Is the post-election rally over?

The S&P 500 is now trading below November 5th levels and has erased -$2.5 TRILLION of market cap in ~4 weeks.

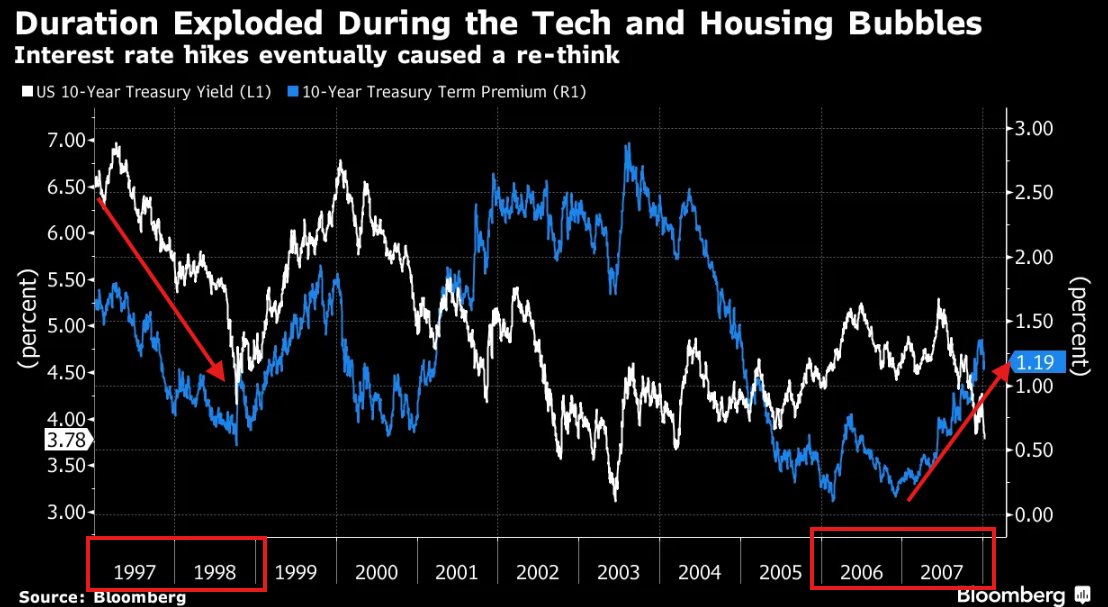

Rising "term premiums" are pressuring stocks, something you will hear A LOT in 2025.

What does it mean? Let us explain.

(a thread)

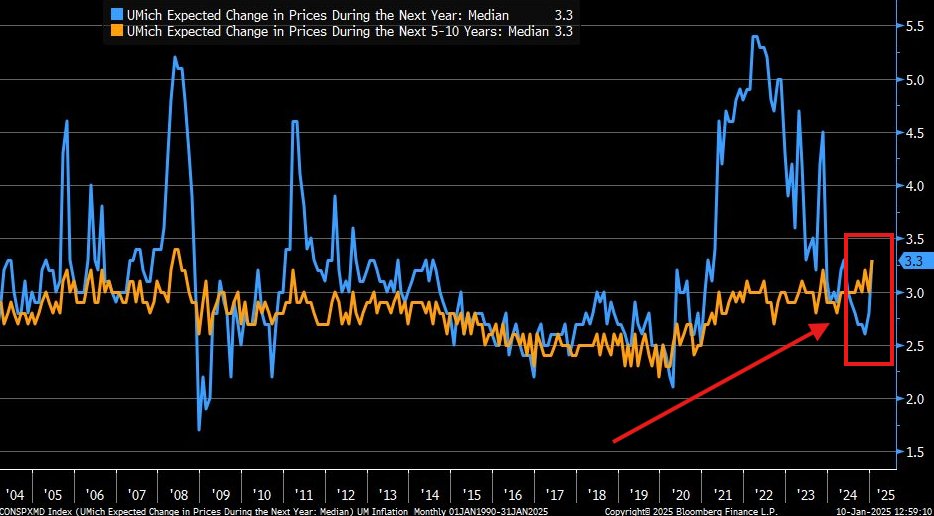

By now, you've probably heard that inflation is back on the rise.

