Author: Arunkumar Krishnakumar, CoinTelegraph; Compiled by Wuzhu, Jinse Finance

I. The US Reserve Status: The Role of Gold, Oil and Bitcoin

The US government has long relied on gold and oil as reserve assets, but with the growing institutional adoption of Bitcoin, its potential role as a strategic reserve has significantly increased. With the new US government taking office in January 2025, the possibility and potential of Bitcoin as a strategic reserve has received a major boost.

While gold has historically been the backbone of the monetary system, and oil remains an important economic and security asset, Bitcoin represents a new type of digital reserve that challenges the traditional financial paradigm.

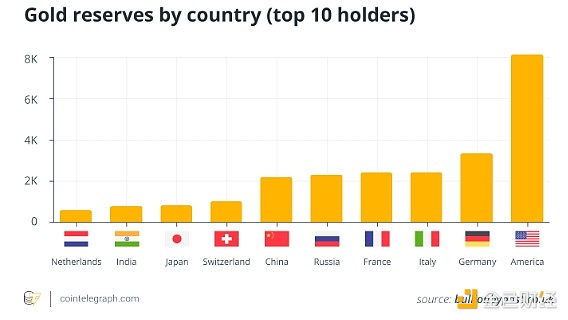

The US holds large quantities of gold and oil reserves, but its Bitcoin holdings are relatively small, mainly acquired through asset seizures. As of Q3 2024, the US held around 8,133.46 tons of gold, worth about $789.87 billion (as of March 8, 2025), making it the largest sovereign holder of gold reserves.

Prior to abandoning the gold standard in 1971, these reserves were historically used to hedge economic uncertainty and support the US dollar.

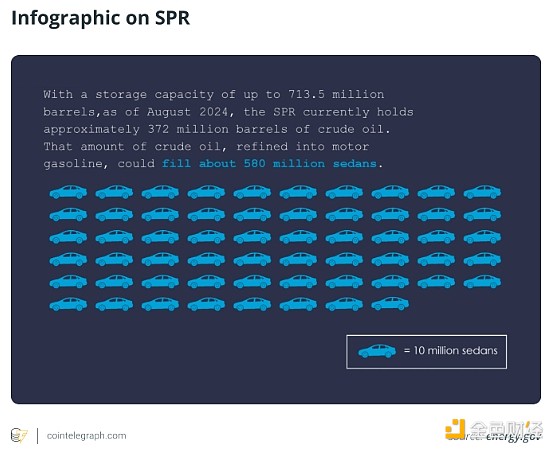

In terms of oil, the US maintains a Strategic Petroleum Reserve (SPR), which as of August 2024 held around 372 million barrels. The SPR was established in the 1970s to address oil crises, and is currently valued at around $28 billion at current market prices. These reserves are managed to address supply disruptions, control inflationary pressures, and stabilize the energy market during geopolitical crises.

Unlike gold and oil, Bitcoin is not an official reserve asset, but the US government has seized large amounts of Bitcoin. It is estimated that the government controls around 200,000 BTC, worth approximately $15.9 billion (as of March 10) at a BTC price of $79,515.

However, unlike gold and oil, these assets are not held as strategic reserves, but rather as assets awaiting auction or liquidation by the Department of Justice and the US Marshals Service.

II. Liquidity and Market Dynamics of Gold, Oil and Bitcoin

Gold, oil, and Bitcoin each exhibit unique liquidity and market dynamics, with gold being the most stable, oil driven by geopolitical factors, and Bitcoin characterized by high volatility and 24/7 accessibility.

The depth of liquidity in the market is an extremely important indicator of an asset's health. Generally, the higher the liquidity, the more choices investors have in terms of pricing and risk management.

Let's understand how gold, oil, and Bitcoin differ in terms of liquidity and market dynamics:

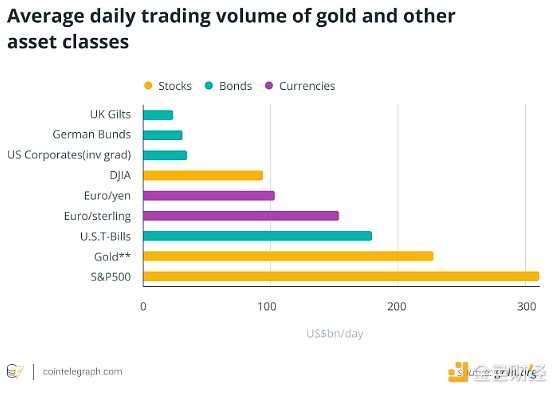

Gold: Gold remains one of the most liquid financial assets, with daily trading volumes exceeding $200 billion in the futures market, exchange-traded funds (ETFs), and over-the-counter (OTC) trading. Gold's deep liquidity and widespread acceptance make it the preferred asset for central banks, institutional investors, and governments seeking to hedge against inflation and currency volatility. While gold prices fluctuate, its volatility has historically been lower than most other assets.

