Solayer's Shining Debut: From Hardware Acceleration to the Dark Horse in the SVM Race

If Napoleon had the power of "prophetic ability" in advance, Waterloo might not have become a turning point. Applying this saying to the blockchain industry, Solayer has undoubtedly grasped the ever-changing "moment" and is preparing to embark on a different legend.

From Solana's re-staking protocol to hardware acceleration, and then to targeting the SVM track, Solayer has rapidly grown from a small project to a heavyweight challenger in the market in less than a year. Its evolution speed is comparable to "Sun Wukong's apprenticeship", leaping from a "stone monkey" to the "great sage of black mythology".

Now, with the investment support of Binance and Polychain Capital, as well as the upcoming Buidlpad public offering, Solayer is preparing to compete for the peak of the SVM track with other strong opponents. Can it break through the encirclement and become the next unicorn project to exceed $1 billion? This has become a hot topic in the crypto community, no less suspenseful than "whether Zhuge Liang can borrow the East Wind".

Solayer: From Re-staking to Hardware Acceleration's Cross-border

Solayer, this name has appeared frequently in the discussions of the crypto community in the past week. As a young crypto project, founded in 2024, it has experienced several major strategic transformations in less than a year.

Initially, Solayer's positioning was a re-staking protocol on Solana, and after its launch, it quickly became the darling of the market, and within a few months, it obtained more than $12 million in seed round financing.

MarsBit has previously written an analysis of Solayer, if you are interested in the basic information of Solayer, you can refer to the detailed introduction in that article.

《Exploring Solayer, Binance's Investment: The Rising Star in Solana's Re-staking Domain》

Solayer's TVL Explosive Growth, This Operation is Stable!

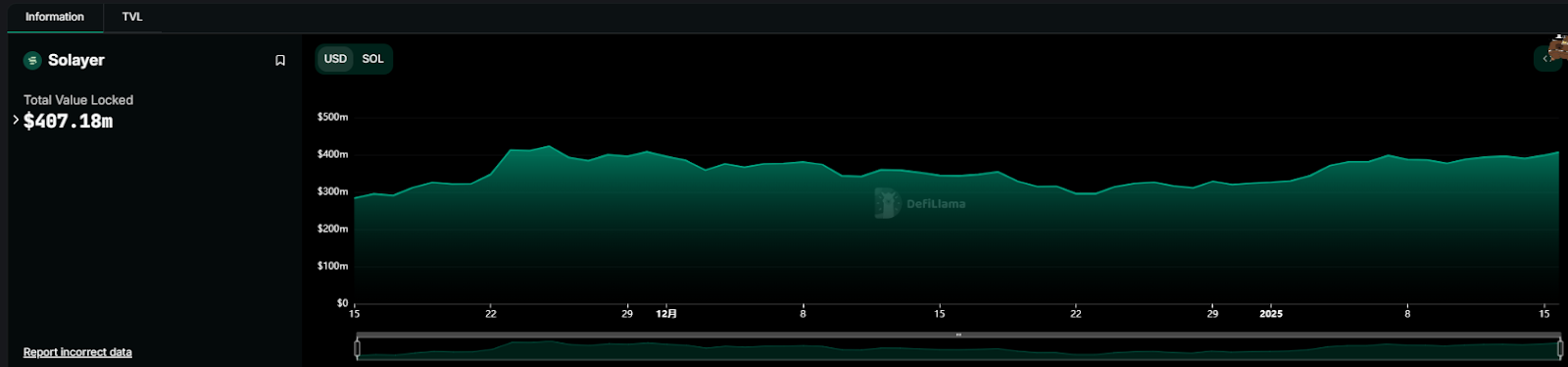

Solayer's re-staking protocol has made a remarkable performance in the Solana ecosystem. As of January 13, 2025, Solayer's TVL (Total Value Locked) has exceeded $407 million, with nearly 280,000 depositors and an annualized yield of up to 14%.

In the Solana TVL rankings, Solayer's ranking has entered the top ten, and even among all re-staking protocols, Solayer's ranking is also in the top six.

