Original Title: The Secret Sauce of Hyperliquid

Original Author: @stacy_muur, CuratedCrypt 0 member

Original Compilation: zhouzhou, BlockBeats

Editor's Note: Why are whales so keen on Hyperliquid, a decentralized derivatives platform with up to 50x leverage, zero Gas fees, and a fully on-chain transparent order book, becoming a paradise for high-risk traders. Recently, according to BlockBeats news, several whales made multi-million dollar profits by opening high-leverage long and short positions after Trump announced a strategic crypto reserve. The platform's low-cost, high-leverage features, combined with the violent market fluctuations, have made whales flock to it, and Hyperliquid has thus become the new focus of contract trading.

The following is the original content (edited for better readability):

In the history of DeFi derivatives, few protocols have been able to occupy more than half of the on-chain perpetual contract market, but Hyperliquid has done so. What is its secret?

Data shows that within 24 hours, the total trading volume of on-chain perpetual contracts was $14.37 billion, and @HyperliquidX alone accounted for a staggering $9.3 billion, a share of 64.71%, demonstrating Hyperliquid's absolute dominance in the market.

However, most DEXs have struggled to match these aspects, often relying on:

AMM design (leading to high slippage for large orders, e.g., GMX);

Partial off-chain solutions (such as dYdX v3), which can affect transparency or increase the complexity of user experience.

Hyperliquid recognized this issue: if the user experience is poor or liquidity is insufficient, users will not migrate to the on-chain platform en masse. Therefore, the team is committed to providing "CEX-level speed and liquidity, but fully on-chain."

Hyperliquid's success proves the potential of DEXs in the face of giants like Binance. Binance's 24-hour perpetual contract trading volume was $97.22 billion, while the overall DEX trading volume was only $14.637 billion, of which Hyperliquid contributed $9.532 billion.

With Hyperliquid, the DEX trading volume can reach 15% of Binance; without it, this ratio would drop to 5%, leaving only $5.105 billion. This demonstrates Hyperliquid's driving force for DeFi trading.

This performance fulfills Hyperliquid's core promise - to provide a CeFi-level trading experience on a fully decentralized Layer-1.

Background and Origin Story

Origin and Team Composition

Hyperliquid was founded by @chameleon_jeff (a Harvard graduate and former quantitative trader at Hudson River Trading) and a small team of engineers from top institutions like MIT and Caltech.

They were involved in high-frequency trading (HFT) during 2020-2022 and turned to trustless solutions after the FTX collapse. Seeing billions of dollars disappear due to centralized custody, their goal became clear: to build a self-custodial alternative without sacrificing performance, and to choose a "no VC, self-funded" approach to ensure long-term alignment with users and traders, rather than catering to short-term investor interests.

Why Do CEXs Still Dominate?

Despite the collapse of major CEXs like FTX, user trading habits have not immediately shifted towards DeFi. Many traders still use centralized platforms like Binance, not because they ignore the custody risk, but because CEXs still have:

Fast and familiar interfaces

Deep liquidity

Advanced trading features (stop-loss orders, professional charting, etc.)

No Gas fees and seamless cross-chain experience

Low barriers and a convenient trading experience

2022 refers to the period after the FTX collapse (November to December). The 2025 data is an estimate as of March 6th. Hyperliquid recognized this shortcoming: if the user experience is poor or liquidity is insufficient, users will not migrate to the on-chain platform en masse. Therefore, the team is committed to providing "CEX-level speed and liquidity, but fully on-chain."

Building a Product with User Experience in Mind from Day One

1. Perpetual Contract DEX

Hyperliquid's core product is its perpetual contract DEX, which uses a fully on-chain central limit order book (CLOB) and supports:

Up to 50x leverage on BTC and ETH

Up to 20x leverage on SOL, SUI, kPEPE, and XRP

Up to 3x leverage on small-cap tokens

Hyperliquid was built from the ground up, providing higher openness than competing off-chain solutions and designed specifically for high-frequency trading (HFT) needs. Its features include:

Sub-second trade confirmations

Ability to process 100,000 orders per second

No or near-zero Gas fees for placing and canceling orders

These key factors make its user experience comparable to CEXs.

Advanced Trading Mechanics

Atomic operations: Supports atomic liquidations based on the latest oracle prices and hourly distribution of atomic funding rates

Asset safety checks: The platform performs asset safety verification at the end of each block

Order prioritization: Prioritizes order cancellations and limit orders only, protecting market makers from the impact of malicious liquidity

As of last week, Hyperliquid Perps' trading volume reached $66.5 billion, nearly 7 times that of the second-ranked Jupiter ($9.7 billion), and exceeding the total of the next 14 competitors ($33.6 billion).

