The case for a SHORT SQUEEZE:

Since February 19th, the S&P 500 has erased -$5 TRILLION in its most one-sided move since the 2022 bear market.

Total PUT option volumes have surged to a record 30+ MILLION contracts over the last 5 days.

Is a short squeeze coming?

(a thread)

In just 14 trading days, the Nasdaq 100 has now fallen a whopping -12.5%.

The S&P 500 was trading at all time highs less than 3 weeks ago.

The recent one-sided nature of the stock market's decline is rarely sustainable over the long-term.

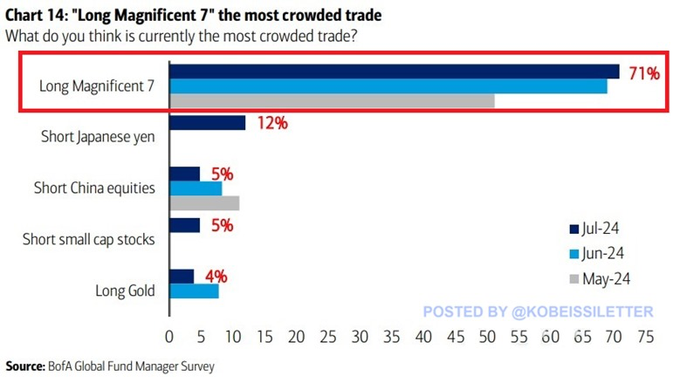

We think the SHORT trade is crowded.

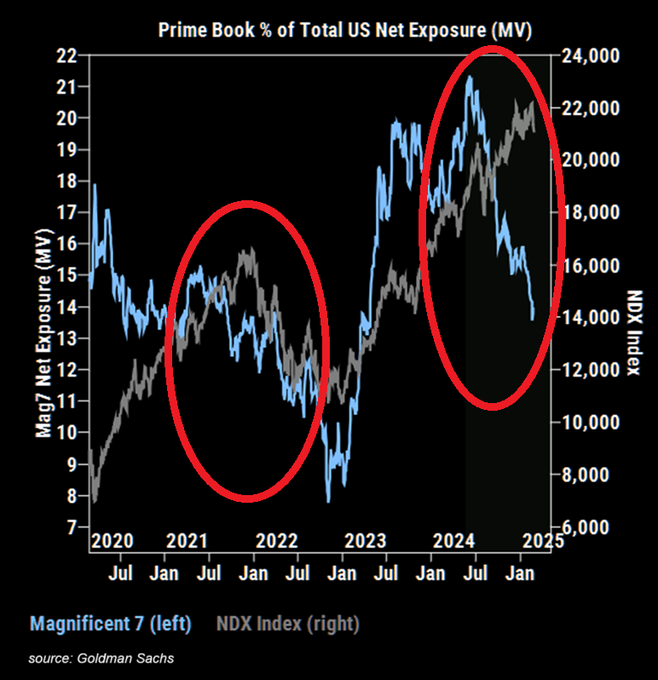

Take a look at institutional positioning in the lead up to this decline.

Heading into 2025, hedge fund exposure to Magnificent 7 stocks fell to a 22-month low.

We saw a colossal divergence between the Nasdaq 100 and fund positioning for the first time since the 2022 drop.

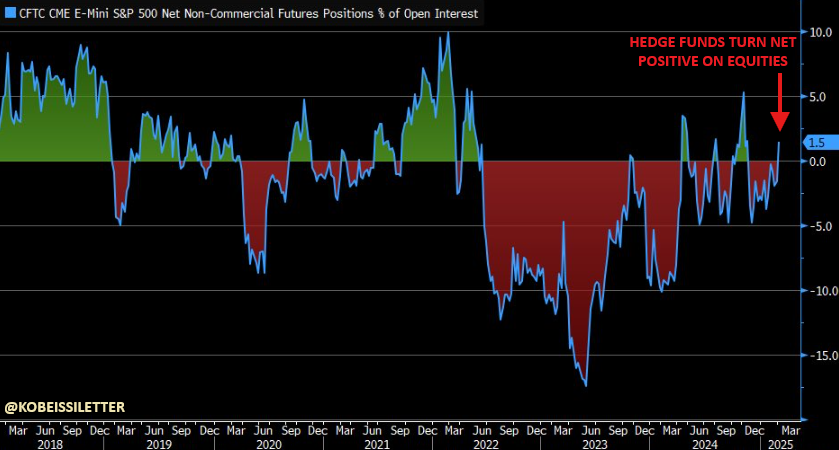

Now, take a look at hedge fund positioning in the S&P 500 as of today.

