The Crypto Craze for IP Tokens is Crazier than On-Chain Memes!

The crypto market has recently seen the emergence of a new speculative token - the IP token of Story Protocol. In just 4 days, it surged from $1.36 to $2.8, reaching a market cap of $2.8 billion and topping the Binance futures leaderboard. Retail investors are simultaneously cursing the whales for dumping and frantically 'All In'-ing, creating a scene reminiscent of the Spring Festival ticket-buying frenzy.

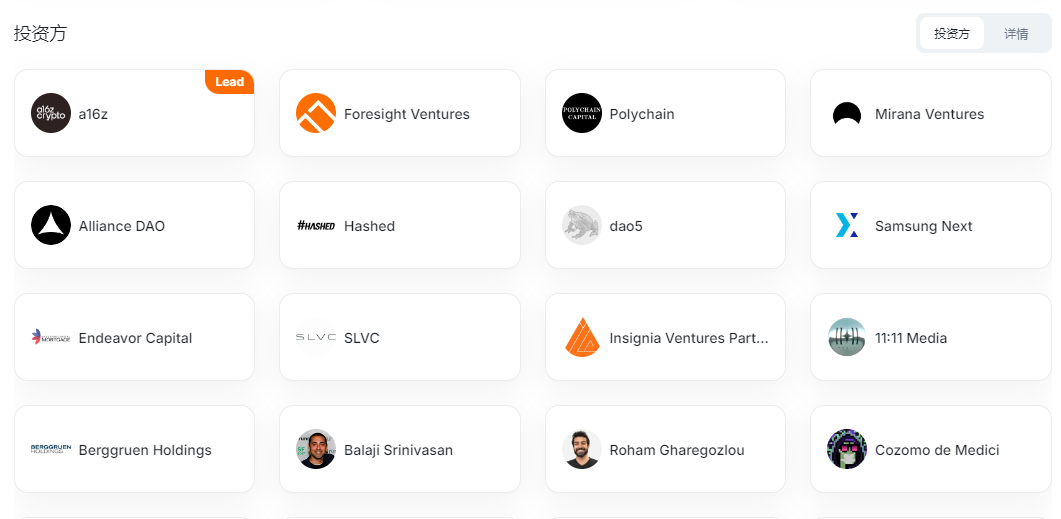

However, this time I would advise against rushing to condemn the project. Because this project may not be just another on-chain meme, but a "blockchain + IP + AI" civilization-level disruption, backed by top-tier investors like a16z and Polychain. With $140 million in funding and a $2.25 billion valuation, the mainnet has just launched and they've already pulled off an epic maneuver: to "put the world's intellectual property (IP) on the blockchain"!

Today, let's take a closer look at this project, which claims to be the "Alipay of the IP world" - is it just another retail investor harvester, or the next Ethereum?

What is Story Protocol? In a nutshell: The Blockchain Nuclear Weapon of the IP World

1. How Terrible is the Traditional IP Market? Even Worse than the Blind Date Market!

Intermediary Exploitation: You work hard to create a comic, and Disney says they want to help you sell the IP? First, they'll take a 30% commission fee, then make you sign a 20-page contract, and finally tell you "the profit share is based on net profit" - which could even be negative.

AI Chaos: ChatGPT uses your novel to train its model and sells the generated content, but you don't get a single penny? Now, all the AI companies on the internet are doing this, leaving the original authors in tears.

Cross-border Rights Protection: Your IP registered in the US is being counterfeited in Vietnam? The lawyer fees are even more expensive than the compensation, so you can only accept your misfortune.

2. What is Story Protocol?

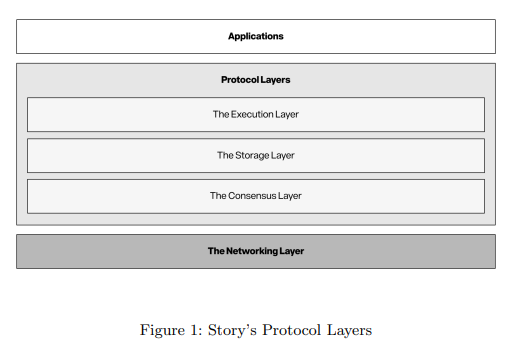

Source: Story Whitepaper

Story is a purpose-built decentralized blockchain, enhanced with a multi-core execution environment. It consists of a main execution core and multiple highly customized cores.

