Market Situation

The risk asset plunge last night can be described as a "bloody night". On the US stock market, the S&P 500 index recorded its worst single-day performance since 2022, with a market value evaporation of $1.4 trillion. Tech stocks led the decline, with Tesla's stock price falling 15%, reflecting the market's repricing pressure on high-valuation growth stocks. MicroStrategy, as a representative of Bitcoin-related stocks, saw a 16.68% drop, further highlighting the correlation between cryptocurrencies and traditional markets. In a report released on March 11, Citigroup strategist Dirk Willer downgraded US stocks from "overweight" to "neutral" and upgraded Chinese stocks to "overweight", indicating that the "US exceptionalism" thesis has at least temporarily paused. This suggests that the global capital flow may be undergoing a structural change.

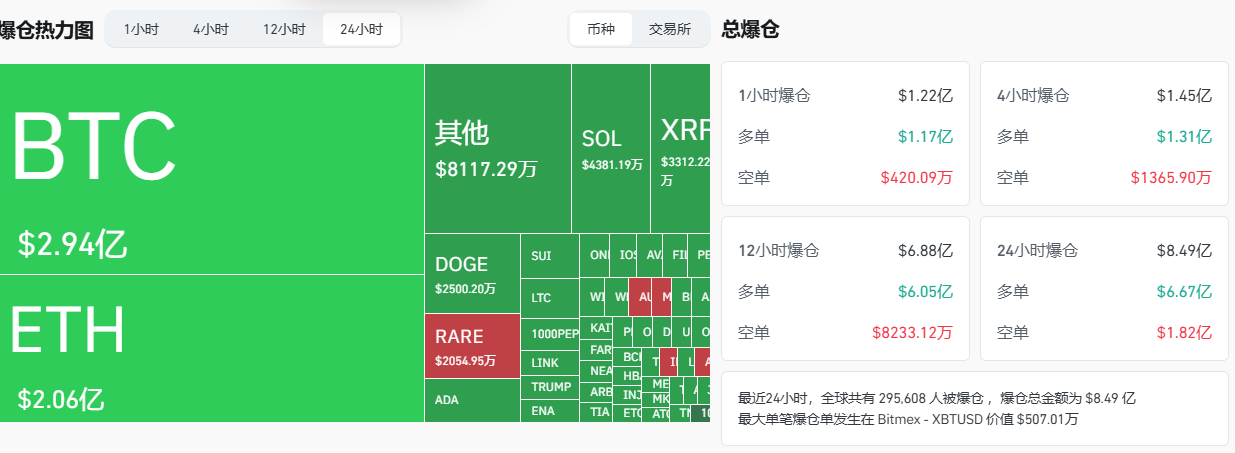

The cryptocurrency market was also not spared. Bitcoin fell below $77,000, Ethereum fell to $1,830, and the global liquidation amount reached $833 million within 24 hours.

On-chain data shows that a whale sold 25,800 ETH at an average price of $1,853 to avoid liquidation, obtaining $47.81 million in USDT for repayment. However, this batch of ETH was leveraged-bought by the whale at an average price of $3,084 in July 2024, resulting in a loss of $31.75 million on this part alone, highlighting the risks of high-leverage trading. Additionally, the Solana network transaction fee has dropped to the lowest level since September 2024, with only 53,800 SOL in fees generated last week, a decrease of 85% from the January peak (361,000 SOL), indicating a significant slowdown in market activity.

Behind this plunge, the macroeconomic signals are not optimistic. The yield spread between the 10-year and 3-month US Treasury bonds (10Y-3M) has turned negative again, and the yield curve inversion has intensified, a signal that has preceded every economic recession in the past 50 years. The short-term Treasury yield is dominated by the Federal Reserve's federal funds rate, while the long-term Treasury yield reflects economic growth and inflation expectations. The inversion indicates that investors are flocking to long-term Treasuries for safe-haven, pushing down their yields, and losing confidence in the economic outlook.

How to View the Future Market?

