Hyperliquid launched in 2023, featuring an on-chain derivatives trading platform, providing a more decentralized exchange option. Jeff mentioned in an interview that the goal is to build a platform where all finance can happen. 《 Hyperliquid Founder: How to Win in Crypto (by Building for Users, Not VCs 》

On 2024/11/29, an airdrop of $12 billion worth of $HYPE tokens was distributed to early users, with the $HYPE price at $3.9. It later peaked at $34 on 12/24, reaching a fully diluted market cap of $340 billion, which is about a quarter of BNB's market value.

Notably, this team behind the highest-value airdrop in history stated that they did not raise any funding, and the pre-launch hype and accumulated trading volume and revenue were in stark contrast.

In addition to the wealth creation myth from the airdrop, several well-known projects have auctioned off HIP-1 tokens for $300,000 to $500,000 to list on Hyperliquid's spot market, attracting widespread attention in the CT circle, so it is worth exploring the full picture of what is being called the "on-chain Binance".

Hyberliquid Team Background

The documentation states that the Hyperliquid team was founded by Jeff and iliensinc, with only Jeff publicly attending interviews and posting on X. Jeffrey Yan graduated from the Harvard Mathematics Department, previously worked as a software engineer at Google, and was responsible for developing trading algorithms at the trading firm Hudson River on Wall Street.

In 2020, he founded the quantitative trading company Chameleon Trading, until 2022 when he realized the team had reached the limit of high-frequency market making and began exploring opportunities in DeFi.

Jeff said that after the FTX collapse, people suddenly had real reasons to distrust centralized exchanges, and he started thinking about what could be done with the existing resources, leading to the idea of building Hyperliquid. The official Medium announced in 2022 the "Introducing Hyperliquid: your new home to trade perps on DeFi", which will be built on Tendermint as an on-chain Perp DEX.

In April 2023, it was announced that Hyperliquid L1 would be established, as an investigation of existing L1 solutions found that none could meet the low latency and TPS requirements for building an on-chain exchange, so they decided to build an L1 focused on high-performance derivatives trading, initially focusing on optimizing efficiency and throughput.

How to Use Hyberliquid

Hyperliquid's main functions are derivatives and spot trading. Users deposit USDC through Arbitrum to trade, with fees and gas paid in USDC. Users can also deposit USDC into the HLP Vault to earn yields, or stake HYPE to validator nodes to earn HYPE, all of which are demonstrated in the tutorial video.

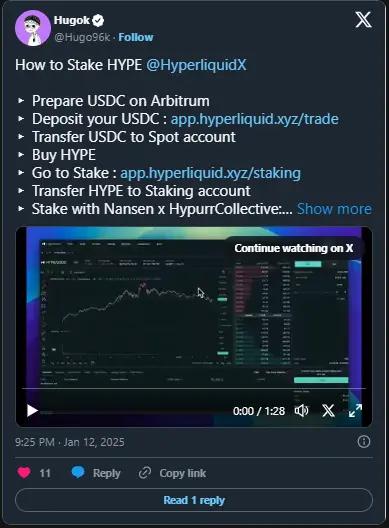

How to Stake HYPE with HyperCollective

The Hyperliquid Foundation announced that HYPE Staking officially launched on 2025/12/30, with 16 validators joining. The Nansen x HypurCollective node has accumulated 30 million HYPE, worth $600 million, the largest unofficial validator node (the top 5 are Hyper Foundation).

Prepare USDC on Arbitrum, deposit it into Hyperliquid, transfer USDC to Spot Account, buy HYPE spot, go to Stake page, transfer HYPE tokens to Staking Account, input staking amount, select Nansen x HypurrCollective as the validator.

Hyperliquid Ecosystem Projects

HYPE ecosystem tokens representing memes and community culture: VAPOR, FARM, PURR, HCR...

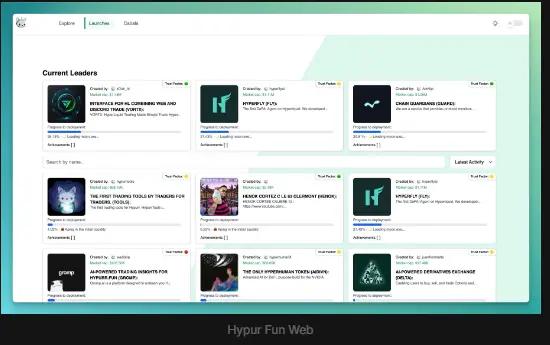

HypurrFun

Hype ecosystem's Pump.fun, requiring participation through the Hypurr Fun bot in Telegram groups or the hypurr.fun website. Users use USDC to participate, and if the cumulative amount in the current pool exceeds 65% of the current auction price, a new token will be bid and created to be listed on Hyperliquid.

Since there are no smart contracts on Hyperliquid yet, the Bonding Curve implementation is done off-chain, with users sending USDC to a specified address for purchase, and the off-chain calculation of their current token balance according to the Bonding Curve. Successful auctions will list the token on Hyperliquid and distribute it to the participating addresses.

Recommended reading is @chrischang43's information, as publicly available mechanism information is very difficult to find.

The recent breakout project is the technically-focused HCR, which has also interacted with Aixbtx on Twitter, though its responses tend to be lengthy and uninteresting, not resonating well with the market.

