Author: Zuoye

VCs and market makers are the main front-end barriers of the exchange

Airdrops and Memes kick off the process of re-evaluating the on-chain value system

The more complex token economics of the project teams conceal the lack of growth

Retail investors have been a bit annoyed lately, first with the ups and downs of RedStone, where retail investors' resistance ultimately failed and RedStone still got listed on Binance, and then with GPS pulling out the radish and taking the mud with it, Binance cracking down on market makers, demonstrating the absolute power of the Cosmos.

The story won't be perfect, as VC tokens gradually decline, value tokens become an excuse for project teams and VCs, market makers to offload, completing the trilogy of foundation establishment, airdrop plan launch and exchange dumping during each market turbulence period.

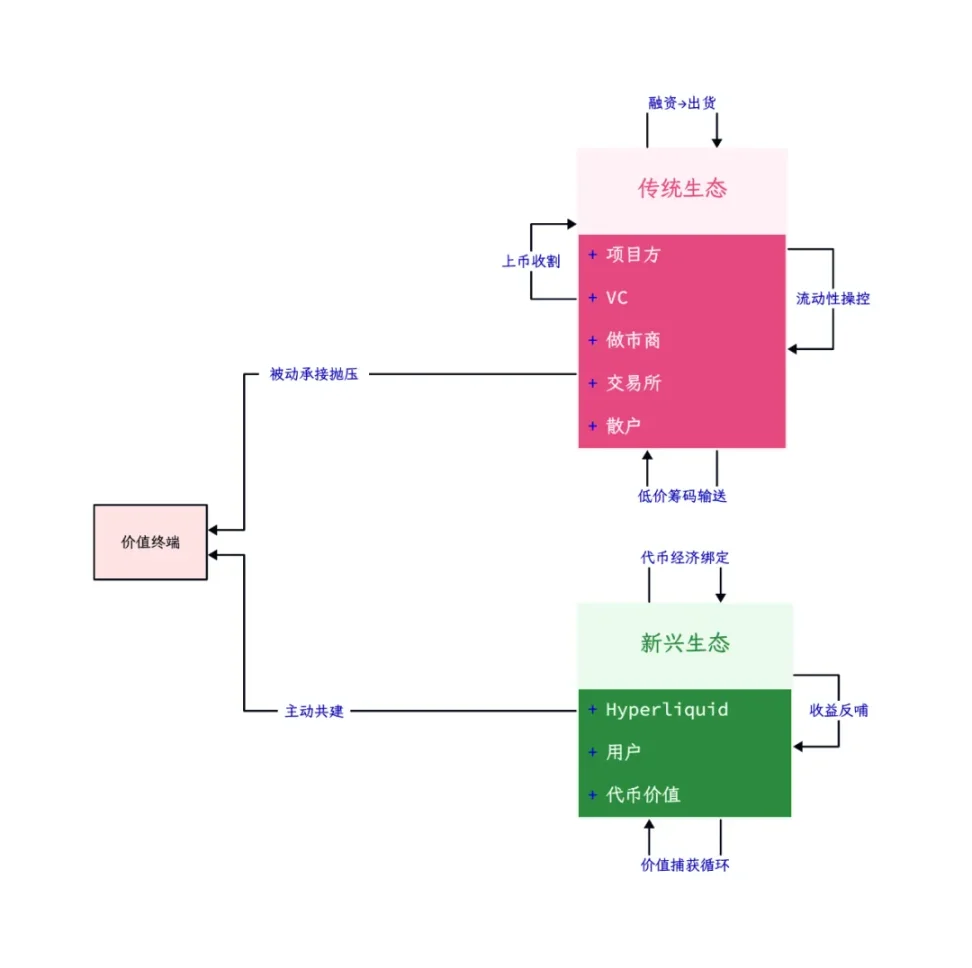

Caption: Traditional and emerging value circulation, image source: @zuoyeweb3

We can predict that ecosystems like Babylon and Bitlayer will repeat this process, and we can review the bizarre trends and project performance of IPs after listing, which have nothing to do with the project itself, but are positively correlated with the crazy buying power of Koreans, and it is not excluded that market makers, project teams and exchanges are working together.

That's why Hyperliquid's roadmap is truly unique, with no investment, no big exchanges and no interest separation, achieving a balance between project teams and early users, with all protocol revenue empowering its own token to meet the value preservation needs of the later token buyers.

From the performance of IPs and Hyperliquid, the unity and empowerment of the project teams themselves can suppress the concentration of chips and dumping behavior of the exchanges and VCs.

Ebb and flow, as Binance pushes market makers to the forefront, its own industry barriers are rapidly collapsing.

A self-fulfilling prophecy, the emergence of RedStone

In my world, RedStone is buried 16 layers underground and needs to be mined and ground before use.

In the entire mining process, the exchange, relying on its absolute flow effect and liquidity, becomes the final destination of the token, in this process, the surface is the win-win of the exchange and the users, the exchange gets more tokens, thereby attracting users, and users can access new assets to seek potential returns.

On this basis, the empowerment value of platform tokens like BNB/BGB can be superimposed to further consolidate its own industry position.

But since 2021, with the participation of large Crypto VCs in Europe and the US, the initial valuation of the entire industry has been too high, taking the cross-chain bridge industry as an example, the final disclosed valuation before listing was that LayerZero was valued at $3 billion, Wormhole at $2.5 billion, Across Protocol at $200 million in 2022, and Orbiter at $200 million, while the current FDV of the four projects are $1.8 billion, $950 million, $230 million and $180 million respectively.

Data source: RootData&CoinGecko, chart: @zuoyeweb3

The endorsement effect of adding each Big Name to the project is actually at the expense of retail investors.