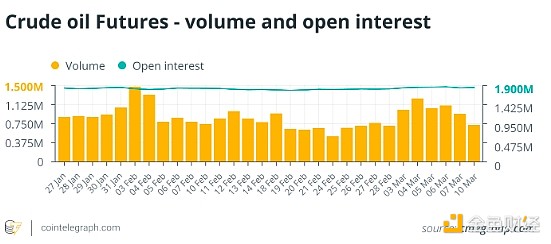

Oil: Oil has massive trading volumes in the spot and futures markets, with global daily futures trading volume reaching around 1 million barrels. Unlike gold, the liquidity of oil is largely dependent on its industrial demand and geopolitical developments. Oil prices are highly sensitive to supply chain disruptions, OPEC decisions, and macroeconomic policies. Given its role in the energy market, oil's volatility is much higher than gold, and its prices can be driven by political instability, production cuts, or major conflicts.

Bitcoin: Although Bitcoin is a relatively new asset, it has extremely high liquidity, with daily trading volumes on global exchanges typically exceeding $30-50 billion. While BTC has gained institutional recognition, its volatility remains much higher than gold and oil due to speculative demand, regulatory uncertainty, and market structure. Unlike gold and oil, Bitcoin's trading cycle is 24/7, which makes it unique in terms of accessibility and global liquidity.

III. Storage and Security Challenges of Reserve Assets

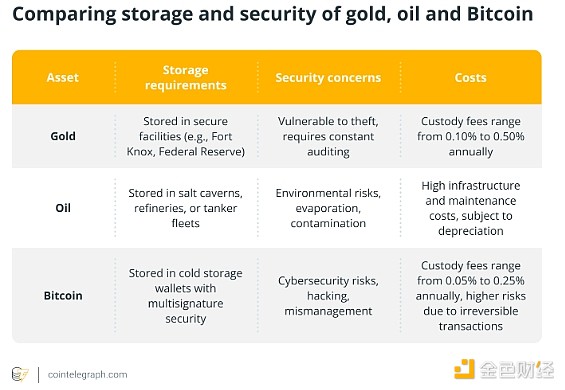

Storage and security are critical for any reserve asset, and each asset has unique challenges and costs.

Gold: Gold is typically stored in highly secure facilities, such as Fort Knox, the Federal Reserve Bank of New York, and other vaults around the world. The costs of storing gold vary, but large-scale sovereign reserves require significant security infrastructure, transportation costs, and insurance. Additionally, physical gold is susceptible to theft and requires constant auditing to ensure authenticity and weight accuracy. Furthermore, the custodial fees for institutions holding gold in vaults range from 0.10% to 0.50% per year, depending on the storage provider.

Bitcoin: Bitcoin storage is fundamentally different, as it is a digital asset. Governments and institutions typically use cold storage wallets and multi-signature security to protect their assets. While Bitcoin custody does not require physical storage facilities, the risks of cyber attacks, mismanagement of private keys, and regulatory oversight pose significant challenges. Institutional-grade custody solutions, such as BitGo, Fireblocks, and Coinbase Custody, charge annual fees ranging from 0.05% to 0.25%, significantly lower than gold storage costs. However, the irreversibility of Bitcoin transactions increases the risks associated with mismanagement or unauthorized access.

IV. The Strategic and Economic Role of Reserve Assets

Gold, oil, and Bitcoin all play strategic roles in the global economy, with gold being a hedging tool and oil influencing geopolitical stability.

Over time, all these assets have strategic and macroeconomic significance. The narratives associated with their relationship to broader capital markets may be precisely what is needed to attract investor interest.

Bitcoin: The potential of BTC as a reserve asset lies in its decentralized nature, fixed supply (21 million BTC), and resistance to currency debasement. Unlike gold and oil, which require significant infrastructure, Bitcoin can be transferred globally in minutes and stored at almost zero cost.

As institutional adoption grows, the strategic value of Bitcoin as a hedge against inflation and government debt is becoming increasingly recognized.

V. The Future of the US Government's Bitcoin Policy

Policy initiatives suggest that establishing a strategic Bitcoin reserve could potentially put it on par with traditional assets like gold and oil in the future.

In January 2025, President Donald Trump signed an executive order titled "Strengthening American Leadership in Digital Financial Technologies," which established a Presidential Digital Assets Market Working Group to explore the creation of a national digital asset reserve.

Building on this initiative, on March 7, Trump signed another executive order establishing a "Strategic Bitcoin Reserve" and a "US Digital Asset Reserve," aimed at positioning the US as a leader in the cryptocurrency space. These reserves will be entirely funded by cryptocurrency seized through law enforcement actions, ensuring that no taxpayer funds are used.

However, the reserve will be funded using the government's existing cryptocurrency holdings, primarily through asset seizures rather than new government purchases.

This strategy has elicited mixed reactions. While some see it as a positive step towards embracing digital assets, others express concerns about the lack of new investment and the potential impact of using seized assets. As of March 10, 2025, the value of BTC has declined by over 5% to around $79,515, reflecting the market's disappointment with the reserve funding approach.

Looking ahead, the U.S. government's BTC policy may continue to evolve. The President's Working Group is expected to provide recommendations by July 2025, which could influence future regulatory frameworks, investment strategies, and the integration of digital assets with the broader financial system.

As global interest in cryptocurrencies continues to grow, the U.S. may further refine its policies to balance innovation with safety and economic stability, as well as traditional assets like gold and oil, which remain an integral part of the nation's financial strategy.