Hyperliquid dominates 66% of the total trading volume of the top 15 perpetual exchanges.

2. Spot Exchange

Hyperliquid's spot exchange launched in mid-2024, initially supporting over 20 native assets, including HYPE and memecoins.

Compared to Hyperliquid's massive $106 billion perpetual contract market, the spot trading started small but is growing rapidly. By early 2025, with key updates, especially the addition of BTC, Hyperliquid is gradually becoming a formidable competitor in on-chain spot trading.

Back in mid-2024, Hyperliquid's spot trading was limited to its own token and a few other assets (like RAGE). This limited asset range deterred many professional traders who preferred mainstream assets like BTC, not just speculative tokens.

Messari analyst MONK predicted in a report that if Hyperliquid added BTC, it would be a game-changer, turning it into a one-stop platform covering both spot and derivatives trading, challenging centralized exchanges. This prediction was soon validated on February 15, 2025, when the Unit team launched the ability to trade BTC spot directly on Hyperliquid's order book.

What does this mean?

Surge in trading volume: Before the BTC listing, Hyperliquid's spot trading volume was only a small fraction of its $63 billion monthly BTC perpetual contract trading volume. Messari estimates that with the right assets, the spot trading volume could reach 20%-30% of the perpetual contract volume, a potential increase of tens of billions of dollars. With the BTC spot launch, other DEXs already have $33 billion in monthly BTC trading volume, and Hyperliquid is rapidly capturing this market share.

More assets to come: The Unit solution supports not only BTC but also lays the groundwork for introducing ETH, SOL, and even real-world assets in the future. This could make Hyperliquid the core market for crypto asset spot trading.

3. Hyperliquid HLP (Liquidity Vault)

HLP is a liquidity vault where users can deposit funds (primarily USDC) to serve as counterparties for the derivatives trading platform, and receive a share of the trading profits.

Purpose: To provide passive earning opportunities for users who do not want to actively trade, following the "house always wins" model, allowing depositors to benefit from trading activity.

Key features:

The user's deposited funds will be lent to traders for leveraged trading.

The returns are volatile, but the annualized yield reached 54% by the end of 2024.

4.Vaults (Copy Trading)

Hyperliquid provides copy trading (Vaults) functionality, allowing users to allocate funds to professional traders' strategies for automated trading.

Purpose: To allow ordinary users to profit from the expertise of top traders without having to trade directly themselves.

Core features:

Anyone can create a Vault and manage the funds, with the manager needing to hold at least 5% of the position and receiving a 10% profit share.

Users can browse the performance of different Vaults and choose to invest, realizing profit sharing.

5.HIP-1 and HIP-2 Token Standards

Hyperliquid has introduced two innovative token standards to enhance its ecosystem:

HIP-1: Native token protocol, allowing users to issue custom tokens (such as PURR, a meme coin launched as a proof of concept) on the Hyperliquid L1.

HIP-2: Liquidity solution, providing a market-making strategy for the tokens issued under HIP-1, ensuring liquidity without relying on external platforms (unlike Pump.FUN).

Core features:

HIP-1 tokens can be directly used for spot and perpetual contract trading on Hyperliquid.

HIP-2 is customized market-making by the Hyperliquid team, leveraging their quantitative trading capabilities to provide liquidity support.

Example: PURR has a native ledger, spot order book, built-in oracle, and perpetual contract trading, demonstrating how these standards can build a composable trading ecosystem.

Hyperliquid's Technical Core

From perpetual contracts to spot trading, all of Hyperliquid's products are built on its custom blockchain - Hyperliquid Layer 1. On February 18, 2025, HyperEVM was officially launched on the mainnet.

Hyperliquid's blockchain can currently process over 20,000 transactions per second (TPS), supporting a powerful ecosystem including perpetual contract trading and a BTC spot market. Based on the HyperBFT consensus, its L1 has evolved from an initial professional trading platform to a general-purpose blockchain.

Key Optimizations of HyperBFT

Significantly increased TPS: Previously limited to 20,000 TPS by Tendermint, the upgrade can now handle 200,000 TPS.

Faster processing speed: The consensus process does not stall due to execution, with transactions being continuously ordered without waiting for the current block to complete.

Lower latency: Confirmation times are faster and more stable, only affected by network latency.

Optimistic responsiveness: Block generation speed depends on the communication efficiency of the validators.

HyperEVM: Full Layer-1 Capabilities

HyperEVM integrates a general-purpose EVM network into the Hyperliquid blockchain state, forming a dual-VM architecture:

Native VM: Optimized for high-performance trading.

EVM layer: Supports permissionless third-party development.