The main core provides EVM equivalence, allowing the rapid adoption of existing applications in the ecosystem. The Intellectual Property (IP) core is one of the specialized cores, which efficiently handles IP registration as a native asset class, while optimizing operations in complex IP relationship graphs. This core will transform smart contracts into programmable IP assets. Although Story primarily focuses on intellectual property, its flexible architecture supports the adoption of future cores that can extend beyond IP-related applications.

The Operational Principles of Story

Story is a Turing-complete, specialized L1 blockchain at the intersection of AI and IP. By making IP programmable, Story introduces a new digital marketplace for one of the world's most valuable asset classes.

The Story platform structure consists of three core layers, including:

Story Network Layer1 Blockchain: This is the foundational part of the platform. The Story Network is optimized for handling complex data structures and is EVM-compatible, allowing developers to easily port applications written in Solidity. A key feature is the integrated graph data storage system in the execution layer, which simplifies IP asset management.

Application Ecosystem: Provides developers with tools to build decentralized applications (DApps) on the Story Protocol network, including DEXs, lending platforms, AI integrations, real-world asset (RWA) tokenization, and DAOs.

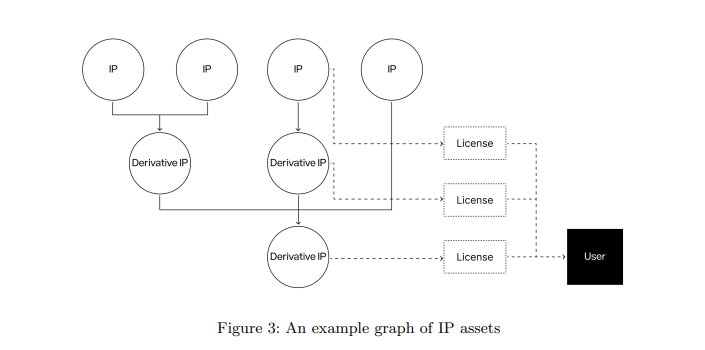

Creativity Proof and Programmable IP Licensing (PIL): These are Story's two flagship features. "IP assets" are recorded as non-fungible tokens, but these tokens use a modified version of the ERC-6551 Ethereum standard, which transforms NFTs into smart accounts that can control other assets, conduct transactions, and interact with smart contracts and DApps. This allows Story Protocol to automate licensing and enable users to embed pre-paid fees, royalty percentages, and usage restrictions. The Creativity Proof protocol is responsible for managing and exchanging creative works through tokenization, allowing creators to register their works on the blockchain and receive a unique digital certificate confirming ownership. PIL links legal contracts with smart contracts, making rights both legally enforceable and on-chain executable. It is compliant with the Berne Convention, making it applicable to most global markets.

Story Protocol's Clever Moves: Turning IP into Code, Using Blockchain to "Lock" Ownership

This project has done one thing: turning IP assets into NFTs and automatically collecting royalties through smart contracts! Specifically:

IP on the Blockchain: Your novels, comics, and music will all be minted as NFTs, with ownership verifiable on the chain, making it more costly to tamper with than stealing from the Palace Museum.

Smart Contract Royalties: Set a "10% royalty" and any use of your IP for films, games, or merchandise will automatically send the revenue to your wallet, bypassing Disney's legal department.

AI Regulatory Body: AI companies want to use your IP to train their models? They'll have to buy the licensing tokens first, or else they'll be directly blocked on the chain.

In a nutshell: Story Protocol aims to turn IP into "programmable assets" like Bitcoin, allowing creators to passively earn money, and leaving pirates and AI companies with nowhere to go!

What are IP Tokens?

IP tokens are the native cryptocurrency of the Story Protocol, used for on-chain transactions, security, and governance.

$IP is not just a digital asset, but also empowers creators to register, license, and monetize intellectual property rights through the immutability of blockchain and programmable smart contracts.

