Market Overview

The market saw a clear pullback in February: Bitcoin fell from $98,768 to $84,177, a decline of 14.8%, while Ethereum fell more sharply, from $3,065 to $2,216, a decline of 27.7%. In the last week of the month, selling pressure further intensified as security concerns spread.Regulation and Policy Changes

The Trump administration's cryptocurrency executive order focused on self-custody and stablecoin development, providing the industry with much-needed policy clarity. However, the $1.5 billion hack of Bybit on February 21, the largest loss in cryptocurrency history, raised new security concerns, quickly shifting market sentiment. Meanwhile, the SEC's attitude softened, suspending investigations into companies like Coinbase, Binance, and Uniswap, and abandoning its appeal of the "Dealer Rule". The bipartisan-supported GENIUS Act further strengthened the regulatory framework for stablecoins, indicating a friendly regulatory environment in the US.Layer 1

Layer 1 public chains were generally under pressure, with the total market capitalization declining 20.8% to $2.3 trillion. Bitcoin's dominance rose from 71.3% to 74.2%, while Ethereum's share shrank from 14.0% to 11.9%. BNB Chain's share rose slightly to 3.7%, but Solana's share fell from 4.0% to 3.3% after a 36.3% price plunge.Bitcoin Layer 2 & Sidechains

The TVL of Bitcoin L2 and sidechains shrank 24.5% from $2.7 billion to $2.1 billion. Core led with a TVL of $460 million (down 42.0%), followed by Bitlayer ($350 million) and BSquared ($320 million). BOB stood out, declining only 7.9% to $220 million.Ethereum Layer2

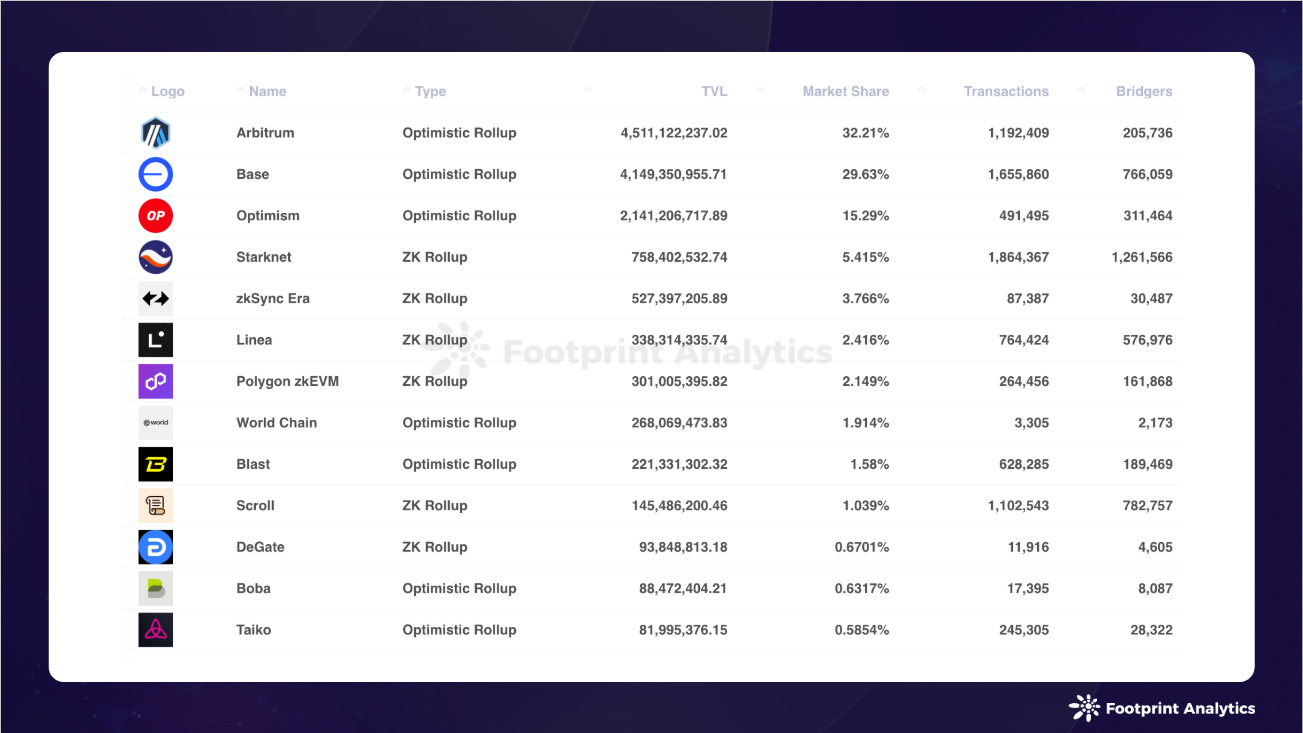

Ethereum L2 TVL declined 23.4% to $14 billion. Arbitrum maintained the lead with a TVL of $4.5 billion (down 33.4%), while Optimism ($2.1 billion) was pushed to third place by Base ($4.2 billion, down 10.6%). Polygon zkEVM surged 104.1% to $300 million, becoming a rare bright spot this month. Data source: Footprint Analytics — Overview of Ethereum Layer 2 (Bridge-related Metrics)

Data source: Footprint Analytics — Overview of Ethereum Layer 2 (Bridge-related Metrics)

Base launched Flashblocks (faster transaction confirmation), Appchains (customized L3), and smart wallet sub-accounts, aiming to maintain user stickiness. Unichain mainnet launched on February 16, with its testnet having processed 95 million transactions cumulatively, positioning itself as a game-changer in scalability performance, with heavyweight institutions like Circle already on board. Starknet's Nums application chain, as a Layer 3 gaming innovation, showcased the future of modular design.