As a result, there has been a NOTABLE shift higher in consumer inflation expectations.

In a matter of weeks, consumers have seen long-run inflation rising from 2.6% to 3.3%.

This is a MASSIVE shift.

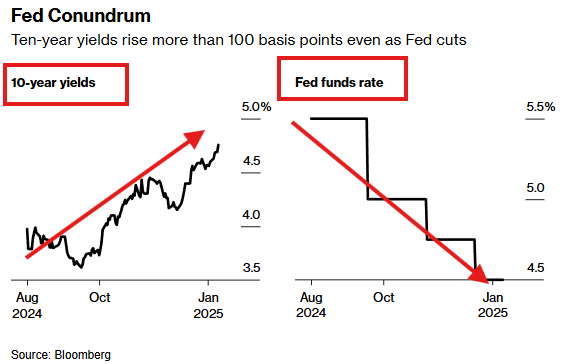

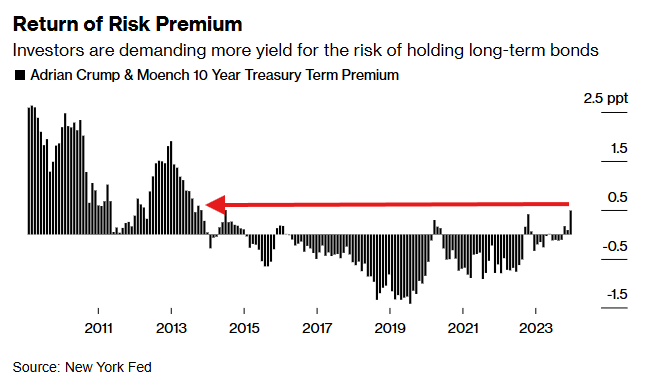

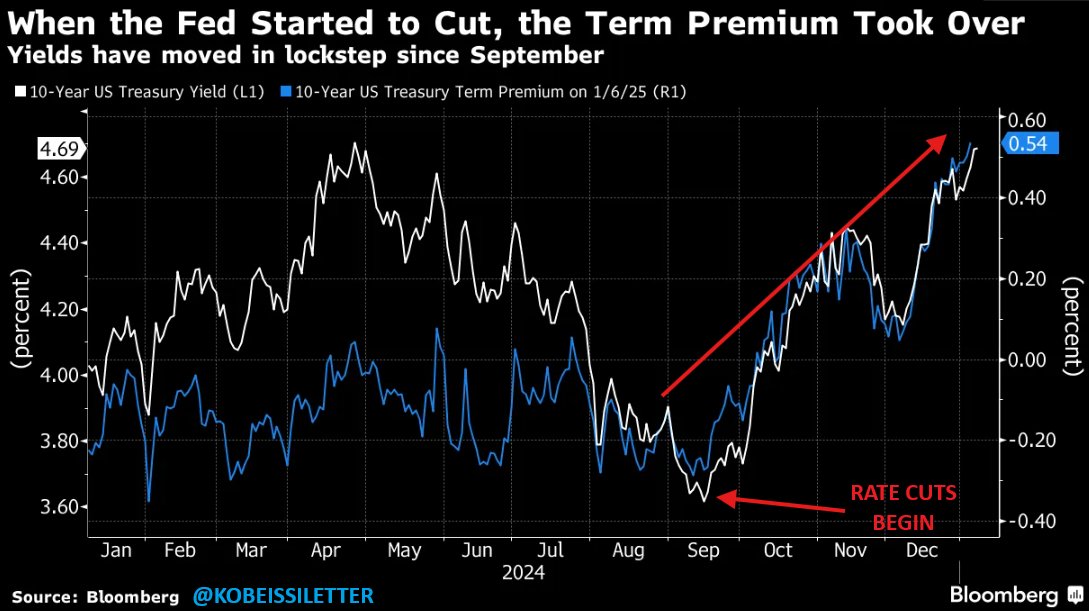

The rise in inflation expectations has resulted in a rapid spike in "term premiums."