Hedge funds have turned NET POSITIVE on equities over the last week based on S&P 500 futures positioning.

This is the first such occurrence since the leadup to the post-election rally in November 2024.

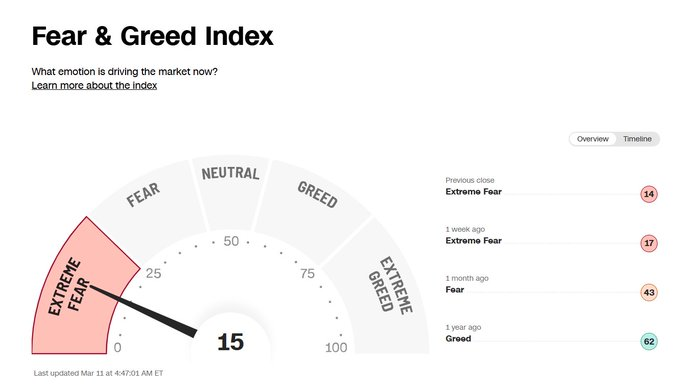

On top of this, Extreme Fear is everywhere in the market.

In stocks, the Fear & Greed index is now approaching March 2020 levels.

Just as the market was unable to sustain Extreme Greed levels, the market is also unable to sustain Extreme Fear.

Sentiment is everything here.

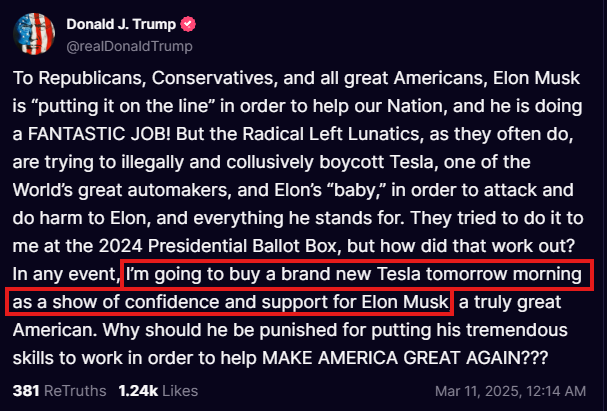

Furthermore, President Trump's post about Tesla, $TSLA, was very telling last night.

President Trump said he is going to "buy a brand new Tesla [today] as a show of confidence and support for Elon Musk."

This was Trump's first sign of support for the market as it crashes.

Market sentiment has deteriorated because of Trump's apparent willingness to weather a downturn.

When asked if he "sees a recession this year," he responds "I would hate to predict something like that."

He says, "it will be great" but knows there will be short-term pain.

Trump's post on $TSLA is the first sign of a potential reversal in sentiment.

With tariffs, rising recession risks, rising inflation, slowing GDP growth, and a tech bear market all priced-in, there are lots of potential bullish headlines.

Could Trump soften his stance here?

