GameStop's "Digital Balance Sheet" Revolution: Ambitions and Controversies Mimicking MicroStrategy

In the fourth-quarter financial report released on March 25, 2025, the American game retailer GameStop (GME) officially announced that its board of directors has unanimously approved a Bitcoin investment plan, intending to use nearly $4.8 billion in cash reserves or issue bond funds to purchase Bitcoin and US dollar stablecoins. This decision marks another "meme stock" company incorporating crypto assets into its core financial strategy after MicroStrategy (now named Strategy).

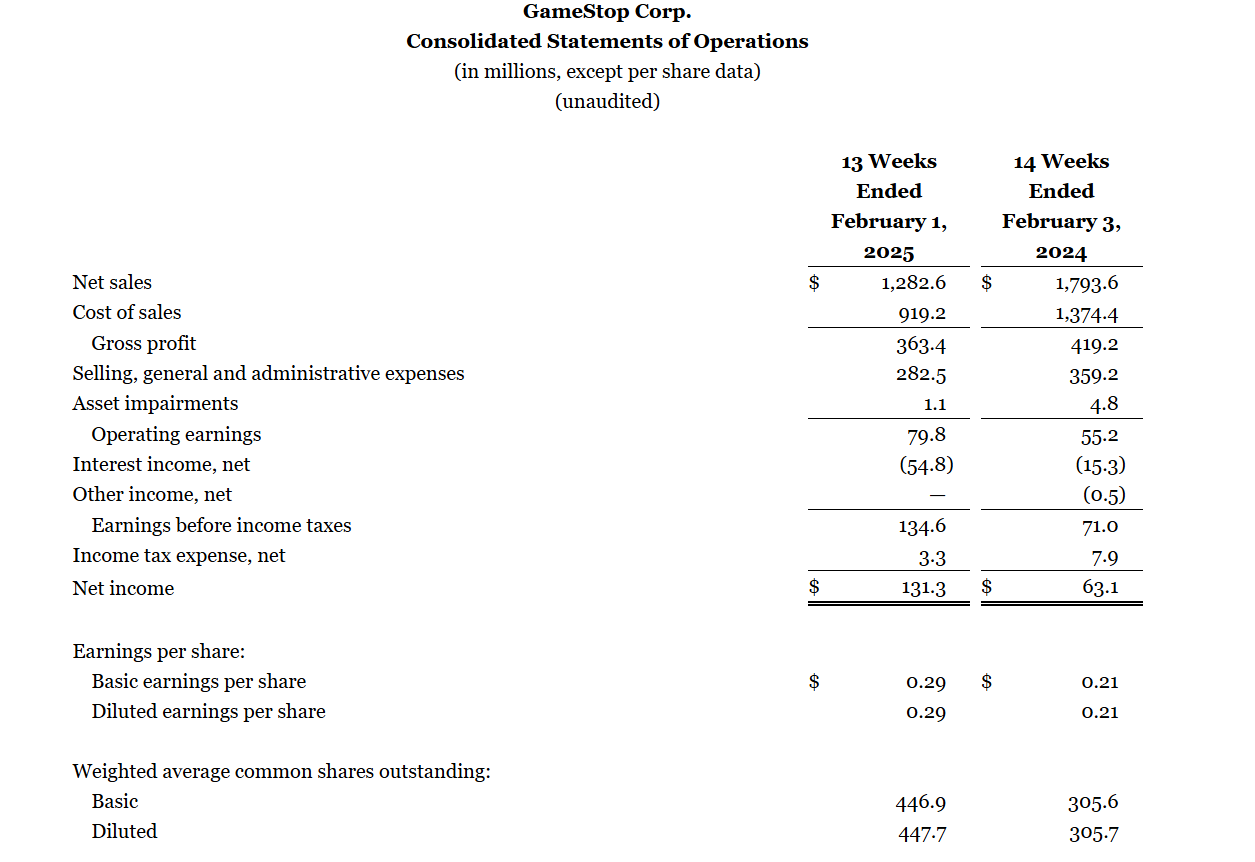

GameStop Quarterly Financial Statement

GameStop's transformation is not accidental. Since the "retail investors vs. Wall Street" event in 2021, the company has continuously reduced costs and optimized cash flow under CEO Ryan Cohen's leadership. As of February 2025, its cash reserves have surged 418% year-on-year, reaching $4.77 billion.

This financial strength provides ammunition for its crypto deployment.

Notably, Cohen previously posted a photo with MicroStrategy founder Michael Saylor on social media, which has sparked market speculation about "copying the Bitcoin holding model". MicroStrategy's latest holdings show that its Bitcoin reserves have reached 506,137 coins, accounting for 2.4% of the total circulating supply.

If GameStop follows this proportion of investment, its purchase volume could impact the short-term market supply and demand balance.

