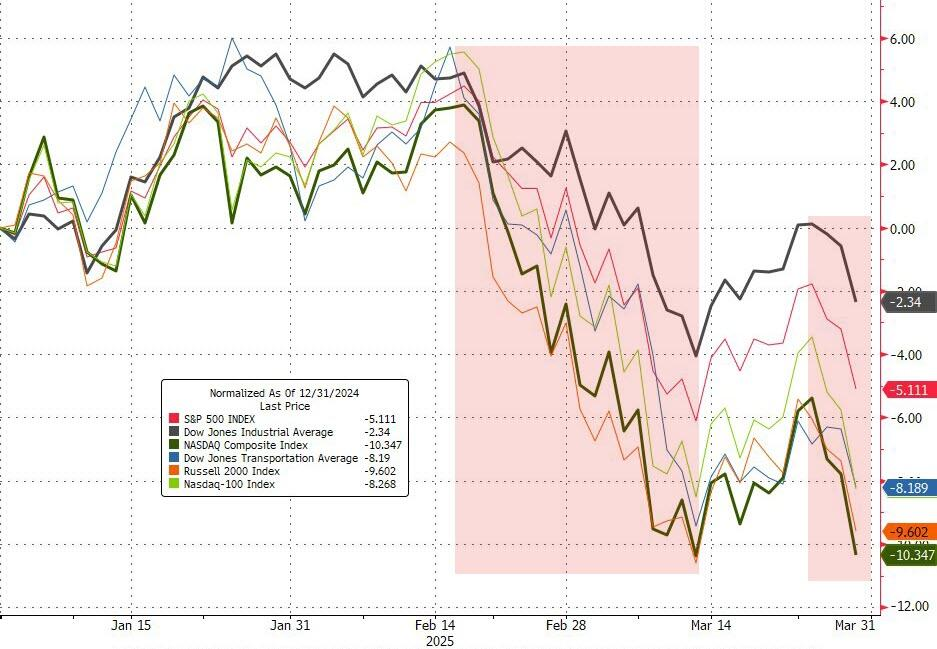

In late March 2025, global financial markets experienced a period of intense volatility. US stocks faced “Black Friday” on March 28, when the S&P 500 fell 1.97%, the Nasdaq plunged 2.7%, and the Dow Jones lost 715 points, down 1.69%. The sell-off quickly spread to the cryptocurrency market: Bitcoin (BTC) fell from $84,000 on the afternoon of March 29 to $81,565 on the morning of March 31, Ethereum (ETH) hit a new low of $1,767, and Solana (SOL) fell to $122.68 at 6 p.m. on March 30.

According to data from Coinglass, around 70,000 crypto investors have had their positions liquidated in the past 48 hours, losing around $200 million. This chain reaction across the market has not only caused panic but also exposed the fragility of the current economic environment. This article will analyze the causes of the crash based on the views of reputable organizations, and also assess the important events of the week that investors should pay attention to and their potential impact.

Causes of the Crash: From Black Friday to the Crypto Weekend Dominance Effect

Important Timelines and Data

The US stock market crash began on “Black Friday” on March 28. According to Investopedia, the S&P 500 fell 112.37 points to 5,580.94, the Nasdaq lost 481.04 points to 17,322.99, and the Dow Jones fell 715.80 points to 41,583.90. Technology stocks led the decline, with seven tech giants (including Apple, Microsoft, Amazon...) losing a total of $505 billion in Capital capitalization, while the Philadelphia Semiconductor Index fell 2.95%. This was the biggest one-day drop since the March 10 crash, marking a sharp correction at the end of the first quarter of 2025.

The cryptocurrency market came under pressure shortly after. Bitcoin fell from $84,000 on the afternoon of March 29 to $81,644 after 8 hours, losing more than 3%, then recovered to $83,536 at 6:00 p.m. on March 30 but could not maintain the increase, down to $81,565 at 6:00 a.m. on March 31. Ethereum fell to $1,767, Solana hit $122.68. According to The Block, the total cryptocurrency Capital fell from a peak of $3.9 trillion to $2.9 trillion, down 25%, with volume falling from $126 billion after the November 5 election to $35 billion, down 70%.

Market Psychology and Money Flow

The simultaneous declines in U.S. stocks and cryptocurrencies reflect increased risk-off sentiment. Galaxy Research points to a strong correlation between Bitcoin and tech stocks, with crypto-related stocks such as MicroStrategy (MSTR) falling 10% on Friday and Coinbase Global (COIN) falling more than 6%, indicating widespread panic. InvestingHaven analyst Taki Tsaklanos sees Bitcoin’s near-term support at $77,000, which could trigger larger-scale liquidations if lost.

