Here is the English translation of the text, with the specified terms translated as instructed:

If someone stayed up late to watch the Trump White House crypto summit, they would likely be quite disappointed. The entire summit completely matched the stereotypical image of Trump - absurd and full of performance traces. In the weeks before the summit was held, the industry was like facing a major exam, researching the meeting topics, digging into the participants, imagining possible dialogues, and paying attention to the participating journalists, afraid of missing any of the wealth codes brought by the first White House crypto conference. And just on the eve of the summit, a flurry of news came, one moment the crypto reserve list was released, the next moment the Bitcoin strategic reserve was established, which once again raised expectations high in the minds of industry insiders, "the big one is coming."

Unfortunately, while high-profile slogans of "establishing the crypto direction for the next four years" were raised, there was no mention of any implementable policies throughout the event, and the market also successfully fell in this incomprehensible summit, with Bitcoin falling from $91,000 before the meeting to $85,000, currently continuing to decline, once falling to $80,000, and now reported at $82,000.

Raised high and gently put down, but after all, it was the White House crypto summit, and it still released some effective signals.

First, it should be noted that this crypto summit was a closed-door event, and prior to that, the participants had been thoroughly investigated, with about 30 senior government officials, members of Congress, and corporate executives attending the event, with the leaders gathered together. In addition to the most heavyweight guest, President Trump, there were senior officials from the government side, such as David Sacks, the White House's crypto and AI chief, Tom Emmer, the House Majority Whip, and Bryan Steil, the chairman of the House Digital Assets Subcommittee, as well as top platforms and well-known companies, including Ripple, BitGO, Crypto.com, Kraken, Coinbase, Chainlink, Mara, Gemini, Robinhood, and Trump's crony WLFI, as well as top capital firms such as a16z, WisdomTree, Paradigm, and Multicoin.

Although it was a closed-door summit, there was still an official live stream link at the beginning of the meeting, giving the market an important window to listen to the summit content. Unfortunately, the official live stream was abruptly cut off in less than 20 minutes, and in this short 20 minutes, apart from less than 5 minutes of Trump's speech, a large-scale workplace Machiavellian study was also being performed.

The summit, originally scheduled to start at 4 o'clock, was delayed by about 45 minutes, and the market had been eagerly waiting for Trump's long-awaited arrival. But the first topic Trump started with was not crypto, but the upcoming 2026 World Cup soccer tournament. He first had FIFA President Gianni Infantino display the World Cup trophy, and then casually mentioned that Bitcoin's value is higher than FIFA, before returning to the main topic.

Trump thanked his right-hand men for attending, and in his usual fashion, he harshly criticized the Biden administration's "stupid" decision to sell Bit and stifle Action 2.0, and after announcing that he would introduce legislation to provide clarity on stablecoin and digital asset market regulation, with the hope of submitting it to the President's office in August, he ended his speech.

Then it was the turn of various regulatory officials and industry leaders to speak, and the expected insightful views evaporated into thin air, as everyone started with thanking the great President and ended with thanking the President's wisdom, turning the summit into Trump's far-sighted boasting camp, which is quite rare for a serious meeting hosted by the top leader.

It is clear that the value of the summit is more in the form than in the real discussion of industry development. In other words, this is Trump's feedback on the attitude towards crypto supporters, as well as the political endorsement of crypto being included in the campaign agenda. But based on the speeches, Trump is not a seasoned crypto enthusiast, lacking attention to the DeFi application areas that the industry is focused on, and not even mentioning the crypto tax exemption that the market had anticipated. His attitude towards crypto is more like "as long as it can make money, it's a good cat, whether it's a black cat or a white cat."

Of course, this summit was not entirely without information. Trump's speech did release some signals.

First, the strategic Bit reserve will become the 'virtual Fort Knox' of digital gold, to be stored by the U.S. Treasury Department. Compared to the previous market speculation on the increase in reserves, Trump stated that the Treasury Department and the Department of Commerce will also explore new ways to increase the holdings of Bit reserves, on the premise that there will be no cost to taxpayers.

Secondly, in terms of regulation, Trump maintained his consistent deregulatory attitude, clearly stating that he will end Action 2.0 (the Biden administration's attempt to curb crypto activities by banning crypto access to banking services), and the Office of the Comptroller of the Currency (OCC) also reiterated that the federal banking system can legally custody crypto assets, hold deposits as stablecoin reserves, and use blockchain technology to facilitate payment business.

The most important information is about stablecoins. There have been market rumors that Trump is very interested in stablecoins, and his family project WIFL has also mentioned plans to enter the stablecoin field. This speech confirmed this signal. Lawmakers are pushing for legislation on dollar-backed stablecoins and digital asset market regulatory clarity, and Trump believes this will become a "highly promising" growth model, hoping that Congress can submit the relevant legislation before the August recess. It is worth emphasizing that he also mentioned that "the status of the dollar will remain stable in the long term."

From the remarks on stablecoins, it can be seen that the U.S. dollar stablecoin will be an important part of Trump's crypto policy. Faced with the impact of cryptocurrencies on sovereign currencies, the U.S. has adopted a strategy of "better to be leaky than to be blocked," emphasizing the establishment of its own rules and the control of discourse power, and constructing the influence of the U.S. dollar through the control of the core value benchmark. In fact, this approach is quite similar to the U.S. claim on oil.

