Two tokens that were airdropped by HODLers continued to fall after being listed on Binance, causing users to question; a new token on Launchpool changed the community airdrop ratio before it was about to open, angering the community. Recently, three new assets, RED, GPS and SHELL, that were launched on Binance in succession exposed the "hidden disease" of the project circle, and Binance, which has the obligation to review, showed its "scalpel".

On March 6, Binance urgently stopped listing RED, which brought a turning point for the community users who were defending their rights against the Red Stone project. However, the tough attitude of the top exchanges is not limited to this, and there is something more explosive coming.

On March 7 and 9, Binance exposed a market maker of GPS for selling 70 million GPS in a row, which was judged as "illegal", and it was found that the market maker also participated in the market making activities of SHELL. The profitable account of the market maker was frozen by Binance, and the platform received a market making ban. After that, the two project parties came up with user compensation plans such as buyback.

The three consecutive new coin incidents also officially kicked off Binance's rectification of the on-site market. The "voting to list/delist coins" mechanism was added to the new asset review system. In addition, Binance has updated the frequency of adding "observation tags" to listed tokens to "monthly", and will continue to review the performance of on-site assets, and will remove them if they do not meet the rules.

As the crypto asset market enters a downward trend, although popular tokens and new assets have potential traffic effects, the world's largest crypto asset trading platform has decided to tighten the loopholes and strictly enforce market entry thresholds, which also sounded the alarm for project parties who believe that "listing on Binance is the end point."

Abnormal K-line questioned, Binance found illegal market makers

The weirdness is revealed by the K-line.

In early March, GPS (GoPlus Security), a token airdropped by Binance HODLers, has been falling since entering the Binance spot trading market. After listing on March 4, GPS opened at about $0.104 and closed at about $0.068 that day, soaring to around $0.151, which is its highest point on Binance so far. Since then, GPS has continued to fall, falling to a low of about $0.032, and now it is only $0.038, nearly halved from the closing price on the first day and 74.83% from the highest point.

This blockchain project, which focuses on Web3 security business, is not very safe in the secondary market. However, in just over a week, it has completed the trend that some old cryptocurrencies in the crypto circle need to go through a bull and bear market to get out of.

Users who participated in GPS secondary market transactions criticized it and also began to doubt the HODLer airdrop product, because the token project SHELL (My Shell) launched through the airdrop channel in February also followed the same trend, and also halved from the first day's closing price of around US$0.59 to around US$0.257.

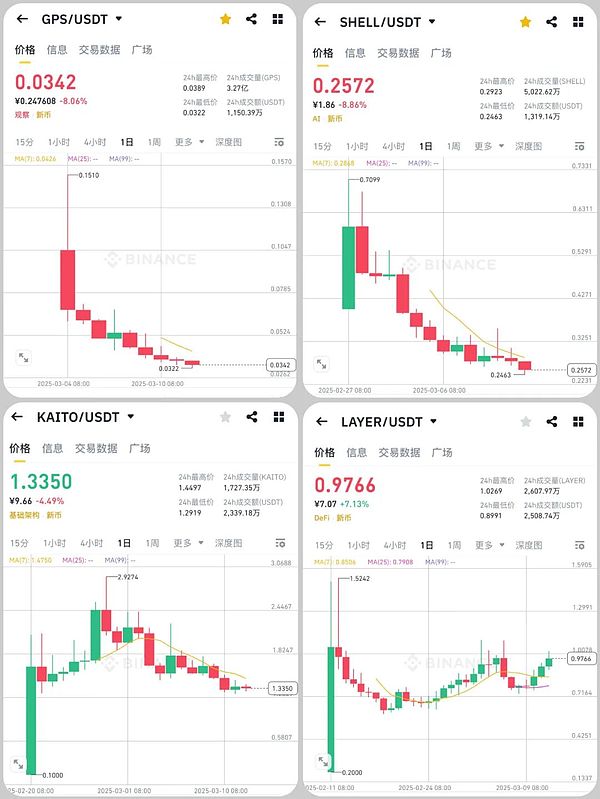

Compared with the other two HODLer airdrop projects, GPS and SHELL show a "waterfall" trend (data as of March 10)

KAITO and LAYER, which were previously airdropped by HODLers and put on the market, have risen and fallen with the market. In comparison, the waterfall trend of GPS and SHELL seems abnormal. Many users have questioned on social platforms, "Is the project party shipping on Binance?"

