Recently, the violent fluctuations in the Bit market have attracted widespread attention. Bit (BTC) has fallen 27.4% from its historical high of $110,000, and the global Bit market capitalization has evaporated more than $1.2 trillion. Against this backdrop, a number of institutional experts and key opinion leaders (KOLs) have expressed their views on the market trend, trying to answer a core question: Has the price hit the bottom? The following is a summary and analysis of these views.

Institutional Views

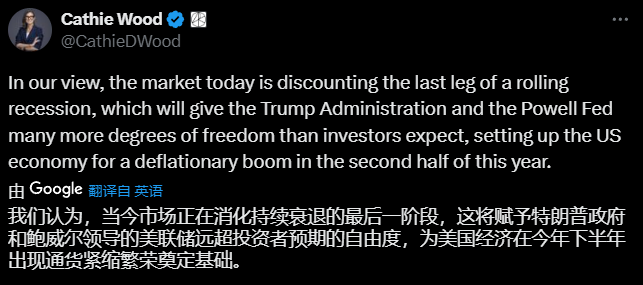

Cathie Wood: The end of the rolling recession, policy space is favorable for the long-term outlook

Cathie Wood, founder of ARK Invest, said that the current market is in the final stage of a "rolling recession", which will provide more policy adjustment space for the Trump administration and the Federal Reserve. She predicted that the US economy may enter a "deflationary boom" in the second half of this year, implying that the flexibility of monetary policy may drive a rebound in the Bit market, and the long-term outlook is optimistic.

Strategy Company: $21 billion preferred stock plan, firmly bullish on Bit

Strategy Company, formerly known as MicroStrategy, plans to sell $21 billion in preferred stock to increase its Bit holdings. The company has reached sales agreements with more than a dozen financial institutions, showing its long-term confidence in the Bit market, although the successful execution of the sales plan cannot be guaranteed.

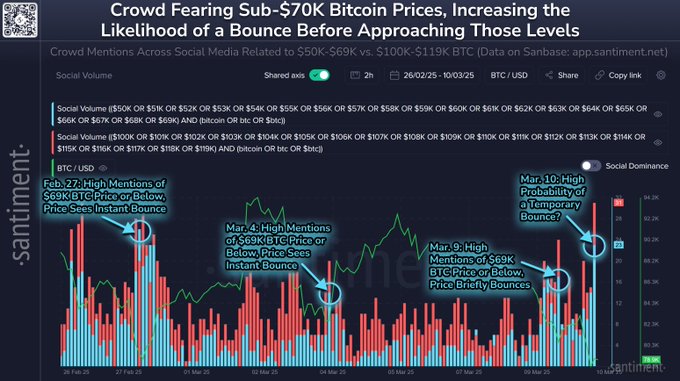

Santiment: Panic sentiment points to the capitulation point

Santiment observed that discussions on social media associated with Bit below $70,000 have surged to the highest level since the crash on February 27. The real "capitulation point" (the best buying opportunity) may appear when forecasts are concentrated in the $50,000-$69,000 range, and high prices (such as $100,000-$119,000) are not mentioned.

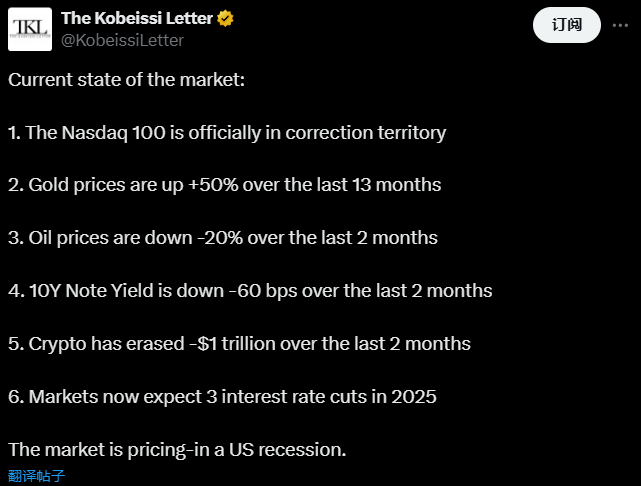

KobeissiLetter: The market expects a US recession

KobeissiLetter pointed out that the Bit market has evaporated $1 trillion in market value in two months, and "the rally after the US Strategic Petroleum Reserve announcement has been completely erased". Combined with the Nasdaq entering an adjustment range, gold prices rising 50%, and oil prices falling 20%, the market seems to be pricing in a US economic recession.

