I. Century Tariff Bill: Penetrating the Seven-Layer Logic of "Reciprocal Tariffs"

Policy Core Architecture and Implementation Path

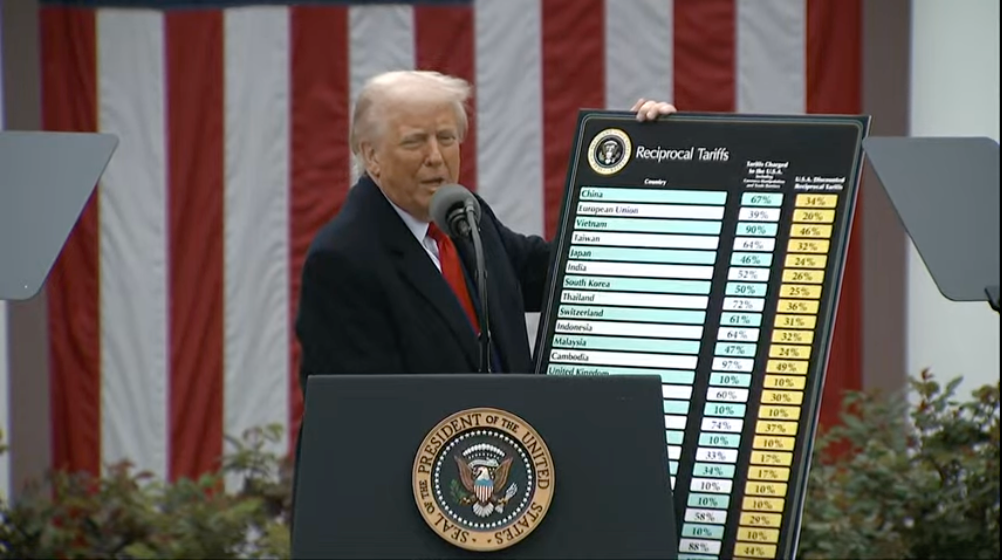

US President Donald Trump speaks to the media about reciprocal trade tariffs at a press conference on April 2.

In the early morning of April 3 Beijing time, the executive order signed by Trump constructed a "dual-track tariff system", marking a comprehensive shift in US trade strategy. According to the details released by the White House, the "base layer" requires a 10% "minimum baseline tariff" on imported goods from all countries, while the "strike layer" targets 60 "key non-compliant countries" with a "semi-reciprocal tariff" (50% of the target country's tariffs on the US).

Specific tax rates show that China's total tax rate reaches 54% (34% new addition on top of existing 20%), EU 20%, Japan 24%, South Korea 25%, Vietnam 46%, Cambodia 49%, with automobiles and parts separately taxed at 25%. Notably, the US government bypassed congressional review by invoking the International Emergency Economic Powers Act and Section 232 of the 1962 Trade Expansion Act, using "national security" as a pretext to accelerate policy implementation.

White House senior officials revealed that the baseline tariff will take effect on April 5, while reciprocal tariffs will be launched on April 9, with a negotiation window reserved to pressure trade partners to make concessions.

Economic Theory and Historical Tracing

Trump reiterated the "tariff nation theory" at the press conference, anchoring the policy logic to the "gold standard + high tariff" era from 1789-1913, emphasizing that tariff revenue accounted for 95% of federal government income at that time, and claiming "to make foreigners pay for the US fiscal budget".

This framework implicitly contains a "fiscal revolution" intent - gradually replacing income tax with tariffs. Commerce Secretary Howard Lutnik has proposed a concept of "replacing IRS with External Revenue Service (ERS)", with calculations showing taxpayers could save $130,000-$320,000. However, economists view this strategy as a modern reproduction of import substitution industrialization (ISI), with historical lessons traceable to the Great Depression triggered by the 1930 Smoot-Hawley Tariff Act and the Latin American debt crisis of the 1980s.

