Author: C00k1e (@lonelyhorseme)

On January 6, 2022, TreasureDAO ’Official Twitter issued a bold declaration: “The Nintendo of Web3 will be a DAO.”

Such a major adjustment in development strategy, suddenly announced in such a weak market environment, naturally aroused many questions.

The dilemma faced by TreasureDAO may be the dilemma faced by all projects in the crypto. It is hard to blame them for expanding when they have enough food at home, but they tightened their belts too late. The $MAGIC coin price drop caused by this unexpected official announcement undoubtedly made the situation worse.

On January 6, 2022, TreasureDAO ’Official Twitter issued a bold declaration: “The Nintendo of Web3 will be a DAO.”

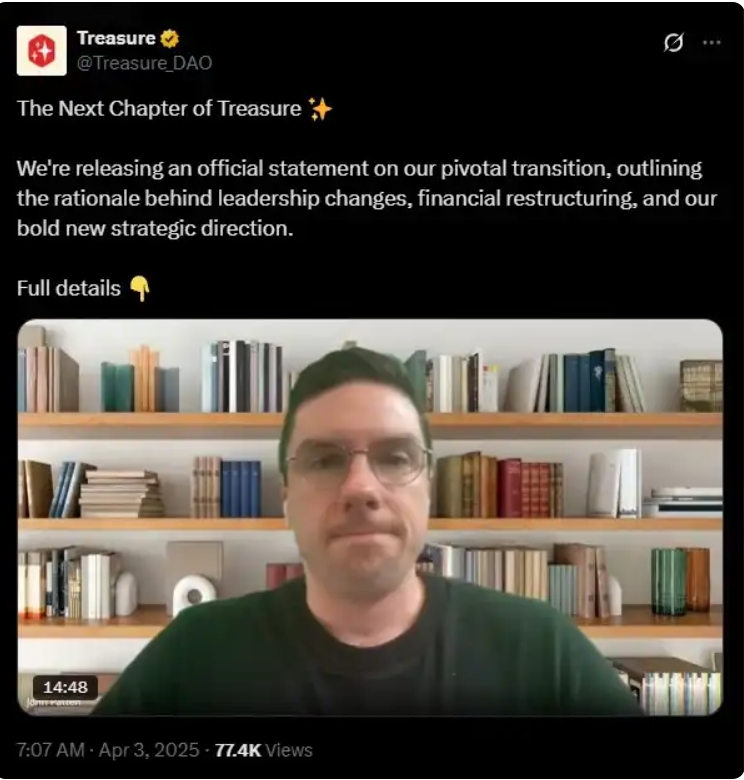

On April 3, 2025, TreasureDAO released a nearly 15-minute video titled "The Next Chapter of TreasureDAO", announcing the decision to completely terminate the game publishing stack and game distribution and transform to AI.

After waiting for 3 years, I still didn’t get my own “Nintendo”. How did the once-popular TreasureDAO gradually fall into decline?