Causes of the Crash: Many Intertwined Factors Impacting the Market

Macroeconomic Pressures: Inflation Exceeds Expectations and Weak Consumer Sentiment

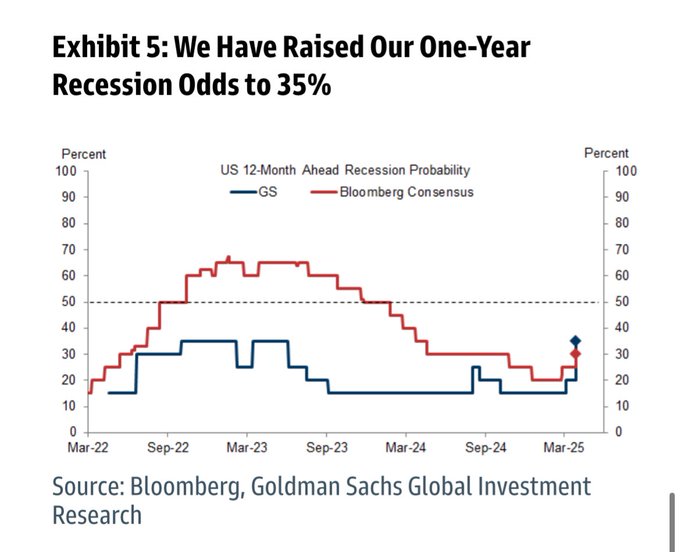

The US Commerce Department reported on March 28 that the core PCE price index rose 0.4% month-over-month and 2.8% year-over-year in February, beating forecasts of 0.3% and 2.6%. Goldman Sachs predicted in a report on March 31 that Dai inflation could push the core PCE up to 3.5%, cutting its 2025 GDP growth forecast from 1.5% to 1% and raising the probability of a recession to 35% from 20%. The University of Michigan consumer confidence index fell to 57 – its lowest since 2022, with one-year inflation expectations rising to 5% and five-year expectations to 4.1%, both multi-decade highs.

Comments from Fed officials added to the concerns. Boston Fed President Collins said “it is appropriate to keep interest rates higher for longer,” while Richmond Fed President warned that tariffs could have “prolonged inflationary effects.” Goldman Sachs said that higher-than-expected inflation, which reduces the case for rate cuts and pushes Capital into safe-haven assets, was a major driver of the decline.

Policy Uncertainty: Trump Tariffs Cause Panic.

The Trump administration’s “reciprocal tariffs” expected to be announced on April 2 are a major catalyst. Goldman Sachs predicts an Medium tariff of 15% across all trading partners, up 5% from its previous forecast, which could raise import costs and trigger global retaliation. “If countries retaliate, the risk of further tariff escalation would undermine market confidence,” warned Matthew Aks of Evercore ISI. Michael Arone of State Street Global Advisors said that “uncertainty continues to haunt us, with next week potentially being the peak of volatility.”

Investopedia cites experts who say tariffs not only drive up inflation expectations but also weaken corporate profits and purchasing power, particularly affecting the tech and auto industries. Jay Woods of Freedom Capital Markets said: “As big events approach, investors are choosing to avoid risk, which has led to increased weekend selling pressure.” X user @White7688 wrote: “BTC is being influenced by external ETF flows, more like tech stocks than safe havens.”

Cash Flow and Market Linkages

The “Black Friday” of US stocks has a domino effect on risk assets. Nasdaq data shows that the correlation between Nasdaq and Bitcoin reached 0.67 in early 2025, with the Nasdaq’s 2.7% decline quickly spreading to cryptocurrencies. Bloomberg’s Mike McGlone analyzed: “If the S&P 500 continues to weaken, Ethereum could fall to $1,000, Bitcoin to $72,000.” Gold prices hit a new high, the US 10-year bond yield fell from 4.369% on Thursday to 4.254% on Friday, showing money flowing into safe-haven assets. Crypto-related stocks such as MicroStrategy fell 11%, MARA Holdings fell 11%.

The Block points out that the end-of-quarter Capital combined with the upcoming “super-risk week” (April 2 tariff announcement, April 5 non-farm payrolls) will cause investors to adjust their portfolios early, pulling Capital from risky assets to gold and US bonds. Alex Thorn of Galaxy Research commented: “The decline in volume may signal greater volatility, low liquidation will amplify the price impact.”

The Block points out that the end-of-quarter Capital combined with the upcoming “super-risk week” (April 2 tariff announcement, April 5 non-farm payrolls) will cause investors to adjust their portfolios early, pulling Capital from risky assets to gold and US bonds. Alex Thorn of Galaxy Research commented: “The decline in volume may signal greater volatility, low liquidation will amplify the price impact.” Intrinsic Risk: Leverage and Volume Shrinking

InvestingHaven predicts that if Bitcoin breaks $77,000, about $300 million in long positions will be liquidated, exacerbating the decline. The Block analyzed that volume dropped from $126 billion to $35 billion, indicating that investors are waiting for regulatory clarity and lack short-term buying power.

