Ethereum's price dropped 6% between March 19 and March 21, failing to break through the $2,050 resistance level. More notably, ETH has declined 28% since February 21, underperforming the broader cryptocurrency market, which fell 14% during the same period.

VX:TZ7971

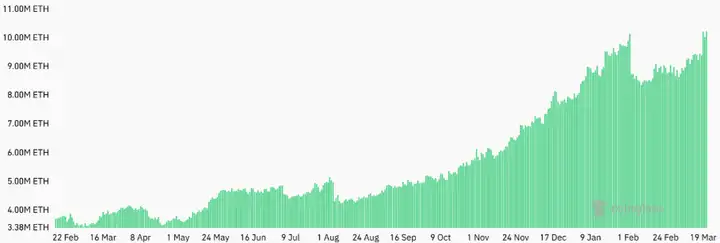

Despite ETH's challenges, the open interest (OI) in Ethereum futures market reached a historic high on March 21. This prompted traders to question whether large investors are prepared for a potential price rise to $2,400, while also raising concerns about the risk of large-scale liquidation due to increased leverage.

Ethereum futures market open interest increased by 15% within two weeks, reaching a record 10.23 million ETH on March 21.

According to CoinGlass, Binance, Gate, and Bitget collectively account for 51% of the market, while the Chicago Mercantile Exchange (CME) holds 9% of ETH futures open interest. This contrasts sharply with Bitcoin futures, where CME leads with a 24% market share.

Declining Demand for Leveraged ETH Long Contracts

Increased ETH futures contract activity typically indicates institutional investor interest, as open interest measures leverage demand. However, buyers (longs) and sellers (shorts) always match orders, so increased open interest does not necessarily signal a positive outlook.

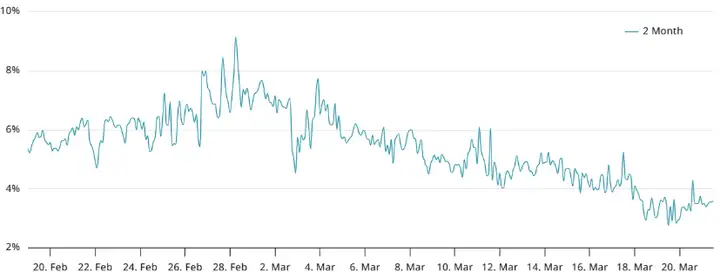

To assess whether buyers want to increase leverage, monthly ETH futures prices should be compared with spot exchange rates. In a neutral market, these derivatives typically have an annual trading price increase of 5% to 10%. If traders are bearish, the premium (spread) might fall below this range.

On March 21, the monthly ETH futures contract's annual premium dropped below 4%, down from 5% two weeks earlier. This indicates that traders using the "cash and carry" arbitrage strategy are bearish, involving selling futures contracts while purchasing spot ETH to profit from the premium as fixed income.

Spot ETF Inflows and Network Fees Pressure ETH Price

Ethereum's decline is partly due to weak demand for US Ethereum ETFs, with net outflows reaching $307 million over two weeks as of March 20.

The macroeconomic environment has also weakened investor confidence, with global trade tensions, inflation pressures, and potential US spending cuts increasing recession risks.

Additionally, Ethereum's recent price weakness stems from imbalances between network fees paid to validators, decentralized application (DApps) revenues, and Layer 2 scaling solutions.

Ethereum's successful transition to proof-of-stake and introduction of blob space to improve scalability through rollups significantly enhanced network throughput. These are also considered factors limiting Ethereum's price growth.

Despite lower transaction costs on Layer 2 solutions, some ETH investors feel they are not receiving sufficient returns.

Influenced by rising macroeconomic risks, Ethereum's price is under pressure, with DApp demand continuously declining amid increasing competition and diminishing investor interest. On March 17, Ethereum's seven-day base layer income dropped to $605,000, a significant decline from $2.5 million two weeks prior.

There are no indications that the increase in ETH futures market open interest is due to bullish positions. In contrast, demand for leveraged long positions remains quite weak, suggesting cautious market sentiment.

First, stabilize at the $2,000 level, then look at the next step.