Rekt Capital: Focus on bullish divergence, corrections are part of the bull market

Rekt Capital suggested focusing on Bit's Relative Strength Index (RSI). If the price forms a lower low, while the RSI forms a higher low, a bullish divergence may occur, indicating that the bottom is approaching. In this bull market alone, Bit has corrected 22%, 22%, 21%, and 32%, and corrections are part of the bull market.

KOL Views

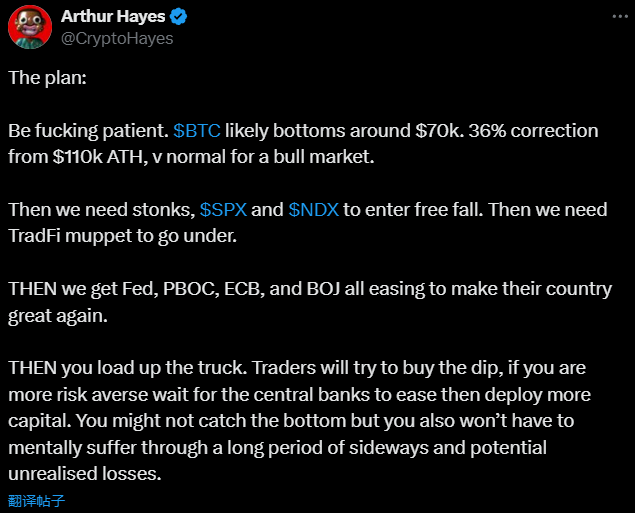

Arthur Hayes: Bit may bottom at $70,000, waiting for easing policies

BitMEX founder Arthur Hayes believes that Bit may bottom around $70,000, which means a 36% drop from the high, a normal adjustment in the bull market. He pointed out that the stock market (especially SPX and NDX) may fall further, while the Federal Reserve, the European Central Bank, and the Bank of Japan are expected to implement easing policies to stimulate economic recovery. He advised investors to be patient and "go all in" after the policies are implemented, to avoid potential losses during the volatility period.

Adaora: Economic recession determines the Bit bottom, CZ says it's short-term

Crypto KOL Adaora analyzed that Bit prices are closely related to economic indicators. If a recession occurs, Bit may fall to $50,000; if there is no recession, the bottom is expected to be between $70,000 and $75,000. Binance co-founder CZ responded that this analysis only applies in the short term, implying that the long-term trend may be dominated by other factors.