Currently, the main use cases of $IP tokens are:

Staking: Story Protocol uses a Proof-of-Stake (PoS) consensus mechanism, and users holding $IP tokens can choose to stake them to become validators, supporting the network's operation and earning staking rewards. This not only helps maintain the blockchain's security, but also allows holders to earn additional token rewards through staking.

Medium of Exchange: Similar to Ethereum's gas fees, Story Protocol requires the payment of $IP tokens to register IP, transfer ownership, and set licensing terms, helping to prevent spam transactions and ensure fair resource allocation.

Governance Mechanism: $IP token holders can participate in voting on protocol upgrades, fund allocations, and governance proposals, allowing the community to directly influence the direction of Story Protocol.

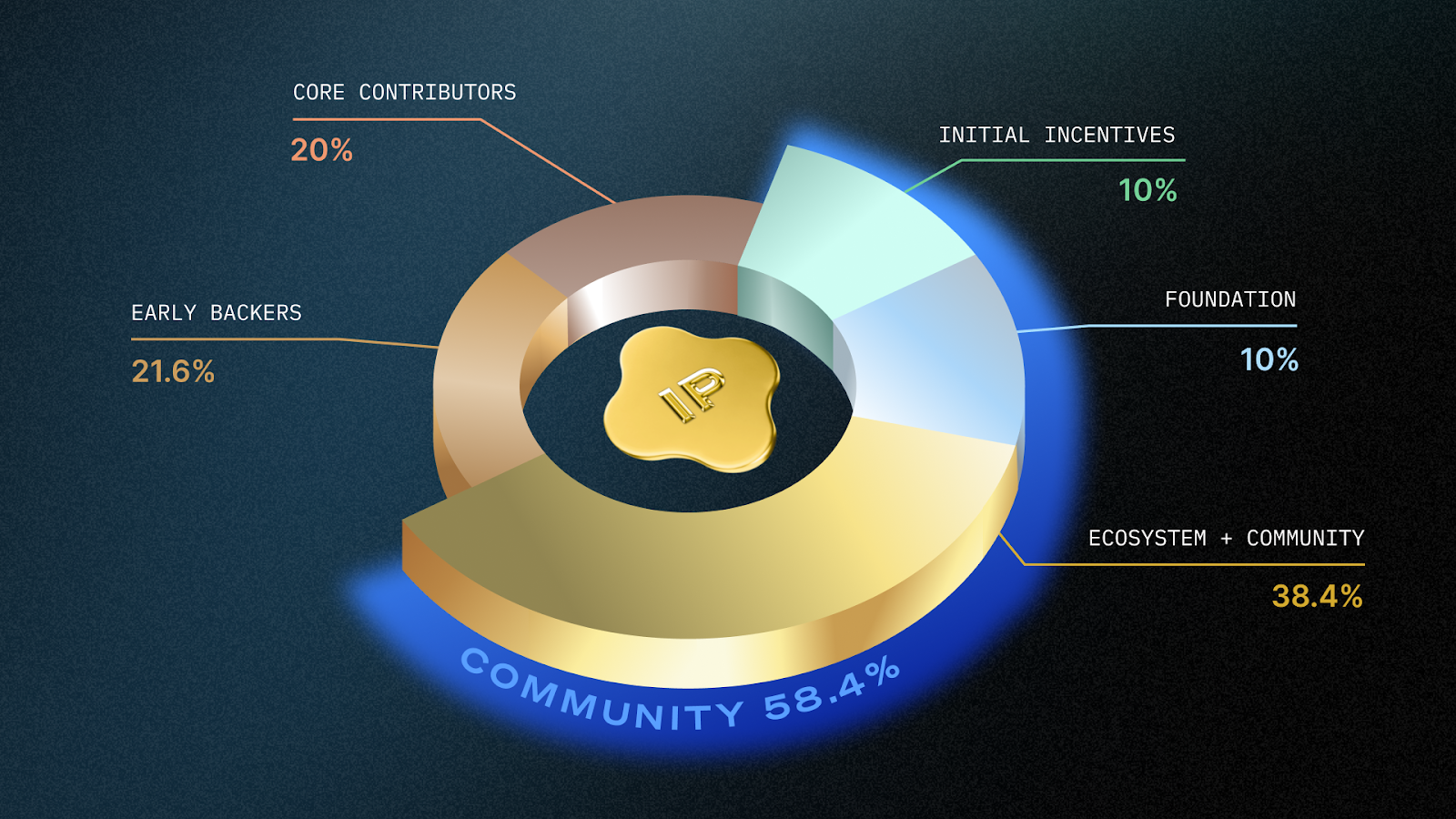

The total supply of $IP tokens is capped at 1 billion, with the following distribution:

- Ecosystem and Community (38.4%) - Including developer grants, community support, and marketing.

- Initial Incentives (10%) - Rewards for early users and validators.

- Foundation (10%) - For Story Protocol's operations and long-term development.

- Early Investors (21.6%) - Early supporters and advisors of Story Protocol.

- Core Contributors (20%) - Rewards for the Story Protocol development team and strategic partners.

Story Protocol will unlock 25% of the tokens upon launch, allowing for trading, staking, and ecosystem participation, with the remaining tokens to be gradually released according to a structured unlock schedule.

Why are IP Tokens Skyrocketing? Whales Manipulating the Market? No, it's a Double Nuclear Explosion of Capital and Technology!

1. Capital Backing: $140 Million Raised from a16z, with an All-Star Team

Investment Powerhouse:

On 2023-05-17, Story Protocol completed a $29.3 million funding round.

On September 6, 2023, Story Protocol completed a $25 million Series A funding round.

On August 21, 2024, Story Protocol completed an $80 million Series B funding round, with a valuation of $2.25 billion.

a16z, Polychain, Hashed... These people have invested in Coinbase, OpenAI, and they pick projects that can change the world.

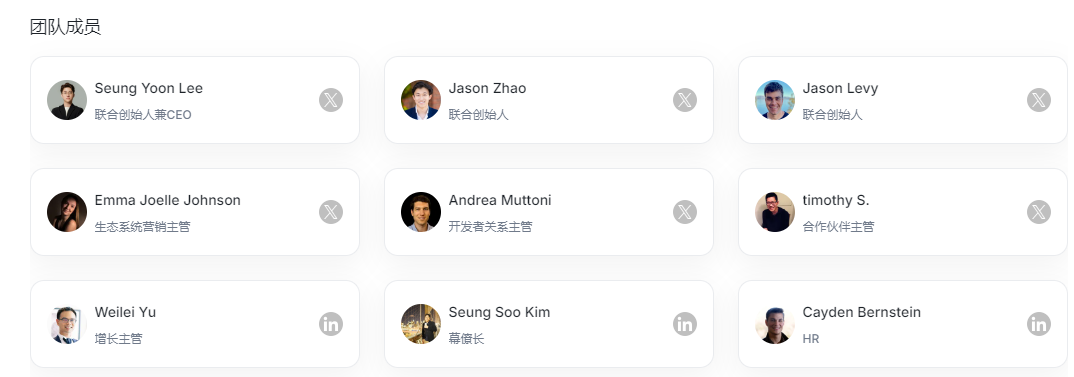

Team Configuration:Founder Seung Yoon Lee is the founder of the Korean version of "Qidian Novel Network" Radish Fiction, which was acquired for $440 million;

CTO Jason Zhao is an AI genius from Google DeepMind, with a perfect SAT score of 2400, a full scholarship from Stanford, and is the founder of Stanford Rewired.

Valuation Logic:The global IP market is worth $6.1 trillion. Even if 1% is converted on-chain, it will be a super track that crushes DeFi.

2. Technical Advantages: Multi-Core Architecture + AI Agent, Better than Ethereum

Multi-Core Execution Layer: The main core is responsible for coordination, the IP core manages copyrights, the off-chain core connects to real-world laws, and the cross-chain core connects to other public chains - clear division of labor, more efficient than Meituan Waimai.

AI Agent Protocol (Agent TCP/IP): In the future, AI robots can buy IPs, negotiate collaborations, and distribute royalties on their own, while humans can just lie back.

Deflationary Model: 1 billion tokens, each transaction burns IP tokens, 20% annual staking yield - want to dump the market? Ask the miners first.

