Preface: A $4.2 Billion Blockchain Performance Art

After the three waves of EOS, the value is expected to reach $50, and a surge to over $100 cannot be ruled out, heading straight for four digits

EOS itself has no risk, the biggest risk of EOS is that you think there is a risk, and you may not be able to hold on

The above two classic quotes, I believe every old 'Bit' in the crypto world is familiar with.

In 2018, when the 'Bit' were still cheering for Bitcoin breaking the $10,000 mark, a project called EOS quietly refreshed the ceiling of performance art in human financial history: a year-long ICO that raised $4.1 billion, and the founder Brendan Blumer (known as BB in the circle) was even crowned the "Blockchain Jesus" by his fans.

Seven years later, this public chain that once claimed to "beat Ethereum" has seen its market cap shrink from a peak of $18 billion to less than $800 million, with a community activity level comparable to a ghost town, and the founding team has been hammered by the SEC, even the famous "Whale King" in the crypto world has lost money and made meme stickers.

And just as the 'Bit' were about to carve an epitaph for EOS, it suddenly resurrected - announcing a name change to Vaulta and a transformation into a "Web3 Bank", with the token surging over 30% in 24 hours. This absurd drama is even more exciting than "The Wolf of Wall Street".

Chapter 1 From Genius to Joke: The Magical Drift of EOS

ICO Myth: The Collective Hysteria of the 'Bit'

In the crypto world of 2017, the air was filled with the hormones of "All In to get rich". EOS, with its "million TPS", "zero fees", and "developer-friendly" selling points, successfully infected the 'Bit' with "Blockchain Stockholm Syndrome" - they were being slaughtered, but still shouted "Long live the faith".

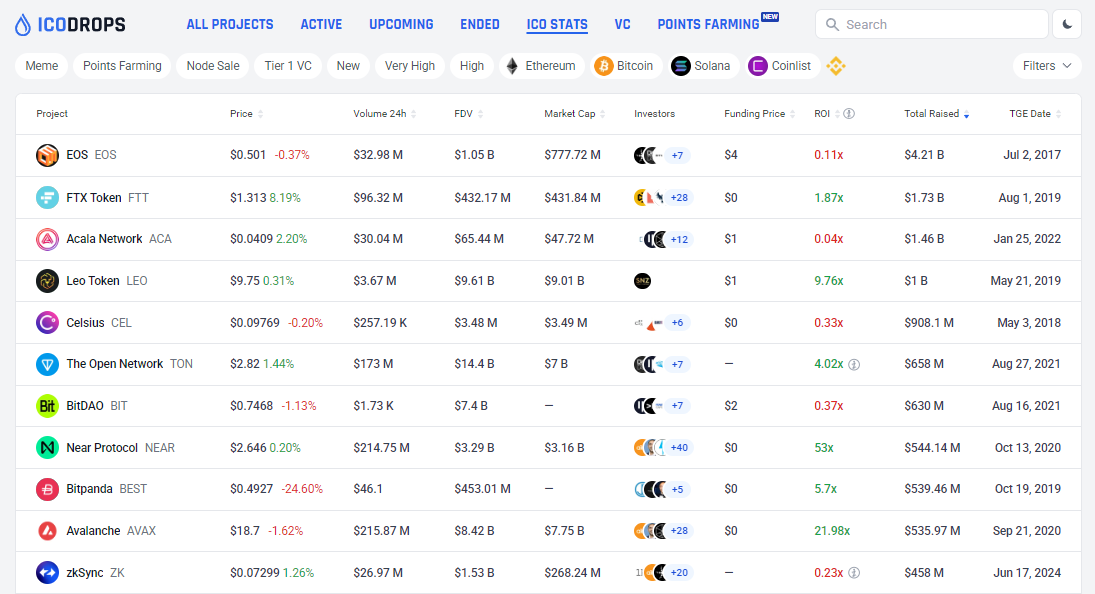

ICODROPS data shows that EOS raised a total of over $4.21 billion, ranking first

The magical highlights include:

- Epic Financing: The year-long ICO was like a suction pump, sucking away $4.1 billion worth of ETH, setting a record that no one has broken since

- Li Xiaolai Endorsement:This "Bitcoin Billionaire of China" on one hand cursed EOS as "air coin", on the other hand secretly built a position, truly a performance artist of split personality

- Super Node Election:The 21 node seats were divided up by exchanges and capital oligarchs, decentralization instantly became the "Blockchain People's Congress"

The EOS token fell from a high of $20 in 2018 to a low of $0.4, a drop of over 98%.

