Source: glassnode; Compiled by Baishuei, Jinse Finance

As we enter 2025, the cryptocurrency market continues to gain momentum, driven by structural changes in liquidity, investor positioning, and on-chain activity. Institutional adoption remains a dominant theme, with spot Bitcoin ETFs attracting record inflows, Ethereum's Layer-2 driving network growth, and stablecoins consolidating their position as the backbone of crypto finance.

This quarter, we will explore:

As the market structure is reshaped by profit-taking around the cycle peak, the supply dynamics of Bitcoin are constantly evolving.

Ethereum's Layer-2 is accelerating, with surging activity and lower fees driving increased adoption.

With on-chain liquidity reaching historic highs, the dominance of stablecoins is growing.

The Evolving Bitcoin Landscape

In Q4 2024, institutional Bitcoin adoption hit new highs, with record inflows into spot ETFs and a significant expansion of the derivatives market. However, on-chain data reveals a more nuanced picture - as demand surged, long-term holders also seized the opportunity to realize gains near all-time highs, reshaping the market structure.

ETF Inflows Drive Institutional Demand

The launch of spot Bitcoin ETFs in early 2024 was a watershed moment for institutional entry into the crypto market. By year-end, the total BTC ETF balance exceeded $105 billion, with a net inflow of $16.6 billion in Q4 alone.

The surge in demand has helped cement Bitcoin's status as a macro-correlated asset, increasingly integrated into traditional investment portfolios. However, as ETF demand grows, on-chain data indicates changes in supply dynamics, which investors must closely monitor.

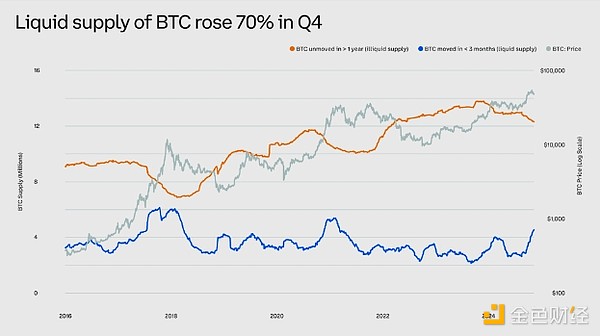

Profit-Taking Reshapes Market Structure

As Bitcoin reached new highs in Q4, long-term holders began to distribute Bitcoin into the market. The active supply (BTC that has moved in the past 3 months) increased by nearly 70%, bringing over 1.8 million BTC into active circulation.

This suggests that for many long-term investors, $100,000 was seen as a strategic profit-taking level, leading to a redistribution of supply from experienced holders to new market participants. However, despite the increase in liquid supply, the overall uptrend remains intact, reflecting strong underlying demand.

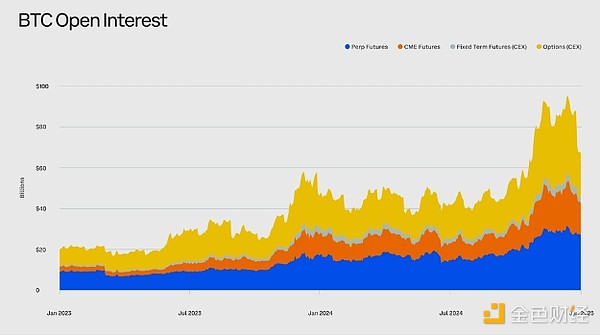

Derivatives Market Signals Rising Risk Appetite

Institutional involvement extends beyond ETFs, as the Bitcoin derivatives market expanded rapidly in Q4:

Futures open interest surged 60% to nearly $100 billion, reflecting increased positioning activity.

Perpetual funding rates spiked, indicating a strong bullish bias in positioning.

A large-scale liquidation event occurred after BTC briefly breached $100,000, suggesting excess leverage in the system is being flushed out.

The continued growth of institutional capital inflows, changes in supply dynamics, and the positive derivatives positioning make Bitcoin's market structure one of the most important factors to monitor in early 2025.