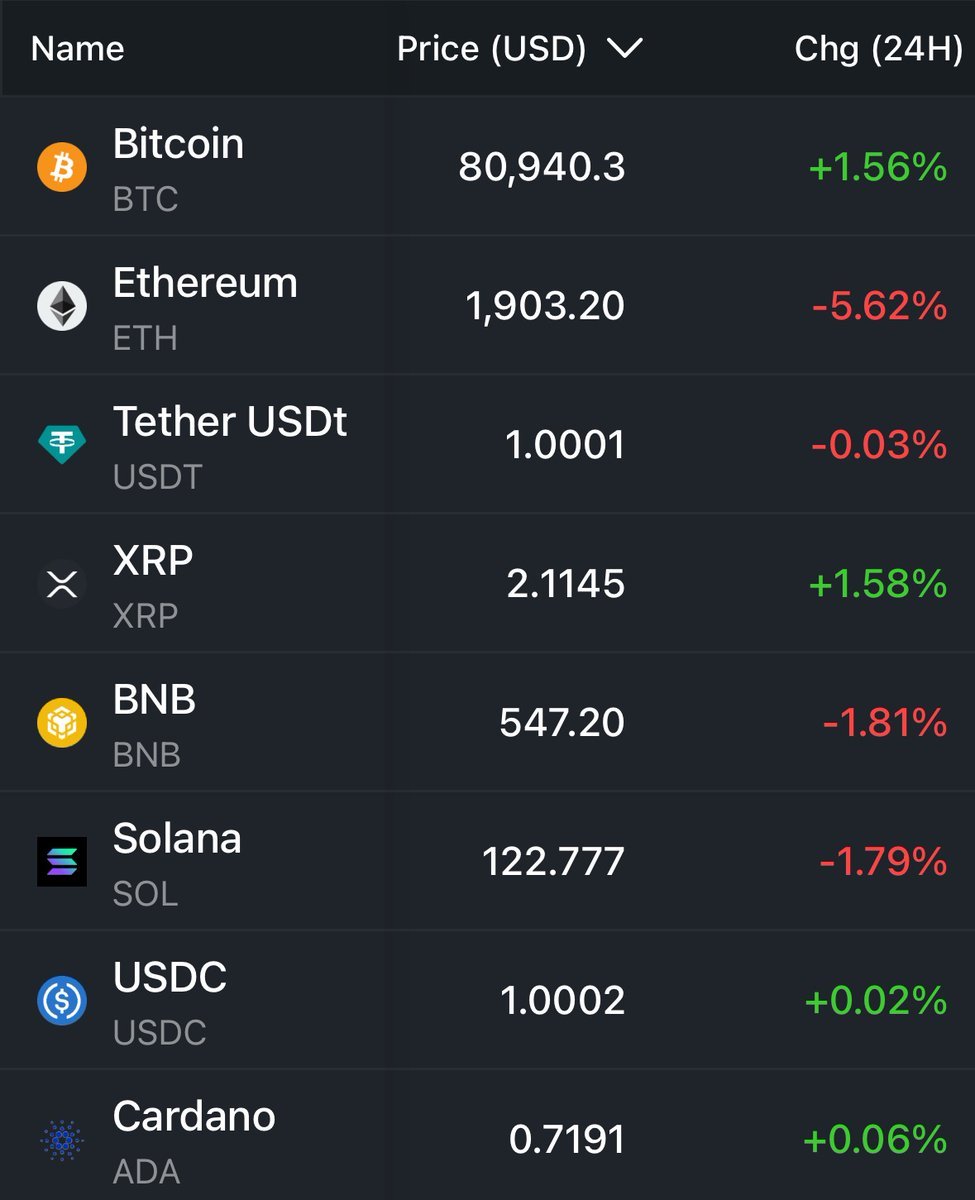

Crypto is also another key leading indicator here.

Last year, crypto saw Extreme Greed levels of 92+; it's now at a polar opposite of 17.

Sentiment is the ultimate driver of price in ANY market, regardless of fundamentals.

