Author: insights4.vc

Compiled by: TechFlow

To help you save time and focus on market hotspots, we have carefully compiled over 300 forward-looking predictions for 2025. Every year, top institutions and industry leaders share insights that have a profound impact on the future development of cryptocurrencies. This report brings together the views of ETF issuers, investment funds, research institutions, and market pioneers, providing not only an overall picture of market sentiment, but also practical advice and actionable insights on emerging opportunities.

The five most prominent themes for 2025 include:

Growth and Adoption of Stablecoins

Tokenization of Real-World Assets (RWAs)

Expansion of Bitcoin and Ethereum ETFs

Convergence of Artificial Intelligence and Blockchain

Decentralized Physical Infrastructure Networks (DePINs)

1. Growth and Adoption of Stablecoins

Predictions from Blockworks founder Jason Yanowitz and Inversion Capital founder Santiago R Santos

By 2025, the market capitalization of Stablecoins is expected to account for 10% of the total cryptocurrency market value. This growth may be driven by at least one major bank, tech company, or fintech firm launching a Stablecoin. For example, BlackRock, Robinhood, and Meta are considered likely participants. Tether is expected to maintain its market-leading position through its strategic political relationships, while USDC's market share may decline from the current 20% to around 15% due to the entry of new competitors like PayPal. These changes may drive regulatory progress in the US, making Stablecoins a key driver in the payments and e-commerce sectors.

Predictions from 21shares

The current market capitalization of Stablecoins has exceeded $170 billion and has made significant progress in the global remittance market, particularly in countries like the Philippines and Turkey. With the increasing adoption of private credit tokenization, this trend is expected to further enhance capital fluidity and improve financial transparency. Platforms like Maple Finance, which utilize smart contracts to simplify operations and reduce costs, have become industry leaders. As institutions like Moody's start to provide ratings for tokenized credit, this sector is expected to become a mainstream asset class by 2025.

2. Tokenization of Real-World Assets (RWAs)

Predictions from Coinbase

The market for tokenized real-world assets (RWAs) is growing rapidly. It is expected to grow 60% by 2024, reaching $13.5 billion, and could further surge to $30 trillion by 2030. Currently, global financial institutions like BlackRock and Franklin Templeton are actively driving the tokenization of government securities. Tokenized assets are becoming an important collateral in the DeFi ecosystem.

Predictions from Pantera Capital managing partner Paul Veradittakit

This year, RWAs grew 60% to $13.7 billion, with 70% being private credit and the rest being Treasuries and commodities. Capital inflows are accelerating, and more complex tokenized asset types are expected to emerge by 2025.

Private Credit: With improved infrastructure, Figure added $4 billion in tokenized credit in 2024. More companies are bringing private credit capital into the cryptocurrency space.

Treasuries and Commodities: The current on-chain Treasury size is $2.67 billion, while the off-chain size remains in the trillions of dollars. Treasuries offer higher yields than Stablecoins. BlackRock's BUIDL fund has $500 million on-chain, while the off-chain size is in the hundreds of billions. DeFi pools have started integrating Treasuries, reducing user adoption barriers.

3. Expansion of Bitcoin and Ethereum ETFs

Predictions from Bloomberg ETF experts Eric Balchunas and James Seyffart

The US Securities and Exchange Commission (SEC) approved the first 11 Bitcoin spot ETFs on January 10, 2024, and then approved an Ethereum spot ETF on July 23, 2024. This approval marks a gradual easing of the regulatory environment and lays the foundation for the launch of Altcoin ETFs. The emergence of Altcoin ETFs may further enhance market liquidity and lower the entry barrier for crypto investments.

The assets under management of the Bitcoin ETF are expected to surpass those of the Gold ETF by 2025. Currently, the Bitcoin ETF has $110 billion in assets, while the Gold ETF has $128 billion. The rapid growth of the Bitcoin ETF suggests this trend may be realized earlier than expected.

If the SEC leadership leans more towards liberalism, they may approve Altcoin ETFs including XRP, Solana (SOL), and Hedera (HBAR) in the future, further diversifying the range of cryptocurrency investment products.