But obviously, this is not Solayer's ultimate goal.

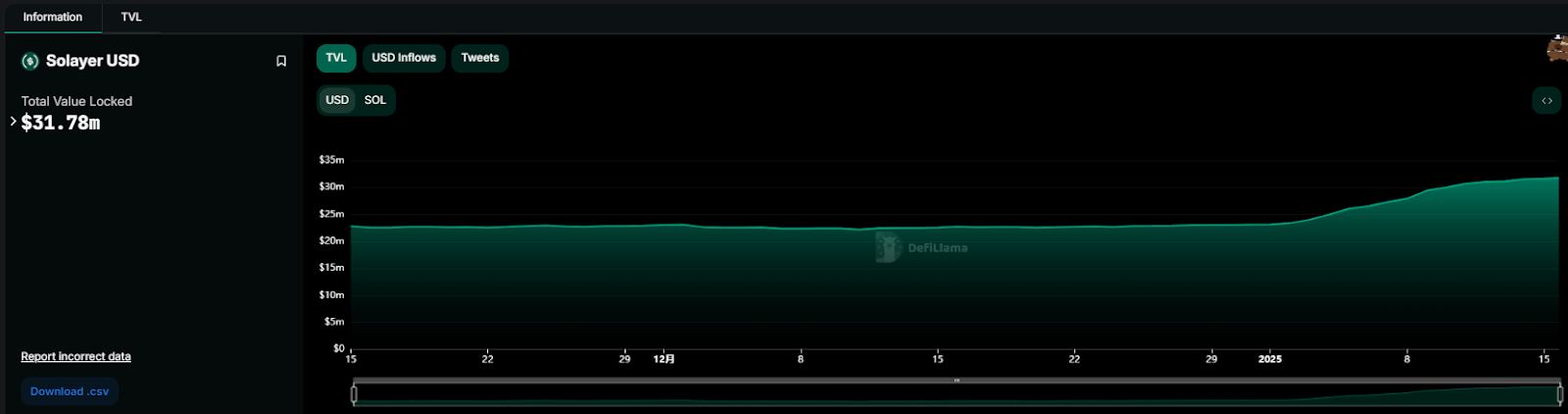

By October 2024, Solayer released the decentralized stablecoin protocol Solayer USD (sUSD) based on Solana, which is the first synthetic stablecoin supported by real-world assets (RWA), allowing anyone to participate in the tokenization of low-risk assets such as US Treasuries with just $5. Solayer collaborated with OpenEden to achieve a fully decentralized and user-owned stablecoin architecture through a non-custodial RFQ market to exchange USDC for sUSD.

sUSD is based on a basket of low-risk RWAs, currently supporting US Treasuries and will expand to other assets such as gold, with an annual yield of 4.33%, and the earnings are automatically distributed in USDC without additional operations. sUSD provides users with a convenient channel to directly redeem USDC, and aims to achieve the integration of blockchain and the real economy through the Solana network.

Data shows that the current total market value of Solayer USD is $31.78 million. Although the market value of Solayer USD in the Solana ecosystem and the stablecoin market is still relatively small, it has shown the potential to become an industry dark horse.

Limited to Re-staking Protocol? That's the Past!

In December 2024, Solayer's official blog published an article titled "Software Expansion Has Reached Its Limit - The Future Lies in Hardware Expansion", marking a shift in Solayer's strategic direction, as it began to aggressively enter the field of hardware acceleration and make in-depth deployments in the SVM (Scalable Vector Machine) track.