origin

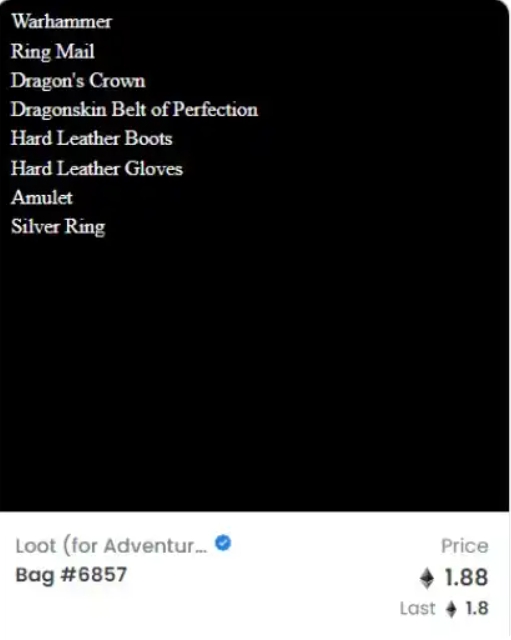

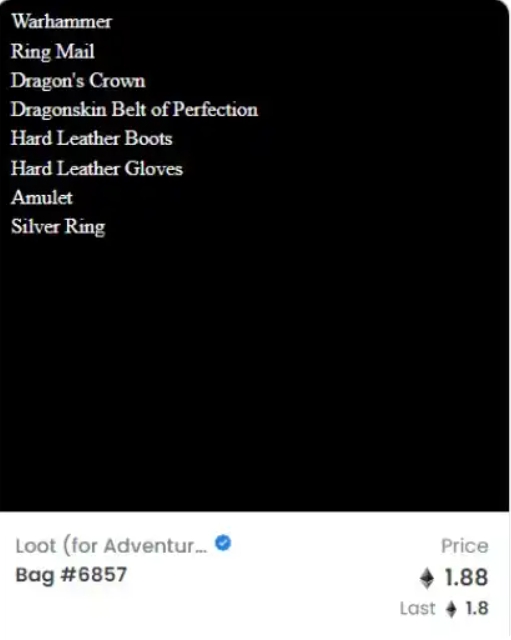

Treasure was founded by John Patten (@smoldev__) and yyyy (@0xyyyy) in September 2021. It first appeared as a Loot derivative project. Loot NFT is generated by random weapon and equipment names, such as "Dragon Crown", "Silver Ring" and so on in the picture below.

Loot NFT, which once made everyone say that they couldn’t understand it, “Is this English word made of gold?”

