Author: Mary Liu, Bitpush News

Affected by the escalating global trade tensions and the overall selling pressure in the crypto market, investors' interest in risk assets has continued to cool down. Over the past 24 hours, Bit once fell to a daily low of $82,131.90, the lowest since November last year, Ethereum fell to around $2,300, XRP and Solana fell by nearly 5%, and the overall market sentiment remains fragile.

Trade war concerns reignited: Macroeconomic gloom

US President Trump said on February 26 local time that he will soon announce tariffs on the European Union. He may impose a 25% tariff and plans to impose tariffs on Mexico and Canada, triggering market concerns about a global trade war. Although Trump had previously stated that he hopes to reach an agreement with the EU, the advancement of the tariff plan has worsened market sentiment.

The decline in the crypto market is synchronized with the sell-off of other risk assets such as US stocks. Trump's recent multiple threats to raise tariffs, including potential tariffs on copper imports, have further exacerbated market uncertainty. In addition, weak US consumer confidence data has also raised concerns about economic slowdown, which puts pressure on the US economy, which is mainly driven by private consumption.

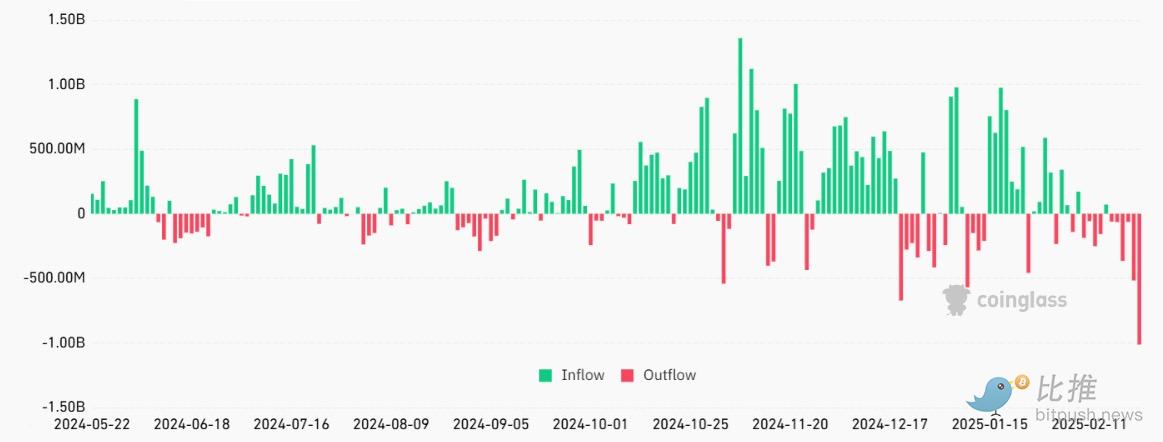

Bleeding of Bit ETF funds: Micro-market shocks

This week, Bit ETFs listed in the US have experienced nearly $1 billion in capital outflows, setting a single-day record high since the launch of the spot ETF in March 2024. Fidelity and BlackRock's Bit ETFs recorded daily capital outflows of $344.7 million and $164.4 million, respectively.

Standard Chartered Bank warned that the continued ETF capital outflow may put further pressure on the Bit price. Geoff Kendrick, the bank's digital asset research chief, pointed out that since the US election, the average purchase price of Bit ETFs has been $97,000, and the current net loss is about $1.3 billion.

Technical analysis "taking the pulse": Is the next target $70,000?

Ruslan Lienkha, market director of YouHodler, told FXStreet: "Based on technical analysis, the next target for the Bit price is around $70,000, which is a strong support area. However, we will only see this level when negative sentiment dominates the US stock market. US stock indexes have fallen for several consecutive days, but it is still too early to conclude that the broader uptrend has ended - this may just be a market adjustment."

TradingView data shows that the fair value gaps (FVG) of $76,900-$80,216 and $81,500-$85,072 are key levels where potential buyers may accumulate Bit, which could lay the foundation for a subsequent rebound.

FVG refers to the price range where there is insufficient trading volume due to market sentiment or lack of liquidity during rapid price increases or decreases. This gap usually manifests as the price jumping over an interval directly from one level to another, forming a "blank" area, and the FVG interval is considered a key area where the price may fill.

Joel Kruger, crypto strategist at LMAX Group, pointed out that Bit has "strong support" in the $70,000-$75,000 range, which could become an "attractive higher low" and lay the foundation for the next major rally, pushing Bit to break through $110,000 and set a new high.

Intertwined bulls and bears: The market is not a "one-way" pessimism

At the same time, Ruslan Lienkha, market director of YouHodler, said that the Bybit hacking incident last week had a limited impact on the confidence of institutional investors. He pointed out that institutions usually follow strict capital management rules, allocating only the daily trading liquidity needed for centralized exchanges (CEXs), while conducting large-scale transactions through the over-the-counter market, and storing long-term held assets in self-custody solutions.

Meanwhile, positive regulatory signals have emerged: the SEC has ended its multi-year investigations into Gemini and Uniswap Labs and decided not to take enforcement action. Previously, the SEC also informed Coinbase that it would drop the lawsuit against it (pending final confirmation) and terminate its investigations into Robinhood and OpenSea.

In summary, the crypto market remains pessimistic in the short term, and the future direction will require close attention to this week's US initial jobless claims and PCE data, which may provide more guidance for the market.