What is happening with Ethereum?

Short positioning in Ethereum is now up +40% in ONE WEEK and +500% since November 2024.

Never in history have Wall Street hedge funds been so short of Ethereum, and it's not even close.

What do hedge funds know is coming?

(a thread)

We saw the effects of this extreme positioning on February 2nd.

Ethereum fell -37% in 60 hours as the trade war headlines emerged.

It felt almost like the flash crash seen in stocks in 2010, but with no headlines.

More than $1 trillion was erased in crypto in HOURS.

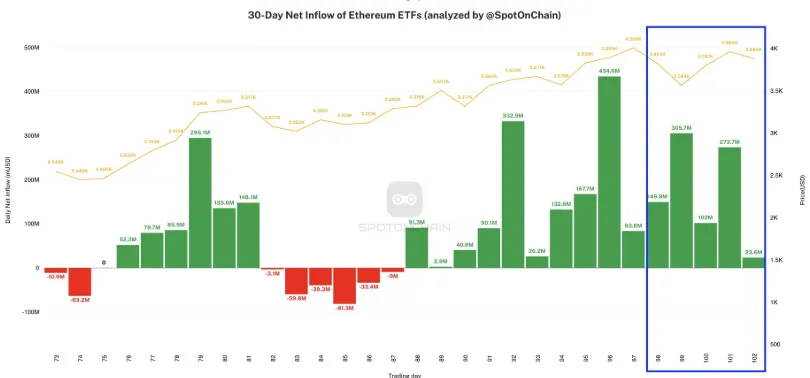

Interestingly, even as short exposure was ramping up in December 2024, Ethereum inflows were HIGH.

In just 3 weeks, ETH saw +$2 billion of new funds with a record breaking weekly inflow of +$854 million.

However, hedge funds are betting ETH's surge and limiting breakouts.

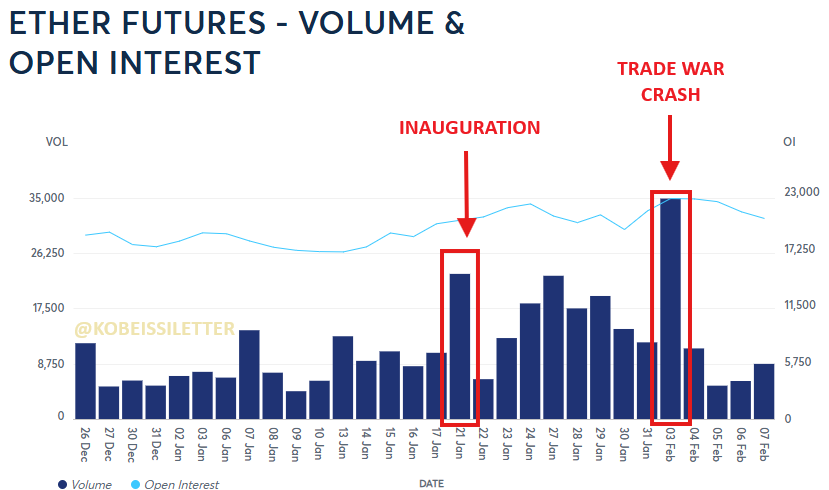

Furthermore, volume has been strong in ETH generally speaking.

We saw large spikes in volume on January 21st after Inauguration Day.

We also saw large spikes in volume around the February 3rd crash.

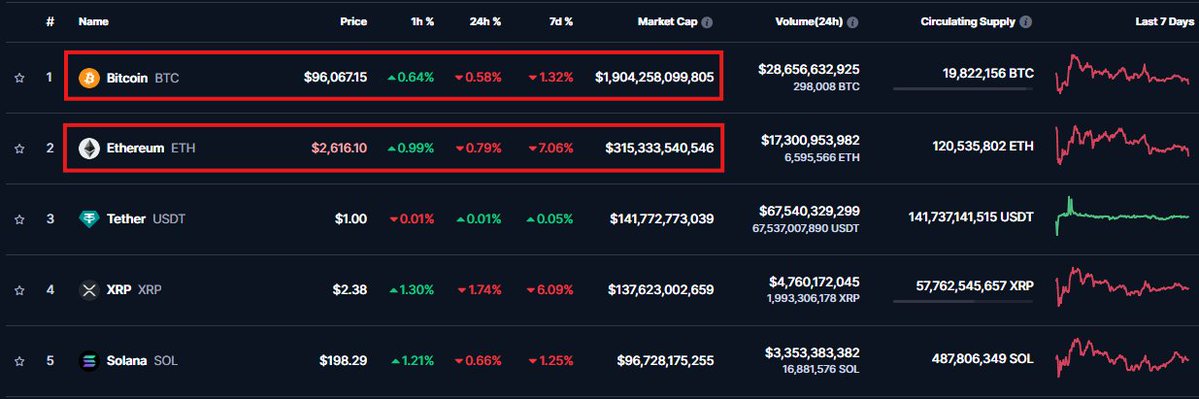

Price action has failed to recover the gap lower even as one week has passed.

In fact, even as Bitcoin and other major cryptocurrencies have broken out, ETH is stuck.

ETH is currently trading a whopping ~45% below its record high set in November 2021.

This brings the next question.

Why are hedge funds so dedicated to shorting Ethereum?

For years, there was fear of ETH being classified as a security by the SEC.

However, with the new SEC under the Trump Admin this seems unlikely.

In fact, Eric Trump recently posted "it’s a great time to add ETH" and prices briefly surged.

So why is ETH so widely hated?

There is a lot of debate over the answer to this question.

Potential reasons range from market manipulation, to harmless crypto hedges, to bearish outlook on Ethereum itself.

However, this is rather strange as the Trump Administration and new regulators have favored ETH.

Largely due to this extreme positioning, Ethereum has significantly underperformed Bitcoin.

Bitcoin is now 6 times larger than Ethereum in one of its largest caps since 2020.

Could Ethereum be setting up for a short squeeze?

This extreme positioning means big swings like the one on February 3rd will be more common.

Since the start of 2024, Bitcoin is up ~12 TIMES as much as Ethereum.

Is a short squeeze set to close this gap?

Follow us @KobeissiLetter for real time analysis as this develops.

Sector:

From Twitter

Disclaimer: The content above is only the author's opinion which does not represent any position of Followin, and is not intended as, and shall not be understood or construed as, investment advice from Followin.

Like

Add to Favorites

Comments

Share

Relevant content