Until March 7, Binance announced that it had exposed a "big melon" and GPS was pinned with an "observation label" because the price of GPS fell sharply after it was listed on the spot market, and a market maker made abnormal market behavior. Binance quickly resolved the issue and froze the market maker's account.

According to Binance’s investigation results, from 9:00 p.m. on March 4 to 5:55 p.m. the next day (Beijing time), the market maker sold about 70 million GPS in 21 hours, and there were no pending buy orders during this period; after spot trading was opened, the market maker continued to sell tokens, with a cumulative profit of about 5 million USDT, becoming the largest beneficiary.

As soon as the news came out, the market was in an uproar. Users seemed to have found the reason why GPS continued to fall, but Binance’s investigation was not over.

On March 9, Binance officially announced that the market maker was also responsible for the market making activities of the MyShell (SHELL) project. Although Binance has not yet announced the name of the market maker, it has clearly determined that the market maker's behavior is "illegal" and has taken two heavy blows against it: delisting the market maker and prohibiting it from conducting any market making activities on Binance; confiscating the market maker's related income and using it to compensate users of the GPS and SHELL projects.

Binance’s heavy blow also forced the project party to take remedial actions.

On March 10, MyShell said that after receiving the Binance investigation report, it had terminated its relationship with the abnormal market maker and introduced several new partners to ensure stable liquidity. All Binance accounts related to the market maker have been suspended, and all remaining assets will be transferred to the new market maker. In addition, all stablecoins sold by the market maker will be used to repurchase SHELL within 90 days, and the official wallet address related to the repurchase will be announced for community verification.

On March 11, GoPlus Security stated on the X platform that the 4.34 million USDT generated by GPS transactions in the original market maker account frozen by Binance will be returned to the control of the project party after completing the regulatory process, and these funds will be used to repurchase GPS tokens within 90 days, and all repurchased tokens will be permanently destroyed. In addition to the repurchase, GoPlus Security will allocate an additional $2 million in funds to compensate users who made net purchases during the illegal market maker activity period on Binance. This compensation plan includes spot and leverage users.

Binance's actions against the anomalies of the two projects have been praised by many users. Its actions against the market makers of GPS and SHELL can be regarded as a form of self-defense for the platform users. Some users believe that Binance has only torn off a corner of the fig leaf of the problematic projects. "GPS and SHEL have already entered other exchanges, but the market maker problem has not been discovered. Is it waiting to be listed on Binance to cut off the users here?"

People hope that platforms that provide trading venues can more strictly review and supervise the entire process of project tokens entering the market, and Binance is adopting these voices.

Community voices must be heard, users vote to "up/down tokens"

On March 7, Binance announced the optimization of the listing/delisting policy, adding the "voting for listing" and "voting for delisting" mechanisms to achieve community co-governance. It stated that the platform will not profit from listing coins, and will continue to disclose the marketing expenses of each project in the listing announcement, and will airdrop to Binance users in batches according to the token unlocking time.

Another Binance new coin event may have provided impetus for the introduction of the new mechanism.

On March 6, the modular blockchain project RED (Red Stone) was suddenly stopped by Binance 20 minutes before it was originally scheduled to be officially launched for spot trading. The reason was that "RedStone (RED) unexpectedly changed its community airdrop allocation at the last minute." That is, the project party originally promised to distribute 9.5% of the total supply of tokens to the community, but the ratio was temporarily reduced to 5%.

At this time, RedStone suddenly increased the conditions for obtaining airdrops, resulting in a large number of community members who worked hard on on-chain transactions not receiving airdrops. This outrageous operation is causing the community to be furious, and the complaints have obviously been conveyed to Binance.

After Binance showed a tough attitude towards the project team's temporary change of the economic model, RedStone compromised and released an additional 2% from the "Ecosystem & Data Providers" fund pool to compensate some community contributors who failed to receive the airdrop.

On the day when the RED incident was resolved in stages, Binance added the "community governance" dimension to the listing/delisting of coins.