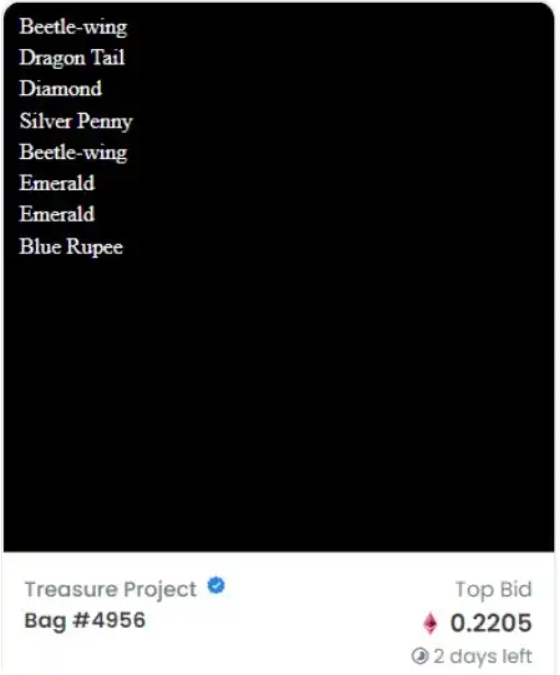

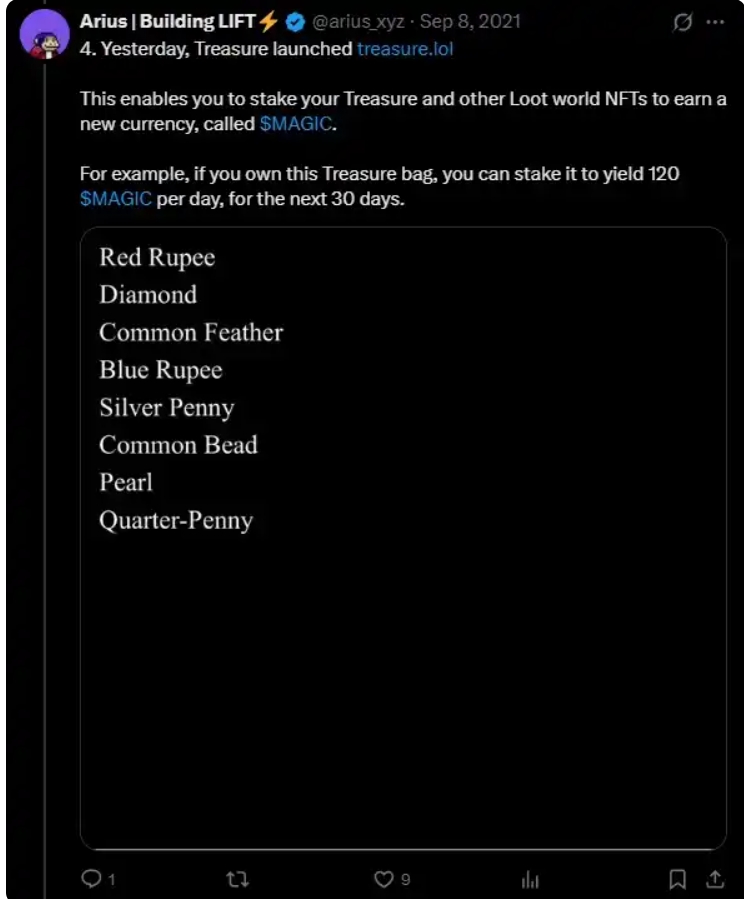

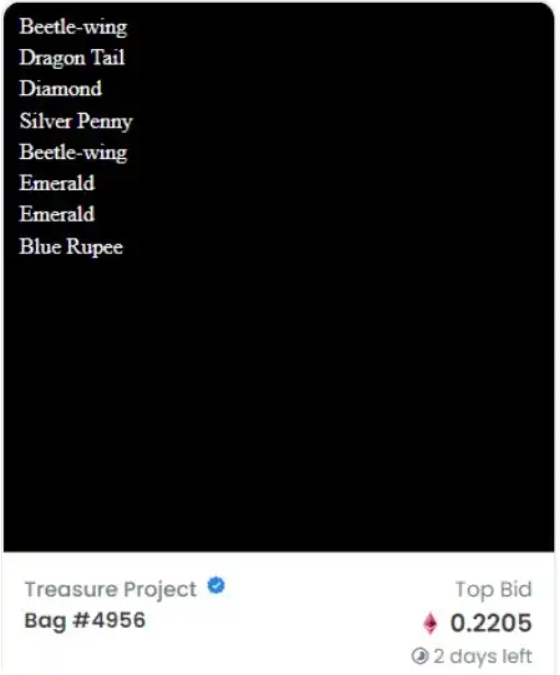

Inspired by Loot, John Patten and yyyy thought that since randomly generating NFTs from weapon names is a great idea, wouldn’t it be interesting to randomly generate NFTs from the names of treasure materials commonly seen in RPG games, such as “diamond” and “emerald”? Thus, the following “Treasure Bag” appeared.

Soon, they set up a staking website where NFTs from projects including $AGLD, Loot, Treasure, etc. could be pledged to obtain $MAGIC tokens and Legion NFTs from the Bridgeworld game.

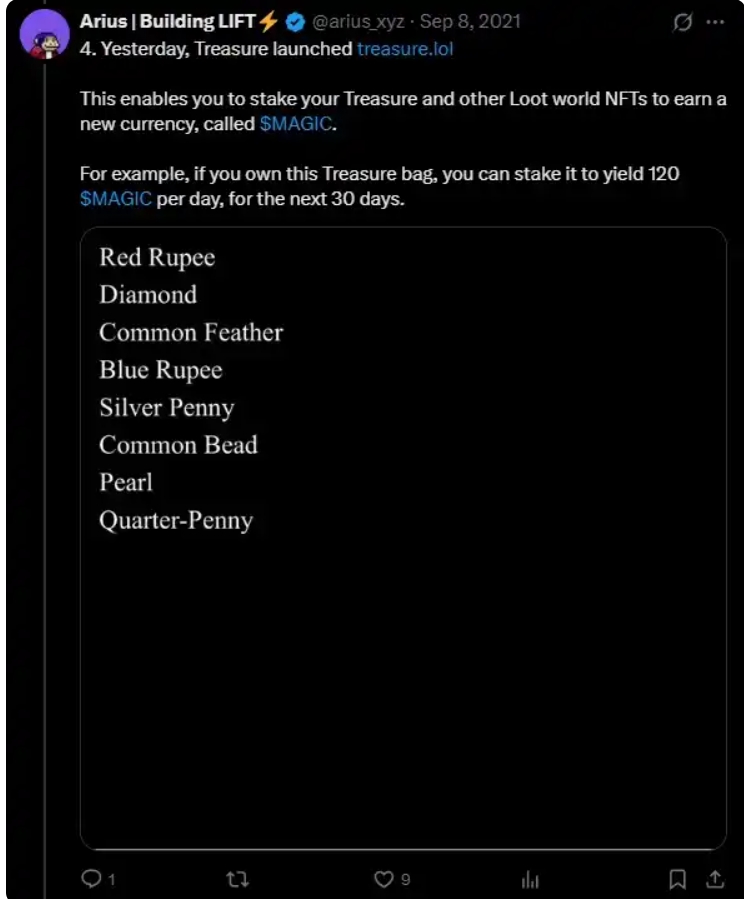

According to a tweet posted by @arius_xyz on September 8, 2021, staking a "Treasure Bag" NFT can get 3,600 $MAGIC within 30 days. The historical highest price of $MAGIC is $6, which means that staking a "Treasure Bag" NFT for 30 days at that time would become $21,600 six months later.