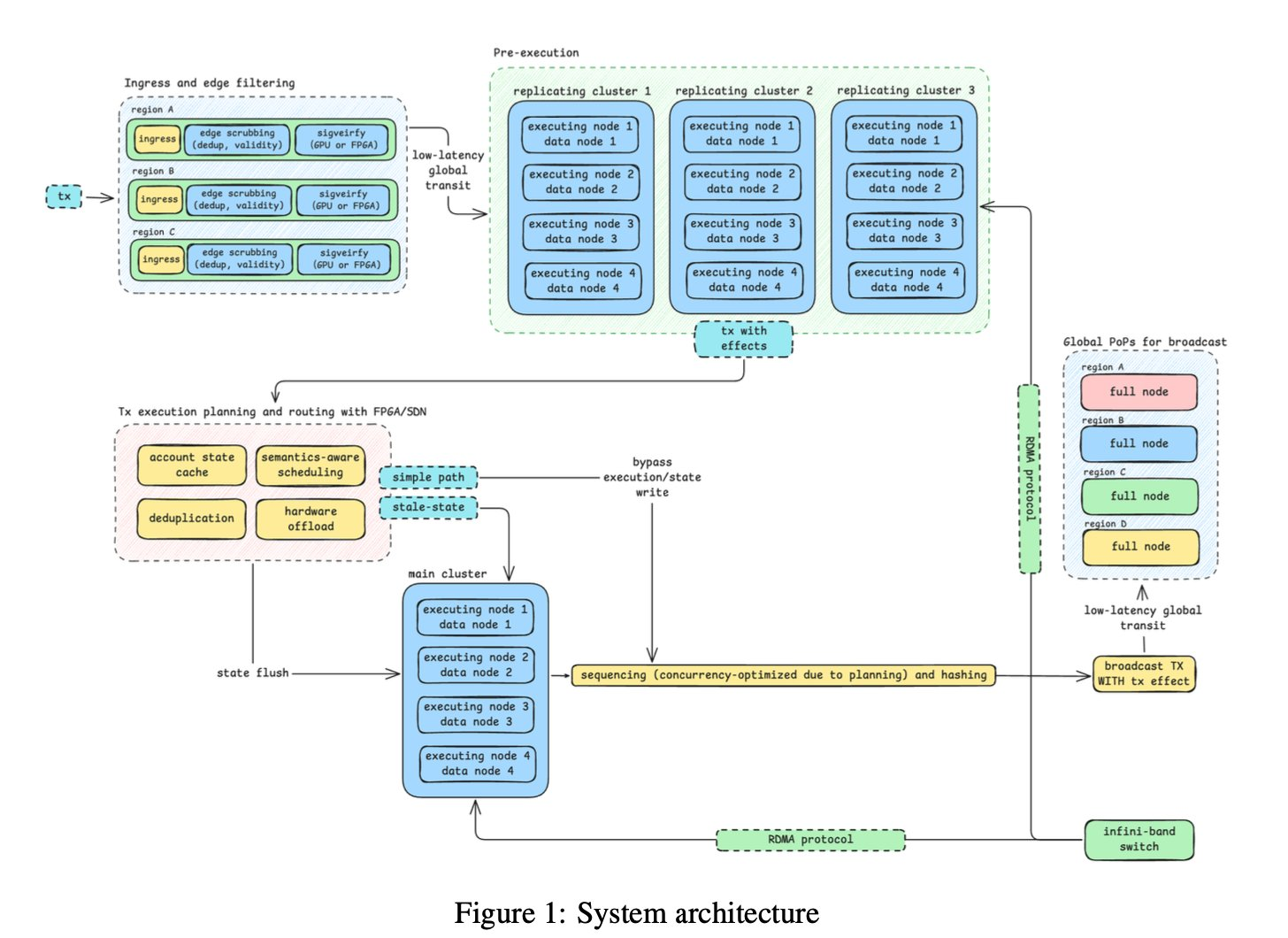

On January 7, 2025, Solayer further announced its 2025 roadmap, officially launching the hardware-accelerated SVM blockchain - Solayer InfiniSVM. This plan will adopt a multi-execution cluster architecture, achieve 100Gbps bandwidth through SDN (Software-Defined Networking) and RDMA (Remote Direct Memory Access) connections, and maintain atomic state. Solayer InfiniSVM will dynamically shard the individual SVM execution machines to an infinite number of machines based on application requirements, driving a significant increase in blockchain throughput and scalability.

The core of Solayer's hardware acceleration technology lies in the "InfiniBand RDMA" technology, aiming to improve cross-node communication efficiency, reduce latency, and reduce system load. Moreover, Solayer also plans to introduce a hybrid Proof-of-Authority-and-Stake consensus mechanism.

