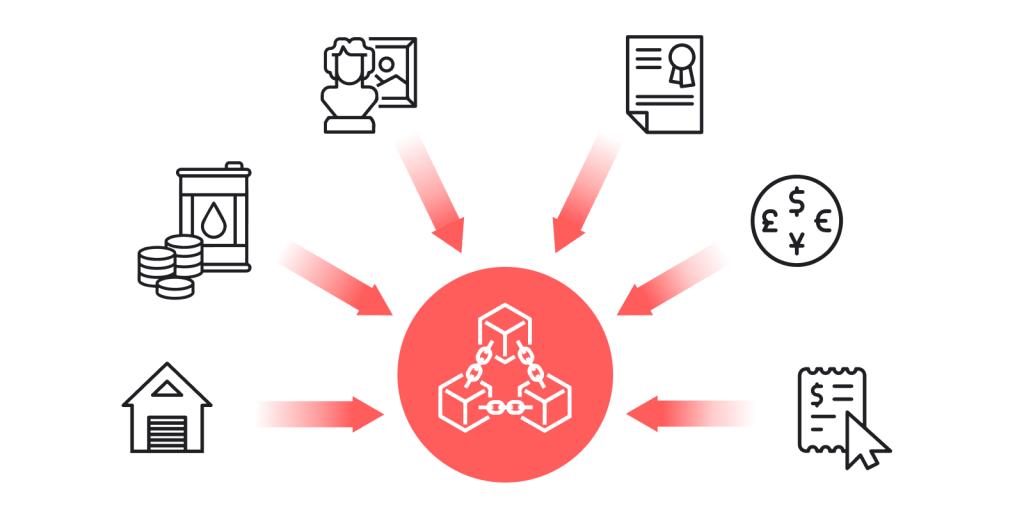

Tokenization of real-world assets (RWA) represents a revolutionary approach to bringing tangible assets such as real estate, art, commodities, and intellectual property into the digital financial ecosystem. The tokenization process involves creating digital representations (tokens) of physical assets on the blockchain, enabling them to be traded, fractionally owned, and accessed by a wider pool of investors.

Tokenizing RWA allows assets that were previously limited to slow-moving, high-barrier traditional markets to benefit from the speed, transparency, and accessibility provided by blockchain technology.

Why Tokenize Real-World Assets (RWA)?

The key drivers behind the tokenization of real-world assets include enhanced liquidity, accessibility, transparency, and global reach. Traditional asset classes such as real estate or art often have illiquid markets due to high costs and limited accessibility.

By converting these assets into tokens, they can be accessed by a larger pool of investors, and even allow for fractional ownership (instead of requiring the purchase of the entire asset). Additionally, tokenization simplifies and improves the transaction process, reducing costs associated with intermediaries and legal procedures.

The benefits of tokenizing real-world assets include:

- Liquidity: Tokenization enhances liquidity by allowing assets to be traded on blockchain platforms 24/7. Tokenized assets can be partially or fully sold, enabling owners to unlock value without going through lengthy sale cycles.

- Accessibility and Fractional Ownership: Tokenization allows the division of high-value assets into smaller fractions, enabling more people to participate. For example, you can own a portion of a commercial building, a rare artwork, or a luxury asset through fractional token ownership. This expands the pool of investors who can access assets that were previously only available to a select few. Tokenization can also improve liquidity (ease of buying and selling) and contribute to more reasonable pricing.

- Transparency and Security: The immutable ledger system of blockchains enables all transactions to be traceable, reducing the risk of fraud and enhancing transparency. Smart contracts also automate compliance and ownership updates.

- Reduced Intermediaries: The tokenization process eliminates traditional intermediaries such as brokers or legal agents, reducing costs and making asset transfers faster and more efficient. This often allows for real-time, on-chain settlements.

- Liquidity Unlocking: Capital markets typically operate on a T+2 basis, where T is the transaction date and T+2 is the time it takes to complete the transaction and exchange the asset. This results in a two-day liquidity lock-up, affecting the yields of participating companies. When a real-time (T) settlement mechanism is applied, a significant amount of liquidity is unlocked for more efficient use by capital markets and participants.

- Efficient Ownership Transfer: Blockchain-based tokenization enables easy, fast, and even integrated secondary markets where tokens backed by assets can be traded. Efficient ownership transfer is crucial, but the ability to track an asset's ownership history also helps assess its provenance and, in some cases, better price the asset. This is particularly true for high-end assets like art and precious gems.

- Better Risk Management: As mentioned, instant settlement helps reduce liquidity risk. Furthermore, tokenizing traditional capital market assets can also help mitigate counterparty risk. If all of a company's assets are moved onto the blockchain, the actual liquidity status of that company can be determined immediately before a transaction is executed. This can help reinforce market confidence during crisis periods, such as the 2008 global financial crisis.

Steps to Tokenize Real-World Assets

The process of tokenizing real-world assets (RWA) typically involves the following steps:

- Step 1 - Asset Selection and Valuation: Identify and value the assets to determine the tokenizable value. This may require collaboration with valuation firms to establish a reliable reference price.