Similar to Loot’s vision at the time, Treasure wanted to build a bottom-up on-chain gaming world. After the eight items in each “Treasure Bag” were split into NFTs, the number of pledge operations increased significantly, and the congested Ethereum mainnet at the time made the gas fees required for operations unbearable. Considering the current situation of poor player experience and the large number of transaction demands that can be expected after the release of future games, Treasure made the decision to migrate to Arbitrum. TreasureDAO was also officially established to promote this grand vision.

At that time, there was no NFT trading market that supported Arbitrum, and there was no NFT trading market on Arbitrum. So, TreasureDAO's NFT trading market was also launched. Later, this NFT market developed into Trove, and for quite a long time, it was the undisputed representative of Arbitrum NFT.

brilliant

At the time, the Treasure team was the leading version in understanding how to use NFT and gamification to create the latest DeFi narrative. Even if you look at TreasureDAO's Medium now, I believe you will sigh, "They are really good at telling stories." "Liquidity is the weather, liquidity is time, and liquidity is a measure of spatial scope." This metaphor will always be on Mount Rushmore in my crypto.

They not only talk, but also do. The speed at which TreasureDAO advanced its work at the time was amazing not only in the Loot ecosystem, but also in the entire crypto. Only one month after the project went online, it completed operations such as material splitting, material animation production, and asset cross-chain. In particular, it announced the integration of a new game "Life". This is the first project in the Treasure ecosystem that is not made by the team but comes from the community. The idea of the game at the time made me join the Chinese white paper translation organized by @GavinGPT without hesitation, and he also paid all translators out of his own pocket.

As they evolve, individuals develop new traits and undergo age-related changes. They go to school, fall in love, pursue careers, experience the many successes and disappointments that characterize life, and eventually die.

Life is one long experiential board game. It’s meant to be an emotional experience. NFTs multiply like people, not like hamsters. They have a finite but non-mundane lifespan, just like our own.

When co-founder John Patten said he wanted to make an NFT project called Smol Brains, many people did not understand and thought it would dilute the value of $MAGIC. But then, Smol Brains became Arbitrum's leading NFT series. This was the most successful story-based GameFi series at the time. What impressed me most was that when the story line advanced to the point where the island where the Smol Brains lived was about to sink, Smol Brains holders needed to choose whether to take a rocket to leave the island and go to the moon to survive. In order to build a rocket, Smol Brains must reach a certain number of IQ values through staking. At that time, Smol Brains was already a price I couldn't afford, but I was paying attention every day. Where would Smol Brains with insufficient IQ go? Will they be destroyed?

Smol Brain is a Free Mint project. At the peak of the price, according to the price of $MAGIC, holding one Smol Brains from beginning to end can earn $100,000. The Legion NFT of Bridgeworld, another ace project of the TreasureDAO ecosystem, had a floor price of 20 ETH at its peak. That was an era when ETH diamond hands were still proud.

Before Treasure, Arbitrum's daily NFT trading volume was less than 1 ETH. Since the launch of the NFT market on November 13, 2021, it has achieved more than $285 million in trading volume in just 7 months. At the beginning of 2022, Treasure's market was the second highest-grossing NFT market in the world, with Bridgeworld and Smol Brains alone accounting for 10% of OpenSea's total trading volume.

At the end of February 2022, the price of $MAGIC reached an all-time high of $6.

Afterglow

The good times didn’t last long. After the peak of $6, $MAGIC fell almost all the way. By May 2022, the price of $MAGIC fell below $1, and at its lowest point it fell below $0.3. Although there was a rebound to about $2 in early 2023, since the peak, $MAGIC has never returned to half of its historical high.

Despite this, games within the ecosystem are still progressing steadily, and more and more games are choosing to join the TreasureDAO ecosystem. The most famous one is The Beacon, which became popular at the end of 2022. This is the last glory of TreasureDAO in my eyes.

Due to the long time and difficulty of game development, quite a few games in the ecosystem ended up in failure, such as the "Life" mentioned above, and "Battlefly", which was once an NFT worth four figures in US dollars.