Under this mechanism, the super leaders can execute millions of transactions per second (1MM TPS) and coordinate and publish to the validators to verify the "shreds", while accelerating the transaction processing of the super leaders through hardware offloading. Solayer's ultimate goal is to break the bottleneck of existing blockchain networks, meet the challenge of explosive growth in blockchain applications, and achieve transaction confirmation times as low as 1 millisecond.

In addition, Solayer also plans to integrate its product-grade suites (such as sSOL and sUSD) as native yield assets into the Solayer chain, allowing users not only to earn rewards by using applications on the Solayer chain, but also to stake, re-stake, earn rewards, and consume in the real world. Through these innovations, Solayer InfiniSVM is expected to stand out in the future SVM track.

For more information on Solayer's innovations and technologies, please refer to the concise whitepaper on https://solayer.org/network.

Can Solayer's Hardware Acceleration Break the Bottleneck? Break Through or Bust?

Although Solayer's technology roadmap has sparked heated discussions in the market, whether the technology can be successfully implemented remains an uncertain issue. Can the hardware acceleration technology of InfiniSVM truly break through the existing performance bottleneck of Solana? This will directly affect Solayer's competitiveness in the SVM track.

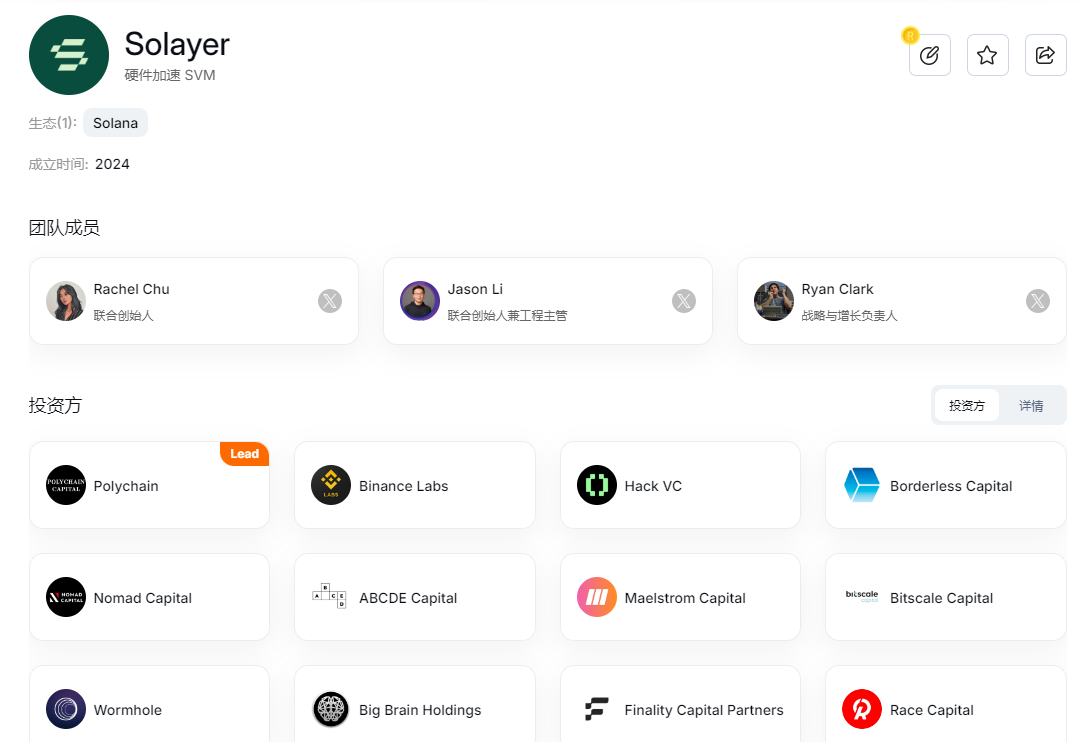

At the same time, the technical background of the Solayer team adds a lot of trust.