- Step 2 - Legal Compliance and Structuring: Ensuring legal compliance is a critical factor. The tokenization process must adhere to local regulations regarding ownership and securities, often requiring working with legal and financial experts to create an appropriate structure.

- Step 3 - Asset Digitization and Smart Contract Development: Smart contracts are self-executing code on the blockchain created to manage the asset's rules and transactions. These contracts define the terms of ownership, access rights, compliance requirements, and profit distribution, if any.

- Step 4 - Token Issuance and Distribution: Tokens representing the assets are created on the blockchain. They are then distributed to investors through public offerings (such as ICOs) or private placements.

- Step 5 - Secondary Market Creation: To increase liquidity, a secondary market for the tokenized assets may be established on compatible exchanges, allowing investors to buy and sell tokens as needed.

- Step 6 - Token Enablement Tools: As blockchains develop token standards to support real-world assets, it is crucial to build an ecosystem to enhance these standards with supporting tools. Since fund managers often lack the technological capabilities to develop these tools in-house, providing support tools for mainstream real-world assets will drive widespread adoption.

- Step 7 - Ongoing Compliance and Management: Continued compliance with regulations, updating, and maintaining records on the blockchain is essential, especially to ensure asset safety and alignment with evolving legal requirements.

Ethereum and Solana: Comparison in Real-World Asset (RWA) Tokenization

Both Ethereum and Solana have implemented RWA tokenization with innovative standards and products. However, each platform has its own advantages and challenges in deploying real-world asset tokenization. Here's a detailed comparison:

Network Performance and Transaction Speed

- Ethereum: Renowned for its decentralized security, Ethereum processes around 15-30 transactions per second (TPS). This speed may be limiting when tokenizing real-world assets with high demand, especially during network congestion.

- Solana: Focused on scalability, Solana achieves over 1,000 real transactions per second, making it well-suited for tokenizing assets that require real-time transactions and high trading volumes. This efficiency is particularly important for highly liquid assets like foreign exchange that are brought onto the blockchain.

Transaction Costs

- Ethereum: Ethereum's high gas costs have been a widely recognized challenge. While various Ethereum upgrades aim to reduce costs, they remain significantly higher than Solana.

- Solana: Transaction costs on Solana are extremely low, often under $0.01 per transaction, making it highly cost-effective for asset tokenization and complex operations at affordable prices.

While Solana has a cost advantage, some Solana-based trading platforms like Zeta Markets have chosen to create their own application-specific chains to further enhance performance based on Solana's capabilities.

Ecosystem Maturity and Project Support

- Ethereum: As the leading blockchain for decentralized applications (DApps), Ethereum has a large ecosystem and broad support for RWA tokenization projects, with protocols like Centrifuge. Ethereum benefits from innovation, with the ERC-3643 standard created to support RWA tokenization.

- Solana: While newer, Solana is growing rapidly and gaining attention for its high performance and low costs. However, in terms of ecosystem maturity, Solana still lags behind Ethereum. There are some RWA tokenization projects on Solana, but the ecosystem is still in its early stages. For example, Paypal has used its in-house technology to build on Solana and launch the PYUSD stablecoin.

Developer Community Support

- Ethereum: Ethereum has a large developer community, providing abundant documentation, tools, and support for new projects.

- Solana: The Solana community is smaller but growing rapidly, with increasing resources and support for developers as the ecosystem matures.

| Feature | Ethereum | Solana |

| Speed | 15-30 TPS; limited scalability | Over 1,000 TPS; high scalability, suitable for real-time transactions |

| Transaction Costs | High gas fees | Extremely low fees |

| Ecosystem Maturity | Mature with strong RWA standards (e.g., ERC-3643) | Developing but less mature |

| Developer Support | Large and established community | Smaller but rapidly growing community |

Here are some examples of projects and market opportunities around RWA tokenization.

- Ethereum: Centrifuge is a decentralized platform that specializes in tokenizing real-world assets on Ethereum, helping businesses raise capital based on real assets such as invoices and real estate. As of 2024, Centrifuge has supported the tokenization of over $250 million in asset value. RealT provides real estate tokenization services on Ethereum, allowing ownership of a portion of real estate properties. With over 200 properties tokenized, RealT enables users to earn rental income and easily trade their real estate ownership shares.

- Solana: Ondo Finance and several other projects on Solana have led tokenization initiatives across a variety of asset types. Leveraging Solana's speed and low costs, these projects have brought accessible trading capabilities to individual investors.

The tokenization of real-world assets is reshaping the way assets are bought, sold, and managed. By making valuable assets more accessible, tokenization democratizes investment opportunities and brings liquidity to traditionally illiquid traditional assets. While Ethereum remains a popular choice due to its extensive ecosystem, Solana is emerging as a cost-effective and high-speed alternative, particularly suitable for high-volume transactions.

With ongoing advancements in blockchain technology, the tokenization of real-world assets has the potential to redefine asset ownership, investment opportunities, risk management, and liquidity on a large scale. The coming years may witness a surge of growth in this field, with both Ethereum and Solana playing crucial roles in shaping the future of the market.

However, any major transformation of traditional assets is a process that can span decades, even across generations. The pace at which the tokenization of real-world assets is adopted remains an open question.