Ethereum Layer-2 Expansion Continues

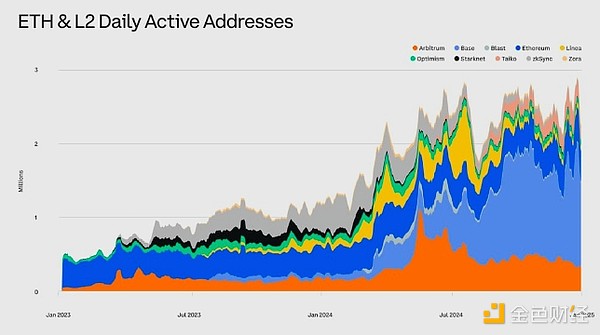

In Q4 2024, Ethereum network activity surged, with Layer-2 solutions playing an increasingly crucial role in transaction execution. While Ethereum's price remained range-bound, the underlying network dynamics are worth noting - driven by the efficiency gains from Layer-2 adoption, daily transactions and active addresses skyrocketed.

Layer-2 Leads Network Growth

In 2024, the Ethereum ecosystem's daily active addresses grew by nearly 150%, with Layer-2 seeing the most significant growth, led by Base.

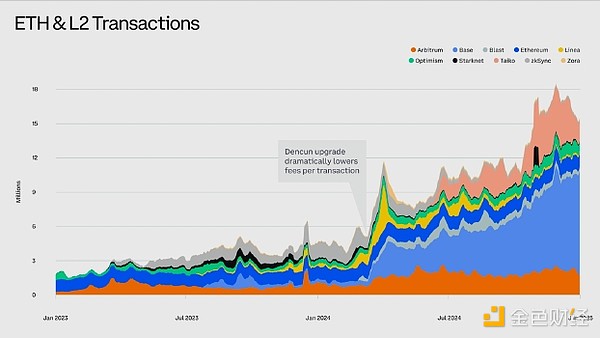

Ethereum's rollup-centric roadmap continues to materialize, with Layer-2 networks absorbing an increasing share of transaction activity. In Q4 alone:

Ethereum and Layer-2 daily transaction volume grew by 41%, reflecting strong user adoption.

Base led the activity growth, with a surge in transactions as it rapidly expanded.

Layer-2 adoption surpassed the Ethereum mainnet, highlighting the shift towards cheaper and faster execution environments.

With the continued increase in on-chain activity, the Ethereum ecosystem's daily transaction count grew by 41% in Q4.

These trends are further amplified by the Dencun upgrade in March 2024, which significantly reduced Layer-2 transaction fees. The cost reduction has made Layer-2 a more attractive settlement layer, unlocking new use cases in DeFi, payments, and gaming.

Staking and DeFi Participation Remain Robust

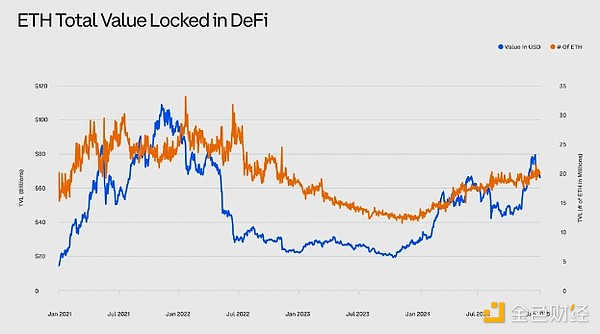

In addition to the growth in transaction volume, Ethereum's staking and DeFi ecosystem have also shown resilience:

Despite a slight decline in Q4, ETH staking remains near all-time highs.

Annual staking yields have stabilized around 3%, providing a predictable reward structure.

DeFi's Total Value Locked (TVL) increased by 6% in Q4and 58% for the full year, indicating sustained participation in on-chain financial applications.

The amount of ETH locked in DeFi grew by 6% in Q4 and 58% for the full year.

Looking Ahead: The Layer-2 Landscape in 2025

As Layer-2 proves its ability to scale Ethereum while maintaining security guarantees, 2025 is poised to be a defining year for its adoption. The next phase of competition may revolve around:

Liquidity fragmentation and interoperability - how assets can flow seamlessly between different rollups.