If you would like to learn more about the Bitcoin spot ETF, we recommend referring to our article published last month: Bitcoin and Ethereum ETFs Surpass Gold ETF. Here are the ETF data as of January 8, 2025:

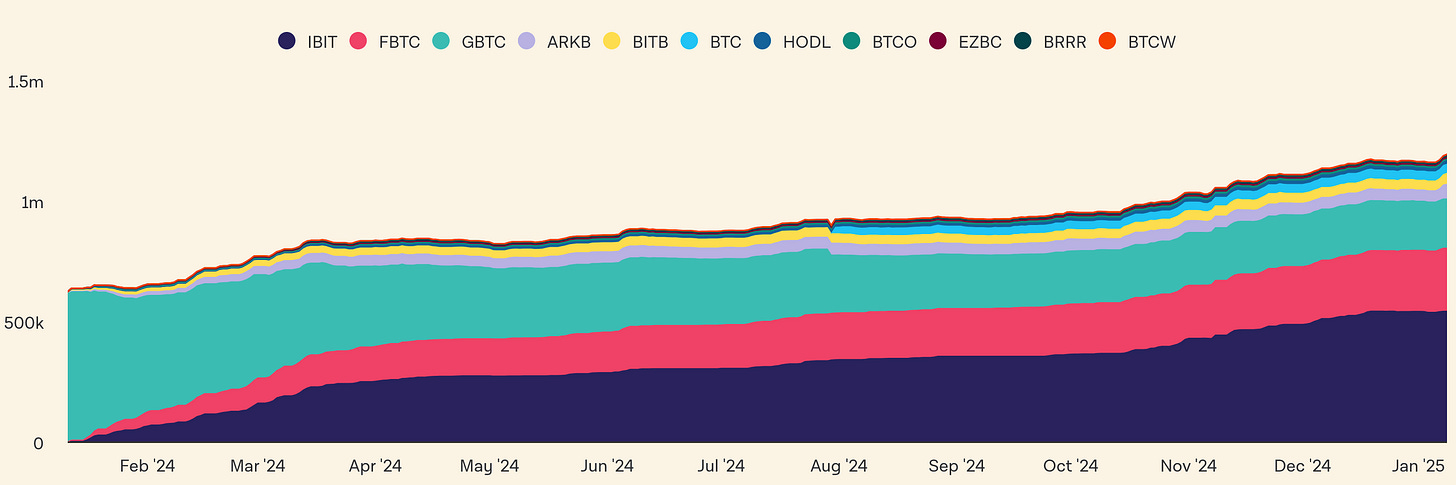

On-chain holdings of Bitcoin spot ETFs (Data source: The Block)