However, this strategy has also faced questioning from traditional financial circles. Economist Peter Schiff sharply criticized that GameStop's crypto investment is a "desperate business strategy" attempting to mask the decline of its core game retail business with high-volatility assets (hardware/software sales decreased by 12% year-on-year in the 2023 fiscal year).

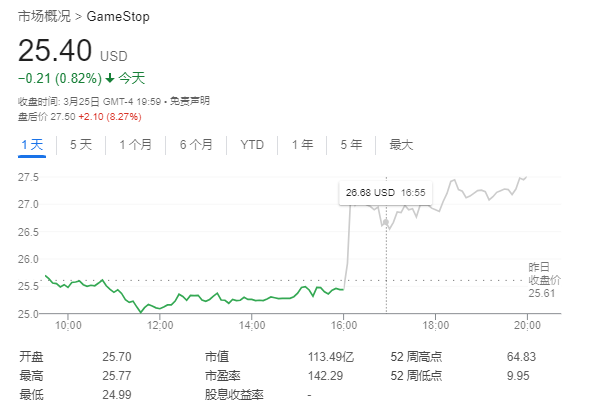

Despite ongoing controversy, the market still gave a positive response: after the news was announced, GME's stock price rose 7.46% after hours.

Bitcoin Faces Strong Resistance at $89,000

While the GameStop event injects narrative expectations into the market, Bitcoin's price is experiencing repeated oscillations at the critical resistance zone of $88,000-$90,000.

According to on-chain data platform Alphractal's monitoring, whale groups holding positions over $1 million have heavily shorted above $88,000, and their position sentiment indicator shows the most significant reversal since the 2024 bull market.Historical data shows a correlation of 87% between sentiment indicators and price trends, with the current signal indicating an increased risk of short-term price pullback.

As shown in the image, two circles mark the area where Bitcoin price explores down to $88,000. When whale position sentiment declines, even if the price rises short-term, it often means whales have started to short, potentially causing price drops. Alphractal CEO Joao Wedson confirmed that whales have closed positions and stated that price trends are usually influenced by these large players' operations.