Specifically, stablecoins are the key pricing tool in the crypto market, and only U.S. dollar stablecoins can drive cryptocurrencies to be priced in U.S. dollars, rather than allowing decentralized currencies to shake the foundation of U.S. dollar hegemony. In other words, U.S. dollar stablecoins can become another tool for the U.S. dollar to dominate the decentralized field. Through the widespread application of stablecoins, the U.S. dollar hegemony can be further extended to the crypto field, thereby making digital currencies an appendage and derivative of the U.S. dollar. In this context, even if the world enters the digital currency era, the U.S. dollar will still be the first currency.

In addition, the reason for the establishment of the Bit reserve can also be seen. Bit is a key pillar in the crypto field, and it is most controllable to be priced in U.S. dollars and established on the solid foundation of U.S. dollar hegemony. This is also why the "Made in America" coins have taken the lead in this round of altcoin market, while the industry's more concerned ETH and DeFi have been cold-shouldered by the government, and they can only gain enough policy narrative by integrating into the system based on U.S. dollar pricing and U.S. priority.

On the other hand, Trump's speech also reveals his core attitude towards cryptocurrencies. The U.S. authorities hope to use tokenization to alleviate debt pressure, rather than promote the development of coin prices. Whether it is the access to banking services or the legislation of stablecoins, it is all to lay the foundation for this purpose. It can be foreseen that on-chain U.S. debt tokenization may become a focus in the future. A subtle corroborating evidence is that in the speech, Trump no longer used the term "cryptocurrency" (Crypto), but replaced it with "digital asset" to emphasize stability and compliance, which will become the main theme of the industry.

Although there was some substance, there was more nonsense. Given the high expectations, this summit was no exception in once again disappointing the market.

Here is the English translation:

The price of Bitcoin also fell from the previous $91,000 to around $85,000, and ETH also fell back to around $2,000. More interestingly, the previous list of crypto reserves also caused a blunder, and David Sacks explained that "the President mentioned the top five cryptocurrencies by market capitalization, and people have interpreted it a bit too much." Cardano founder Charles Hoskinson even stated that he was unaware of the plan to include ADA in the strategic reserves, and said he did not know why ADA would be included in the reserves. Currently, tokens such as XRP, SOL, and ADA that the President had "handpicked" have all declined, with SOL falling below $130, currently trading at $127.

In addition to the disappointing summit, Bitcoin's strategic reserves also encountered problems. On March 10, the much-anticipated Utah State Senate passed HB230, the Blockchain and Digital Innovation Amendment Act, but ultimately removed the original provision allowing the state treasury to invest in Bitcoin, also disappointing the market. Currently, of the 31 state Bitcoin reserve bills introduced, 25 are in progress, including bills from Illinois, Iowa, Kentucky, Maryland, Massachusetts, New Hampshire, New Mexico, North Dakota, Ohio, and Oklahoma.

Overall, although policies have been frequent, regulatory easing has become a fact, and strategic reserves have also been established, the current market's upward momentum is still clearly insufficient, and the price of Bitcoin continues to be under pressure from macroeconomic development and global trade issues, and the bugle of the policy bull market seems to have come to an end.

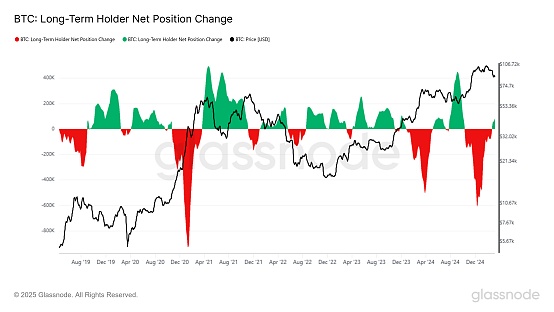

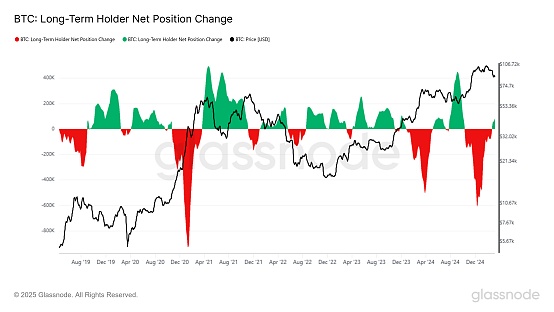

Looking at the future market, the market's prediction of the market trend is also hesitant. Julio Moreno, research director of CryptoQuant, wrote that the growth in spot demand for Bitcoin is contracting, and Bitcoin's short positions are dominant in the futures market. This contraction is the largest decline since July 2024, indicating that market participants are unwilling to establish new positions, and long-term holders (LTH) have shifted from distribution to holding, also signaling the end of the uptrend.

And just today, BitMEX co-founder Arthur Hayes posted on social media again, saying that the market had a poor start this week, and Bitcoin may retest the $78,000 support, and if it breaks through, the price will point to $75,000.

Interestingly, the market is fair, and the Trump family project WLFI investment portfolio is currently down about $110 million, with the $336 million worth of 9 tokens now worth only $226 million. It is worth mentioning that in response to President Trump's coin issuance, David Sacks also responded, saying "I don't think it has any impact, it's unrelated to the work we're doing here," and further stated that Trump's personal investment in crypto is "a fact without evidence."

From the current situation, the market is at the junction of bull and bear, the signals are not clear, the short-term downward pressure is more obvious, the existing policy stimulus effect is gradually decreasing, and under the changing global situation, the "water absorption" capacity of the crypto market itself is facing a major test. The big one is basically over, conspiracy theories are flying all over the sky, and it is crucial to hold on to your own wallet.