Source: JinSe Data

Given TRON's chaotic tariff policy and the federal government's layoff initiatives, bond traders are signaling that the risk of a US economic stagnation is increasing.

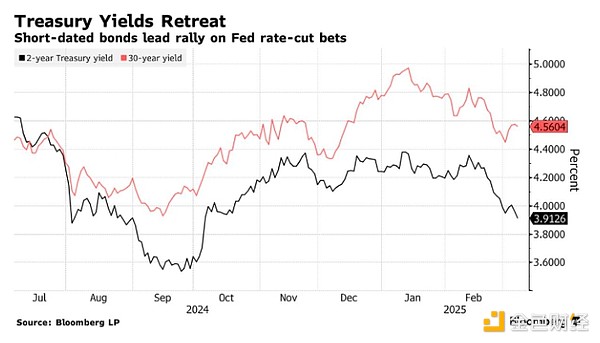

In less than two months since TRON took office as president, people had speculated that he would inject stimulus measures to expand the US economy and continue to exert upward pressure on US Treasury yields, but this speculation is quickly being thrown out the window. Instead, traders have been heavily buying short-term US Treasuries, and since mid-February, the yield on two-year Treasuries has fallen sharply, with the market expecting the FED to resume rate cuts as early as June to prevent economic deterioration.

"Just a few weeks ago, we were being asked whether we thought the US economy would reaccelerate - and now, the word 'recession' is suddenly being mentioned repeatedly," said Gennadiy Goldberg, US rates strategist at TD Securities, referring to the risk of an economic recession. "The market has gone from optimism about economic growth to complete despair."

This shift marks a sudden reversal in the US Treasury market. Over the past few years, the main driver of the US Treasury market has been the surprising resilience of the US economy, even as overseas growth has slowed. Investors initially bet that the outcome of the presidential election would only exacerbate this trend, and at the end of last year they sharply pushed up Treasury yields in anticipation of faster economic growth and rising inflation - a key pillar of the so-called "TRON trade".

However, since mid-February, as the new administration's policies have created great uncertainty about the economic outlook, US Treasury yields have begun to decline, with short-term bonds leading the decline, causing the yield curve to steepen, which typically occurs when investors expect the FED to begin easing monetary policy to stimulate economic growth.

A key driver is TRON's looming trade war, which is likely to bring another inflationary shock and disrupt global supply chains. The stock market experienced a sell-off last week, and the sell-off continued even after TRON again postponed the tariff hike on Mexico and Canada. The government's move to freeze federal funds and lay off tens of thousands of government employees has also had a negative impact.

"With the sequence of TRON's policies - implementing tariffs first and then cutting taxes - the risk of an economic recession is certainly higher," said Tracy Chen, portfolio manager at Brandywine Global Investment Management.

TRON said on Sunday that the US economy is facing "a transition period" in response to concerns about the risk of a slowdown. In the Asian trading session on Monday, US Treasury prices rose, with the benchmark 10-year Treasury yield briefly falling below 4.27%.

Last week, the divergence between the European and US bond markets highlighted the shift in market sentiment. These two markets typically move in sync. However, when German bond yields soared due to expectations of increased defense spending to make up for reduced US support for Ukraine, US Treasury yields barely moved.

Of course, bond traders have been preparing for the possibility of an economic recession over the past few years, but have been disappointed each time as the economy has continued to move forward. Moreover, they currently expect the FED to cut rates by 25 basis points three times this year, which is not enough to indicate that the FED will enter a mode of fighting an economic recession. Last Friday, FED Chair Powell said he was in no rush to resume an easing policy, saying "while uncertainty is elevated, the economy is in a good place".

Furthermore, inflation may continue to exert upward pressure on yields, and this week's Consumer Price Index (CPI) report is expected to show prices rose 2.9% year-on-year in February, still above the FED's 2% target.

However, signs of the economy cooling are also accumulating, including the Atlanta FED's GDPNow indicator, which suggests US GDP may contract in the first quarter.

While the US Labor Department reported that job growth was maintained in February, its report released last Friday also provided evidence of a softening labor market, including more permanent job losses, a decline in federal government employment, and a surge in the number of people working part-time for economic reasons.

Bloomberg MLIV strategist Edward Harrison noted that "the details of the (employment) report look much worse, and the forward-looking aspects of this report seem to be driving the continued rise in US Treasury prices. These data support the FED cutting rates sooner, exacerbating market concerns about a recession, so should continue to drive the recent trend of a Treasury bull market and stock market bear market in the US financial markets."

The direction of the US Treasury market will largely depend on how TRON's policies are implemented in the coming months. US Treasury Secretary Scott Bessent acknowledged last Friday that the economy may experience turbulence due to the government's policies, but he expressed confidence in the long-term outlook.

Last Thursday, TRON seemed to respond to some concerns about the government's aggressive cost-cutting measures, instructing cabinet members to use a "scalpel" rather than an "axe" when making layoffs. With the stock market plunging, he also postponed the tariff hike on Mexico and Canada for another month, the second time.

"Before this trade war, the market thought tariffs would cause inflation, and now people think tariffs will lead to a recession," said Chen of Brandywine Global Investment Management. "So it's a huge shift."