EOS market cap fell from $18 billion to $775 million, perfectly demonstrating "debut as the peak"

The Nightmare of the Tech Geek: The "Oligopolization" of DPoS Consensus

The DPoS mechanism that EOS was proud of is essentially a "blockchain aristocracy game":

- 21 Super Nodes: Exchanges like Bitfinex and OKX monopolize the seats, the voting rights of ordinary users are virtually non-existent

- ECAF Arbitration: Touted as the "Supreme Court of the Chain", it is actually a puppet of Block.one, and has frozen user accounts without authorization, causing widespread anger

- Stagnant Development:Research by Imperial College London found that 95% of transactions on the EOS chain are zero-value operations, a true "blockchain ghost town"

More ironically, EOS forks like Telos and Wax, with lower resource costs, have actually attracted developers to defect, staging the ethical drama of "the son beating the father".

Regulatory Crackdown: SEC's "Precision Strike"

In 2019, the SEC's lawsuit exposed the emperor's new clothes:

- Charges:Block.one defrauded financing through unregistered securities

- Fine: $24 million - only 0.58% of the financing amount, mocked by the crypto circle as "paying protection fees"

- Magical Move: Block.one used the fine to buy 160,000 BTC, becoming a "Bitcoin Whale"

This move is comparable to a thief using the loot to buy a lottery ticket and win the grand prize, and even getting a pat on the back from the police officer.

Chapter 2 Vaulta: New Bottle, Old Wine or True Revolution?

The "Four Pie-in-the-Sky" of the Web3 Bank

Facing the triple whammy of "technology not working, regulation not working, and ecosystem not working", the EOS team pulled out the ultimate trump card - redefining the bank.

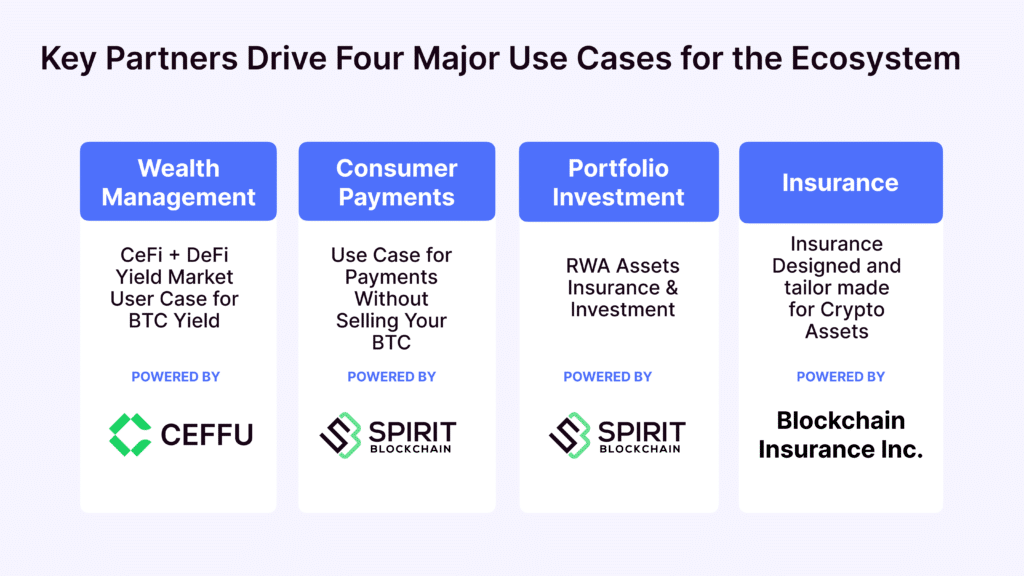

According to thenew Vaulta whitepaper, Vaulta aims to build a "Web3 Banking Operating System", with core selling points including:

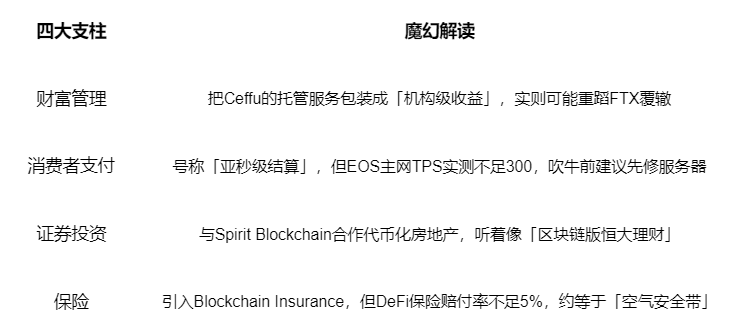

(Vaulta's "four-legged" architecture perfectly inherits the tradition of EOS's Frankenstein)

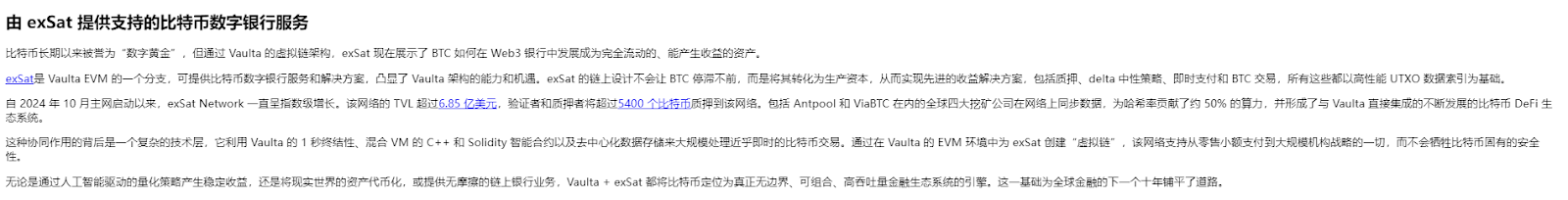

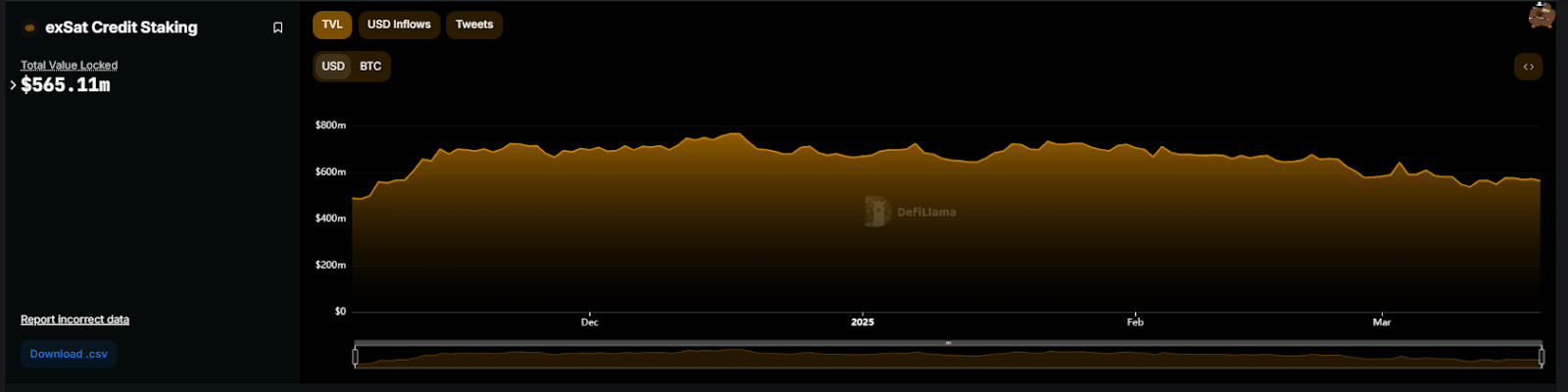

Technical Foundation: exSat's "Bitcoin Ecosystem" Magic

To gild the story, Vaulta brought in exSat to endorse it. According to its introduction,exSat is a branch of Vaulta's EVM, which can provide Bitcoin digital banking services and solutions, highlighting the capabilities and opportunities of Vaulta's architecture. exSat's on-chain design will not let BTC stagnate, but transform it into productive capital, realizing advanced yield solutions including staking, delta-neutral strategies, instant payments and BTC trading, all based on a high-performance UTXO data index.

