Trump's tweet helped $ADA surge 60%, the policy narrative drove the market cap turnaround, Cardano transformed from a "Japanese public chain" to a "US strategic asset", but the on-chain ecosystem remains doubtful.

This is not the first time $ADA has surged due to a "policy narrative" in a bull market. Why can a public chain that has long been criticized for its "empty ecology" always leverage the trend?

VX: TTZS6308

Followin' the narrative, Bit the price pumping: Cardano's bull market script

Reviewin' Cardano's bull market history, it's apparently a "history of ridin' the trend":

2018 bear market: Promoted as an "academic blockchain", packaged the technical barrier with peer-reviewed papers and Haskell programming language;

2021 bull market: Transformed into a "green public chain", attracted ESG funds with the "carbon neutrality" concept;

2024 cycle: Bound to the "Bitcoin Layer2" narrative, announced the development of a cross-chain protocol without the need for a new token;

2025 outbreak: Riden' the tailwind of Trump's policy, became a "national-level crypto reserve asset".

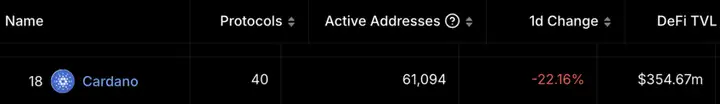

Each narrative shift precisely captured the market sentiment, but the ecological progress has always lagged behind. As of March 2025, Cardano's on-chain total locked value (TVL) was only $350 million, less than 5% of Solana's; the number of active addresses has long hovered around 100,000; in contrast, its staking data: $23.34 billion in staking volume, ranking fourth among PoS chains, with a 60.1% staking rate, showing that holders are more willing to "lie down and earn" rather than participate in ecosystem building.

Token as a product: $ADA's market cap alchemy

BitMEX co-founder Arthur Hayes once mocked: "Cardano's market cap is not written in code, but drawn in PPT." Its market cap management strategy presents multiple logics:

Technologizin' the future: The team is good at transforming academic concepts into capital expectations. The Hydra scaling solution to be launched in 2023 claimed "1 million TPS", but the actual implementation was only used for NFT minting; the "Bitcoin DeFi ecosystem" plan proposed in 2025 has no code revealed yet, but has already helped push $ADA up 40%.

Policy arbitrage: From cooperation with African governments to lobbying the US legislation, Cardano is constantly transforming geopolitical games into market cap fuel.

Token as a product, for Cardano, the price of $ADA has been among the top gainers in the past three bull markets, but the bear market declines have also reached as high as 90%.

Behind the frenzy: How far can the policy narrative go?

Although Trump's "crypto strategic reserve" has gilded Cardano, doubts continue to ferment:

Doubtful execution path: The US Congress has not yet approved the relevant budget, establishing a crypto reserve requires legislative process, and the current proposal lacks funding sources and operational details; Ripple CEO revealed in January that he had discussed including $XRP in the reserve with Trump, and now $ADA "hitching a ride" to be selected, which is accused of being a behind-the-scenes lobbying group operation; Hollow on-chain ecosystem: Taproot Wizards founder said: "No matter how high the staking rate, it cannot cover up the desert of the DApp ecosystem, this is not a strategic asset, but a strategic bubble."

The market may have already given the answer - $ADA price retreated more than 20% within 48 hours after Trump's post.

This frenzy once again proves the jungle law of the crypto market: when technological progress cannot keep up with capital ambition, narrative becomes hard currency. Cardano's survival skills may not be able to build a real moat, but it has indeed written an alternative textbook for the industry: how to use political tactics and imaginative storytelling to continuously "harvest faith" in the crypto chaos.