Introduction

As the price of Bitcoins continues to rise and more and more institutions join the market, the market's attention to crypto assets is constantly increasing. In particular, the continued increase in Bitcoin holdings by large companies like MicroStrategy shows their high level of trust in this asset. At the same time, Coinbase CEO Brian Armstrong publicly stated at the World Economic Forum in Davos that Bitcoins (BTC) have more advantages than gold and may become a global reserve asset in the future. This article will take you through the latest market trends of Bitcoins and the dynamics behind the institutions, and analyze the potential and challenges of Bitcoins in the future.

Bitcoins price continues to rise, MicroStrategy increases its holdings

On January 22, 2025, the price of Bitcoins once again surged to $107,000, although it has since retreated to $105,786, the overall trend still shows a strong upward momentum. Behind the strength of the Bitcoins price is the continuous increase in holdings by enterprises and institutions, especially MicroStrategy (MicroStrategy). After launching the "21/21" plan in October 2024, MicroStrategy, through a shareholder meeting proposal, increased the number of Class A common shares from 330 million to 10.3 billion, creating conditions for further fundraising to purchase Bitcoins.

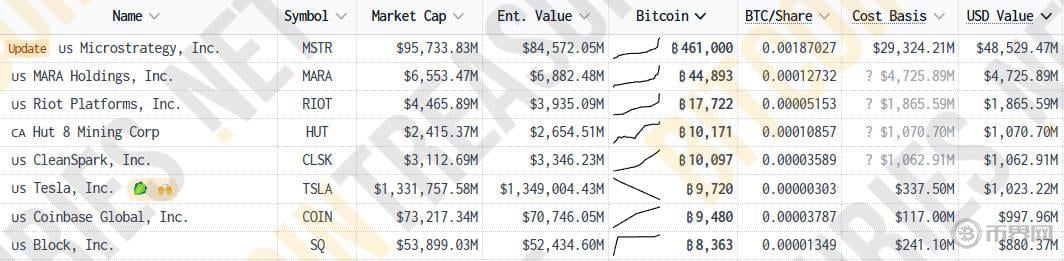

MicroStrategy founder Michael Saylor recently announced that MicroStrategy has again added 11,000 Bitcoins at an average price of $101,191 with $1.1 billion in funds from January 13 to 20, 2025. This additional purchase has brought MicroStrategy's total Bitcoins holdings to 461,000, with a total value of $48.51 billion and a cost basis of $29.32 billion, resulting in an unrealized gain of $19.2 billion. MicroStrategy remains the largest corporate holder of Bitcoins globally, far exceeding other institutions.

More companies join the Bitcoin reserve plan

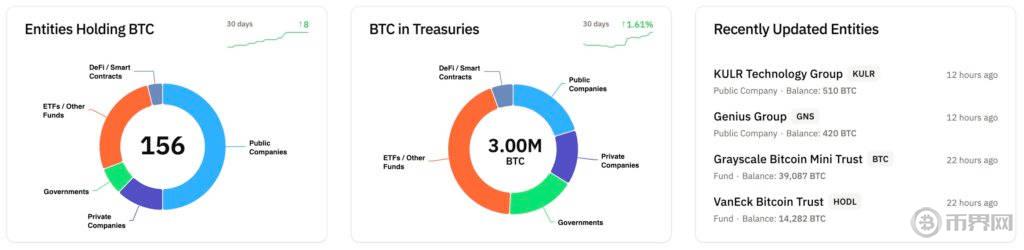

In addition to MicroStrategy, more and more institutions and companies are also starting to increase their Bitcoins holdings. According to data from bitcointreasuries, the total Bitcoins holdings of institutions (including listed companies, investment firms, exchanges, governments, etc.) have now exceeded 3 million, accounting for 14.3% of the total Bitcoins supply, with a total value of $316.7 billion. It is worth noting that in addition to MicroStrategy, the Bitcoin mining companies MARA Holdings and Riot Platforms hold about 44,900 and 17,700 Bitcoins respectively, and Tesla owned by Musk holds 9,720 Bitcoins.

Recently, other companies have also enhanced their asset allocation by purchasing Bitcoins or launching Bitcoins reserve plans. For example, the reinsurance company Oxbridge announced that it will use Bitcoins and Ethereum as treasury reserve assets, KULR company has added $8 million worth of Bitcoins, bringing its total holdings to 510 BTC; AI company Genius Group has also increased its Bitcoins holdings by $5 million, with a total of 420 BTC.

Bitcoin's market dynamics and correction trend

In January 2025, Bitcoins quickly corrected to lower prices after breaking through the historical high of $109.3K, this rapid price correction was mainly driven by the optimistic sentiment on social media. A lot of FOMO (fear of missing out) sentiment has permeated platforms like X (formerly Twitter), Reddit, and Telegram, with investors predicting that Bitcoins will break through the $110K to $119K range. However, historical experience shows that the market often develops in the opposite direction of most people's expectations, especially when Bitcoins volatility is high.

Market analysts point out that the price fluctuations of Bitcoins often have a pattern of contrarian trading. According to a report by Santiment, historically, when the market price of Bitcoins reaches a certain high point, the large amount of discussion and prediction by retail buyers often signals that whales (large capital) are preparing to sell their Bitcoins to retail investors, which can lead to a market price correction. Therefore, investors need to be wary of short-term price volatility, especially when market sentiment is overly optimistic.

Bitcoin's long-term trend and market expectations

Although there is volatility in the short term, in the long run, the price trend of Bitcoins is still full of potential. Analyst Mags points out that Bitcoins usually reach their final peak price within 230 to 330 days after breaking through the historical high. Based on this historical pattern, Bitcoins may reach a new price level between July and October 2025. In addition, with the global adoption of cryptocurrencies, the participation of governments and institutions will further drive the long-term growth of Bitcoins' value.

Coinbase CEO: Bitcoins are superior to gold

At the World Economic Forum in Davos in January 2025, Coinbase CEO Brian Armstrong reiterated that Bitcoins are more suitable as a currency than gold. He believes that Bitcoins, like gold, have scarcity, but Bitcoins' advantages in divisibility and portability make it a better form of currency. Armstrong also predicted that in the future, governments will gradually increase their Bitcoins reserves, initially perhaps 1%, and this proportion may further increase over time.

Armstrong pointed out that although the crypto industry has experienced uncertainty in the past few years, with the introduction of new regulatory frameworks, the future prospects of the crypto asset industry are very bright. He believes that Bitcoins will play an important role in the global financial system and become a more liquid and easier to transact store of value tool.

Conclusion

The long-term prospects of Bitcoins are well-regarded by many industry insiders, especially as more and more companies and institutions are including it as part of their reserve assets. Compared to gold, Bitcoins have higher liquidity and divisibility, making it more practical for global payments and store of value. As governments gradually adopt cryptocurrencies, Bitcoins may become an important component of the global financial system in the future.