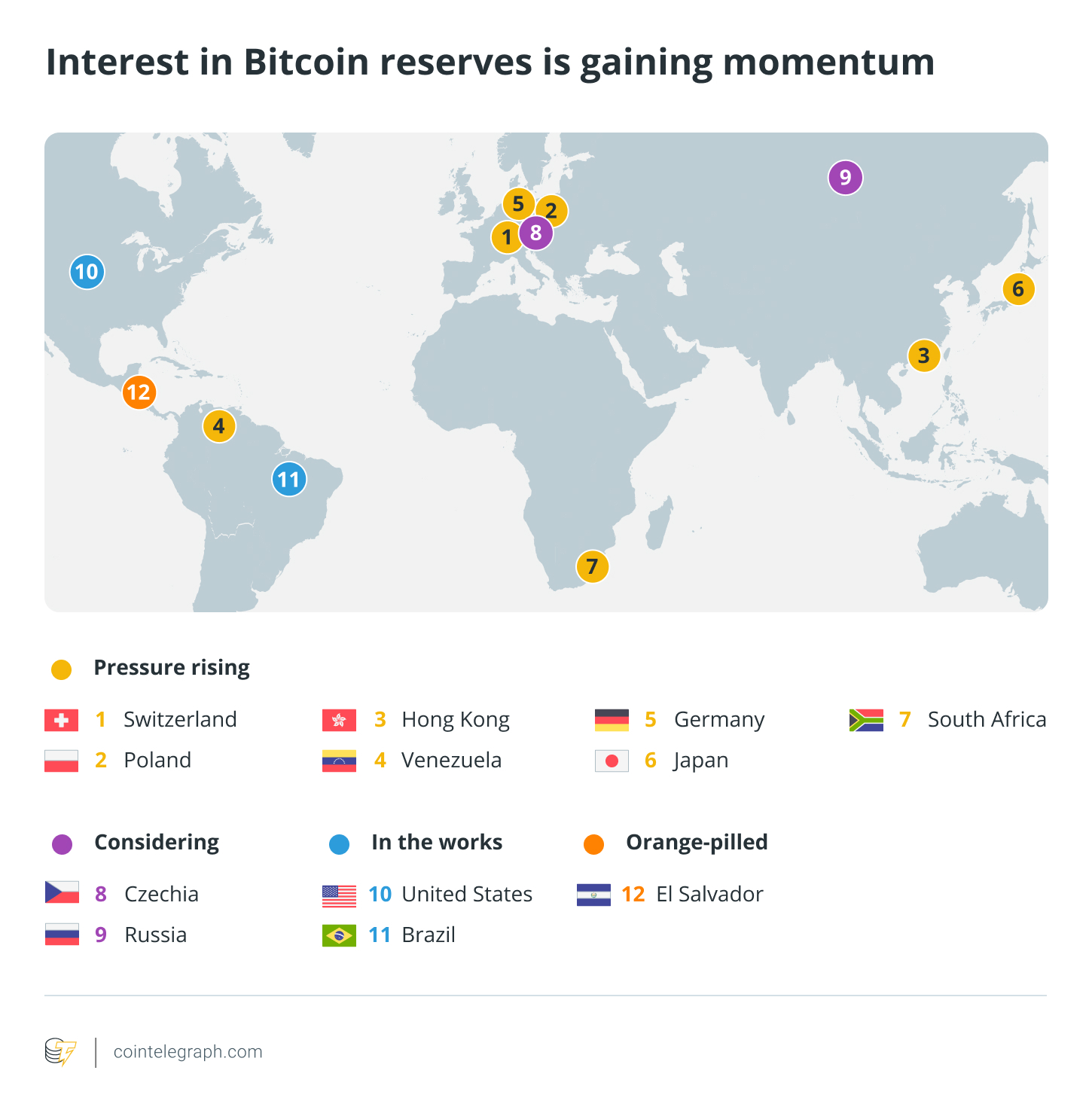

Politicians around the world are debating whether Bit reserves would benefit their respective countries.

Over the past year, the popularity of Bit has surged to the point where lawmakers and regulators across all five continents now view it as a potential reserve asset - a transferable store of value that can be held by central banks and used to settle transactions.

The Czech Republic has become the latest country to draw media attention for considering this measure. Aleš Michl, the governor of the Czech National Bank (CNB), said on January 5 that the bank is considering incorporating Bit into the country's foreign exchange reserve diversification strategy.

Meanwhile, the US Congress is considering a bill that would require the Treasury Department to establish a national Bit reserve, purchasing 1 million Bits at a rate of 200,000 BTC per year over five years. Governments in other countries are also facing pressure and are considering similar moves, such as Switzerland and Poland.

Cointelegraph has compiled a map of countries where governments are taking an interest in Bit reserves. For the first time in history, this map covers all five continents and includes nine countries.

Bit reserve plans in the US and Brazil

So far, only El Salvador has established a Bit reserve. Under the leadership of President Nayib Bukele, the country became the first to adopt Bit as legal tender in 2021. Bukele has accumulated 6,022 Bits, worth over $56 billion at current prices.

The US and Brazil may soon join El Salvador as the second and third countries to have Bit reserves.

United States

During the 2024 US federal election, Bit became a focal point as politicians developed crypto policies to attract voters and secure funding from the crypto industry.

President-elect Donald Trump made a series of positive statements, claiming that the US should become a global leader in the crypto industry. Beyond the strong rhetoric, Congress is currently considering a bill that would require the US government to establish a Bit reserve.

The 2024 Bit Act, proposed by Senator Cynthia Lummis, would require the US Treasury to acquire 1 million Bits over five years, purchasing 200,000 BTC per year.