Events Investors Should Pay Attention To This Week

As we enter early April, investors should keep an eye on the following events that could shape the direction of US stocks and cryptocurrencies:

- 2/4 (Tuesday): Trump's "reciprocal tariff" policy announced

Overview: The Trump administration is expected to impose an Medium 15% tariff on all trading partners. Goldman Sachs predicts higher import costs and a possible global retaliation. If the tariffs are severe, US stocks could fall 3-5%, Bitcoin could break $80,000; if they are milder (excluding semiconductors and autos), the market could recover briefly, Bitcoin could reach $85,000. “The market reaction depends on the timing and the industry,” said Matthew Aks of Evercore ISI. - 3/4 (Wednesday): ECB March Monetary Policy Meeting Minutes Released

Overview: The ECB will reveal a new assessment of the eurozone economy and inflation, and the possibility of accelerating interest rate cuts. If dovish (further cuts), global risk assets could rise, with cryptocurrencies following US stocks; if cautious, risk sentiment could rise, weighing on Bitcoin and Ethereum. “The ECB’s direction impacts global liquidation expectations,” said Michael Arone of State Street. - 4/4 (Thursday): Remarks by Fed Chairman Powell

Overview: Powell will talk about the US economy and monetary policy, possibly responding to inflation and tariff data. If he signals a rate cut (due to a slowing economy), stocks and cryptocurrencies will rise 2-3%, Bitcoin will surpass $83,000; if he keeps rates high, selling pressure will increase. Bloomberg's Mike McGlone warns: "Powell's tone directly affects the short-term trend of risk assets." - 5/4 (Friday): US Non-Farm Payrolls Report

Overview: March jobs data is expected to be below 200,000 new jobs, unemployment rate could rise to 4.2%. If weak (below 150,000), rate cut expectations increase, supporting stocks and cryptocurrencies, Bitcoin could reach $86,000; if strong, bond yields rise, weighing on risk assets. Goldman Sachs predicts: “This data is the peak of volatility for the week.” - 5/4 (Friday): Microsoft's 50th Anniversary and Copilot Update

Overview: Microsoft celebrates 50 years, may announce major upgrade to Copilot. If tech stocks beat expectations, Nasdaq could rise 1-2%, supporting crypto sentiment; if underwhelming, limited impact. “Tech stocks are the bellwether for crypto,” says Taki Tsaklanos of InvestingHaven.

Organizational Perspectives and Market Outlook

Goldman Sachs: Recession Risk Increases

Goldman Sachs on March 31 raised its 2025 tariff forecast to 15%, core PCE to 3.5%, GDP to 1%, and the unemployment rate to 4.5% at the end of the year. The 12-month recession probability has increased to 35%, and the Fed may cut interest rates three times in the second half of the year to respond. The analyst commented: "Consumer and business sentiment is weak, the economy is vulnerable, and policy risks are greater than before."

Galaxy Research: Cryptocurrency Still Has Potential

Galaxy Research predicts Bitcoin will hit $185,000, Ethereum will surpass $5,500 in 2025 if regulation improves and institutions become more involved. Alex Thorn said: “Short-term volatility is inevitable, but in the long term Bitcoin will surpass the S&P 500 and gold.” The size of US Bitcoin ETF assets could reach $250 billion by the end of 2025.

InvestingHaven: Technical Support and Risk Go Hand in Hand

Taki Tsaklanos from InvestingHaven said that Bitcoin's long-term uptrend remains unchanged, with $77,000 as key support, which could see a recovery in May if it holds. But if it breaks, it could fall to $70,000. He warned: "The market needs to respect the 50% Fibonacci retracement level, otherwise the uptrend will be invalidated."

Bloomberg and Evercore ISI: Short-Term Volatility Rising

“The high correlation with the Nasdaq 100 makes Bitcoin look like a high-beta asset, which could fall with U.S. stocks,” said Bloomberg’s Mike McGlone. “The April 2 tariff announcement is a milestone, but the uncertainty won’t end anytime soon, and we need to watch out for a chain reaction of retaliatory tariffs,” said Evercore ISI’s Matthew Aks.

Conclusion and Future Trends

The Black Friday and weekend crypto crash were the result of macroeconomic pressures, policy uncertainty, cash flows, and inherent risks. In the short term, the April 2 tariff announcement was a turning point: if it is severe and causes global trade tensions, Bitcoin could break $80,000, and US stocks could fall further. However, expectations of a rate cut from Goldman Sachs and institutional participation from Galaxy Research could provide a boost to the recovery.