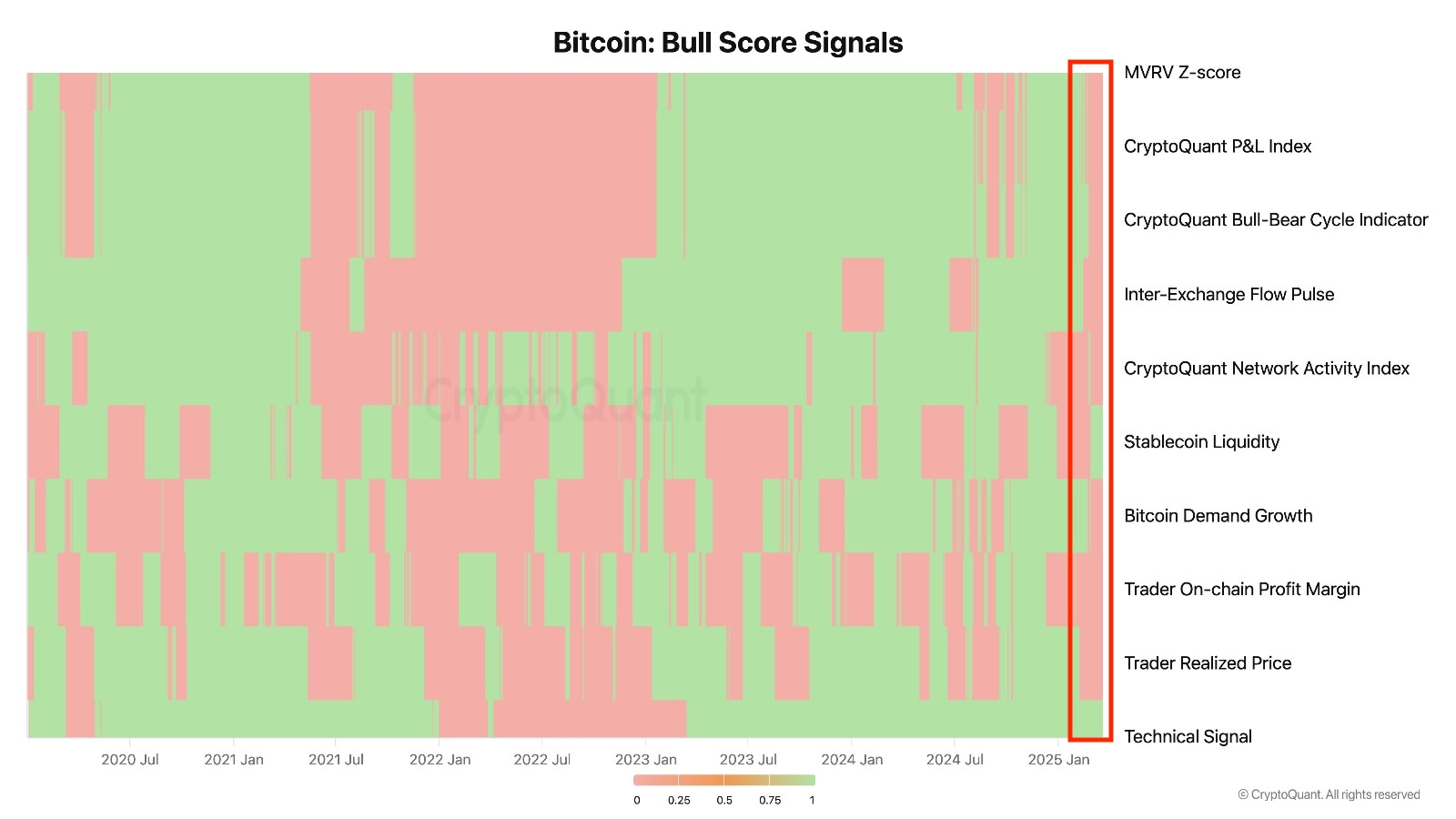

Bitcoin: Bull Market Score Signal

Bitcoin: Bull Market Score Signal

Meanwhile, CryptoQuant's on-chain signals show bearish market sentiment,with 8 out of 10 major indicators showing bearish signals. Except for stablecoin liquidity and technical indicators, other indicators are bearish, further increasing the risk of Bitcoin price pullback.

CryptoQuant CEO Ki Young Ju pointed out that the market has entered a bear market, expecting potentially bearish or sideways movement in the next 6 to 12 months.

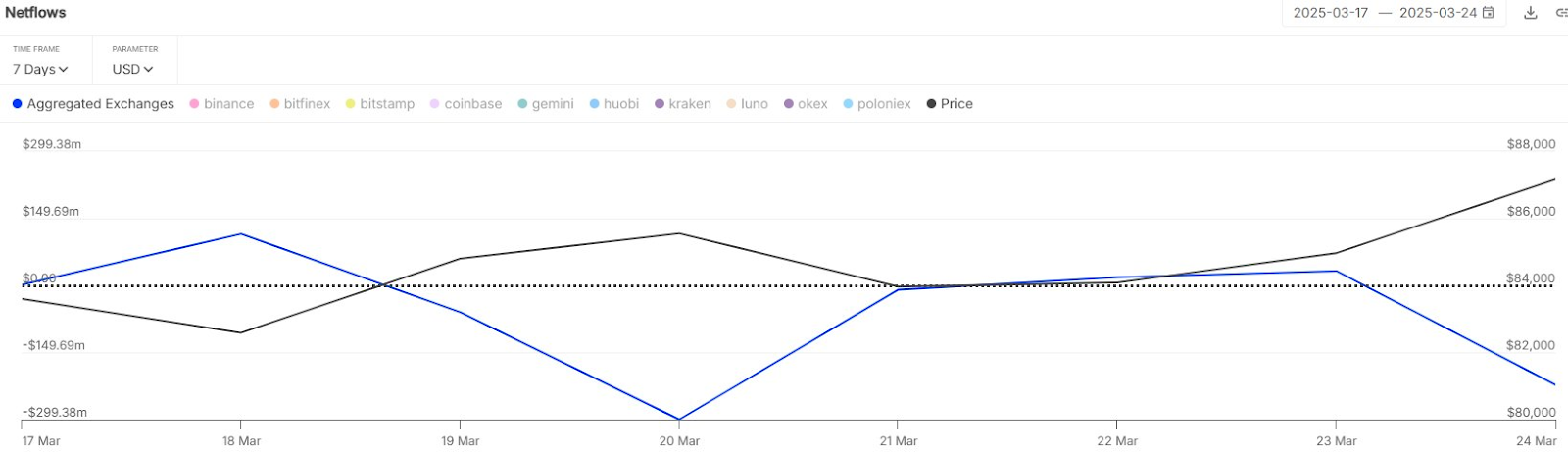

IntoTheBlock's Bitcoin Net Outflow

Despite weakening on-chain signals, some investors still show confidence in Bitcoin. According to IntoTheBlock data, the net Bitcoin outflow from exchanges in the past 24 hours was $220 million, with a total outflow of $424 million between March 18 and March 24, indicating that some investors are increasing their positions.

In a shorter time frame, Bitcoin reached an intraday high of $88,752 on March 24 but failed to create a new high. As Bitcoin consolidates within the ascending channel, it is expected to face multiple resistances from the pattern upper limit on the daily chart and the 50-day, 100-day, and exponential moving averages.Considering whales shorting in the $88,000 to $90,000 range, Bitcoin needs to break through $90,000 to further advance to $100,000.