Founder Rachel Chu was a core developer of Sushiswap, and co-founder Jason Li graduated from UC Berkeley with a computer science degree and previously founded the Web3 wallet MPCVault. Ryan Clark, Solayer's head of strategy and growth, was previously the chief growth officer of nftperp and has also worked at 1kx. This technically strong team undoubtedly provides a guarantee for Solayer's hardware acceleration plan.

Buidlpad Boost: The Heavyweight Debut of the IDO Platform

Solayer's IDO (Initial DEX Offering) is not just a simple issuance event, but has become the focus of attention in the entire market by leveraging the emerging community sales platform Buidlpad.

Buidlpad's founder Erick Nomad was previously the Head of Research at Binance and is now a partner at Nomad Capital, indicating that his team's industry resources and project discovery capabilities are widely recognized by the market.

Buidlpad's Debut: Providing a Financing Platform for Quality Projects

Buidlpad's goal is to become the leading Pre-TGE financing platform in the 2025 bull market cycle. It not only provided strong support for Solayer, but also helped Solayer attract maximum community investor participation through a relatively fair community offering platform. As the first appearance of this IDO, Buidlpad undoubtedly injected additional market attention and credibility endorsement into Solayer's IDO.

Solayer Public Offering New Rules: Hard Cap Cancelled, KYC Reopened

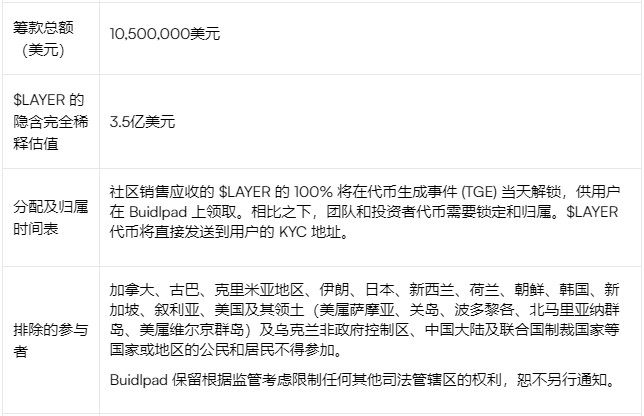

Solayer's IDO will officially launch on January 16, 2025 and end on January 18. The total token issuance for this public offering is 1 billion, of which 30% will be sold through the IDO, with a total fundraising amount estimated at $10.5 million.

It is worth noting that Solayer has cancelled the hard cap mechanism this time, and there is no lock-up period, which means that investors' funds will be unlocked on the TGE (Token Generation Event) day, providing investors with higher liquidity. This undoubtedly increases the attractiveness of the investment.

However, on the day before the IDO officially starts, that is, today, Buidlpad announced that in order to ensure the fairness of the community sale and implement a strict anti-bot policy, it has decided to reopen the KYC service.

The specific time is from today until 07:59 (UTC+8) on January 16, 2025. New account registration and KYC will be closed at the deadline, and the qualification review results will be announced before the subscription starts.

During the subscription phase, participants should pay attention to the following details:

- Subscription time: 18:00 on January 16, 2025 to 07:59 (UTC+8) on January 18.

- Allocation mechanism: LAYER tokens will be allocated based on the proportion of the participant's subscription amount to the total pool. If the total subscription amount exceeds $10.5 million, the excess will be adjusted proportionally and the surplus funds will be refunded.

- Subscription limit: The minimum subscription amount for each participant is 50 USDC/USDT or equivalent assets, and the maximum subscription amount is 2000 USDC/USDT (for Solayer users, the maximum can reach 3000 USDC/USDT, but they need to pass the anti-bot review). In addition, whitelist users (i.e., users who have staked Solayer before January 10) can subscribe up to 3000 USDC/USDT, while community contributors listed on the Buidlpad whitelist can subscribe up to 5000 USDC/USDT.

The final allocation results will be announced on the official website at 18:00 (UTC+8) on January 20, 2025, and any surplus funds will be refunded proportionally. It is worth noting that participants must complete the KYC verification in advance, and the time and speed of completing the KYC will directly determine whether they can successfully participate in this offering.

