JP Morgan recently based on the market adoption of Bitcoin (BTC) and Ethereum (ETH) ETPs, predicts that Exchange Traded Products (ETPs) related to Solana (SOL) and XRP could potentially attract over $15 billion in net inflows.

Current ETP Asset Management Situation

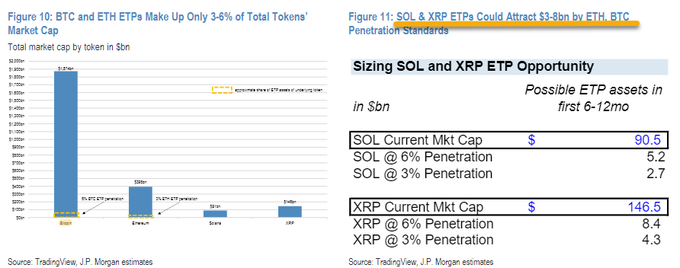

JP Morgan's analysis indicates that if the successful experiences of Bitcoin and Ethereum ETPs are used as a reference, the future inflows of funds into Solana and XRP could see significant growth. For example, the Bitcoin ETP attracted $108 billion in inflows in its first year, accounting for about 6% of BTC's market cap; the Ethereum ETP attracted $12 billion in inflows within half a year, about 3% of ETH's market cap.

Based on this, the inflows into SOL and XRP ETPs could reach $7-13.6 billion, representing 3% to 6% of their market caps.

According to a recent report by crypto asset investment firm CoinShares, Solana and XRP-related ETPs currently manage around $1.6 billion and $910 million in assets respectively. By 2024, the inflows into these two products are projected to be $438 million and $69 million respectively.

Low ETF Approval Probability, Other Assets May Break Through First

However, JP Morgan emphasizes that the approval probability of Solana and XRP ETFs remains low in the short term, mainly because the SEC's regulatory policy on crypto assets is still unclear. The SEC has recently rejected multiple Solana-related ETF applications, and the legal status of XRP is still uncertain due to the lawsuit between Ripple Labs and the SEC.

Bloomberg ETF analyst said:

The new Trump administration may support more ETF approvals, but the approval of XRP and SOL ETFs may still take time.

In comparison, ETFs for other crypto assets may be approved first. Litecoin (LTC), as a fork of Bitcoin, may be classified as a commodity, with relatively lower regulatory risks; Hedera (HBAR) has not yet been clearly regulated by the SEC, and is expected to avoid being treated as a security.

Further Reading: Not SOL? Bloomberg Analyst: HBAR, LTC May Get Crypto ETF Approval Next Year