3. Binance Listing of Contracts: Liquidity Nuclear Bomb, Retail Frenzy

As soon as the Binance contract was launched, leveraged players entered the market, and the trading volume reached $1.1 billion in 24 hours, the cost of the whales to pull the market up soared, and the short positions were blown up without a trace.

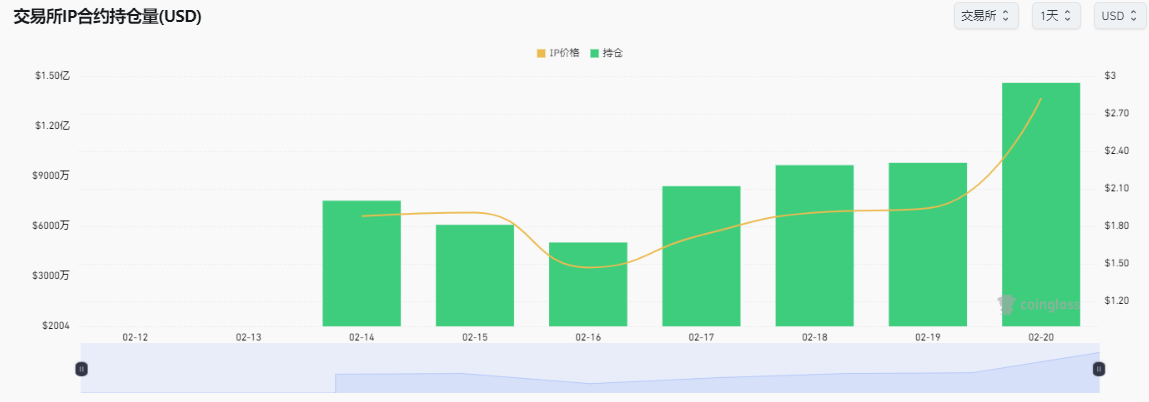

According to Coinglass data, the current global IP contract open interest is $165 million, up more than 45% in the past 24 hours.

4 Reasons Why IP Tokens Will Surge Further! Retail, Don't Miss the Opportunity to Get Rich!

AI Revolution Necessity: IP is the Oil of the AI Era, Story is Saudi Aramco

Data Rights Confirmation: Without Story, AI companies will be sued to bankruptcy for data theft; with Story, paying to put it on-chain is legal and compliant.

AI Autonomous Economy: In the future, AI will write novels and make music, and the copyrights will be automatically owned, humans just need to collect the money - this story is enough for Wall Street to drink a pot.

Token Economics: Deflation + Staking, Whales Don't Want to Sell

Staking Lockup: 20% annual yield, miners won't dump, circulating supply gets tighter and tighter.

Burning Mechanism: Each transaction burns IP tokens, the total supply evolves from 1 billion to 100 million - this model, Dogecoin would be impressed.

Compliance Moat: Legal + Blockchain Double Insurance

On-Chain Evidence: Infringement? Directly check the blockchain records, the court will rule in favor.

Globally Applicable: Complies with the Berne Convention, usable in 150 countries, Disney can't block it.

Retail Consensus: Top Gainer, FOMO Sentiment Exploding

What's the most valuable thing in the crypto circle? Consensus! After the IP token was listed on Binance, the community's shilling memes were flying all over, even the square dance grannies were asking "how to buy IP" - this sentiment, it's hard not to surge!

Risk Warning: Don't Just Look at the Thief Eating Meat, Be Careful of the Thief Getting Beat!

Regulatory Black Swan: The attitudes of different countries towards on-chain IP are unclear, beware of a one-size-fits-all policy.

Technical Vulnerabilities: Smart contract hacked by hackers? IP assets can be wiped out overnight.

Ecosystem Cooling: If major brands don't enter, Story is just a high-end QQ show.

Conclusion: Can I Buy IP Tokens? My Advice is Just One Sentence

If you believe that "blockchain + IP + AI" is the biggest opportunity in the next decade, and you can bear the risk of going to zero, it's not too late to get on board now. But remember: there are no eternal myths in the crypto circle, only eternal retail investors.