The HyperBFT upgrade, combined with the introduction of BTC spot trading, has gradually transformed Hyperliquid into a more powerful and versatile trading platform.

How does Hyperliquid compare to...?

Hyperliquid vs. Other DEXes

Fully on-chain vs. Partially off-chain

Hyperliquid uses a fully on-chain central limit order book (CLOB), while many DEX competitors (such as dYdX v4) still rely on partially off-chain order books. Hyperliquid's approach ensures verifiability and a transparent matching engine, avoiding dark pool operations and front-running issues.

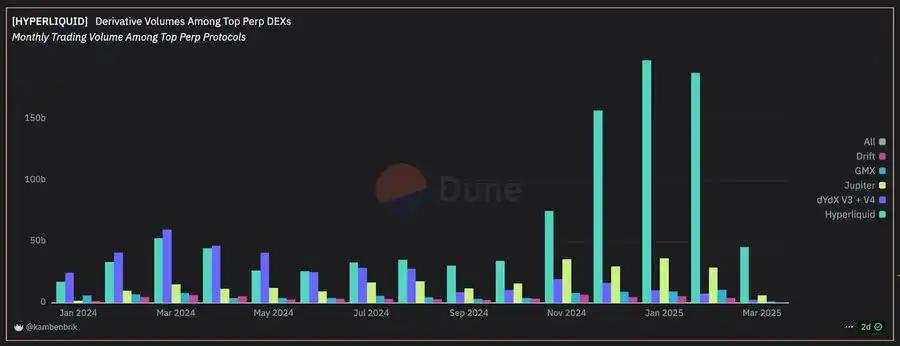

Dominance in the perpetual contract market

As of February 2024, Hyperliquid accounted for 56% of the on-chain derivative DEX trading volume. Since July 2024, its monthly perpetual contract trading volume has surpassed the major competitors. In January 2025, Hyperliquid's monthly perpetual trading volume reached $196 billion, while the other four major protocols totaled only $60 billion.

Performance and market maker prioritization

Hyperliquid's custom Layer-1 and consensus mechanism (HyperBFT) allow it to handle sub-second latency and around 100,000 transactions per second. This is specifically designed for high-frequency trading. Other DEXes based on general blockchains have to share block space with many other transactions, making it more difficult to maintain high throughput.

Comparison with CEXes

Trading volume gap and growth trajectory

Although Hyperliquid is still smaller than top CEXes like Binance, it has narrowed the gap in some months, reaching over 26% of the total trading volume shown (compared to Binance's top 100 spot trading pairs) by March 2025. This comparison highlights how a high-performance on-chain perpetual contract exchange can effectively challenge and even dominate centralized spot markets.

On-chain transparency vs. centralized control

CEXes typically have proprietary off-chain engines, which may lack transparency in order routing, fees, or front-running. Hyperliquid's fully on-chain design allows anyone to verify transactions in real-time.

Future goal: "On-chain Binance"

Analysts have described Hyperliquid's bullish case as developing into an on-chain Binance equivalent. It has already provided perpetual contracts and a growing spot market, recently launching BTC spot, and now with HyperEVM running on the mainnet, it is starting to attract a wider range of DeFi applications.

Beyond becoming a product leader in the DeFi derivatives space, Hyperliquid's rapid success has relied not only on its performance, but also on its community-first ethos.

Hyperliquid's Community: A Trading Platform Built for Traders

Community-First Token Distribution

No venture capital dilution: Hyperliquid's team self-funded the development, avoiding the situation of private investors owning a large stake. This ensures the tokens are not diluted by venture capital, in contrast with competitors like dYdX (over 50% to investors) or GMX (30% to insiders).

Generous airdrops:

Genesis airdrop (31% of supply): Distributed to 94,000 early users, averaging around $45,000 per person. This rewards real users, not speculators.

Loyalty program: The non-transparent reward mechanism discourages Sybil attacks, favoring loyal users over bots.

76% community allocation: Over 3/4 of the $HYPE tokens are allocated to the community (airdrops + incentives), ensuring alignment with long-term growth.

Listening to users

Direct feedback has built a community with shared interests. The team reached out via private messages to traders like @HsakaTrades (500k+ followers) and @burstingbagel, and based on their feedback, established Vaults (e.g., a 20%+ annualized yield Delta-neutral strategy) and HLP. Since 2024, over 50% of feature updates have come from user requests, making traders co-creators rather than just users.

Building trust through reliability

A reliable product can retain users in a skeptical market. Traders initially came for the airdrop, but stayed because Hyperliquid provided 1-second deposit speeds, deep liquidity in HLP, and 99.9% uptime, unlike competitors that frequently experience downtime.

