Author: Yashu Gola Source: cointelegraph Translator: Shan Ouba, Jinse Finance

The native token of Ethereum, ETH, has entered the oversold zone multiple times recently, but has not shown any signs of bottoming out. The current trading situation is similar to a historical scenario, and the market structure suggests that ETH may repeat this trend in the second to third quarter of 2024.

Ethereum Breaks Down Again, May Still Have Downside

On the 3-day candlestick chart, the Relative Strength Index (RSI) of ETH is still below 30, which typically signals potential for a rebound.

However, historical data shows that after entering the oversold zone, ETH has not been able to form a clear bottom and has continued to decline, indicating that the market is still dominated by bears.

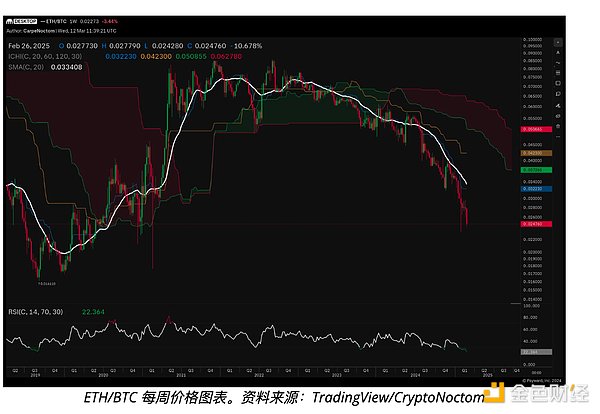

Since mid-2024, the ETH/BTC trading pair has broken down multiple times, with declines of 13%, 21%, 25%, and 19.5%, exhibiting a consecutive downtrend. Additionally, the 50-day and 200-day Exponential Moving Averages (EMAs) are both in a downward trend, further confirming the lack of upward momentum in the market.

X platform market analyst @CarpeNoctom pointed out that the negative price performance of the ETH/BTC trading pair has not yet formed a bullish divergence (where price makes a new low but the RSI forms a higher low), further undermining market confidence.

ETH ETF Outflows and On-Chain Data Indicate Further Weakness

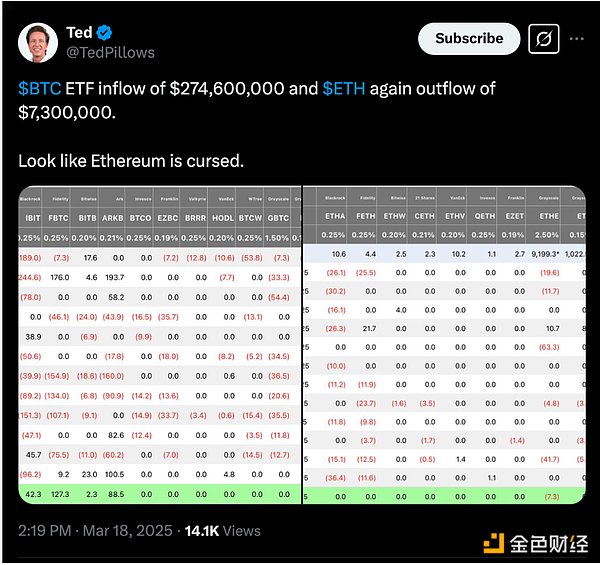

The "cursed" downtrend of ETH/BTC is particularly prominent in the entire cryptocurrency market, as evidenced by outflows from the US spot ETH ETF and negative on-chain data.

In March 2024, the net inflows of the spot Ethereum ETF declined by 9.8%, reaching $2.54 billion. In contrast, the net inflows of the spot Bitcoin ETF only declined by 2.35%, still maintaining at $35.74 billion.

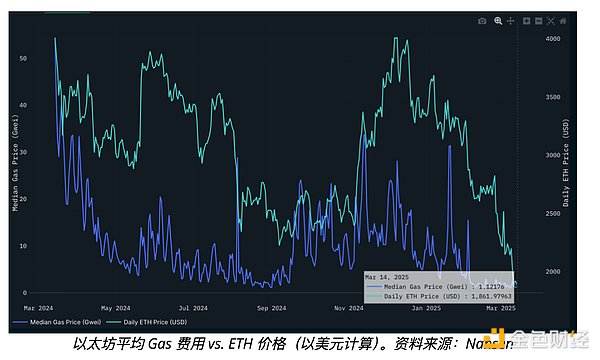

Meanwhile, the average daily Gas fees (calculated by the median) on the Ethereum mainnet have dropped to 1.12 GWEI, a nearly 50-fold decrease compared to the same period in 2023.

Data analysis platform Nansen noted in its latest report that "although ETH is expected to see a second wave of uptrend by the end of 2024, the mainnet activity (measured by Gas consumption) has not been able to recover."

Nansen believes that the decline in mainnet transaction activity is mainly due to capital and users shifting to Solana and Layer 2 networks (L2s), and states that the risk/reward ratio of ETH is inferior to BTC and some undervalued altcoins, thus maintaining a cautious bearish stance.

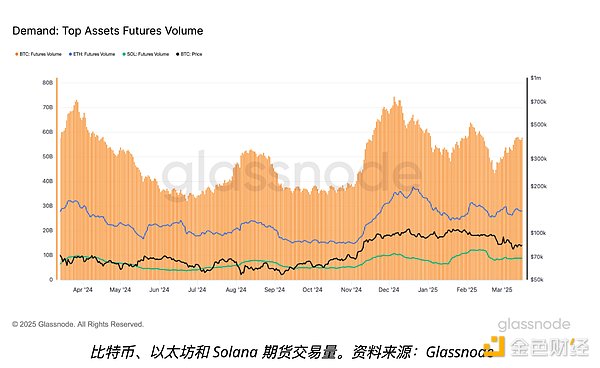

Furthermore, the weak demand for ETH compared to BTC is also reflected in futures trading volume: Bitcoin futures trading volume has rebounded 32% from the February 23 low, reaching $57 billion as of March 18. Ethereum's trading volume, on the other hand, has remained essentially stagnant, with no significant growth (data source: Glassnode).

ETH/BTC May Drop Another 15%

The ETH/BTC trading pair is forming a bearish flag pattern on the daily chart, which typically appears during the consolidation phase after a significant decline, exhibiting converging trendlines.

From a technical perspective, once the bearish flag pattern breaks below the lower support line, the price usually declines by an amount equal to the previous drop. Based on this rule, the downside target for ETH/BTC in April is 0.01968 BTC, a further 15% decline from the current level.

Furthermore, the ETH/BTC trading pair is well below the 50-day and 200-day Exponential Moving Averages (EMAs), and these two key moving averages are still in a steep downtrend, indicating that the market is still in a persistent bearish structure.

Although the downside risk remains, if ETH/BTC breaks above the bearish flag pattern's resistance and successfully converts the 50-day EMA into support, it could invalidate the current bearish trend, potentially paving the way for a rebound.