- RWA (On-Chain Tokenization of Real Assets): With the prospect of clearer regulation under the Trump administration, this is undoubtedly positive news for the RWA sector, which is heavily dependent on regulation.

- DeFi (Decentralized Finance): As long as the bull market continues, some DeFi protocols that have already evolved into infrastructure will continue to thrive.

- DeSci (Decentralized Science) and Depin: Exploring future technology-driven innovation scenarios.

- Coinbase 50 and other projects selected by renowned institutions: For example, assets supported by the SEC and BlackRock.

Binance Copy Trading Analysis

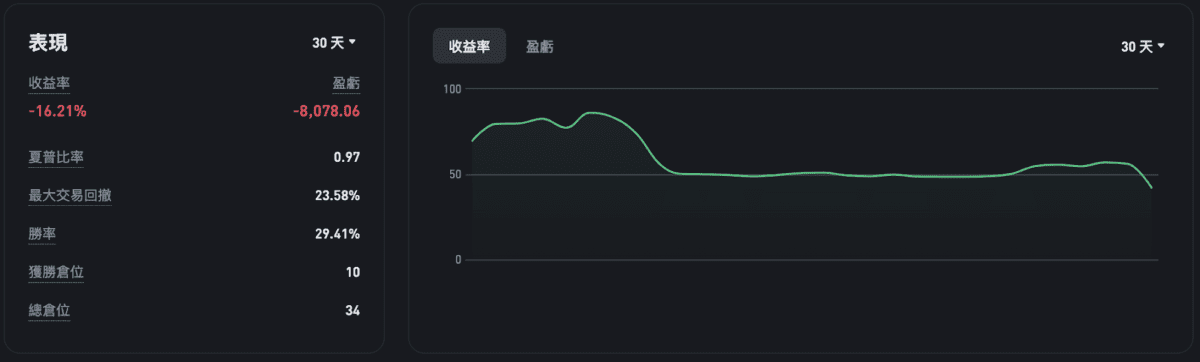

GTRadar - BULL

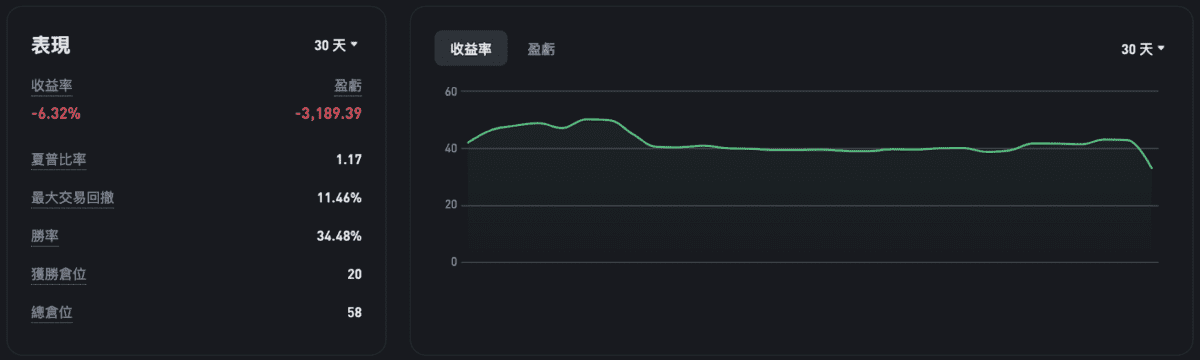

GTRadar - Balanced

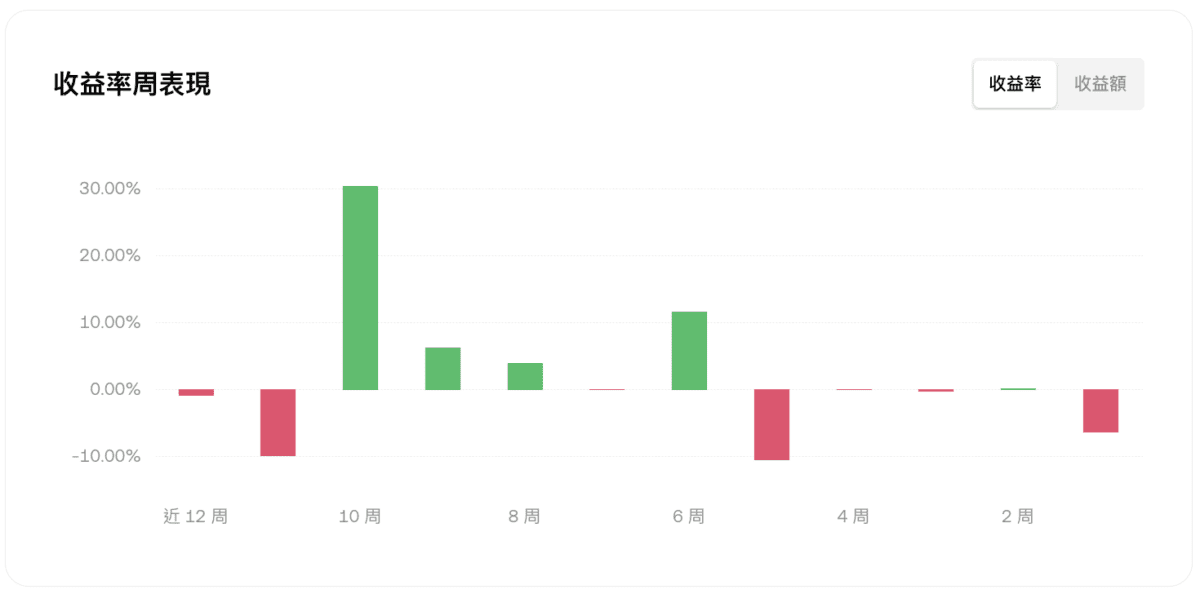

GTRadar - Potential Public Chain OKX

- The 7-day returns of 'GTRadar - BULL', 'GTRadar - Balanced' and 'GTRadar - Potential Public Chain OKX' are -5.48%, -4.55% and -6.28% respectively, and the 30-day returns are -16.21%, -6.32% and -6.62% respectively.