The Peterson Institute warns that as the first supereconomy to implement ISI, the US policy spillover effects may trigger a global recession. The International Monetary Fund (IMF) has lowered the 2025 global GDP growth expectation from 3.1% to 2.7%.

Global Supply Chain Restructuring and Industrial Impact

The policy specially exempts steel, aluminum, and auto parts already constrained by Section 232, but strategic industries like semiconductors and pharmaceuticals still face future tax risks.

Peterson Institute experts point out that this essentially establishes a tariff "whitelist" system, forcing companies to relocate core production back to the US. Taking the automotive industry as an example, a Michigan think tank calculates that a 25% tariff could cause imported car prices to rise up to $20,000, with full-size SUVs and electric vehicles most affected. Tesla has already announced reducing its German factory capacity to 30% and accelerating the construction of a Mexican super factory to avoid tariffs. The chain reaction of supply chain disruption is emerging: 80% of Mexico's car exports depend on the US market, and a 25% tariff might shrink its GDP by 16%; Vietnam's textile industry faces order loss due to 46% tariffs, with some enterprises already shifting production capacity to Cambodia.

II. Market Nuclear Explosion Scene: Tech Stocks Precisely Struck, Epic Diversion of Safe-Haven Assets

US Stock "Black Three Minutes" and Liquidity Crisis

Before the policy announcement, the market still harbored lucky psychology, with Nasdaq rising 0.87%, and Chinese concept stocks showing false prosperity;

However, after the executive order was implemented, Nasdaq futures instantly plummeted 4.5%, with Apple and Tesla dropping 7% after-hours, and the semiconductor sector evaporating $320 billion in market value.

The deep logic lies in tech giants' average overseas production accounting for 68%, with tariffs directly eroding profit margins - Goldman Sachs calculates that each 1% tariff will reduce S&P 500 component stock profits by 0.8%.

Notably, hedge funds have already positioned themselves: Goldman Sachs data shows their tech stock exposure has dropped to a five-year low, with NVIDIA, AMD, and Tesla becoming the largest short targets, and AI hardware manufacturers experiencing concentrated selling of 59%. Liquidity squeeze intensified market panic, with the S&P 500 volatility index (VIX) surging 42% in a single day, the largest increase since March 2020.

