Author: Nancy, PANews

In recent months, the crypto market has continued to fluctuate downward, with investor confidence hanging by a thread. As market sentiment remains depressed, a "buyback wave" has quietly emerged, with project teams attempting to boost market confidence and drive token value recovery through substantial investments. PANews has compiled 15 crypto projects that will launch or announce token buyback plans in 2025, with the DeFi track being the most active. Many of these projects have buyback scales reaching tens of millions of dollars, but their execution transparency varies, and token prices remain largely flat under market downturn conditions.

DeFi Leads Token Buybacks, Market Reactions Diverge

To some extent, buybacks are not only a short-term market rescue measure but are also seen as an important strategic layout for projects to reshape token economics and provide long-term value.

Among the 15 crypto projects, DeFi remains the main force in token buybacks, with 7 DeFi projects launching or planning buyback programs, including Hyperliquid, Ether.fi, Raydium, Jupiter, Aave, Jito, and Arbitrum. This reflects the urgent need for optimization of token economic models in the DeFi track. AI, security, Layer1, Layer2, and MEME sectors are also gradually exploring buyback mechanisms.

In terms of buyback scale, Hyperliquid, Raydium, Jupiter, Aave, Aerodrome, and Virtual Protocol have significant buyback efforts. For example, Raydium uses part of the transaction fees from each pool for buybacks, accumulating over 55 million RAY to date, approximately 10% of circulating supply, with $54 million spent on buybacks in January alone, setting a new monthly buyback expenditure record; Jupiter allocates 50% of protocol fees to buy back and lock JUP tokens for 3 years, estimated at around $50 million based on last year's protocol revenue, already buying back over $9 million in about a month; Aave initially plans to execute a 6-month buyback at $1 million per week, totaling $24 million, with potential adjustments based on overall protocol budget; Virtuals Protocol has bought back and burned approximately $40 million of VIRTUAL through a TWAP mechanism.

Three projects affected by Binance's market maker investigation have also announced buyback plans, with Movement planning to use $38 million recovered from market makers to buy back MOVE within three months. In comparison, projects like MyShell and GoPlus Security have smaller buyback scales.

In terms of execution, many crypto projects have already started and continuously implemented buyback plans, demonstrating high transparency and execution. For instance, Hyperliquid began token buybacks after TGE, with HYPEBurn data showing over 189,000 HYPE tokens worth over $3.026 million burned by March 25; Aerodrome has accumulated over 100 million AERO tokens burned since protocol launch. However, some projects' buyback plans remain uncertain, with Jito's proposal still in the discussion stage, Berachain only indicating a buyback arrangement without disclosing specific amounts or methods, and Arbitrum announcing a strategic acquisition plan without revealing exact details.

Market reactions have been mixed, with some projects seeing positive price impacts. Aave, MyShell, and Virtuals Protocol showed relatively significant price increases, but about one-third of projects experienced maximum gains under 10%, with relatively flat market responses. This divergence may be related to buyback scale, execution, project fundamentals, and overall market decline.

Behind the Buyback Wave: Value Bet or Self-Rescue?

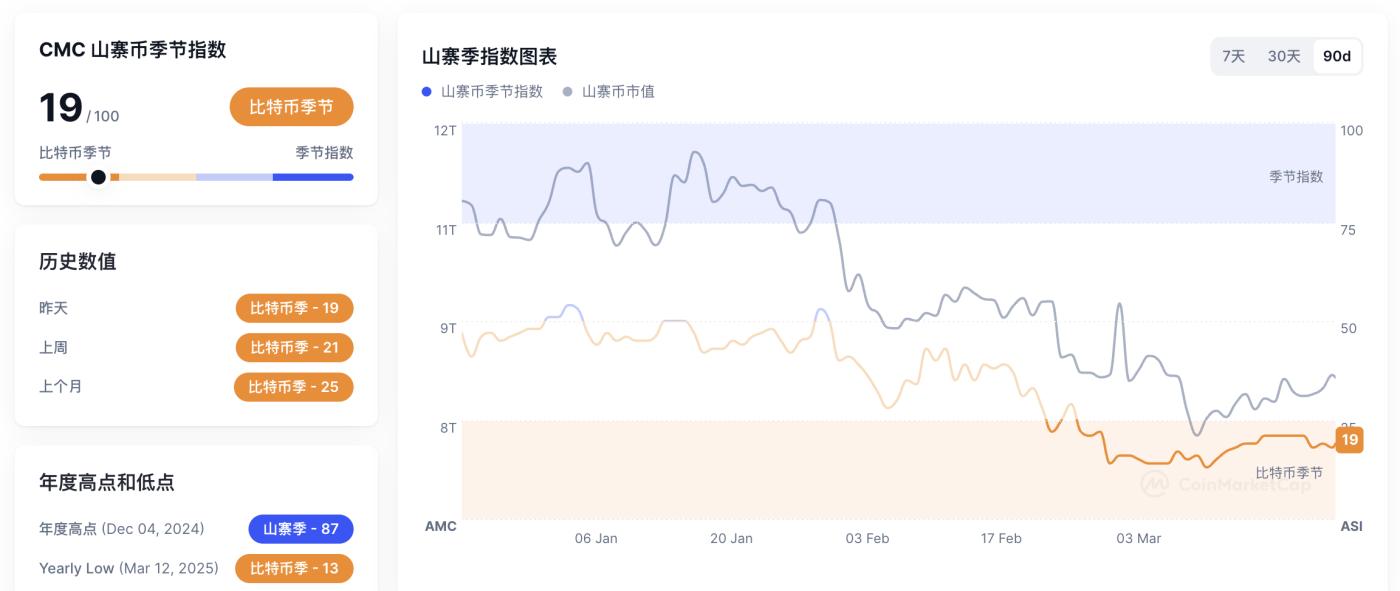

In this crypto cycle, Bitcoin's market dominance has long remained above 60%, while most Altcoins have seen their market value halved or even hit rock bottom, sparking discussions about the "Altcoin Season" demise. Coinmarketcap data shows the Altcoin Season Index dropped to 19 on March 25, a new low since December 4, 2024, with only 19 projects in the top 100 outperforming Bitcoin.

Under market pressure, token buybacks have become a standard strategy for many projects, but market opinions differ. Supporters view buybacks as a demonstration of project confidence and a positive signal, while critics argue that buybacks must match the project's growth capacity. Some even suggest buybacks might become a tool for project teams to "offload" tokens or provide short-term liquidity, failing to address core development issues.

[The rest of the article continues in a similar professional translation style, maintaining the original structure and tone while translating to English.]