Hypurr Fun : https://app.hypurr.fun/

Hypur Fun Bot : https://t.me/HypurrFunBot?start=ref_98ca8973

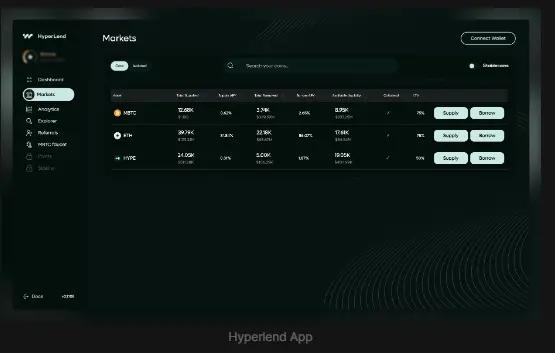

Hyperlend

Hype ecosystem's native lending protocol, in addition to basic functions, the feature is to support HLP Vault as collateral, unlocking leveraged yield opportunities. Users can Supply HLP as collateral, borrow other stablecoins, and deposit them back into the HLP Vault to cycle and earn leveraged yields. The testnet is currently available for participation.

Website : https://hyperlend.finance/

Thunderhead ( stHYPE )

Focused on liquid staking, in addition to HYPE, it also supports staking for Ethereum, AO, Arch and other networks. The current Hyperliquid testnet version is only accessible to invited users, where users can stake HYPE to receive stHYPE tokens.

Rootdata shows the team was founded in 2022 without any announced funding, but the website states they have support from 1kx, Rocktree, Piertwo and other capital and node operators.

Website : https://thunderhead.xyz/

PvP.trade

Hyperliquid ecosystem's trading bot, using the PvP Bot to trade spot and futures on Hyperliquid, with accumulated PVP points. This project has already auctioned the $PVP token ticker for $200,000 on 12/7, so an airdrop is expected.

Users can join clans and accumulate points based on trading volume, but some have complained about the lack of transparency in point distribution, as the daily total is fixed and points vary by trading pair, requiring collaborative research to effectively farm airdrops, which have a certain participation threshold.

PvP Bot : https://pvp.trade/join/f1d8zc

Kinetiq ( LST )

A liquid staking protocol built on HYPE, with a team backed by @anthiasxyz, a consulting firm focused on risk design and system management, having collaborated with ecosystems and clients from Arbitrum, Solana, Compound...

Website : https://kinetiq.xyz/

Felix Protocol

Hype ecosystem's native stablecoin protocol, where users can deposit HYPE, PURR and other assets to mint the feUSD stablecoin. It has already launched on the testnet, with a simple and easy-to-use UI.

Hypur Collective

The Hypur ecosystem is initiated by community members, aggregating current Hype ecosystem projects, serving as the most important entry point for new projects and users to join the ecosystem. They have already organized the core circle of HypurCo Members.

They have partnered with Nansen to become one of the first 16 validator nodes for Hyperliquid, with 30 million HYPE staked, worth about $600 million, the largest non-official staking node.

Website : https://www.hypurr.co/ecosystem-projects

- Website: https://hypurrscan.io/dashboard

- X: https://x.com/hyperactive_cap

- X: https://x.com/HyBridgeHL

- Website: https://hybridge.xyz

- X: https://x.com/HypioHL

- Opensea: https://opensea.io/collection/hypio

Hypur/active

An investment DAO initiated by the Hypeliquid community, created by @laurentzeimes and @fiege_max. It is stated that they have no connection with the core members of the Hype official, but they were mentioned in the Hyperliquid annual review, so they must have achieved some results and influence in the ecosystem, which has not been explored in depth yet.

HyBridge

The official Hyperliquid channel only accepts USDT and USDC deposits from Arbitrum. HyBridge supports cross-chain transfer of various assets from 7 chains including Ethereum, BASE, and Solana to Hyperliquid, and can also directly specify the receiving assets as HYPE, USDC, FUN and other ecosystem tokens. The documentation introduces the current running of the 2nd season bonus activity.

HyBio - NFT

HyBio is a currently popular NFT collection in the ecosystem. The earliest tweet related to NFT was in 2025, and it seems to have been created by @8tejj8. The team announced the participation method in ⅛, with users minting on BASE, including whitelist and public sale; the total supply is 5500, with 155 held by the team and 400 contributed to the treasury.

Rariable's public tweet mentioned that the HyBio NFT minting price is 0.025 ETH, with the highest price reaching 0.39 ETH; the trading volume on Opensea is 506 ETH, and it will be opened on 1/14.

How to issue tokens on Hyperliquid?

Hype mainly has HIP-1 format tokens, which must be obtained through the open auction every 31 hours. The latest auction situation can be found on AXSN Data or the latest auction information on Hypurscan data, and the recent projects (1/10) are mostly around $300,000.

How to get the latest news of the Hyberliquid ecosystem

Hypur Collective is a community-initiated project, with HypurCo member-limited ecosystem partners able to join by submitting an application form. Currently, HypurCo and Nansen are running a joint node, and it is recommended to choose this node when staking, as there may be future airdrops.

AXSN, as a node validator, provides data analysis tools and will share Hyperliquid data from time to time. Their The Hyperliquid Issue #1 released on 1/3 covered a lot of information. The Weekly Update from HypurCollective can also provide a good understanding of the voices and updates from the community and ecosystem.