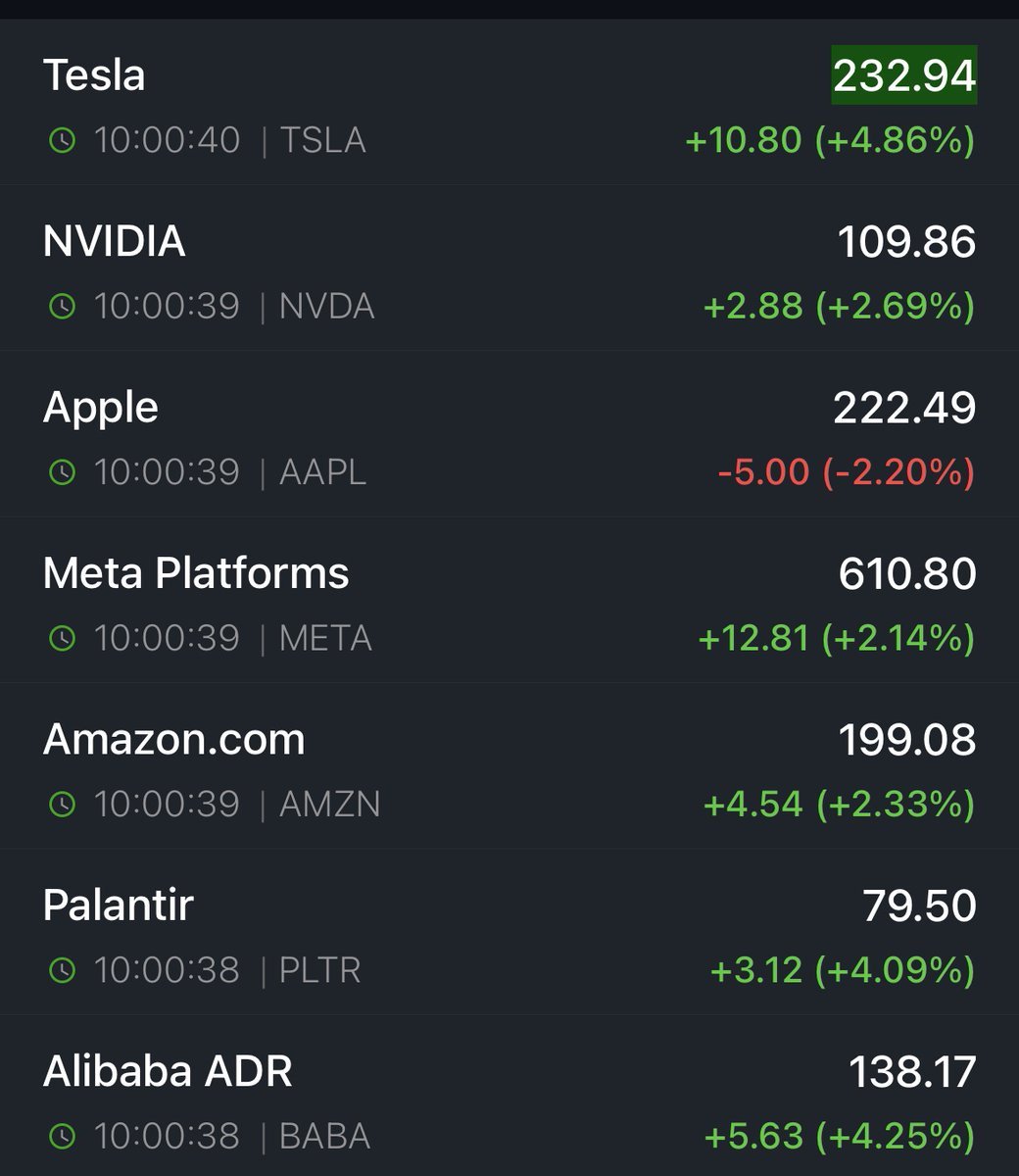

Today, both tech and crypto are outperforming.

Take a look at tech and crypto at the open today:

Magnificent 7 names are up 3%+ across the board and Bitcoin is back above $80,000.

This is the first day with strong outperformance in big tech and crypto since February 19th.

Many of these tech names are down 30%+.

This is a key point.

Many of the large cap technology stocks that LEAD the stock market are well beyond bear market territory.

Nvidia is down nearly -30% from its ATH and Tesla is down -50%.

Google and Microsoft are both down nearly -20% and Apple is down -15%.

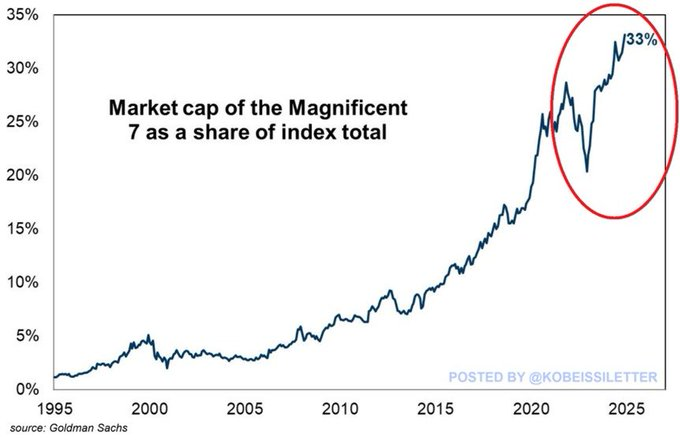

These are the same stocks that now reflect over 33% of the S&P 500.

If the drivers of the stock market are well beyond bear market territory in a 14 trading day decline, that is very telling.

A simple relief rally in the Mag 7 could catalyze a 200+ point rally in the S&P 500.

Sum it all up and you now have:

1. Global tariffs priced-in

2. Recession fears priced-in

3. Extreme Fear in stocks and crypto

4. Polarized short positioning

5. Mag 7 stocks well beyond bear market territory

6. Potential reversal in Trump sentiment

Something must give soon.

As we have noted many times before, we were in the exact opposite scenario just months ago.

71% of Fund Managers believe Long Mag-7 was the most crowded trade in 2024.

If you can get ahead of shifts in sentiment, then you can get ahead of swings in the market.

Through technical and fundamental analysis, we have been trading these swings.

Our premium members just received our latest positioning update.

Want to see how we are trading it?

Subscribe to our premium analysis and alerts at the link below:

Lastly, a short squeeze is not necessarily a call for a complete bottom in the market.

Relief is due, but it may not end the correction.

Can the market finally see some relief after a relentless drop?

Follow us @KobeissiLetter for real time analysis as this develops.

From Twitter

Disclaimer: The content above is only the author's opinion which does not represent any position of Followin, and is not intended as, and shall not be understood or construed as, investment advice from Followin.

Like

Add to Favorites

Comments

Share

Relevant content