This is the premium that investors demand for the risk of taking on long-term debt.

Long-term debt has MORE risk if inflation is unstable.

This is why rates are RISING and the Fed CUTS.

Term premiums have spiked to ~0.55%, the highest in over 10 YEARS.

With CPI, PPI, and PCE inflation on the rise, general market-wide uncertainty has surged.

Bond investors are demanding compensation for this risk.

Bookmark this thread, you will hear about it a lot in 2025.

Here's a chart of Treasury Inflation Protected Securities (TIPS).

This is the yield that will effectively grow your capital in-line with inflation.

Note, it is up from the 2024 low but generally in its last 3-year range.

This brings us to the next crucial point.

Without the recent surge in term premiums, we may not have seen a significant steepening of the yield curve.

This means that rising term premiums are a result of less rate cuts being expected.

In fact, it may even reflect that interest rate HIKES are back on the table.

This came at the worst possible time for stocks.

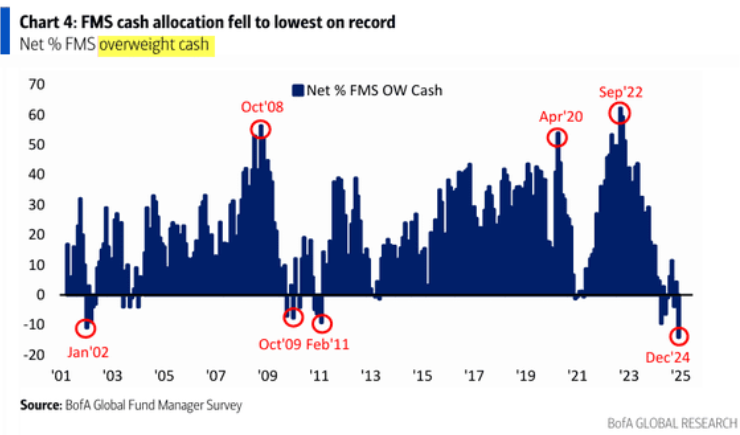

Fund managers were the more bullish of stocks than any time in recent history.

Cash allocation fell to a RECORD low with equity allocation nearing 40%!

In fact, not even 2001 or 2008 saw equity allocation at these levels.

On Friday, we posted this alert as the S&P 500 fell into 5830.

Our premium members took SHORTS ahead of the drop.

Now cashing in +60 points in pre-market trade, it pays to follow technicals and these key trends.

Subscribe below to access our alerts:

Generally speaking, rising term-premiums are NOT something you see in a bull market.

As seen in the chart below, term-premiums fell before the Dot-com bubble but then spiked SHARPLY in 2001.

The same thing was seen in 2006 through 2008.

This is concerning for stocks in 2025.

Adding fuel to the fire is the US Dollar Index, $DIX, which just broke above 110.00.

This marks the first break above that level since November 2022.

The US Dollar has strengthened by ~10% since rate cuts began.

This is NOT what you typically see in a "Fed pivot."

The market can become significantly more profitable in times of uncertainty.

Having the right strategy and avoiding a bias is crucial in these times.

Want to see how we are trading it?

Subscribe to our premium analysis and alerts at the link below:

Lastly, the relationship between Gold and the US Dollar, $DXY, emphasize just how broken the "Fed pivot" is.

Gold is QUADRUPLING $DXY's positive return over the last ~13 months.

This almost never happens.

Follow us @KobeissiLetter for real-time analysis as this develops.

From Twitter

Disclaimer: The content above is only the author's opinion which does not represent any position of Followin, and is not intended as, and shall not be understood or construed as, investment advice from Followin.

Like

Add to Favorites

Comments

Share

Relevant content