At the same time, Vaulta claims to:

- Bitcoin Staking: Turn BTC from "digital gold" into a "laying hen", but the BTC PoW mechanism cannot be staked at all, involving concept fraud

- UTXO Index: Using EOS's RAM to store Bitcoin transaction data, equivalent to running ChatGPT on a Nokia 3310

- Mining Pool Endorsement: Claiming that Antpool and ViaBTC are participating, but the miners are just earning fees and can withdraw at any time

This "Bitcoin Ecosystem" rhetoric is essentially using Satoshi Nakamoto's legacy as a marketing tool, worthy of being called the "Blockchain Freeloaders".

Token Economics: A Guide to the Second Harvest of the 'Bit'

Vaulta's most "cool" move is the two-way exchange to convert EOS 1:1 to the new token, currently planned for the end of May 2025, where chain token holders will be able to access a dedicated exchange portal to exchange their EOS tokens for Vaulta's new native token. Initially the exchange will be two-way, but after a 4-month grace period it will become one-way, subject to future updates and confirmations.

The existing EOS token economics (including distribution, supply, and attribution plans) will remain unchanged.

Three Steps to Harvest the 'Bit':

- Inflation Trap: Reserve 25 million tokens for staking rewards, coupled with 17% APY, a classic Ponzi scheme

- Exchange Collusion: Launched on 136 exchanges in advance, making it easy for the big players to pump and dump

- Cross-chain Hype: Boasted about IBC cross-chain, but EVM compatibility has not yet reached the standard, and the developer documentation is like a foreign language

Vaulta's "Token Swap" is essentially a restart of a Ponzi scheme

Chapter 3 How Big is the Pie of the Web3 Bank?

The "Blockchain Cosplay" of Traditional Finance

Vaulta's "Banking Dream" has three major paradoxes:

- Compliance Black Hole: The partners Ceffu and Spirit Blockchain have no banking licenses, the regulatory risks are as dangerous as walking a tightrope

- Technology Backfire: The 1-second block time of the EOS mainnet is the theoretical value, but the actual network congestion often makes it a PowerPoint slide

- Ecological Vacuum: The so-called "200+ trading pairs" are mostly volume-inflating bots, the real liquidity is less than 0.1% of Bitcoin

In Vitalik's words: "Trying to reform banks with blockchain is like putting Wi-Fi on dinosaurs - the direction is not wrong, but the species is already extinct."

Founder BB's "Art of Absconding"

Digging deep into Block.one's shenanigans, it's a textbook case of "fancy cash-out": this combination of "regulatory arbitrage + asset transfer" is something that even Jia Yueting would admit is a professional move.

Chapter 4 The Self-Cultivation of the Sheeple: Can EOS Still Be Touched?

The Truth of the Surge: The "Swan Song" Package of the Dog Traders

The 30% surge in EOS is essentially the classic four-part manipulation playbook:

- News Preheating: Release the "Web3 Bank" concept in advance to attract speculators

- Exchange Collaboration: Major exchanges like OKX and Binance hype it up simultaneously, creating FOMO

- Quantitative Pumping: Use bots to create a "rising volume and price" illusion, luring retail investors to buy in

- Cash-out and Exit: The big players dump at the top, leaving behind a mess

History always repeats itself - the "Super Node" in 2018, the "Voice Social" in 2021, each pump is an opportunity to escape.

Epilogue: Blockchain Doesn't Need a Savior, Just Unfiltered Eyes

The magical history of EOS is essentially the standard template of the crypto world: "technical fantasy → capital harvesting → faith collapse". When Vaulta packages its rotten code with the new clothes of "Web3 Bank", smart sheeple should have realized long ago:

In the crypto world, the only thing better at deceiving than the white paper is the founder's flight ticket booked overnight.