Original | Odaily (@OdailyChina)

Author | Nan Zhi (@Assassin_Malvo)

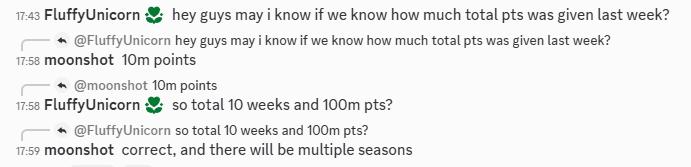

On March 21, the on-chain exchange Backpack Exchange announced the launch of its first points program season, which will last for 10 weeks and is currently in its third week, with plans to launch more seasons. Backpack stated that it will issue points to users weekly based on their activity across all exchange products, with points criteria continuously updated and intentionally not disclosed, aiming to reward users who contribute to Backpack's development.

Backpack has not explicitly stated the connection between the points program and future tokens. This article will review and calculate the points situation based on the assumption of a direct association between points and token airdrop.

Backpack Background

In September 2022, Coral, the development company behind Backpack, announced the completion of a $20 million funding round, led by FTX Ventures and Jump Crypto, with participation from Multicoin Capital, Anagram, K5 Global, and other strategic investors. According to the Wall Street Journal, Backpack Exchange was co-founded by Can Sun, former FTX General Counsel, and Armani Ferrante, former Alameda Research software developer.

In April 2023, Backpack issued the first xNFT series Mad Lads on the Solana ecosystem. The NFT project was extremely popular, with its trading volume once ranking first network-wide, even surpassing the Ethereum ecosystem's blue-chip NFT project BAYC.

In October 2023, Backpack announced the launch of a "regulated" exchange, Backpack Exchange, and obtained a VASP license from the Dubai Virtual Asset Regulatory Authority.

In April 2025, Backpack announced the completion of the acquisition of FTX EU. From this point, Backpack EU has officially initiated the asset recovery and fund distribution process, providing clear and convenient fund return services for former FTX EU users to help them recover previously frozen fiat assets. After this acquisition, Backpack will reactivate the licenses held by FTX EU and will provide comprehensive cryptocurrency derivatives trading services within the EU in the future.

Points Basic Rules

The first season points program will distribute 10 million points weekly for 10 weeks, meaning a total of 100 million points for the first season.

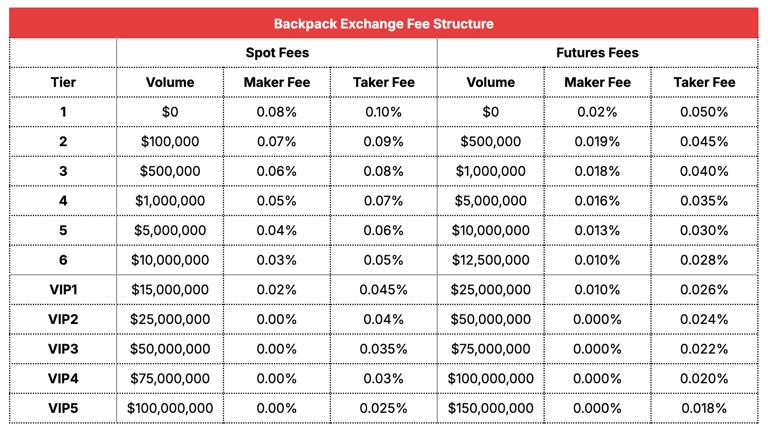

Backpack stated that all activities including spot trading, contracts, lending, deposits, and invitations can earn points, with points distributed every Friday at 10:00 (UTC+8). The official transaction fee table is shown below:

Points Distribution Review

Points distribution for the first week is shown below

Points distribution for the second week is shown below

What Are the Key Factors?

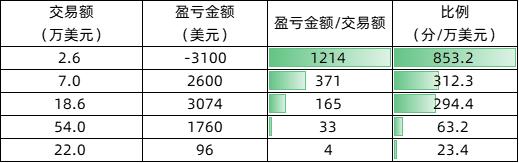

Here, we will divide points by transaction amount to obtain the points acquisition efficiency, i.e., how many points can be earned per 10,000 yuan, shown in the third column of the table (referred to as "ratio").

Based on the above two tables, points are positively correlated with transaction amount, but transaction amount is not the sole determinative factor of points efficiency, with accounts having similar transaction amounts potentially receiving vastly different point allocations.

The factor causing this difference might be the account's proximity to a "genuine user". For "wash trading" accounts, transaction amount is achieved through multiple quick in-and-out trades, characterized by low "profit and loss amount" and short "holding time".

In the community feedback from the first week, many community members pointed out that "holding time" was a key factor. In the second week, more people believed that "profit and loss amount" was modified by the official to become a more critical factor, with both significant profits and losses effectively improving points distribution ratio, especially for the first-place user in the second week, whose airdrop ratio was far higher than others.

Additionally, the author believes that "profit and loss amount/transaction amount" is a highly positively correlated factor. Organizing the known data into a table, we can clearly see that the higher the profit and loss amount/transaction amount, the higher the points acquisition efficiency (ratio). Therefore, for non-wash trading users, improving the profit and loss ratio is a key factor.

Points Value Estimation

Assuming a 1:1 conversion between points and tokens in the final airdrop, with an initial token circulating market value of $50 million and total points of 100 million, each point would be worth $0.5.

We also assume an overall points efficiency (ratio) of 100 points per $10,000, meaning acquiring 1 point requires a transaction volume of $100. The highest spot Taker in the lowest tier would require a fee of $0.1, while the lowest contract Maker would require $0.02.

In this scenario, wash trading is actually profitable. The first-place user in the second week, who obtained 2,178 points worth $1,089, could not compensate for the $3,100 loss. For users simulating genuine user transactions, they should carefully control loss amounts and even consider hedging trades with two accounts.