In addition to the market attention caused by this radical change in development direction, the last time TreasureDAO stood in the spotlight of the market was because of Shaw's AI concept. Shaw was the earliest developer of the Treasure DAO ecosystem. He was responsible for Smol Brains' AI game project Smol World. The vision of Smol World is that each Smol Brains acts as an AI Agent to play on-chain games, stealing each other's assets for PvP, and the game itself is integrated with the Eliza framework. At that time, affected by this positive impact, Smol Brains rose 4 times.

question

Such a major adjustment in development strategy, suddenly announced in such a weak market environment, naturally aroused many questions.

Chinese KOL Lanhu was once a supporter of TreasureDAO. He commented on John Patten’s tweet, “Why now? Why not earlier?”

This is also my question. When AI was the hottest concept last year, TreasureDAO did not fail to attract market attention. Why didn’t it transform at that time, but waited until now?

John Patten said in the video, "This transformation is not a choice, but a necessity for survival. Even if the finances are healthy, this is the most rational choice." According to his disclosure, if only USDC-denominated expenses and stablecoins held are considered, TreasureDAO's current remaining operating funds can only be used to last until July 2025.

Currently, the TreasureDAO treasury holds $2.4 million in stablecoins to support infrastructure and Bridgeworld game development. In addition, Flowdesk (TreasureDAO's market maker) holds approximately $1.49 million in assets, of which $786,000 is idle and can be withdrawn. If the DAO agrees to the proposal to withdraw this part of the funds, the stablecoin assets will increase to $3.2 million.

There are 22.3 million MAGIC in the vault, with a current market value of about $2.3 million. Grants issued to game projects in the ecosystem are priced in US dollars, but the actual issuance is paid in $MAGIC, calculated based on the average price at the time of issuance. With the depreciation of $MAGIC, the actual number of $MAGIC required has increased significantly, greatly reducing TreasureDAO's ability to fulfill its obligations.

Well, for this urgent situation, it seems that it can be explained by "wrong decision-making and untimely transformation." However, TreasureDAO's financial expenses also made some players incomprehensible - after all, the game developed is not a 3A masterpiece, so how can it be so expensive?

Still according to John Patten's disclosure, TreasureDAO's annual manpower expenditure is about $6.1 million, annual operating costs are about $3 million, and the team size was close to 40. When I asked ChatGPT to help me find a traditional game company with an annual operating cost of about $10 million, ChatGPT's answer was Telltale Games, an American game company that had worked on "The Walking Dead" and had about 90 employees.

Arbitrum official Nina Rong also commented on TreasureDAO’s financial difficulties:

Did TreasureDAO receive money for migrating to zkSync? Yes, but it is also burning money. The total grant from the Zk Foundation is about 1.1 million US dollars, half of which has been promised to the game project and will be unlocked in two years. The annual fixed cost of operating Treasure Chain is 450,000 US dollars (denominated in USDC). Even if it is unlocked as planned, Treasure Chain will still lose 175,000 US dollars every year.

Conclusion

The dilemma faced by TreasureDAO may be the dilemma faced by all projects in the crypto. It is hard to blame them for expanding when they have enough food at home, but they tightened their belts too late. The $MAGIC coin price drop caused by this unexpected official announcement undoubtedly made the situation worse.

Currently, TreasureDAO has laid off 15 employees, completely terminated the game publishing stack and game distribution, and communicated with game partners to cancel remaining grants. Annual expenditures have dropped from US$7.5 million to US$3.8 million and are planned to drop to US$3 million within a few months.

But John Patten also emphasized that if $MAGIC depreciates sharply after the news is released and fails to recover, TreasureDAO will find it difficult to survive until 2026.

He proposed that TreasureDAO conduct a strategic contraction and focus on four directions: NFT market, Bridgeworld, Smol World and AI Agent. A number of governance proposals are also coming, including reserving liquidation fees, withdrawing idle assets from market maker Flowdesk, confirming new product directions, and shutting down Treasure Chain.

TreasureDAO will still make games, but the vision of "Web3 Nintendo" has been completely erased. Faced with survival, they are no longer able to pursue their former ideals.

This ideal is not only theirs, but also the ideal of the entire Web3. Whether they are project owners or we are Web3 users, we may never lose our ideals, but we may feel the loss of shattered ideals.

The era is over.