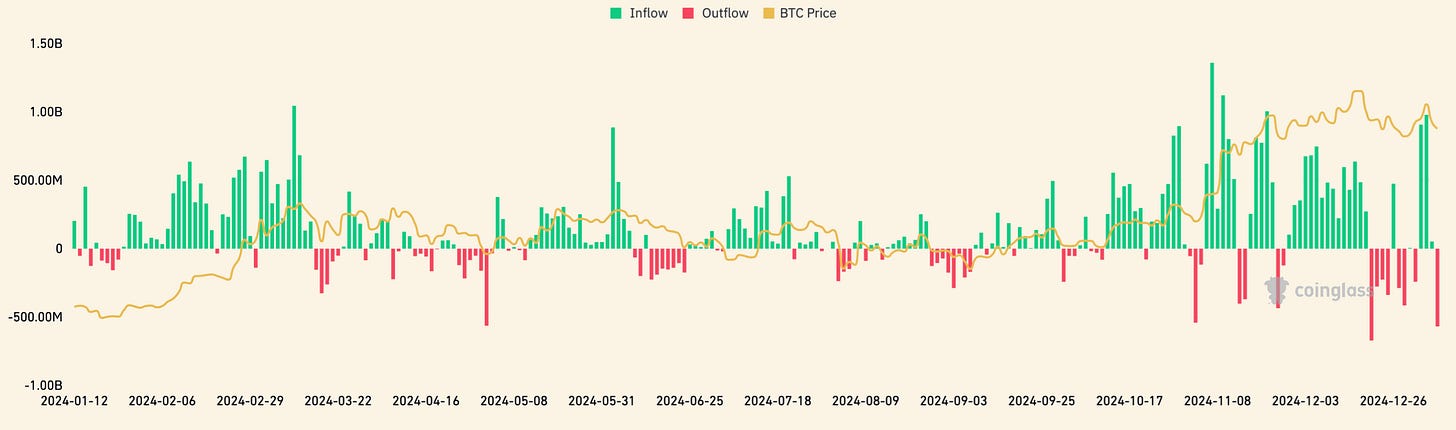

Bitcoin ETF Flows

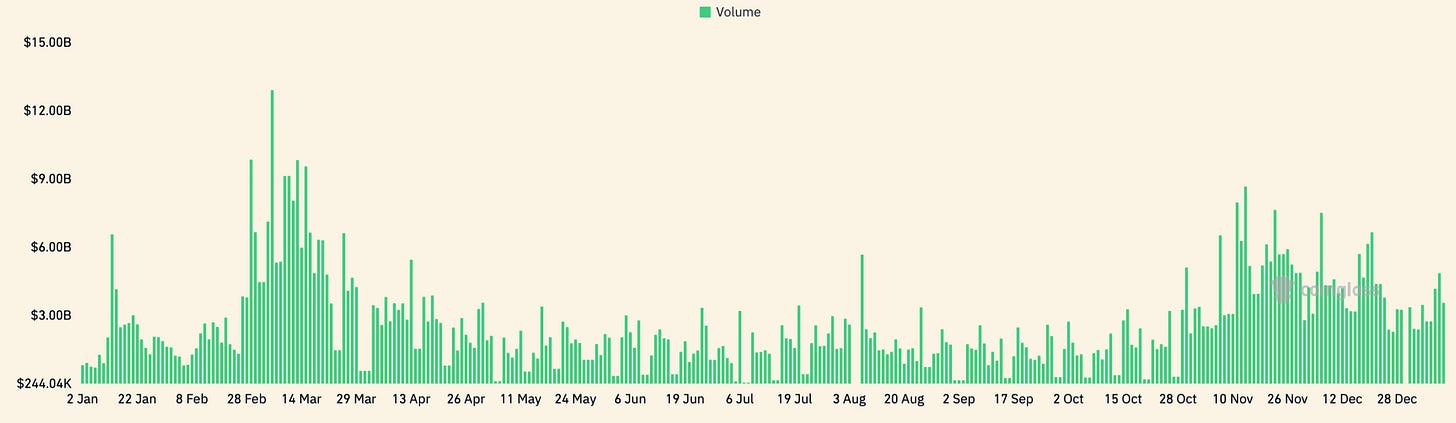

Bitcoin ETF Trading Volume

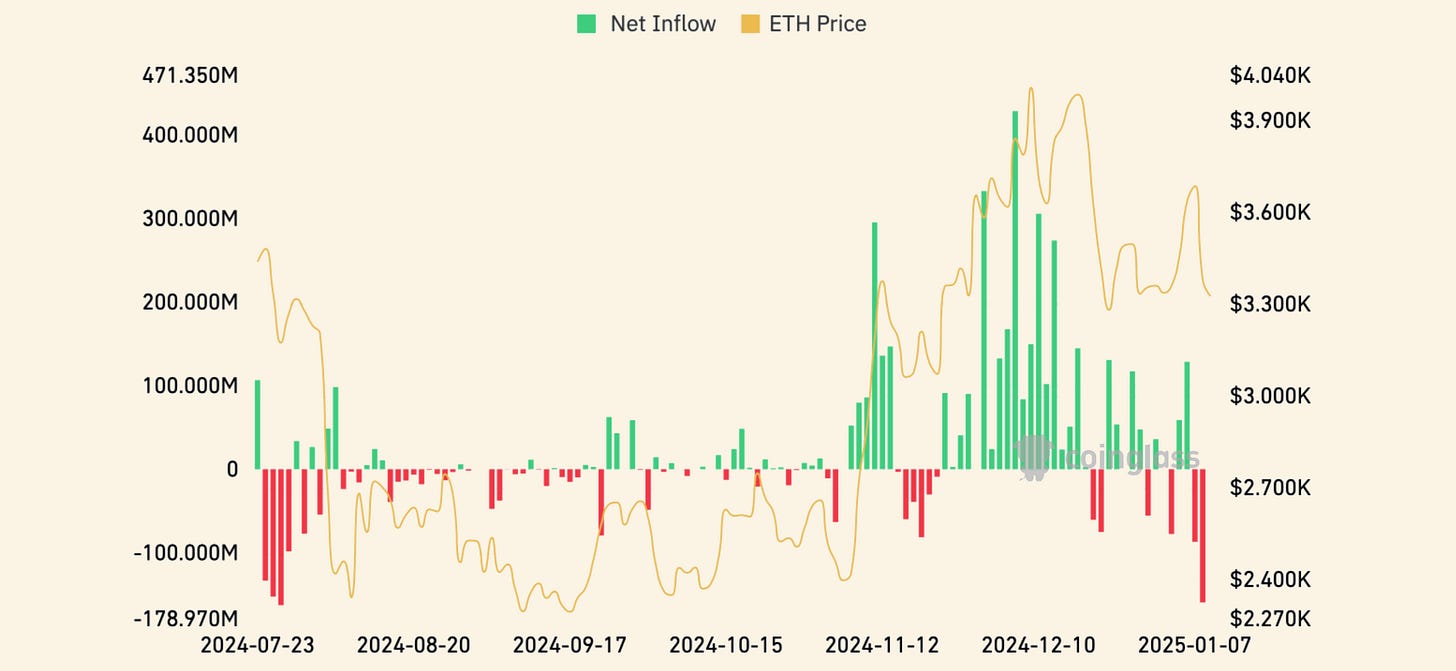

Ethereum ETF Flows

Predictions from Bitwise

The inflows into Bitcoin ETFs are expected to surpass the 2024 record of $33.6 billion in 2025. This growth is primarily driven by the efforts of large brokerages like Morgan Stanley and Bank of America, which will provide more investment channels for their clients to access crypto products. With increasing investor confidence and the gradual mainstream adoption of Bitcoin allocation in portfolios, ETF inflows are expected to accelerate further, a trend similar to the development of Gold ETFs over the past decades.

4. Convergence of Artificial Intelligence and Blockchain

Predictions from Vaneck

By 2025, the number of AI Agents is expected to exceed 1 million. These AI Agents will significantly drive the growth of on-chain activities, not only optimizing DeFi yields but also automating various tasks and enabling interactions in gaming and social media. Platforms like Virtuals Protocol are actively driving the development of AI technology, expanding the application of AI Agents from finance to gaming and marketing, generating significant revenue and enhancing user engagement.

Predictions from Dragonfly Capital partner Haseeb Qureshi

AI Agents will widely adopt Stablecoins for peer-to-peer transactions, especially as Stablecoin regulations are further relaxed. This trend will also extend to large enterprises, which will use Stablecoins to replace traditional banking systems, achieving greater flexibility and efficiency.

Decentralized AI training and inference will see rapid development, driven by projects like ExoLabs, NousResearch, and PrimeIntellect, providing new options for the current centralized AI models. NEAR Protocol is working to build a fully permissionless AI technology stack, making development and deployment more open.

