Author: 0xJeff Compiled by: Zero Difference Research Institute 0xSpread

Note: To facilitate reading, we have adjusted the content without deviating from the original meaning.

Recently, the overall market sentiment in the AI agents sector has been depressed, but DeFAI has become a bright spot. Particularly in the Abstraction Layer category, some projects have performed impressively in the market downturn, providing new opportunities for investors. Next, we will discuss the main performance and potential opportunities of this sector in recent times.

I. Outstanding Projects

1. Orbit: Orbit has shown strong performance with its unique features, including:

USDC Transfer Agent: Integrates multiple on-chain USDC balances, displaying a unified total balance and supporting cross-chain transfers (will support more tokens in the future).

Data Hooks: Allows users to set up automated tasks and on-chain transactions. For example, "Purchase $SOL on Solana with [x] USDC every minute until the $SOL market cap reaches [x]."

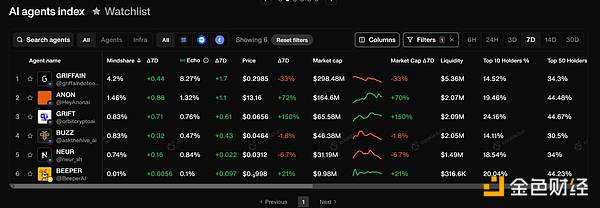

Orbit has integrated 117+ chains and 200+ protocols, aiming to become a "financial assistant for billions of AI agents," using its technology to make payments and operations between agents and users more seamless. Currently, the market valuation of $GRIFT is gradually approaching that of its major competitors.

2. HeyAnon: Led by @danielesesta, HeyAnon has adopted a unique strategy and recently launched the following features:

Gemma: An assistant agent designed for data research, capable of extracting valuable information from on-chain and social data.

AUTOMATE: A TypeScript framework designed for developers to build DeFAI applications.

HeyAnon's goal is to become a universal intelligent layer that can handle multi-step transactions, governance tasks, and data analysis, while ensuring the transparency and security of on-chain transactions. Through collaborations with multiple public chains and developer incentive programs, the $ANON market cap has quickly surpassed $100M, and although the growth rate has slowed recently, it continues to rise steadily.

3. Griffain:

Although Griffain is currently the highest market cap project in the Abstraction Layer category ($330M), it has declined by 21% in the past week. The author analyzes that the reason may be the capital flow to lower market cap projects, or its "universal abstraction layer" positioning lacks clear focus.

Its features are focused on the Solana platform, providing airdrop tools, token issuance, and burning mechanisms, among other services.

II. Challenges Faced by the Abstraction Layer

Although the prospects of DeFAI are widely regarded as promising, the abstraction layer projects currently face the following pain points:

Insufficient research capabilities: Compared to professional analysis tools, the research capabilities of these products are still lacking.

Token recognition issues: Some platforms cannot automatically recognize tokens, and users need to manually enter the address.

Lack of quality DeFi integration: Some platforms do not cover mainstream protocols or lack key data such as TVL and yield rates.

Poor user experience: Complicated interfaces, not user-friendly, and new users can easily get lost.

III. Solutions

Data analysis tools: Recommend using @defillama for yield rate and DeFi data analysis.

Cross-chain tools: For the EVM ecosystem, use @AcrossProtocol, and for non-EVM ecosystems, use @wormhole.

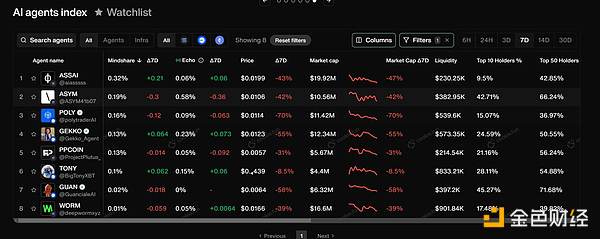

IV. Other Notable Projects: Autonomous Trading Agents

$CATG: Focuses on trading signals and analysis tools.

$LAY: Provides no-code tools for quickly building trading strategies.

$BULLY: Expanded from personalized agents to the trading strategy domain.

Projects with good performance usually have the following characteristics:

Profitability: Able to generate stable earnings consistently.

Verifiability: Transparent data, linked to on-chain wallets.

User engagement: Allows users to share in the profits.

V. Conclusion

The rise of DeFAI has injected new vitality into the market, particularly in the Abstraction Layer and Autonomous Trading Agents sectors. The core of this field is to simplify DeFi operations, thereby attracting a wider user base.

Although there are still shortcomings in technology and user experience, as the market matures, DeFAI is likely to stand out in future market rallies. For investors, the key strategy to cope with future market rebounds is to position themselves early in projects with strong technical capabilities and actual implementation abilities.

The AI agents bull market in 2025 is worth looking forward to!