", provided that the large companies are operating in their own interests rather than those of users.

"The premise of cryptocurrencies is not trusting that large institutions will do what's in your best interest. As big companies get bigger, that becomes more evident."