Meanwhile, although Sonic EVM is not an Ethereum Layer 2, its Mobius mainnet launch on February 27 as Solana's first SVM chain extension has attracted significant attention, achieving 10,000 TPS and bringing $47.6 million in funds to Aave within a few days. These initiatives indicate that Layer 2 projects are doubling down on technology, rather than just hype.

Meanwhile, although Sonic EVM is not an Ethereum Layer 2, its Mobius mainnet launch on February 27 as Solana's first SVM chain extension has attracted significant attention, achieving 10,000 TPS and bringing $47.6 million in funds to Aave within a few days. These initiatives indicate that Layer 2 projects are doubling down on technology, rather than just hype.

Vitalik Buterin commented on February 19, emphasizing the need for Ethereum to define its own positioning in the increasingly competitive landscape. He is driving Layer 2 to take the lead in scalability (such as 17x transaction boost) and interoperability, noting that they have evolved from "advanced multi-sig" to powerful networks. Although he did not directly comment on Sonic EVM, its EVM compatibility and speed resonate with his vision of seamless integration into the "Ethereum universe." However, he also expressed dissatisfaction with the casino-like tendencies in the ecosystem, calling for a focus on real value rather than speculative bubbles.

Funding Situation

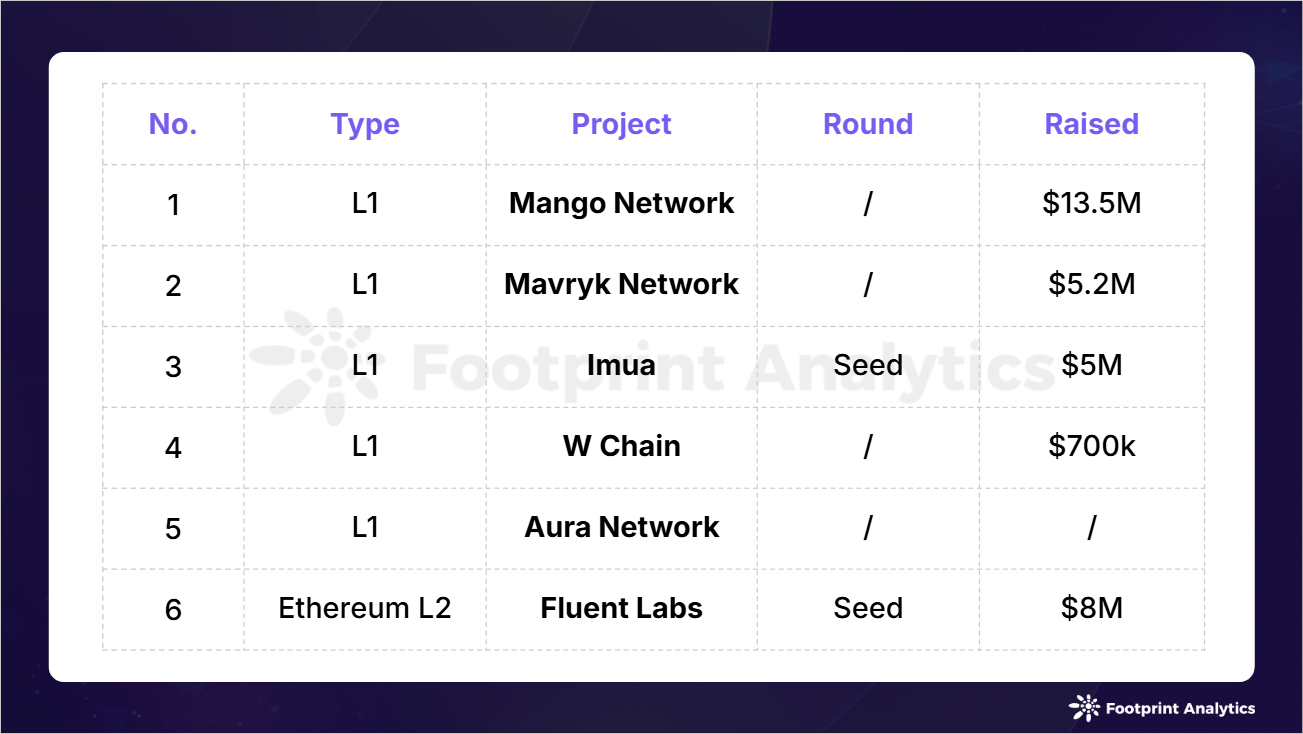

Funding activity has slowed down, with 6 deals completed in February, totaling $32.4 million. Mango Network raised $13.5 million for its EVM-MoveVM hybrid chain, planning to launch in Q1 2025. Fluent Labs received $8 million in funding to develop a multi-virtual machine Layer 2 connecting Ethereum and Solana.

Public chain funding events in February 2025 (Data source: crypto-fundraising.info)

Public chain funding events in February 2025 (Data source: crypto-fundraising.info)