AI-driven wallets will fundamentally transform the user experience by automating complex operations (such as cross-chain bridging, transaction optimization, fee reduction, and fraud prevention). This will provide users with a seamless cross-chain operation experience. By 2026, this automation trend may weaken the importance of network effects in blockchain, as users will no longer need to interact directly with the blockchain.

5. Decentralized Physical Infrastructure Networks (DePINs)

Forecast from Multicoin Capital

The Trump administration is expected to introduce a national standard for autonomous driving (AD), which will provide new development opportunities for decentralized physical infrastructure networks (DePINs) based on autonomous driving and robotics technology. As GPU clusters scale beyond 100,000 H100 units, autonomous driving technology will have the capability for practical application. Some startups funded by traditional venture capital firms may adopt the DePIN model to diversify operational risk and reduce costs. Early adopters of this model will be able to collect critical robotic operation data. For example, the startup Frodobots has already started exploring this direction, and more similar companies are expected to join. Additionally, Hivemapper is also experimenting with similar innovative concepts.

Forecast from Framework Ventures co-founder Vence Spencer

DePIN projects focused on the energy sector (such as Glow and Daylight) are expected to achieve transaction fee levels comparable to top DeFi platforms. This indicates that blockchain technology is becoming increasingly widespread in the management and monetization of energy distribution. For example, these projects optimize energy distribution efficiency through smart contracts, while providing users with transparent transaction records and revenue distribution methods.