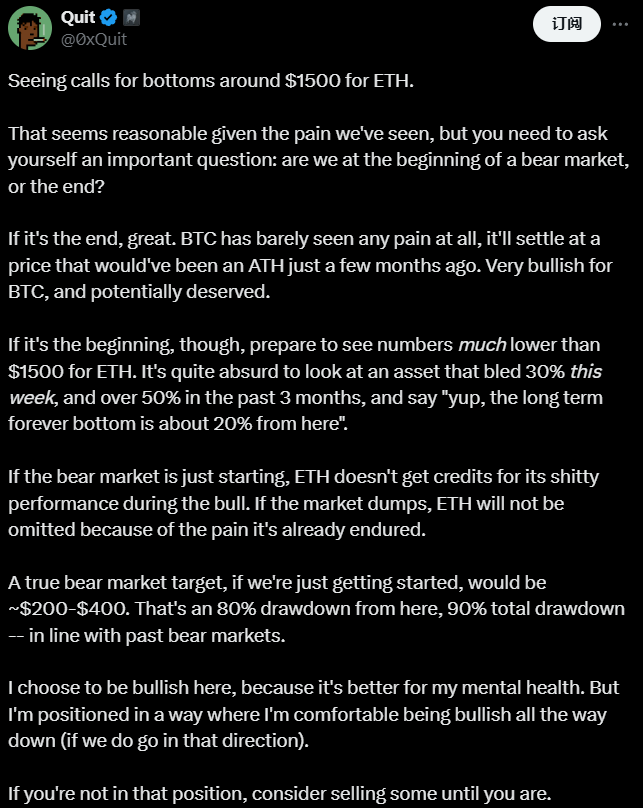

0xQuit: The start of a bear market may push ETH to $200-$400

Yuga Labs Vice President 0xQuit pointed out that the bottom of ETH depends on the market cycle. If the bear market ends, $1,500 may be a reasonable bottom; but if the bear market is just beginning, ETH may fall to $200-$400 (another 80% drop, a total of 90% drop), in line with historical bear market patterns. He personally leans bullish, but advises investors to prepare for the worst.

Anthony Pompliano (Pomp): Trump's strategy may promote rate cuts

Crypto analyst Pomp proposed that the Trump administration may deliberately create stock market chaos to force the Federal Reserve to cut interest rates, in order to address the $70 trillion debt refinancing pressure. He pointed out that the 10-year US Treasury yield has fallen from 4.8% to 4.21%, indicating that the strategy is initially effective. If rate cuts are implemented, it may indirectly benefit the Bit market.

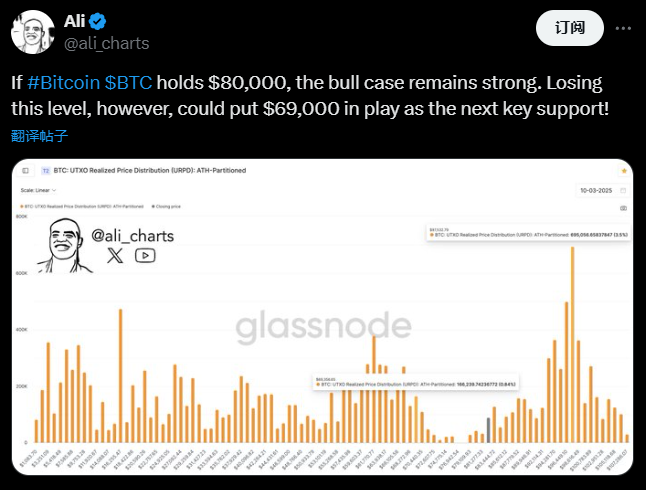

Ali: Key support levels for BTC and target price for ETH

KOL Ali said that if Bit maintains $80,000, the bull market outlook will remain strong; if it falls below this level, $69,000 will be the next support. For ETH, if it follows the ascending triangle pattern, the target may be $1,000 after a breakdown.

Summary

The current market sentiment is cautious, and the views of institutions and KOLs are clearly divided:

- Short-term bearish risks: Adaora, 0xQuit, and Ali believe that if a recession or a bear market continues, Bit may fall to $50,000-$69,000, and ETH may even drop to $200-$400. Santiment's panic sentiment analysis also supports this possibility.

- Medium-term correction expectations: Arthur Hayes and Adaora (in the no-recession scenario) predict that the Bit bottom will be at $70,000-$75,000, which is seen as a normal correction, waiting for central bank policy catalysts to rebound.

- Long-term optimistic signals: Cathie Wood and Strategy Company are optimistic about the long-term benefits of policy easing and institutional participation, and Pomp's rate cut theory also provides support for this.

Has the price hit the bottom? The answer is not yet clear. In the short term, the risk of economic recession and market panic may drive prices to further lows; but in the long run, easing policies and institutional confidence may lay the foundation for a rebound. Investors should pay attention to economic indicators, policy trends, and technical signals, and weigh the risks and opportunities.