From this point of view, Buidlpad's adjustment is obviously to strictly screen bot registrations and ensure that real supporters can participate, while avoiding large institutions monopolizing early investment opportunities. The cancellation of the hard cap and the adoption of the over-subscription model mean that all participants' tokens will be allocated proportionally. This change is undoubtedly an improvement in investment fairness, turning what was once only available to a few institutions into a more equitable "family feast". Compared to the past, this change is indeed a positive progress.

For more details on the public offering, please check: https://www.buidlpad.com/solayer

Solayer's Investment Opportunity: Relatively Low Price, Great Potential

Solayer's project background and financing situation have made it a focus of investor attention, especially with the support of its top-tier VC lineup, such as Polychain Capital, Hack VC, and Binance Labs. For investors, the profit opportunities of this project are obvious.

Low Valuation, High Potential Investment Opportunity

Compared to other high-valued projects like Sonic SVM, Solayer's public offering price is relatively low, making it an attractive investment opportunity.

According to the data provided by Buidlpad, Solayer's FDV (Fully Diluted Valuation) is $350 million, and the valuation range of the previous financing round with Binance's investment may be between $80 million and $150 million.

This makes the cost of Solayer's public offering round and private round very close.

In comparison, the cost difference between public and private rounds for other L1 projects can be as high as 10 times or more, while Solayer's situation appears relatively balanced. In other words, Solayer provides a fairer investment opportunity in this regard.

Similarly, Sonic SVM, another project in the SVM track, once reached a peak market value of nearly $3 billion, and even two days ago when the market fell and many new coins were halved, Sonic SVM's market value still maintained around $1.7 billion.

Furthermore, Sonic has already been listed on the perpetual contract of Binance, Coinbase, and the spot market of Upbit, further supporting its valuation.

In comparison, Solayer's relatively low valuation provides investors with a higher entry opportunity.

More importantly, Solayer's token unlocking policy on the TGE day also provides investors with higher liquidity, which is not common in the market. Through such a high liquidity policy, Solayer provides investors with a more stable investment platform, so in the current market environment, Solayer is undoubtedly a relatively stable investment opportunity.

Potential Risks and Returns of Solayer's Public Offering, Dampening Expected Returns?

Although Solayer's background, technical roadmap, and IDO strategy are all promising, there are still certain risks. First, whether hardware acceleration can be realized and break through Solana's existing bottlenecks remains uncertain. If Solayer's "InfiniSVM" plan fails to successfully increase throughput as expected, it will directly affect the project's competitiveness.

Secondly, whether the project's execution ability can keep up with its ambitious goals still needs to be tested by the market, especially in the process of integrating hardware technology and blockchain ecology, any small deviation may affect the final effect.

After re-evaluating Solayer's IDO, the author believes that investors need to carefully consider the risks and returns. Especially the cancellation of the hard cap, which makes the significance of this public offering less prominent.

According to Solayer's official arrangement, all excess subscription funds will be refunded on January 20, which means that investors' funds will face a waiting period of about two weeks.

Assuming you invest 2000 USDT, and the total fundraising amount reaches $500 million, based on the current market estimation, the return would be around 50 USDT. However, considering that the prices of Altcoins are generally at a relatively low level in the current market, if Solayer refunds in USDT, the final return investors receive may not exceed the return of holding the coins until the refund.

Therefore, investors need to carefully evaluate their investment decisions to ensure they can obtain the best returns in this market environment.

In Summary: Solayer's Future Prospects

As a new blockchain project, Solayer has shown strong potential in terms of technological innovation, financing support, and community offering. Especially in the SVM track, Solayer is trying to distance itself from other competitors through its hardware acceleration innovation plan. At the same time, the support of the Buidlpad platform and the setting of the IDO rules have made Solayer's investment opportunity more attractive.

However, while chasing high returns, investors should also maintain a certain degree of caution. Can the hardware acceleration technology succeed as expected? Can Solayer stand out in the highly competitive SVM track? These questions still need time to be verified.