Divergence and Paradox of Safe-Haven Assets

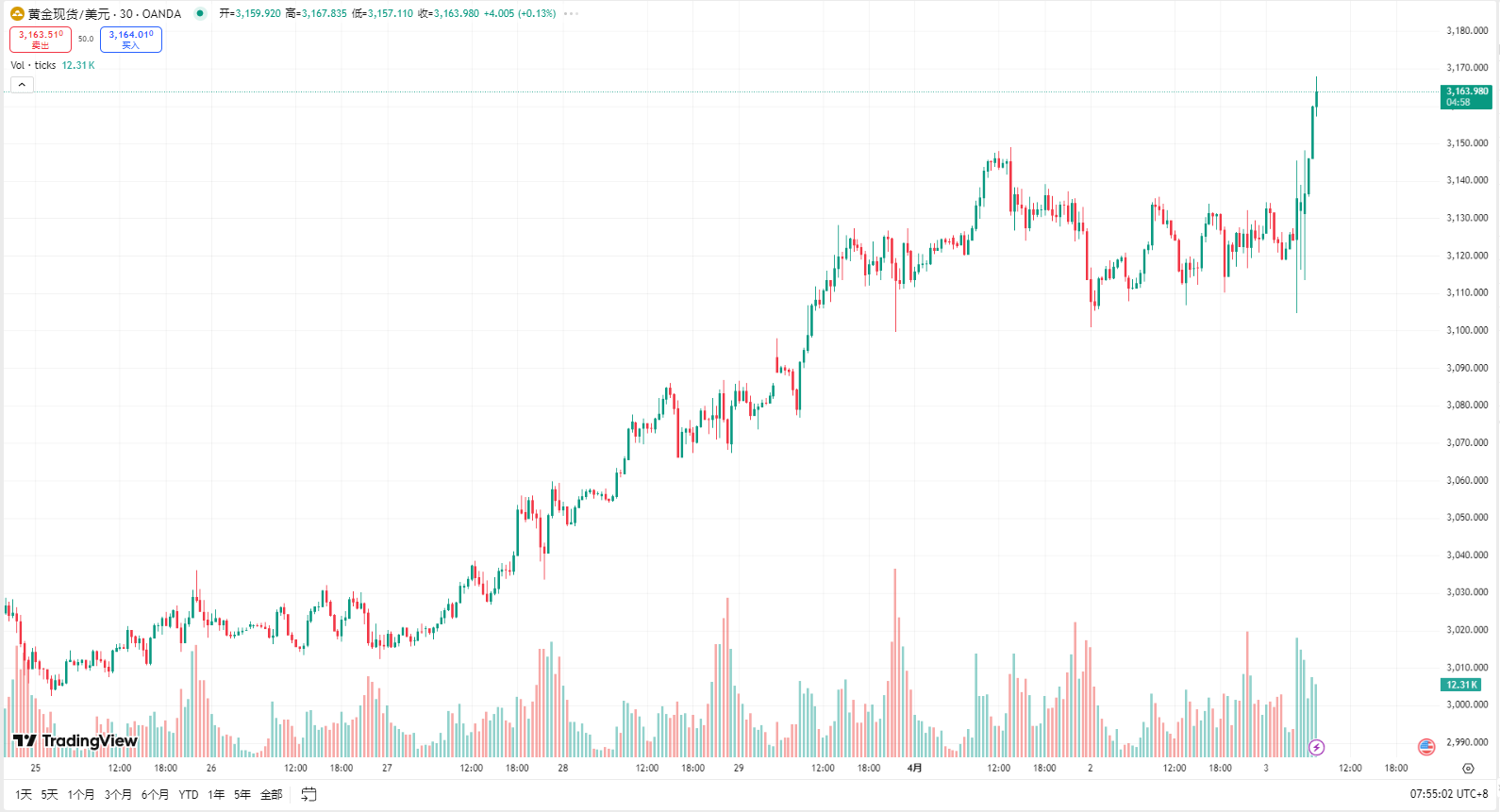

Traditional safe-haven assets showed contradictory trends: COMEX gold briefly broke through $3,200/oz but then fell back to $3,160, reflecting the "policy implementation exhausts positive factors" characteristic; the 10-year US Treasury yield counterintuitively rebounded to 4.3%, reflecting market concerns about "tariff inflation" exceeding safe-haven demand.

Traditional safe-haven assets showed contradictory trends: COMEX gold briefly broke through $3,200/oz but then fell back to $3,160, reflecting the "policy implementation exhausts positive factors" characteristic; the 10-year US Treasury yield counterintuitively rebounded to 4.3%, reflecting market concerns about "tariff inflation" exceeding safe-haven demand.