This plunge has led many to ponder: this could be an artificially created recession, with a "first suppress, then stimulate" script behind it. In simple terms, some believe that Trump's policies deliberately made the economy temporarily worse, in order to force the Federal Reserve to cut interest rates, ultimately allowing the market to rebound. His "Government Efficiency Department" (DOGE) plan aims to cut 75% of federal agencies, from 428 to 99, and may lay off 17.71 million civil servants, accounting for 14.83% of the US workforce. This means that the unemployment rate may rise from the current 4% to 5%, and past data tells us that once the unemployment rate reaches 5% and is still rising, the Federal Reserve usually cuts interest rates to rescue the situation. Additionally, Trump's tariff policy will increase corporate costs and slow economic activity. On March 9, he said in an interview with Fox News: "The economy will go through a transition period." He acknowledged that tariffs may push up prices, but also said: "Interest rates will go down." He does not deny the risk of a recession, but emphasizes "We need to bring wealth back to America, and it will take some time, but the result will be good."

There is also a background in the market: Trump has always wanted the Federal Reserve to provide ample liquidity, such as printing money or cutting interest rates, but his desired Bitcoin strategic reserve lacks the financial support, and the gold revaluation was also rejected by the Treasury Secretary. How to force the Federal Reserve to loosen its grip? Engineered recession is a way. For example, the Atlanta Fed's forecast on March 3 showed that US economic growth in the first quarter of this year plummeted from 2.32% to -2.82% in just five days, with recession signals becoming increasingly evident. The Financial Times said that Wall Street had a tough time last week due to the uncertainty of tariffs, with tech stocks being sold off and the market fluctuating wildly. However, Trump was unfazed: "They're always yelling for clarity, that's an old story. The globalists have emptied America, and we're just taking back what's ours." In his view, this recession is a planned event, and once the unemployment rate rises and the yield curve inverts further, the Federal Reserve will have to cut interest rates and provide liquidity.

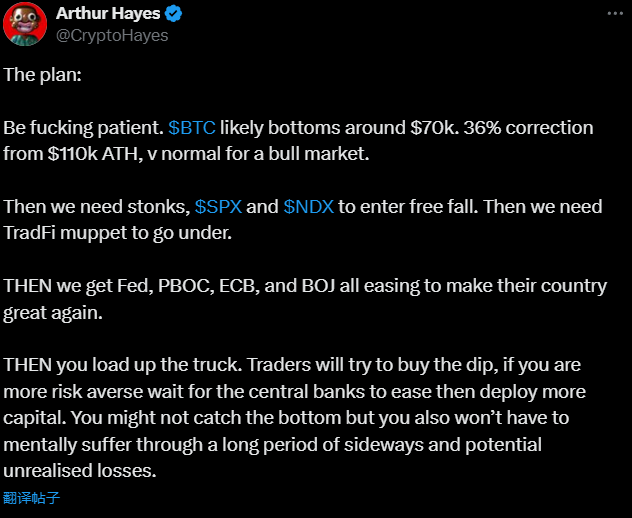

Arthur Hayes shares this view. He believes that Bitcoin may fall to $70,000, a 36% drop from the peak of $110,000, which is quite normal in a bull market. Next, the US stock market may crash, and even some traditional financial institutions may not survive. Only then will the Federal Reserve, the People's Bank of China, and other major players step in to provide easing, rescuing the economy. He advises investors not to be in a hurry to buy the dips, "Wait for the central banks to start providing liquidity before adding positions, you may miss the lowest point, but at least you don't have to go through the trough with a heavy heart." This is in line with Trump's strategy: let the economy take a tumble first, then rely on global central banks to rescue the market, and the market will then experience a big rebound.

What to Watch Out for This Week

There are several key events this week that may affect market trends, and investors need to pay close attention:

Tuesday: CPI Data Release The US Consumer Price Index (CPI) data will directly impact inflation expectations. If inflation remains high, it may delay the Federal Reserve's interest rate cut plan in the March 19 dot plot, exacerbating market volatility. Conversely, if inflation eases, it may boost rate cut expectations and alleviate pressure on risk assets.

Before March 14: Government Budget Deadline The US Congress must pass a new budget this week, or the government will shut down again. Trump acknowledged in a recent FOX interview that his policies may cause turmoil in the US stock market, and Treasury Secretary Yellen also said the economic transition period will be "difficult." The uncertainty surrounding the budget bill may further undermine market confidence.