While Lummis represents the majority - the Republicans currently control both chambers of Congress - the support for this bill among other lawmakers may not be strong enough to turn it into law.

Crypto has supporters in both parties, but the cost of purchasing 200,000 BTC at current prices exceeds $18 billion, and US voters remain skeptical about the value proposition of Bit, with many seeing crypto as a passing fad.

Brazil

Similar to the US, Brazilian lawmakers have also introduced a bill aimed at establishing a Bit reserve. The bill was proposed on November 25, arguing that a "sovereign strategic Bit reserve" (RESBit) would help stabilize the real and shield the sovereign reserve from currency volatility and geopolitical risks.

As of publication, the various committees in Brazil are reviewing the legislation. If passed, the bill would allow Brazil to allocate 5% of its sovereign reserves to Bit.

Russia and the Czech Republic are also considering Bit reserves

In the Czech Republic and Russia, senior central bank and finance ministry officials are considering establishing Bit reserves.

Russia

In July 2024, Russian companies began using crypto for international payments, as the law changed to allow them to bypass Western sanctions using crypto.

This workaround has gained widespread public support among Russian officials. At the Russian Society of Knowledge on November 6, 2024, Finance Minister Anton Siluanov stated that while he does not recommend retail investors enter the crypto market, digital assets play an important role as a means of international settlement in the current geopolitical environment.

"International trade participants - importers and exporters - no longer settle in (fiat) currency, but use crypto wallets and settle in crypto. Why not? In the current situation, this is reasonable and justified."

This important function has apparently prompted Deputy Speaker of the State Duma Anton Tkachev to formally request last month that Siluanov create a strategic Bit reserve for the country.

Tkachev pointed out that traditional currency reserves, such as the renminbi and the US dollar, are facing growing instability, and added that crypto "has effectively become the only tool for countries to conduct international trade under sanctions." The central bank is preparing experiments with cross-border crypto settlements.

Czech Republic

In the Czech Republic, CNB Governor Aleš Michl said in an interview that the bank is considering incorporating Bit into the country's foreign exchange reserve diversification strategy.

Michl indicated that he would only consider purchasing a small amount of Bit, which would not make up a significant portion of the bank's balance sheet. This acquisition plan would require the unanimous approval of all seven bank governors.

Janis Aliapulios, an advisor to the CNB board, later told Cointelegraph that the bank does not have a formal acquisition plan, and Michl has only not ruled out the possibility of further discussing the issue in the future.

"In short, the CNB is not currently considering incorporating crypto assets into its reserves. However, Governor Michl has not ruled out the possibility of further discussing this topic in the future."

Growing global interest in Bit reserves

Interest in the Bit standard is growing globally, with many prominent policymakers and legal experts voicing support in countries like Poland, Switzerland, Germany, South Africa, Hong Kong, Japan, and Venezuela.

Switzerland

Switzerland has been crypto-friendly and forward-looking since the early days of Bit, with many important crypto companies and foundations establishing operations in the country.

The country may soon take further steps to promote crypto adoption. On December 5, 2024, crypto advocates, including Tether's Energy and Mining Vice President Giw Zanganeh and 2B4CH founder and chairman Yves Bennaïm, submitted a proposal to the Swiss National Bank (SNB) requesting that Bit be included as a reserve asset.

The proponents must collect 100,000 signatures by June 30, 2026. Given Switzerland's total population of 8.92 million, this means only 1% of Swiss citizens need to sign.

2B4CH had planned to submit such a proposal before, but it had been postponed due to low support or lack of enthusiasm. Bennaïm recently told Cointelegraph that the times have changed.

"Now, everything is going smoothly, which is why we have submitted the relevant documents and will start collecting signatures."

If the petition gathers the required signatures, the proposal will be put to a public vote.

South Africa

In South Africa, the "uMkhonto weSizwe Party" (MKP) has also called for the establishment of a Bit reserve in the country.

Last month, MKP spokesperson Nhlamulo Ndhlela announced on the X platform that MKP "believes that South Africa should consider Bit as an asset, as a strategic reserve, and Bit mining as part of a broader economic revitalization and diversification strategy."

Here is the English translation:Although many Bitcoin reserve proposals revolve around contractionary policies, inflation, and "digital currency appreciation", Endekhela stated that Bitcoin could become a means of economic liberation, as the current government "continues to indebt our country through loans from the International Monetary Fund and the World Bank."

Endekhela stated that the plan will start with a 1%–2% Bitcoin allocation, which will also help monetize 3 gigawatts of surplus renewable energy production. He further pointed out that this will reduce dependence on the US Dollar and help the country develop a regional financial strategy with BRICS partners.

MKP is currently the opposition party, holding 58 seats in the 400-seat parliament.

Poland

Polish presidential candidate Sławomir Mentzen has promised that if he wins the May 2025 presidential election, he will make Bitcoin a reserve asset.

Mentzen is a far-right nationalist belonging to the Freedom and Lawfulness party, and is also the first presidential candidate in Polish history to propose a Bitcoin policy.

He emphasized that Bitcoin can serve as an "independent reserve asset" to counter the monetary sovereignty control of the International Monetary Fund and the European Union, which he believes is crucial for Poland's financial independence.

Mentzen plans to propose incorporating Bitcoin into Poland's foreign exchange reserves, while further promoting Bitcoin adoption by allowing Polish citizens to hold Bitcoin tax-free.

Conclusion

Global interest in Bitcoin reserves is growing, and lawmakers in many countries are considering it as a reserve asset. Although facing challenges and controversies, Bitcoin may become a core part of the global monetary system in the future. With more countries participating, the potential of Bitcoin as a reserve asset will be further validated.