Author: Lü Boning

"And is that when we do the mic drop?"

Gary Gensler smiled in front of the camera and used the classic "Manba out" pose to end his last tweet video on Twitter. Two days after the tweet, on January 20, 2025, the "notorious" SEC chairman in the eyes of insiders finally ended his career. He was replaced as interim chairman by Mark Uyeda, a Japanese-American SEC commissioner who is relatively more friendly to the crypto industry.

If Fed Chairman Powell indirectly influences the trend of Bitcoin’s candlestick chart by giving eight 30-minute speeches each year, Gensler’s approach is more direct:

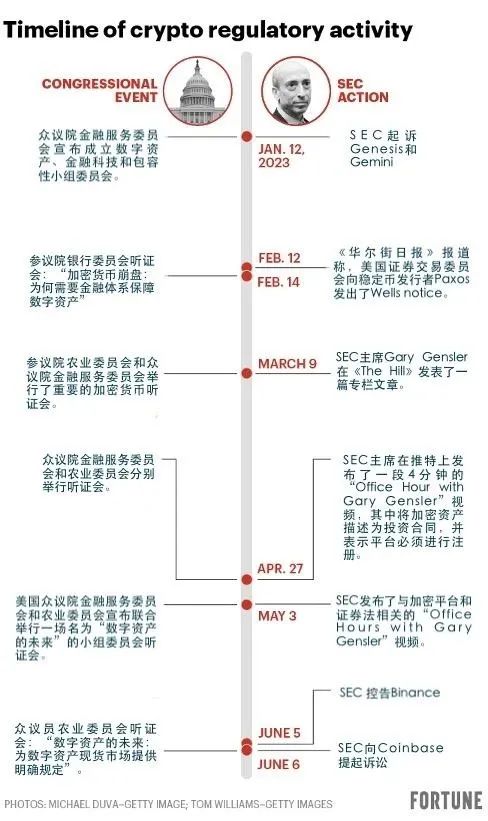

Three months after taking office, he said he would significantly increase the number of SEC staff to address the regulatory issues of the "Wild West"; he made the review of "emerging technologies and virtual assets" a priority, and defined most currencies as "securities" that fall under SEC regulation; he filed lawsuits against Binance, Coinbase, Ripper and other major companies in the industry, turning internal controls into regulations...

Let’s go back to 6 years ago, when you were sitting in an MIT classroom. Although you had already heard your classmates introduce how great the new professor was: he was once one of the youngest partners at Goldman Sachs and helped the NFL secure a $3.6 billion television broadcast contract.

But you would never have thought that the bald man in front of you who taught Bitcoin with a smile and encouraged students to build Uber on the chain would become the chairman of the SEC and would turn around to kill the industry - similarly, the expectation that Trump would bring an eternal bull market to Bitcoin was gradually dashed starting the day before he took office.

Whether the reviews are good or bad, at least until now, Gary Gensler's name is still being mentioned.

Baltimore's financial police

Time magazine described the man in a 2012 interview:

"For a man who strikes fear into the hearts of brazen bankers, Gensler is a remarkably affable man. The 55-year-old single father smiles and jokes frequently, poking fun at his role in making our financial system safer while recounting the perils and joys of raising three daughters (Anna, 22, Lee, 21, and Isabel, 16) on his own after his wife of 20 years, Francesca, died of cancer in 2006."

As chairman of the Commodity Futures Trading Commission, Gensler lived most of his time not in Washington, D.C., but near Baltimore, where he grew up, helping wash his daughter’s dirty laundry while overseeing what was then the Wild West of over-the-counter derivatives.

This $400 trillion market was once one of Wall Street's most profitable business lines and ultimately triggered the famous financial crisis of 2008.

In May of the following year, Gary Gensler, nominated by Obama, was officially sworn in as the 11th Chairman of the CFTC, promising to work hard to "urgently close legal loopholes and bring much-needed transparency and regulation to the OTC derivatives market to reduce risks, enhance market integrity, and protect investors."

But many people think that this is just empty talk - after all, in the two years at the turn of the millennium, Gensler, who was still in the Treasury Department, was famous for promoting the relaxation of bank regulatory rules. He also facilitated the passage of the Commodity Futures Modernization Act under the leadership of Lawrence Summers, then Treasury Secretary and a financial liberalization advocate.

The most important point in this bill is that it abolishes the CFTC's supervision of over-the-counter derivatives (such as credit default swaps, or CDS).