Tuesday: Bitcoin-related Plans US Representative Nick Begich and Senator Cynthia Lummis are pushing for important Bitcoin-related plans, which are expected to be announced on Tuesday. This may involve Bitcoin strategic reserves, and if progress is made, it could instill confidence in the cryptocurrency market.

Additionally, the 10-year Treasury yield trend is worth watching. If the yield breaks above 5%, it may trigger a mini financial crisis, forcing the Federal Reserve to take easing measures; if it falls back, it may provide some breathing room for the market.

How to Operate at the Moment

As the current market volatility intensifies, risk management is crucial. For Bitcoin investors, the following strategies can be considered:

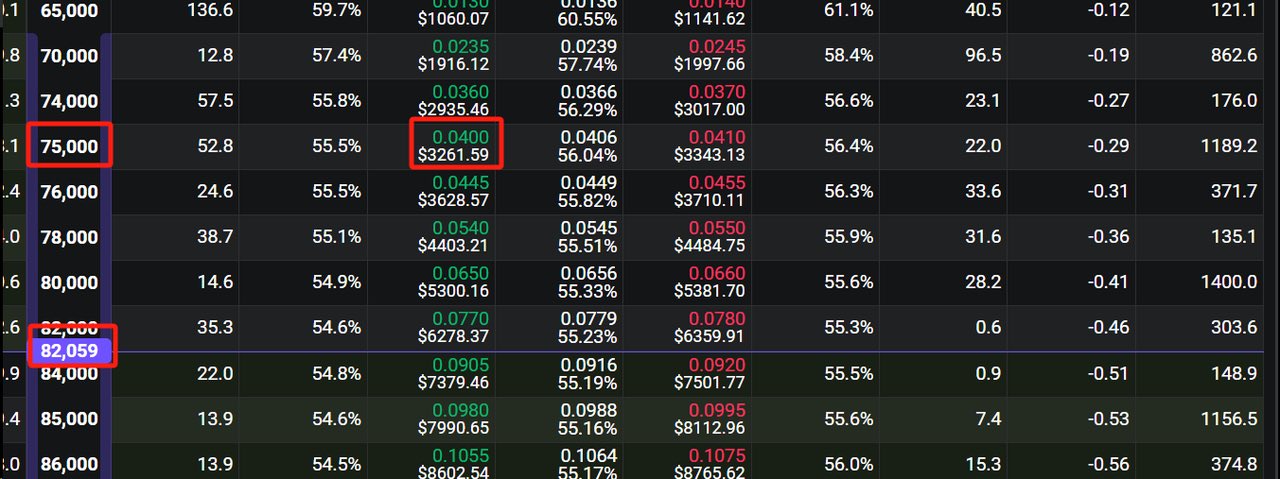

Sell Put Option Strategy

The Bitcoin Volatility Index (DVOL) is 58.41, and selling April-expiry $75,000 put options can generate a 4% premium income, with an annualized yield of around 41.7%.

- If the Bitcoin price is above $75,000 at expiration, investors can keep the premium as profit.

- If the price falls below $72,000, investors will need to buy Bitcoin at $75,000, suitable for long-term holders who want to accumulate at a lower price.

This strategy is suitable for investors who have the intention to hold Bitcoin and also want to earn additional income. Given the high market uncertainty, the premium income can serve as a buffer.

Overall Recommendation

- Short-term caution: US stocks and cryptocurrencies may come under further pressure in the short term, it is suggested to hold more cash and wait for clearer signs of recession or easing.

- Buy the dips: If the unemployment rate rises to 5%, the 10-year Treasury yield breaks through 5%, or the Fed signals rate cuts, consider building positions in batches.

- Risk control: Avoid high leverage operations, pay attention to on-chain data (such as whale movements) and macroeconomic indicators (such as the yield curve).

Conclusion

The sharp drop in risk assets last night was not only a market adjustment, but also a microcosm of the macroeconomic and policy game. The Trump administration's radical policies may exacerbate the risk of recession in the short term, but may also pave the way for subsequent monetary easing, playing out the "first suppress, then stimulate" script. Investors need to remain vigilant, closely monitor this week's CPI data, budget bill progress, and Bitcoin-related policies, while flexibly adjusting their strategies and seeking opportunities in the turbulence. The market is at a crossroads, and caution and patience will be the keys to success.