From the VC token storm that started in mid-2024 to the "He Yi" girlfriend token AMA storm in early 2025, the relationship between the exchange and the VC has become untenable on the surface, the VC's own endorsement and listing assistance effect has become ridiculous under the frenzy of Memes, the only remaining function is to provide capital, driven by the return rate, token investment has effectively replaced product investment.

At this point, Crypto VCs are at a loss, Web2 VCs can't invest in DeepSeek, and Web3 VCs can't invest in Hyperliquid, a new era has officially ended.

After the collapse of VCs, the exchange can only rely on market makers to act as a shelter for retail investors, as users on-chain chase on-chain memes, market makers can only be responsible for PumpFun's internal trading, DEX's external trading, and the market making work of a few listed tokens, of course, the relationship between on-chain business and market makers is not the focus of this article, we focus on the exchange itself.

At this point, Meme tokens, for market makers and exchanges, are the same as VC tokens in terms of high pricing, if value tokens have no value, then air tokens obviously cannot be fairly priced based on air, quick in and quick out becomes the common choice of all market makers.

When the entire process is rolled around by the industry, being listed on Binance in a year is not the original sin of the market makers, but the fact that Binance can be listed so quickly is the crisis of the industry, as the last link of liquidity, Binance can no longer discover truly long-term tokens, and the crisis of the industry is thus born.

This time Binance can either promote RedStone with illness or righteously judge the market makers, but what about afterwards? The industry will not change its existing model, and there will still be highly priced tokens waiting for the listing process.

Complexity and Gigantism Means the End

Ethereum's L2 is growing more and more, and all dApps will eventually become a single chain.

Token economics and airdrop schemes are becoming more and more complex, from BTC as a Gas to ve(3,3), they have long surpassed the understanding of ordinary users.

Starting from Sushiswap relying on airdropping tokens to Uniswap users to occupy the market, airdrops have become an effective means to stimulate early users, but under Nansen's anti-witch hunt, airdrops have become a reserved program for the power struggle between professional moochers and project teams, the only ones excluded are ordinary users.

The moochers want the tokens, the project teams need the trading volume, the VCs provide the initial capital, the exchanges need new coins, and in the end it is the retail investors who bear it all, leaving only the endless decline and the helpless rage of the retail investors.

Turning to Memes is just the beginning, the real seriousness is that all retail investors in the industry are re-evaluating their own interests and losses, if they don't trade on Binance, but on Bybit and Hyperliquid to do contracts, what is the difference in gains and losses?

Currently, the daily trading volume of on-chain contracts has reached 15% of Binance, of which Hyperliquid accounts for 10% of Binance's share, this is not the end, but the true beginning of the on-chain process, just right, the trading volume ratio of DEX to CEX is around 15%, while Uniswap accounts for about 6% of Binance, highlighting the catch-up of Solana DeFi.

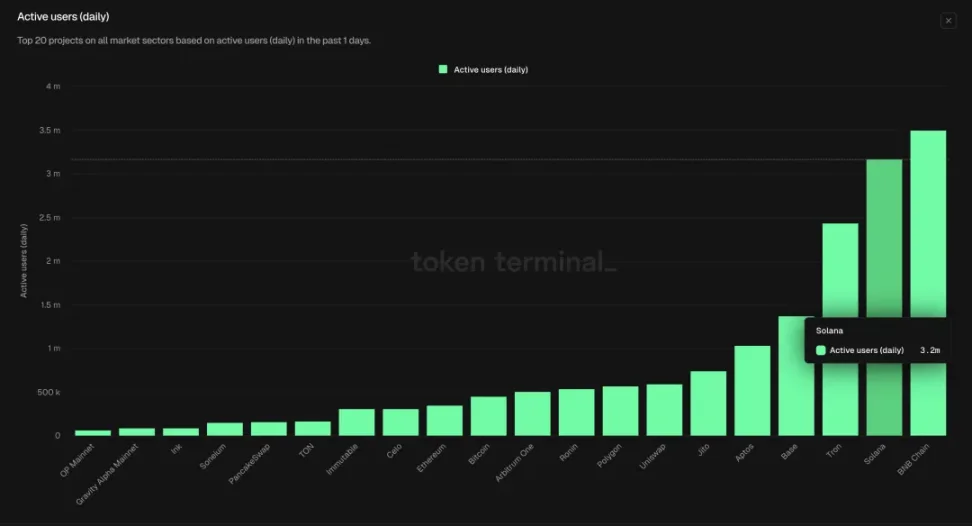

Caption: On Chain DAU, image source: Tokenterminal

While Binance has 250 million users, Hyperliquid has only 400,000, Uniswap has 600,000 active users, and Solana has 3 million daily active users, we estimate the overall on-chain user base to be around 1 million, still in the very early adoption stage.

But now not only are there more and more L2s, the token economics of dApps are also becoming more complex, all reflecting the project teams' inability to balance their own interests and those of retail investors, without the commitment of VCs and exchanges, the project cannot be launched, but accepting the interest division of VCs and exchanges inevitably means sacrificing the interests of retail investors.

In the evolutionary process of biology, whether it is Darwin's theory of evolution or the probabilistic measurement of molecular biologists, they all without exception point out a basic fact, that once a certain organism becomes gigantic and exquisitely shaped, like the Pteranodon, it generally means entering the extinction cycle, and nowadays, the birds are the ultimate conquerors of the sky.

Conclusion

The exchange's cleanup of market makers is essentially a cannibalistic behavior under the existing competitive landscape, retail investors still have to face the encirclement of VCs and project teams, the situation will not fundamentally improve, the migration to the on-chain is still an ongoing historical journey, even as powerful as Hyperliquid, it still hasn't done well in the shock of hundreds of millions of users.

The fluctuation of value and price, the game of interests and distribution, will still move back and forth in each cycle, forming the blood and tears history of retail investors.