Yes, it is the CDS used by the protagonists in "The Big Short"to short the subprime mortgage market.

The FrontPoint team and Vennett are arguing in "The Big Short."

At that time, the CFTC had long lived under the shadow of the SEC and could only manage a few on-exchange futures contracts, including agricultural products. The bills that Gensler helped pass in the early years made the CFTC always play the role of a bystander in over-the-counter derivatives. Although he was in his position and did his job, the trick of fate made the boomerang return to his hands again after many years.

Gensler did tighten the reins, however. Less than two months after taking office, he proposed limiting the size of positions that market participants (such as ETFs) can hold in energy futures markets. In August, he wrote to Congress, arguing that Obama's proposed over-the-counter derivatives regulation plan was not strong enough.

"Here comes a new enforcer," said Michael Greenberger, a former CFTC official, in an interview. Finally, on July 21, 2010, the Dodd-Frank Wall Street Reform and Consumer Protection Act was passed by Congress, formally giving the CFTC the power to regulate this huge market.

After that, Gensler led the enforcement against financial institutions for manipulating the London Interbank Offered Rate (Libor). After years of investigation, Barclays Bank became the first major bank to publicly admit that it had been manipulating Libor for many years and paid a fine of US$450 million. More than a dozen other banks are under investigation and preparing for possible fines. "UBS has even prepared nearly US$610 million."

“We had to cut 41 positions because of budget cuts, but we only have 36 more employees than we had 20 years ago… The president has high expectations for this small agency, not to mention the people who run it.”

Gensler, who did all of the above, complained that he would keep the obsession of expanding the staff until the day he became SEC chairman.

“History tells us that private currencies don’t last long”

In early 2014, Gary Gensler, who had served his five-year term, left the CFTC. He then went to Maryland to serve as chairman of the Consumer Financial Protection Commission (he was once the treasurer of the Maryland Democratic Party), and then went to MIT to become a professor, teaching the history of currency, Alipay, Bitcoin and blockchain.

Gary Gensler's courseware during his time at MIT.

Until November 2020, he was appointed as a volunteer member of President Biden's transition agency, responsible for transition work related to the financial sector. More than four months later, the Senate voted to approve his nomination, and Gary Gensler officially became the chairman of the SEC.

Interestingly, at the end of that Time magazine interview more than a decade ago, an insider said: "If he hadn't made so many enemies in the industry, he might have achieved greater success, such as SEC Chairman or Treasury Secretary."

On the one hand, it should be said that Gensler was chosen to be the chairman of the SEC because of his courage to make enemies and his long-term successful experience in fighting Wall Street. On the other hand, the Democratic Party also needs such a figure to rectify the regulatory relaxation policies during Trump’s past four years in office. The “revolving door” background of former SEC Chairman Jay Clayton led to the continued relaxation of policies on cryptocurrencies during his tenure, but he left a bomb for his successor before leaving office: suing Ripple for selling unlicensed securities (ie XRP).

“Clayton is ready to go. It’s a shame that he decided to sue Ripple and leave the legal work to the next chairman.”

Ripple CEO Brad Garlinghouse said he believed this was a sign of ill will toward cryptocurrencies from Trump administration officials, while predicting that the Biden administration "will be more favorable to the industry" after taking office.

Similarly, many in the industry also consider Gensler to be a crypto dove based on some of his past public statements and praise for various crypto projects.

Will this single father from Baltimore really be as lenient towards the crypto industry as expected? The answer is no:

In an interview with The Washington Post, he argued that the SEC “has great power, but as I discovered, there are some loopholes,” and endorsed the need to work with Congress, while questioning whether digital assets can be a lasting alternative to public currencies. “History tells us that private forms of currency don’t last long.”

Congress is aligned with some of Gary Gensler's lines of action.

If before the FTX crash, the SEC chairman's attitude towards regulation was still questioning, then after the crash, it was a road of choice.

Everything evolved just like when Gary Gensler took office as Chairman of the CFTC - it was obvious that the goodwill released by Ripple was not accepted. In the following years, the former and the SEC had many legal battles over whether XRP is a security. At the same time, institutions such as Coinbase, BlockFi, and Kraken were also sued and eventually paid fines of varying amounts.

The investigation into Binance, led by the U.S. Department of Justice since 2018, finally came to a conclusion five years later: a fine of $4.368 billion, bail of $175 million, and four months in prison, in exchange for a comprehensive settlement with multiple U.S. regulatory agencies - of course, excluding the SEC.