New L2-native applications - developers building directly on rollups, bypassing mainnet constraints.

Institutional adoption - whether capital allocators start to view Layer-2 as viable infrastructure for large-scale financial applications.

As On-Chain Liquidity Grows, Stablecoins Take Flight

While Bitcoin and Ethereum dominated the headlines in Q4 2024, stablecoins have quietly consolidated their position as the backbone of on-chain liquidity. Record supply growth and surging transaction volumes indicate that stablecoins are rapidly becoming the core settlement layer for digital finance.

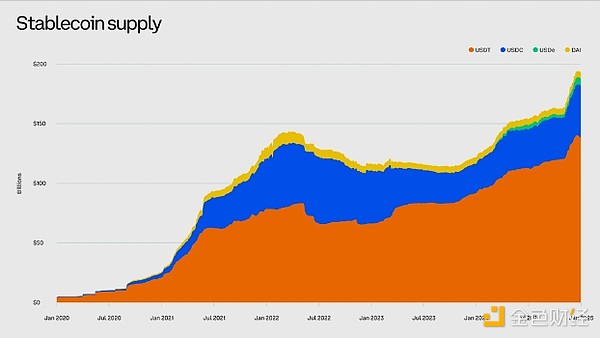

Stablecoin Supply Soars to All-Time Highs

Stablecoin supply grew 18% in the fourth quarter, and the total market capitalization of the top stablecoins will approach $200 billion by the end of 2024.

In the fourth quarter, the total supply of stablecoins grew by 18%, driving the total market value of the largest stablecoins close to $200 billion. This growth reflects:

Increased demand for stable, liquid on-chain assets, especially as institutions deepen their participation in the cryptocurrency market.

A shift towards using stablecoins as an alternative to traditional banking services, with more and more entities using them for settlement and remittances.

USDT continuing to dominate, accounting for the majority of new inflows, while emerging stablecoins like USDe also gaining attention.

Trading volume hits new highs

In 2024, stablecoin trading volume will double to $30 trillion, with a record $5 trillion in trading volume in December.

In addition to the expansion of supply, stablecoin trading activity has also seen record growth:

In 2024, stablecoin trading volume will reach $30 trillion, with a record $5 trillion in transfers just in December.

On-chain settlement efficiency continues to improve, with lower fees and faster transaction speeds on major networks.

Ethereum remains the primary settlement layer, but alternative chains and Layer 2 networks are increasingly handling stablecoin flows.

The speed of stablecoin circulation is unprecedented, highlighting their growing utility - they are not only a store of value, but also the preferred medium for cross-border payments, remittances, and digital commerce.

Stablecoins are the core of institutional crypto adoption

As institutions explore tokenized assets and on-chain finance, stablecoins are becoming an indispensable liquidity layer for institutional market participants. Key drivers of continued adoption in 2025 include:

Regulatory clarity - as governments formally establish stablecoin frameworks, adoption may accelerate.

DeFi integration - stablecoins continue to underpin lending, derivatives, and automated market making on decentralized platforms.

Payments and remittances - more and more businesses and financial institutions are testing stablecoins for cross-border transactions.

What's next?

Stablecoins have long been seen as the "killer app" of cryptocurrencies, but the fourth quarter of 2024 provided clear evidence that they are evolving into something more than just a substitute for fiat currencies. With the development of regulation, deeper institutional adoption, and broader on-chain integration, stablecoins will play a pivotal role in the next phase of the digital asset market.

Conclusion: 2025 Institutional Market Outlook

The crypto market is entering 2025 with strong institutional momentum. The spot Bitcoin ETF has reshaped market structure, Layer 2 is expanding Ethereum, and stablecoins are consolidating their role as the foundation of on-chain liquidity.

Key takeaways from the fourth quarter:

Bitcoin: Institutional demand remains strong, but on-chain data indicates changes in long-term holder behavior.

Ethereum: Layer 2 adoption is accelerating, driving efficiency improvements and broader network activity.

Stablecoins: Continuously growing supply and record-breaking trading volumes highlight their expanding role in global finance.

Institutional investors need to understand these structural changes (not just price behavior) to navigate this evolving landscape.