Hyperliquid was not the first DEX to launch perpetual contracts, but by optimizing trading speed (sub-second order execution), liquidity (over $540 million in HLP pools), and user experience (solving withdrawal delays ignored by competitors), it achieved 100,000 daily transactions, successfully breaking the "dYdX or GMX have already 'finished' the derivatives market" narrative.

Assistance Fund

When traders use the Hyperliquid platform, they pay transaction fees, a portion of which is allocated to an Assistance Fund (AF).

This foundation continuously purchases HYPE tokens from the market, creating sustained buying pressure. As trading volume increases, more fees flow into AF, further driving demand for HYPE. To date, AF has accumulated 16.63 million HYPE tokens, accounting for 4.97% of the circulating supply, currently valued at approximately $267.24 million. The rapid growth of Hyperliquid is evident, with the perpetual trading volume reaching $196 billion in January 2025 alone.

What does this mean for the end-user?

For HYPE holders and traders, this system creates a self-reinforcing value cycle. As Hyperliquid trading activity grows (as shown in the chart below), the purchasing power of the aid fund will also grow, ultimately benefiting long-term token holders.

Self-reinforcing cycle: More trading → More fees → More buybacks → Token value appreciation.

User-centric product design

Gas-free trading: Gas fees are only incurred when the trading state expands (e.g., spot listing or transfer to a new wallet).

No KYC required: Registration through email or a crypto wallet (such as MetaMask).

Intuitive interface: Designed for both beginners and advanced traders, with a layout similar to centralized exchanges (like Binance).

Near-instant settlement: Sub-second block times support real-time trading.

High throughput: Capable of processing over 200,000 transactions per second, without delays even during peak activity.

Easy funding: Deposit USDC via Arbitrum (with plans to support native multi-chain in the future).

Gamified design: Leaderboards and competitive rewards (e.g., airdrops to top traders) to foster a sticky, highly engaged community.

Decentralization roadmap

While Hyperliquid's L1 is initially operated by a team-run validator set (to optimize performance and enable rapid iteration), it is gradually evolving towards a multi-validator network and a distributed node framework:

Expanding the validator set (from 16 to over 100 nodes).

Read-only nodes: Third parties can run nodes to verify the chain's state and block production.

Long-term deployment plan: As the ecosystem matures, the team plans to introduce stronger staking and validator onboarding mechanisms, moving towards a trustless model akin to leading Proof-of-Stake networks.

Team incentive alignment: Since fees currently flow to the protocol treasury and LP providers (rather than the founding team), the team's future compensation is tied to the upcoming token, aligning with the long-term chain performance and decentralization goals.

Looking ahead, Hyperliquid is evolving from a focused perpetual contract DEX into a full-fledged exchange ecosystem, with the addition of BTC spot trading, the launch of HyperEVM on the mainnet, and the expansion of the validator set, showcasing its ambition to become the "on-chain Binance".

By combining the high performance of CeFi and the transparency of DeFi, it has captured 64.71% of the on-chain perpetual contract trading volume, demonstrating how a successful community-driven approach can propel a DEX to challenge even the largest centralized platforms.

What is the secret to Hyperliquid's success?

1. Self-funded, no VC model: Ensures user token ownership, reduces selling pressure from private sales, and prioritizes the interests of genuine traders over short-term investors.

2. User-centric token distribution: Generous airdrops (31% of supply to early users, ~76% to the community overall), dynamic vesting to prevent Sybil attacks, and a buyback fund to benefit holders.

3. High-performance Layer-1 (HyperBFT + HyperEVM): Sub-second confirmations, 100k+ order throughput, and EVM compatibility, providing the speed and composability for future DeFi expansion.

4. Fully on-chain CLOB: Transparent order matching and minimal slippage, bridging the liquidity gap that typically binds traders to CeFi.

5. Spot and perpetual contracts under one roof: Seamless access to core markets: the newly launched BTC spot and a powerful perpetuals offering. Users can manage spot and leveraged positions on a single platform.

6. Community-driven feature development: Direct feedback loops (user requests for Vaults, HLP enhancements, cross-chain bridges) engage traders and shape ongoing improvements.

7. Long-term decentralization vision: Gradual expansion of the validator set, open read-only nodes, and a fee structure without team profits, ensuring incentive alignment and a progressive move towards trustlessness.

By combining technical excellence, community-first incentives, and an uncompromising user experience, Hyperliquid has charted the blueprint for DeFi success.

Its "secret" is essentially the perfect fusion of institutional-grade performance and grassroots user access - a combination that redefines on-chain trading and paves the way for a broader decentralized finance future.