Binance said that the community has provided many valuable opinions on coin listing, and the platform has always valued the voice of the community. After testing and evaluation, it has decided to comprehensively optimize the coin listing mechanism. "Voting for listing/delisting coins" will give users more rights to participate in decision-making. The core goal is to provide users with opportunities for value discovery while ensuring the quality, innovation and compliance of the project.

According to the specific mechanism announced by Binance, users whose parent account holds at least 0.01 BNB can vote for their favorite projects. Projects with high votes and that have passed due diligence will be listed on Binance, and the platform will select projects from the market and Alpha observation area to enter the voting pool. For projects with no product development updates, no community and project maintenance, no regular progress announcements, additional issuances, or major risk behaviors, Binance will include them in the main site's "Risk Monitoring Zone" and will mark projects that do not cooperate in providing token-related information. Users can express their intention to delist projects that are already in the "Risk Monitoring Zone" through voting.

This means that listing on Binance is not the end of the project’s development, and it is very likely to be delisted due to user voting.

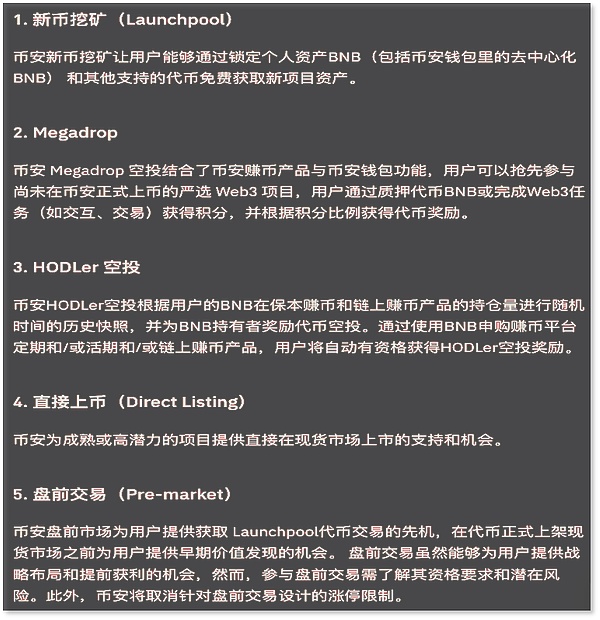

In addition, Binance has also clarified the channels for listing new assets in its governance content, mainly including:

Binance has clarified four new listing channels and pre-market trading mechanisms

It is worth noting that Binance included the "pre-market" that was tested when RED was launched in the governance process of listing coins, but decided to cancel the price limit designed for pre-market trading. Some traders analyzed that this move will help reduce the platform's intervention in prices and make the price discovery of new assets more market-oriented.

Binance said that the "pre-market" can provide users with an opportunity to obtain Launchpool token transactions, "and also provide users with early value discovery opportunities before the tokens are officially listed on the spot market." At the same time, Binance reminded that although pre-market trading can provide users with opportunities for strategic layout and early profit, participating in pre-market trading requires understanding its eligibility requirements and potential risks.

Is listing on Binance enough to meet the standards? Multi-dimensional review has just begun

Binance's move on the three problematic projects also indicates that the world's largest trading platform will more strictly select new assets starting this year, and the strict review process will not only include listing of coins.

On March 4, Binance announced that the frequency of adding "observation tags" to listed assets will be adjusted from irregular to monthly, that is, new projects will be added in the first week of each month; and the removal of observation tags and seed tags will be reviewed "quarterly".

In other words, Binance will review the performance of listed assets more frequently. Once they are "observed" in a certain month, they must perform well within the quarter if they want to remove the label. Otherwise, the probability of delisting will greatly increase.