- Currently, 'GTRadar - BULL' holds a net long position of 30%, mainly in BTC and ETH.

- Currently, 'GTRadar - Balanced' holds a net long position of about 10%, mainly in BTC and BNB.

- Currently, 'GTRadar - Potential Public Chain' holds a net long position of about 30%, mainly in ETH.

- Copy traders who frequently change their investment portfolios tend to have lower long-term returns than those who consistently follow a single portfolio. Do not easily terminate copy trading due to short-term drawdowns, as drawdowns can actually be a good time to start copy trading, and frequent in-and-out trading can significantly reduce returns.

Headline News

According to the latest report from 10x Research, MicroStrategy's stock price has fallen more than 45% from its peak, indicating a significant shift in investors' attitudes towards its leveraged Bitcoin investment strategy. Analysts point out that market participants have gradually realized that the cost of holding Bitcoin indirectly through MicroStrategy is far higher than direct Bitcoin purchases, causing the "leveraged Bitcoin investment tool" narrative to lose its appeal.

Coinbase Premium Index Hits a 12-Month Low

The Coinbase Premium Index, an important indicator of Bitcoin retail demand in the US, has recently fallen to its lowest level in 12 months. Market analysts warn that this could pose a challenge to the short-term price recovery of Bitcoin.

Ethena Releases 2025 Roadmap, Plans to Launch iUSDe and Other Products to Enter Traditional Finance

Guy Young, the founder of the Ethereum stablecoin protocol Ethena, released the 2025 roadmap "Convergence" on Friday, describing Ethena's achievements in 2024 and its plans for 2025, stating that its next phase of growth will primarily rely on bringing its products to the traditional finance sector. The roadmap shows that Ethena is about to launch products including the wrapped token iUSDe, the perpetual contract and spot exchange Ethereal, and the on-chain options and structured products protocol Derive.

Bitcoin exchange inflows (total Bitcoin transferred to exchanges) and miner outflows (Bitcoin sent to exchanges by miners) have declined significantly since November 2024, which may indicate that the market's selling pressure has eased.

Staked Ethereum Continues to Decline, Lido's Dominance Challenged

In October 2024, the total amount of Ethereum (ETH) locked in liquid staking platforms surpassed the important threshold of 14 million. However, after entering 2025, this figure has started to decline. As of January 5, 2025 (Sunday), the total amount of Ethereum locked in liquid staking platforms has dropped to 13.78 million, lower than the 13.85 million recorded at the end of November 2024.

Metaplanet Plans to Increase Bitcoin Holdings to 10,000 BTC This Year

Simon Gerovich, the CEO of the Japanese investment company Metaplanet, stated on the social platform X last Sunday that Metaplanet plans to increase its Bitcoin reserves to 10,000 BTC by "utilizing the most effective capital market tools available to us." The company currently holds approximately 1,761.98 BTC (worth about $175.4 million), with a total cost of 20.872 billion yen.

In his latest article, BitMEX founder Arthur Hayes uses the metaphor of a ski slope in Hokkaido to liken US dollar liquidity to snow, and the "disappointment of high expectations for Trump's policies" to the hidden bamboo leaves (sasa) under the snow, predicting the future trajectory of the global investment market, including Bitcoin.

In a report released on Monday, the cryptocurrency exchange Bitfinex stated that although Bitcoin may still experience a deeper correction in the first quarter of 2025, the broader supply tightening and miners' bullish sentiment indicate that Bitcoin still has the potential for further upside in the medium term.

US CFTC Chair Rostin Behnam to Step Down on Trump's Inauguration Day

Rostin Behnam, the chairman of the U.S. Commodity Futures Trading Commission (CFTC), told the Financial Times that he will step down on January 20, the day of the inauguration of U.S. President-elect Donald Trump. In addition, Rostin Behnam expressed concern that regulation of digital assets (including Bitcoin and other cryptocurrencies) is still not adequate enough.

Strong U.S. economic data leads to $300M of crypto liquidations, as Bitcoin dips below $98K

The U.S. Bureau of Labor Statistics reported that the November JOLTS job openings unexpectedly increased from the previous month's 780,000 to 810,000, while the December ISM Services Index surged to 54.1, higher than the expected 53.5. These two reports shook the already tense bond market, causing the 10-year U.S. Treasury yield to rise another 5 basis points to 4.68%, leading to a decline in the U.S. stock market and cryptocurrency assets.

The above content does not constitute any financial investment advice, all data is from the official announcement of GT Radar, and each user may have slight differences due to different entry and exit prices, and past performance does not represent future performance!