But just after Trump came to power again, the SEC and Binance jointly requested the court to suspend their lawsuit against Binance, "waiting for the Trump administration to develop a new digital asset framework."

Another important event is the approval of the Bitcoin spot ETF. Although Gensler has spoken out against the approval of a pure Bitcoin ETF ("still vulnerable to fraud and market manipulation") and has rejected applications from multiple companies, when BlackRock submitted the ETF application to the SEC in June 2023, the market still believed that "this time it's stable."

In the early morning of January 10, 2024, the SEC officially announced on social media that the Bitcoin spot ETF was approved. Bitcoin instantly rose to around US$48,000 due to the news. People were jubilant and celebrated the advent of a new era.

A few minutes later, Gary Gensler posted a message on his official Twitter account: “Not approved. The SEC’s official Twitter account was hacked. The tweet just now was posted by a hacker.”

Waiting for another "savior"

Gary Gensler left his post without any surprises - although there is still more than a year before the end of his term in 2026, there will not be and cannot be a place for him in the new Trump administration. Those who look forward to Trump's coming to power, just like those who looked forward to the SEC chairman, believe that the new ruler "will be beneficial to the crypto market."

Trump does have more reason to be friendly to the industry: Coinbase, Jump Crypto, A16z and Ripple are all major donors to super political action committees (PACs) that support Trump; his second son launched the DeFi project World Liberty Financial and invited a series of well-known people in the circle, including Justin Sun, as consultants; he also announced that he would nominate cryptocurrency advocate and Patomak Partner CEO Paul Atkins as the new SEC chairman and "establish a strategic Bitcoin reserve in the United States."

The story reached its climax when Trump announced the release of his own Meme coin. On January 18, Trump posted on his social account, announcing the launch of his personal Meme coin TRUMP, and that TRUMP is the only "official Trump Meme coin."

12 hours after the token was issued, TRUMP was trading at around $30, with a FDV of $30 billion.

36 hours after the token was issued, TRUMP’s trading price reached a peak of approximately $85.2, and its FDV reached a peak of $85.2 billion.

48 hours after the token was issued, Trump's wife Melania posted on social media, "Melania's official meme is online." Except for Melania, which rose to $13.69, other currencies plummeted. TRUMP was halved to $35. The price of Bitcoin hit a new high of $110,000 and then fell rapidly.

16 days after the token was issued, World Liberty Financial liquidated almost all of its ETH assets and transferred them to Coinbase Prime. At the same time, Trump’s second son Eric Trump said on the social platform: “Now is the best time to increase your holdings of ETH.”

47 days after the token was issued, Trump signed an executive order to formally establish the United States Strategic Bitcoin Reserve. The approximately 200,000 bitcoins held by the federal government will all be included in the strategic reserve, and "will neither be sold to the outside world nor will new coins be added through the market." Bitcoin has fallen back to $77,000.

Today, 66 days after the token was issued, TRUMP is quoted at $11.3 and its FDV is $11.3 billion; Melania is quoted at $0.677 and its FDV is $677 million; although Bitcoin is still at a high of $86,000, researchers at The Defi Report said: "The bear market may take 9-12 months to end."

John Cassidy, a writer for The New Yorker, once commented on Trump’s new policies before he took office:

“…as pro-crypto governments prepare to take power + crypto investors cheer, there are some similarities to the dot-com bubble of the late 1990s, which I documented in a book over two decades ago. At the time, some long-time market participants and observers, myself included, were equally excited, equally predicting higher prices, much higher, and equally uneasy.”

"...But whatever the object of speculation, one of the conclusions I drew when I wrote about the Internet stock bubble is that large-scale speculative events rely on 'four horses': new technologies that excite investors; effective methods by which they can communicate; active participation by the financial industry; and a supportive policy environment."

“…The worst-case scenario is a total financial collapse, which I saw many times in the 90s, where people hype something up and it often creates a bubble. Something similar could happen with cryptocurrencies, and governments could condone or even support this hype.”

Gary Gensler was ultimately unable to regulate the crypto industry as he had regulated over-the-counter derivatives more than a decade ago, and the industry did not welcome or miss him.

For participants, a relaxed environment without regulation is what they desire, or in other words, "life and death are determined by fate, and wealth and honor are determined by God."