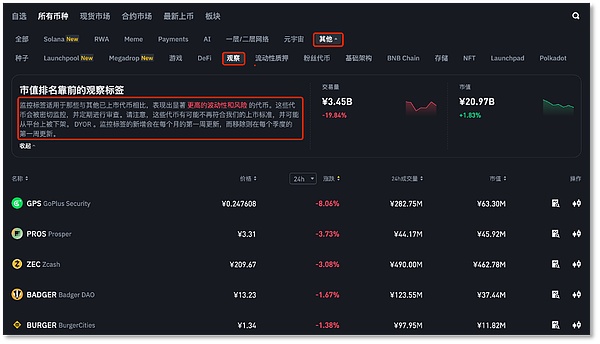

"Adding an observation tag" is Binance's ongoing and regular review of more mature crypto asset projects. Once a project is added with an "observation tag", it means that these tokens may have higher volatility and risks; when they do not meet Binance's listing standards, they may be delisted.

27 tokens added to the "Watch" tab on Binance Market

Tokens that enter the "observation zone" will be displayed with a risk warning banner on Binance. Users will also be subject to actual review of their understanding of the risks of "observation-labeled" tokens - if they want to trade tokens with "observation labels", users need to complete a test every 90 days and only obtain trading permissions after accepting the terms of use.

As of now, 27 tokens have been labeled as “observation tokens”, including new tokens such as GPS that have just entered the market due to violations, as well as familiar faces in the market such as ZEC, FTT, BAL, and ARK.

So, what are the criteria for adding an "observation tag" or removing the tag for a project?

Binance has also listed the review reference factors in each of its bid announcements, including the team's commitment to the project, the level and quality of the project, trading volume and liquidity, freedom from attacks and maintaining network stability and security, network/smart contract stability, community maintenance, willingness to respond to Binance's regular reviews, unethical/fraudulent behavior, and contribution to the construction of the entire blockchain ecosystem.

In addition, GPS’s market maker event will also allow Binance to conduct a “post-listing review” from a dimension that the market values more, namely, whether the liquidity performance is normal.

In the announcement of the investigation results against GPS, Binance warned all market makers authorized by the project parties on the site, requiring them to abide by the platform rules, otherwise Binance will take action. These principles and rules include:

Ensure that both buy and sell orders are supported by pending orders

Ensure sufficient order size within specified depth level

Providing healthy and stable market depth in the trading market

Ensure that pending orders are retained for a certain period of time to avoid high-frequency order cancellations disrupting the market

On March 13, Binance directed its strict review of Alpha, the early project discovery platform in its Web3 wallet, and stated that it would regularly review the "observation selection pool" and remove any tokens that did not meet the platform's "quantitative indicators" and "qualitative standards" from Alpha. On the day of the official announcement, 21 tokens were removed.

Binance Alpha’s “two determinations” framework includes:

Quantitative indicators: transaction volume stability, liquidity depth, on-chain transaction frequency, token holder distribution, and other relevant indicators.

Qualitative criteria: project team credibility, regulatory compliance, ecosystem synergy, community visibility, and other relevant factors.

Since its launch, the Alpha product has been interpreted by the outside world as an important pool for Binance to select new assets from the on-chain ecosystem. Although there is no guarantee that it will be listed on the Binance main site, its coin observation area brings together many popular tokens in the market. Some projects that have conducted exclusive TGE (Genesis Equity) in the Binance Web3 wallet have directly entered the Alpha selection pool, and some have obtained the "ticket" to enter the Binance main site.

Now, under the new "two determinations" review standard, a large number of tokens have been removed. This also means that if you want to be noticed by Binance from Alpha, you must first pass the "two determinations" and then go through user "voting". Even if you pass and go online, you must continue to accept the platform's review and be vigilant about being labeled "observation" at any time.

This time, the strict review of Binance, which was opened by the new currency storm, is also a "wake-up call" sounded by the world's largest trading platform to the project circle.

Whether it is the "inflated marketing" that became popular on the chain in the past, such as "collecting points, promoting interaction, and getting airdrops", or the thinking of "first going to a small platform to show your face, and then going to a large platform to reap the benefits", in the process of Binance's increasingly stringent coin listing review, transaction monitoring, and coin voting, it will to a certain extent break the project party's fantasy that "listing on Binance will achieve the goal", and inject some crisis awareness into them.

At a time when the entire crypto asset market is in a downturn, Binance's approach can be described as "scraping the bone to cure the poison", showing its determination to "protect the people in the door even at the expense of the potential volume-carrying capacity of hot assets". This is also a reform that an industry-leading business entity must make in the context of the crypto asset market moving towards compliance.