III. Bitcoin "Policy Market" Dissection: From Safe-Haven Darling to Liquidity Sacrifice

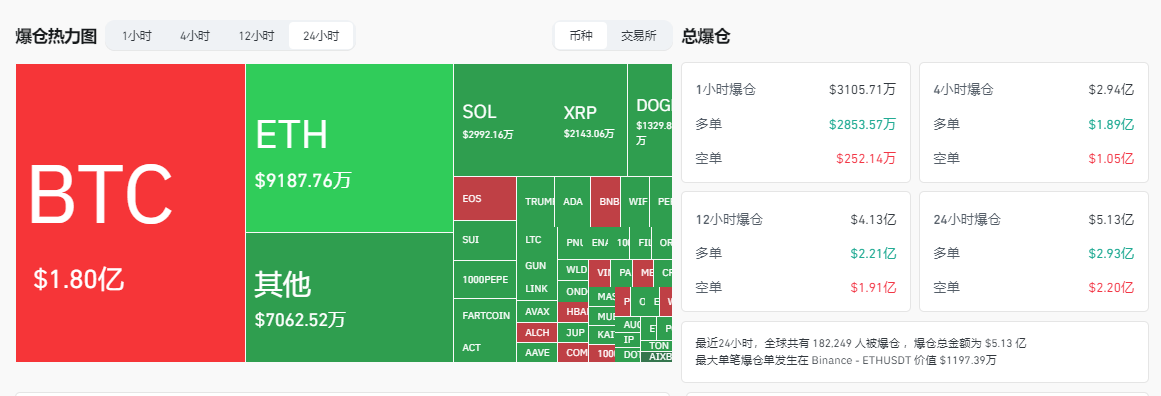

Bitcoin staged a "roller coaster market" - rising to $88,500 before policy announcement, but then experiencing a chain liquidation due to concentrated leverage long position closures, plummeting to $82,500 within 4 hours.

According to Coinglass data, in the last 24 hours, 182,245 global liquidations occurred, with a total liquidation amount of $513 million, including a single ETH-USDT liquidation of $11.97 million.

ETH again falls below $1,800, dropping 5.31% in the past 24 hours;

SOL drops to $117, falling 7% in the past 24 hours;

Doge drops to $0.164, falling 5.5% in the past 24 hours;

BNB drops to $591, falling 3.3% in the past 24 hours;

This volatility exposes the structural fragility of the cryptocurrency market.

Three-Layered Narrative Switching and Market Psychology

From March 31 to April 2, Bitcoin slowly rose from $78,000 to $85,000, reflecting geopolitical risk hedging logic; at 6 PM US Eastern time on April 2, with tariff details leaked, funds rushed to push it to $88,500; after policy implementation, the market realized that tariff-induced "US dollar liquidity contraction" might suppress risk assets, forcing leveraged long positions to close.

On-chain data reveals institutional movements: Coinbase Premium Index (institutional buying intensity) plummeted from +1.2% to -0.8%, with whale address holdings decreasing by 120,000 coins in a single day, indicating Smart Money is withdrawing.

Regulatory Upgrade and Medium-Long Term Concerns

The US Treasury plans to include "tariff avoidance" in virtual asset anti-money laundering monitoring, requiring exchanges to strengthen review of "trade-related addresses"; the EU simultaneously advances the MiCA 2.0 bill, requiring stablecoin issuers to have no more than 50% US dollar assets in reserve funds. These policies might weaken cryptocurrencies' cross-border payment functions, with Tether (USDT) trading volumes already declining 23% in tariff-affected countries like Mexico and Vietnam.

A more profound impact is that global trade fragmentation is giving birth to regional digital currency systems, with digital yuan settlement share in ASEAN rising to 18%, digital euro pilot expanding to the automotive industry chain, challenging Bitcoin's "supranational currency" narrative.

Storm Eye Observation: Follow-up Inference and Investment Strategy

Digital Currency Regulation and Market Differentiation

The US SEC may include "tariff-related tokens" in securities regulation, strengthening scrutiny of cross-border trade settlement projects; the EU requires stablecoin issuers to hold "tariff risk reserves", increasing compliance costs for Tether and USDC. Investment opportunities exist in inflation-resistant crypto assets: Bitcoin computing power tokens benefit from energy tariffs, decentralized prediction markets (such as Polymarket) bet on tariff negotiation results, and privacy coins may see surging demand in cross-border gray trade.

Structural Opportunities and Risk Warnings

In the short term, North American domestic manufacturing ETFs (such as XAR, ITA), inflation-resistant REITs (data centers, warehousing logistics), and computing power tokens have opportunities for oversold rebounds; in the medium to long term, focus on subjects benefiting from regional free trade agreements (ASEAN tech stocks, Mexican consumer stocks) and tariff-exempt enterprises (Intel, Pfizer).

In terms of risk, if retaliatory tariffs escalate among countries, global trade volume may shrink by 12%, triggering a "US dollar liquidity crisis" similar to 2022, with Bitcoin potentially retesting below $76,000.